This week’s newsletter is Sponsored By: HealthQuotes

HealthQuotes provides compliant inbound Medicare calls, is licensed in all 50 states, and is a proud member of Insurance Marketing Coalition.

Did you hear about the FCC’s recent $299,997,000 fine against an international robocaller?

Read more in the Sponsor Snapshot 🚀 section after the deep dive!

If you want to learn more about consumer generated inbound Medicare calls, please contact: [email protected]

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive is the 10 Steps to Create a New Medicare Insurance product!

Sponsor Snapshot 🚀 - The FCC’s $299,997,000 fine.

Data Visual of the week 📊 - Data Visual highlighting the size of the Ancillary Health Insurance Market.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

U.S. Announces First Drugs Picked for Medicare Price Negotiations - The price negotiation program…is projected to save the government tens of billions of dollars in the coming years. (link)

Rural hospitals feel squeeze from Medicare Advantage - Already struggling rural hospitals see an increasing financial threat from the steady growth in Medicare Advantage enrollment. (link)

Medicare Sales M&A: What’s Changed For Insurance Agency Owners - As of late, the life and health side of the business has been feeling the effects of evolving M&A practices, driven by shifts in Medicare business models.. (link)

Jared’s recent LinkedIn posts:

Deep Dive 📚

10 Steps to Create a New Medicare Product.

Our deep dives typically provide information and data related to the Medicare market.

Information that helps you wrap your arms around the Medicare market, see trends, headwinds, and opportunities.

It’s the same information the team at Telos Actuarial uses to help train employees and educate clients when developing new products for the Medicare space.

Today is a little different. Today is a behind-the-scenes look at the PROCESS taken when helping clients launch a new insurance product.

A guide for how to go from:

having no product 😥

to

having a product that consumers love 😁

Our team has helped create and launch 20+ new insurance products over the last several years.

This process is generally the same regardless of which product line you are developing. Medicare Supplement, Medicare Advantage, Dental, Hospital Indemnity, Critical Illness, Short-Term Care, and Accident are all examples of products sold to seniors who are Medicare age.

With that, here are the 10 steps to creating a new insurance product for the Medicare market.

One note: The steps don’t happen in perfect order. Numerous steps often happen at the same time in coordination with one another.

1. Market Research

Identify your target audience within the Medicare market.

Analyze demographic trends, needs, and preferences.

Study potential demand for your product and any gaps in the market.

Consider regulatory and compliance requirements at a federal and state level.

Telos Actuarial publishes market research in the form of Guides and Reports. For Example, this comes from the free “Future of Medicare Supplement” report:

2. Pick Key Partners to Work With

Identify and evaluate potential partners:

Distributors - Sell the products

Third-Party Administrators (TPAs) - handle customer service, pay claims, etc.

Reinsurers - take on underwriting risk

Actuarial management - you should work with Telos Actuarial for this 😎

Technology - quoting and enrollment platforms, underwriting data, etc.

Leads - this week’s sponsor HealthQuotes is an example.

3. Develop Key Assumptions for Pricing

Outline the assumptions that will drive your product's design and pricing.

For example:

Expected Benefit Cost (utilization X cost)

Commission Expense

Acquisition Cost (marketing, underwriting, sending welcome packages, etc.)?

Administrative Cost

Risk Capital Requirements

Profit Margin / ROI Requirements

Setting assumptions is accomplished by coordinating between numerous parties. Distribution, TPAs, Finance, Underwriting, etc. all provide information on the expected costs. It typically falls on the pricing actuaries to determine how to turn these expenses into assumptions used in a pricing exercise.

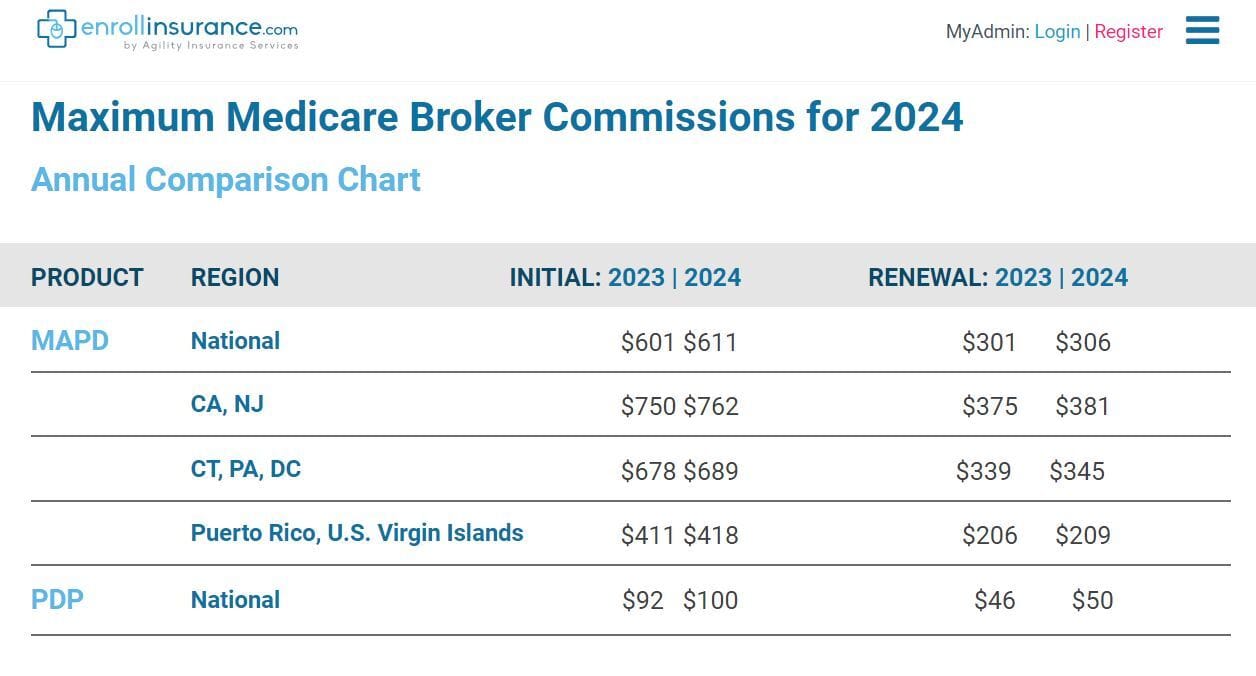

Here is an example of Commission expenses that would be included as an assumptions when pricing a Medicare Advantage product (comes from a post by Agility Insurance Services):

4. Price

Determine the pricing strategy for your product.

does the product have unique benefits where premium rate matters less?

Or are the benefits standardized and the premium rate is the main focus?

Factor in expenses, profit margins, and competitor pricing.

Develop a pro-forma showing how premiums, expenses, and profits emerge over time.

Ultimately, set premium rates that cover expenses, produce profits and make sense competitively

5. Competitive Benchmarking

Research and analyze existing products in the market.

Benchmark your product against competitors

Items to benchmark include:

premium rates

commission rates

benefits being offered

underwriting questions

Use benchmarking insights to differentiate your product and address gaps.

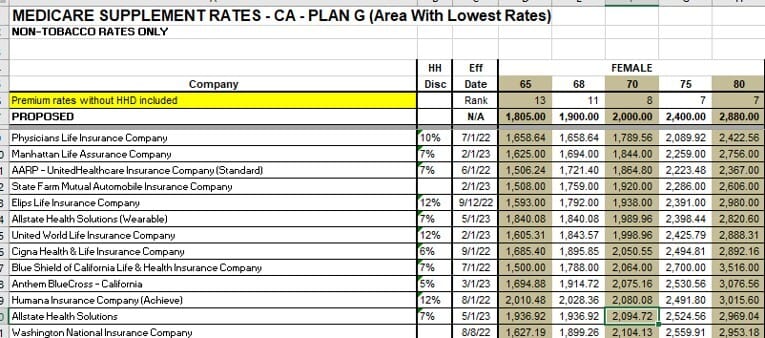

Here is an example of a premium rate benchmarking that Telos uses when pricing a Medicare Supplement product:

6. Develop Policy Forms, Applications, Outlines of Coverage

Create policy documents, application forms, and coverage outlines.

Ensure clarity, accuracy, and compliance with industry regulations.

Provide transparent information about benefits, coverage limits, and exclusions.

Note: This step often happens in coordination with the pricing step.

7. Iterate

Review and refine your product concept, pricing, and documentation.

Seek feedback from internal teams and partners.

Can the Distribution sell it?

Can the TPA administer it?

Will it gain approval from regulatory bodies?

Does it meet internal profit targets?

Iterate based on feedback to enhance product features and user experience.

8. Gain Approval

Submit your Medicare product proposal to regulatory bodies for approval.

Comply with legal and compliance requirements specific to insurance products.

Be prepared to address any concerns or questions from regulators.

Medicare Supplement, Dental, HIP, Critical Illness and other A&H products are primarily filed through a system called SERFF:

9. Build Buzz

Develop a marketing and communication plan to generate interest.

Utilize various channels such as social media, industry events, and press releases.

Highlight unique features, benefits, and advantages of your product.

This is often done by FMOs (Distribution Support Organizations) that have top level contracts. They create buzz with the agencies and agents to get the product to their portfolios.

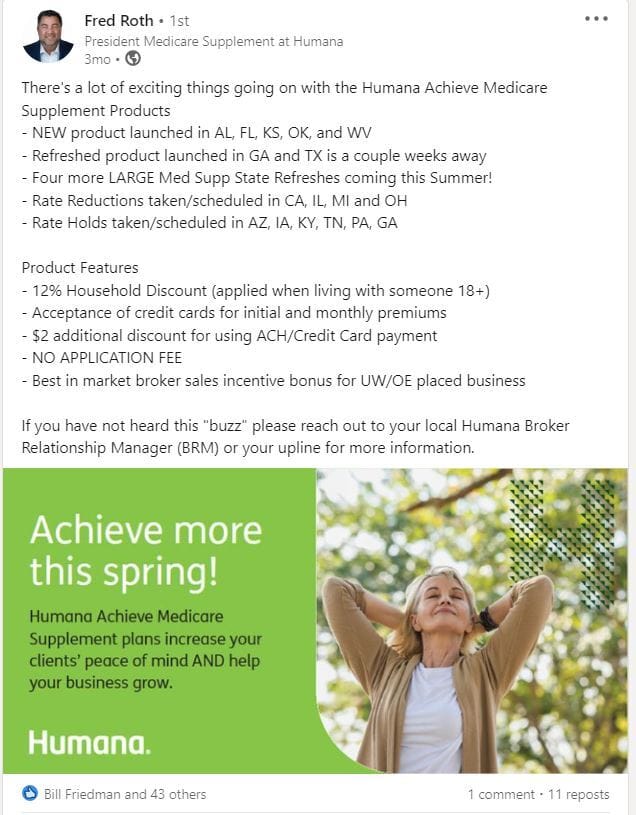

As one of many examples, Humana has recently used Linkedin to create buzz around their new Medicare Supplement products (link):

10. Launch

Once the product is approved and there is buzz, launch!

Congratulations, you now have a Medicare product out there in the market.

Watch sales numbers increase 🚀

Afterward:

This part isn’t as fun, but is very important.

Continuously track product performance, customer feedback, and market response.

Monitor new business coming in the door to make sure it’s lining up with pricing expectations.

Monitor loss ratio expectations, expense and profitability expectations, customer retention expectations.

Finally, for many of the products focused on the Medicare space it is important to re-evaluate and reprice products annually. This happens through rate increases, bidding, or filing enhancements or new products.

Sponsor Snapashot 🚀

Hello Medicare Marketing Professionals,

As professionals engaged in outbound dialing with live or aged data leads, or handling warm transfers from call centers, the recent crackdown on illegal robocalling by the FCC must have captured your attention!

In July of this year, the FCC made a resounding statement with its largest-ever fine of $299,997,000 against an international auto warranty scam operation.

This action highlights the urgency of addressing rampant robocall malpractice. The scheme bombarded unsuspecting consumers with an astonishing five billion robocalls in just three months, cycling through over a million phone numbers and violating numerous regulations, including pre-recorded voice calls without consent, unauthorized telemarketing, and deception in caller ID.

But let’s pivot our focus to what truly matters – making informed choices in your Medicare marketing partnerships.

Transparency: More than just a buzzword, transparency is the bedrock of ethical marketing. The FCC’s recent case underscores the consequences of opacity. When selecting a marketing agency, prioritize those who openly communicate, meticulously document actions, and collaboratively ensure compliance. Transparent practices are the foundation of successful, ethical marketing that safeguards your reputation.

Consumer-Generated Calls: In a landscape crowded with robocalls, authentic consumer-generated calls stand out. Instead of pursuing sheer quantity, prioritize quality connections. Partner with agencies that emphasize genuine engagement and interest-driven interactions. These connections not only yield results but also align seamlessly with regulatory guidelines.

HealthQuotes: Holding licenses to sell insurance in all 50 states, HealthQuotes sets the gold standard for transparency, compliance, and authentic customer connections. Their dedication to value through consumer-generated calls is unparalleled. By teaming up with HealthQuotes, you embrace a partner committed to integrity, client satisfaction, and industry leadership.

Ready to Elevate Your AEP in 2023?

Contact HealthQuotes today to discuss your call requirements and empower your journey toward sales and growth excellence! Contact our sales team today at [email protected] to discuss further.

Data Visual of the Week 📊

This week’s Data Visual of the week comes from a recent blog by Telos highlighting the size of the Ancillary Individual Health Insurance Market.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: promote your product or services to leaders in the Medicare space. Let’s discuss. (link) Note: 6 slots already taken.

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market. Let’s discuss. (link)

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: