This week’s newsletter is Sponsored By: Insurance Regulatory Insights

Stay up to date on Regulatory “movement” each week→ (subscribe)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - 2023 Medicare Supplement Market Results - 📊

Compliance Chatter 📢 - Mississippi prohibits telephone solicitation to any person in the state regarding Medicare Advantage plans.

Sponsor Snapshot 🚀 - brought to you by Insurance Regulatory Insights

Here are IMPORTANT LINKS 🔗 for the week:

CVS warns it could lose up to 10% of its Medicare members next year - (link)

Half of rural hospitals in the red, pressured by high Medicare Advantage enrollment - (link)

Medicaid, Medicare integration rule to shake up market - (link)

Detailed Analysis of the Medicare Hospital Trust Fund Extension to 2036 - (link)

Medicare’s Financial Condition: Beyond Actuarial Balance - (link)

VIDEO 📺- Fireside Chat with Sachin Jain, MD, President & CEO of SCAN Group - (link)

Changing Financial Risks for Medigap Insurance - (link)

Medicare Supplement Broker Sales Mix – 2024 Q1 Review - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

2023 Medicare Supplement Market Results - 📊

This week’s Deep Dive is going to look at how the Medicare Supplement market fared in 2023. The experience below is sourced from the Medicare Supplement Insurance Experience Exhibit (MSIEE) as obtained from the NAIC.

The MSIEE is a component of the annual statement that insurance companies complete every year. This exhibit contains Premium, Claims and Covered Lives experience data and is split by Plan, Issue State and “New Business” vs “Seasoned Business”[1].

Companies that have Medicare Supplement business are required to complete this exhibit as part of the annual statement process. However, there are some companies that report to the California Department of Managed Healthcare and are not required to submit the MSIEE to the NAIC. You may see other data or reports that paint a slightly different picture – the CDMHC data is the likely source of those differences.

2023 Total Market Results

The following table shows the total market results for the past three years.

Premiums | Claims | Loss Ratio | Lives | |

2021 | $34,256,800,000 | $26,490,600,000 | 77.3% | 14,080,000 |

2022 | $34,807,300,000 | $27,996,100,000 | 80.4% | 13,790,000 |

2023 | $35,342,900,000 | $29,643,100,000 | 83.9% | 13,610,000 |

Some key statistical take-aways:

Premiums grew by $536 million from 2022 to 2023. This represents a growth rate of 1.5% which is consistent with the prior year’s growth rate of 1.6%.

Covered Lives decreased by 180,000, this is a 1.3% decrease from 2022. Lives decreased by 2.0% from 2021 to 2022. The decrease in 2023 was smaller than the decrease in 2022.

The Loss Ratio increased by 3.5% from 2022 to 2023. This is an increase from the 3.1% growth in the loss ratio from 2021 to 2022.

What is driving these results?

The recent increases in Premium are primarily attributable to the regular annual premium increases on Medicare Supplement policies. These increases come in two forms:

(1) Carriers pursue premium increases every year to account for medical trend and experience deviations; and

(2) Many plans have premiums that are based on the current age of the policyholder, so they automatically increase every year.

Over the past several years the Medicare market has seen a shift towards more beneficiaries choosing to enroll in a Medicare Advantage plan instead of a Medicare Supplement plan. This trend is generally attributed to the lower premium (often marketed as $0 premiums), access to ancillary benefits and the ease of enrolling in the Medicare Advantage plans.

This movement towards Medicare Advantage is the primary contributor to the decrease in the number of Covered Lives.

Increases in the Loss Ratio are occurring due to a combination of competitive pressures on new products and changes in the average health status of Medicare Supplement policyholders. More on this later.

2023 New Business Results

Med Supp policies that were issued in the past three years produced $7.1 billion of the $35.3 billion premium total market premium in 2023. This ‘New Business’ premium accounts for roughly 20% of the total market premium.

Premium | Claims | Loss Ratio | Lives | |

2021 | $8,128,500,000 | $6,675,100,000 | 82.1% | 4,800,000 |

2022 | $7,463,600,000 | $6,330,100,000 | 84.8% | 4,430,000 |

2023 | $7,108,800,000 | $6,384,100,000 | 89.8% | 4,160,000 |

The total amount of New Business Premium and Covered Lives has decreased over the past several years. This is a direct impact of the growth in Medicare Advantage market share.

Another interesting observation is that the 89.8% New Business Loss Ratio is significantly higher than the total market Loss Ratio of 83.9%. This is directly related to the point above about the competitive pressures in the New Business market.

Loss Ratios on the New Business portion of the market were stable from 2014-2018 but then they started to climb in 2019. Then, after the COVID dip of 2020, the Loss Ratios began climbing again.

2023 Seasoned Business Results

Med Supp policies that were issued prior to the past three years accounted for $28.2 billion of the $35.3 billion total market premium in 2023. This ‘Seasoned’ premium accounts for the remaining 80% of the total market premium.

Premium | Claims | Loss Ratio | Lives | |

2021 | $26,128,300,000 | $19,815,500,000 | 75.8% | 9,280,000 |

2022 | $27,343,700,000 | $21,666,000,000 | 79.2% | 9,360,000 |

2023 | $28,234,100,000 | $23,259,000,000 | 82.4% | 9,450,000 |

From 2022 to 2023 the Premium on this reporting segment grew by 3.3% and the Covered Lives grew by 1.1%.

There were also some interesting changes in the Loss Ratios. From 2021 to 2023 the Loss Ratios increased by 3.4% and 3.1% respectively.

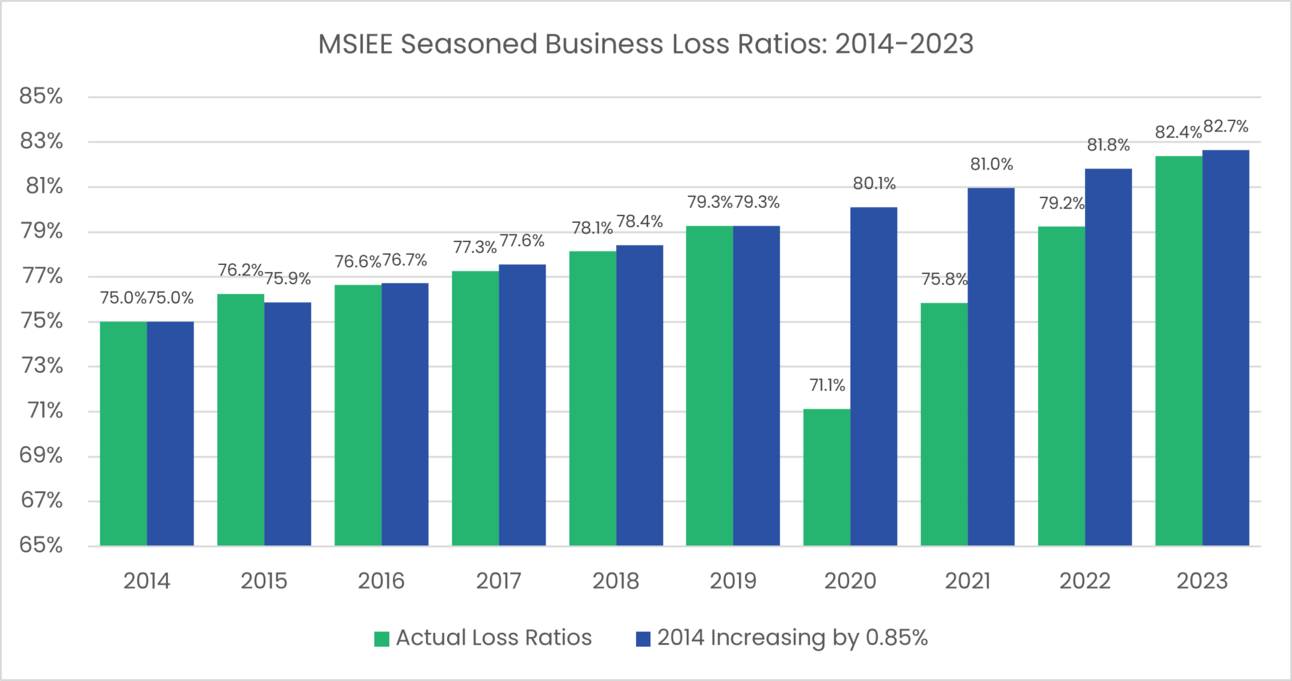

But if you look back at the 2014-2019 period, the Loss Ratios on the Seasoned portion of the market exhibited steady annual increases of about 0.85%. Then there was the big COVID-related decrease in 2020 that was followed by larger increases as the market returned to normal utilization patterns.

Coincidentally, the 2023 Loss Ratio would only be about 0.3% higher if the 0.85% average growth rate continued from 2019 through 2023.

These historical patterns are illustrated in the following chart. The green bars are the actual reported Loss Ratios in the MSIEE and the blue bars are what the Loss Ratios would look like if 2014 Loss Ratio increased by 0.85% every year through 2023.

Take a look at how closely the blue bars track along with the green bars from 2014 to 2019. There are differences by calendar year but the variances are minor.

The blue bars then continue growing by 0.85% per year from 2019 to 2023. You can see that the actual Loss Ratios are materially lower as many healthcare services were deferred during the early stages of the pandemic. The Loss Ratios began climbing as utilization normalized and the bars realigned in 2023.

“Coincidentally” was an intentionally chosen word in that earlier paragraph.

Just because the Loss Ratios have rejoined the 0.85% trend line in 2023 does not mean that we expect the 2024 Loss Ratios to increase by 0.85%. We believe that there will continue to be Loss Ratio pressure in the Medicare Supplement market as companies reset their premiums to levels that will more closely align with their targets.

A total market Loss Ratio of 86.5% - 87.5% seems like a reasonable landing place for 2024.

That is all for this week’s Deep Dive into the Medicare Supplement Insurance Experience Exhibit. We’ll be looking at more additional layers of detail in the coming weeks.

[1] The split is defined as policies issued in the past three calendar years and policies issued prior to the past three calendar years.

Sources: National Association of Insurance Commissioners, by permission. The NAIC does not endorse any analysis or conclusions based upon the use of its data.

Sponsor Snapshot 🚀: Insurance Regulatory Insights

Weekly insight into recent regulatory action.

Get informed of “New”, “Approved”, “Moving”, “Failed” regulations for:

Medicare Supplement

Part C (Medicare Advantage)

Part D (Prescription Drug Coverage)

Hospital Indemnity

Critical Illness

Senior Dental

Focused on changes impacting product design, rating, underwriting, and marketing.

COMPLIANCE CHATTER 📢

The Mississippi Governor approved HB1350, which prohibits telephone solicitation to any person in the state regarding Medicare Advantage plans, unless the person has first initiated the call.

The regulation also prohibits issuers, and agents acting on behalf of an issuer, from a telephone solicitation to any person in the state for the purpose of advertising the sale or soliciting purchase of a Medicare Supplement plan.

This regulation takes effect July 1, 2024.

Exciting News!

You can now receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: