This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - AEP 2024 → Medicare Advantage Enrollment Growth 🚀

Compliance Chatter 📢 - A look at prohibited marketing practices during Medicare Advantage Open Enrollment Period (MAOEP)

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - a sneak peek at the *NEW 2024 AEP Medicare Advantage State Deep Dives eBook!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

What’s behind Aetna’s industry-leading Medicare Advantage growth? - (link)

Insurers brace for continued Medicare Advantage medical costs - (link)

What do Medicare beneficiaries value about their coverage? - (link)

Why won’t Medicare deliver food to sick seniors, if it could get them healthy? - (link)

UnitedHealth under antitrust investigation by DOJ: reports - (link)

Medicare Supplement Rate Filings – March 2024 - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

AEP 2024 → Medicare Advantage Enrollment Growth 🚀

The work of AEP has been over for a while, but we are just now able to see the results of the activity.

Most of you do the hard work during AEP. I mostly just sit around waiting for data to come out so that I can nerd out on the numbers.

Which is what we are going to do today. Enjoy!

__

Medicare Advantage (“MA”) enrollment increased 3.2% during AEP 2024.

Down from 3.8% last year and 5.0% the prior year.

AEP '22 enrollment increase -> ~1.39 million (5.0%)

AEP '23 enrollment increase -> ~1.16 million (3.8%)

AEP '24 enrollment increase -> ~1.03 million (3.2%)

In today’s deep dive we will look at the makeup of the 1.03 million member growth.

Today we will explore Geography and Health Plan. Next week we will explore Plan Types.

Note: the definition of “AEP enrollment increase” is the change in enrollment counts from December 2023 to February 2024.

Geography

To start off we will look at AEP results by state. I always like to say that in Medicare, each state is its own unique market.

The amount of growth in each state is influenced by how many (or little) Medicare eligibles there are in the state, how high or low the MA penetration is, where Health Plans expanded their product offerings, how strong (or weak) networks are, and many other factors.

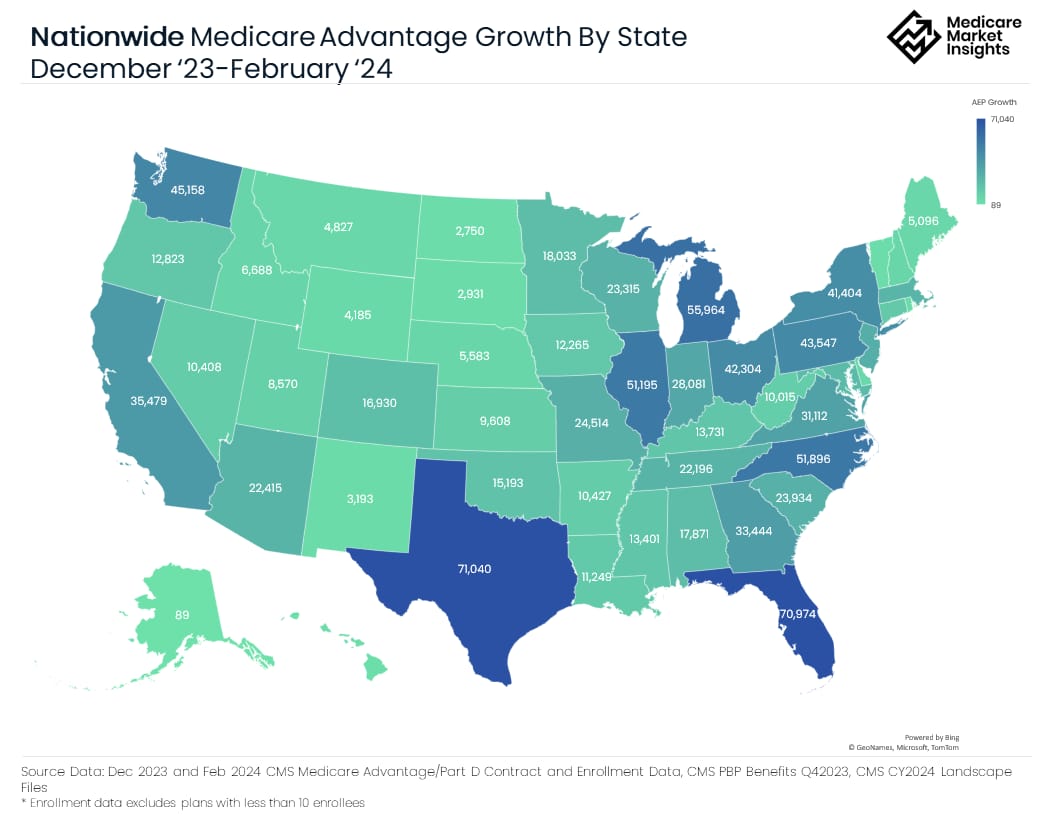

The graph below shows the enrollment growth during AEP 2024 by state.

The top 10 states in terms of overall AEP growth are:

State | AEP ‘24 Growth | % Growth |

Texas | 71,040 | 2.9% |

Florida | 70,974 | 2.5% |

Michigan | 55,964 | 4.2% |

North Carolina | 51,896 | 4.5% |

Illinois | 51,195 | 5.2% |

Washington | 45,158 | 6.6% |

Pennsylvania | 43,547 | 2.9% |

Ohio | 42,304 | 3.1% |

New York | 41,404 | 2.1% |

California | 35,479 | 1.0% |

The top 10 states in terms of overall % growth are:

State | AEP ‘24 Growth | % Growth |

Wyoming | 4,185 | 24.6% |

Maryland | 18,806 | 7.6% |

Montana | 4,827 | 6.8% |

Washington | 45,158 | 6.6% |

Delaware | 4,421 | 6.1% |

North Dakota | 2,750 | 6.0% |

Mississippi | 13,401 | 5.3% |

Illinois | 51,195 | 5.2% |

Kansas | 9,608 | 5.2% |

Virginia | 31,112 | 5.2% |

One factor in a state market’s ability to grow MA membership is the level of penetration the state is already at.

(Note: “penetration”= count of MA members / count of Medicare eligibles)

There is a point in which MA growth tends to slow down once a certain penetration % is achieved.

The chart below is showing AEP growth % by state compared to that state’s penetration %.

You can see that (in general) the higher the penetration, the lower the % growth.

Wyoming, Washington, and Michigan had higher % growth than their penetration suggested they would.

(Side tangent: Wyoming really ruins the graph a bit. You would see the “slope” more clearly if Wyoming was more in line. Come on Wyoming!)

Alaska, California and Hawaii seemed to “underperform”.

Puerto Rico has the highest penetration of any state and likely has less room to grow.

Health Plans

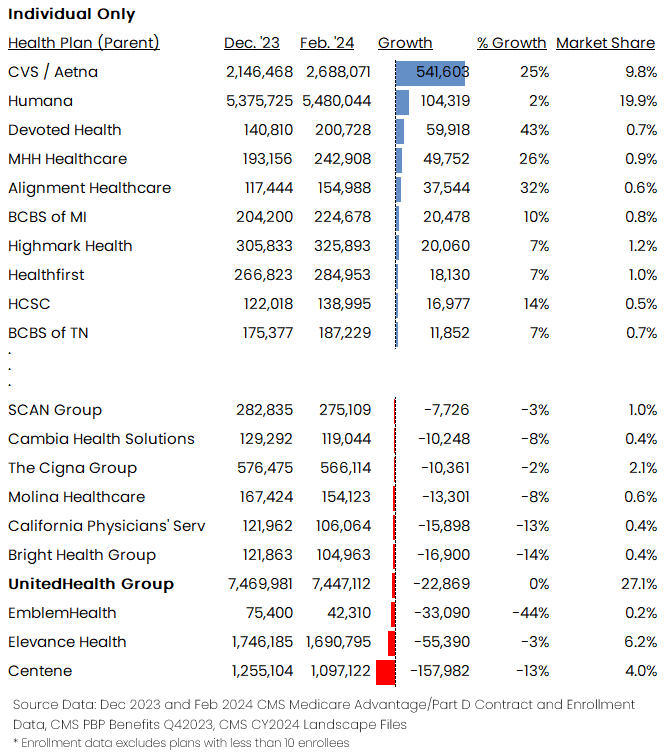

There was one Health Plan that clearly “won” in terms of membership growth during AEP 2024.

While some others showed impressive % growth.

Here is a look at the top and bottom 10 Health Plans by growth (including both Individual and Employer Group combined).

As you can see, CVS / Aetna really “won” enrollment growth this year. Outpacing the nearest (Humana) by ~440,000.

Centene saw the largest decrease, losing ~160,000 members.

One interesting note. UnitedHealth Group’s growth was driven by an increase in Employer Group members.

Looking at Individual only plans we see that UnitedHealth Group drops from the top 10 to the bottom 10, losing ~23,000 individual members.

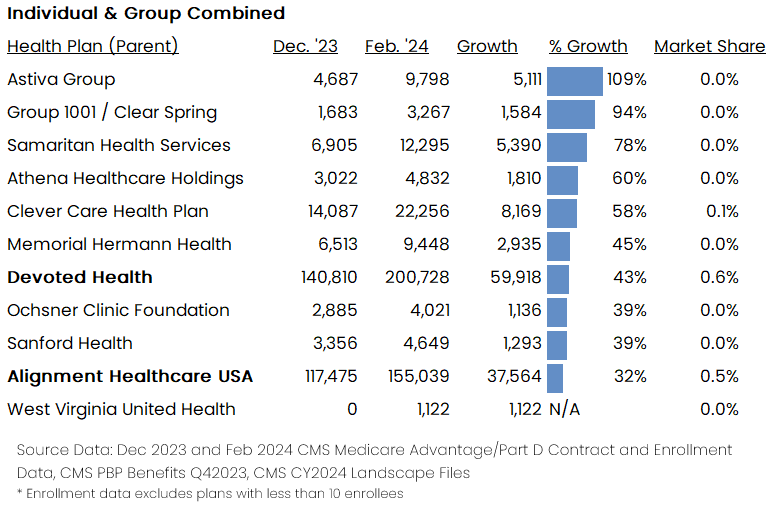

In addition to looking at Health Plans that had the highest overall member growth, it’s also interesting to look at Health Plans with the highest growth percentage.

The table below shows the top 10 growth % companies (excluding any that have <1,000 membership growth).

Devoted and Alignment stand out in terms of both pure enrollment growth combined with percentage growth.

__

That’s all for today! Next week will be Part 2 where we will take a closer look at AEP results by Plan Types.

___

Sources: Source Data: Dec 2023 and Feb 2024 CMS Medicare Advantage/Part D Contract and Enrollment Data, CMS PBP Benefits Q42023, CMS CY2024 Landscape Files. * Enrollment data excludes plans with less than 10 enrollees

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

We are about half-way through the Medicare Advantage Open Enrollment Period (MAOEP) – Check out this Compliance Chatter from January’s newsletter for quick refresher on who is eligible for MAOEP.

Let’s take a brief minute to review some prohibited marketing practices during this period.

Agents are prohibited from:

Sending unsolicited materials advertising the ability or opportunity to make an additional enrollment change or referencing the MAOEP;

Specifically targeting beneficiaries who are in the MAOEP because they made a choice during Annual Enrollment Period (AEP) by purchase of mailing lists or other means of identification;

Engaging in or promoting agent or broker activities that intend to target the OEP as an opportunity to make further sales; or

Calling or contacting former enrollees who have selected a new plan during the AEP.

If you would like to learn more about our compliance services, reach out to [email protected].

DATA VISUAL of the Week 📊

The data visual of the week comes from Medicare Market Insights.

*NEW AEP 2024 Medicare Advantage State Deep Dives ebook available now! If you are a leader in the Medicare space you need this eBook. Buy yours here.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: