This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - BCBS Kansas City’s Exit: Medicare Advantage Market Impact 🖐

Compliance Chatter 📢 - The Tri-Agency Rule includes notice requirements and limitations!

Sponsor Snapshot 🚀 - brought to you by Modivcare.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage sales middleman sues HHS over rule capping broker compensation- (link)

Blue KC exiting Medicare Advantage market by 2025 due to 'regulatory demands' - (link)

Judge sides with SCAN Health Plan in dispute with CMS over Medicare Advantage star ratings - (link)

America’s Health Rankings 2024 Senior Report I AHR - (link)

Medicare Advantage Supplemental Benefits and Improved Healthcare Use - (link)

A Case for Medicare Supplement Plans K and L - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

BCBS Kansas City’s Exit: Medicare Advantage Market Impact 🖐

BCBS of Kansas City is exiting the Medicare Advantage market at the end of 2024.

They point to “heighted regulatory demands and financial pressures.”

If you’ve been following the MA market recently, you know that these are legitimate concerns, especially for a small Health Plan.

While this presents some unfortunate decisions for seniors this coming AEP, it also presents opportunities for agents and plans to help!

Let’s drill down into BCBS of KC to better understand where the opportunities lie along with some evidence as to why they are exiting.

___

As suggested by the name, BCBS of KC is only in the Kansas City area. 20 counties in MO and 4 counties in KS. We will look at each state separately.

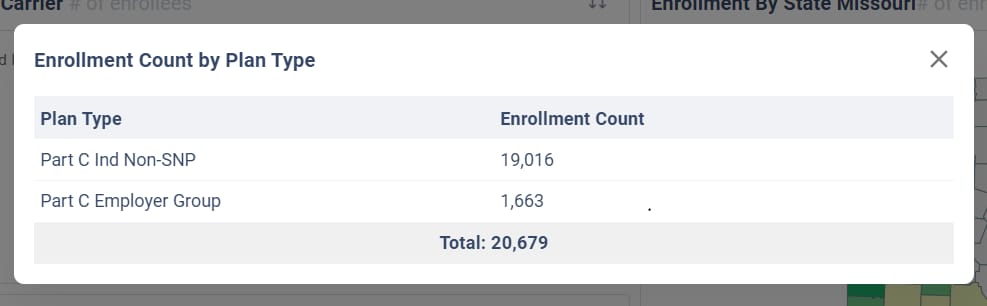

Missouri Enrollment

When including only the 20 counties in MO, BCBS of KC has the 4th largest Market Share.

20,679 of 164,946 enrollees (12.5% of the MA market) as of May 2024, with United, CVS, and Humana leading the way.

Here is enrollment by county. As you can see, the top 5 counties make up 90% of the enrollment in MO.

County | May 2024 MA Enrollment |

|---|---|

Jackson | 9,641 |

Clay | 4,291 |

Cass | 1,860 |

Platte | 1,806 |

Buchanan | 1,145 |

Clinton | 389 |

Johnson | 360 |

Ray | 338 |

Lafayette | 332 |

Andrew | 173 |

Bates | 159 |

Henry | 47 |

Benton | 29 |

Vernon | 24 |

Pettis | 19 |

Carroll | 18 |

Camden | 13 |

Saline | 12 |

St. Clair | 12 |

Hickory | 11 |

Total: | 20,679 |

Nearly all of their members in MO are Individual/Non SNP.

Within the past year (May ‘23 to May ‘24), MA enrollment in these 20 counties grew by ~9,800 (combined) with most of the growth going to CVS (BCBS of KC was second).

It’s notable that much of the market growth from May ‘23 to May ‘24 in these counties was in Special Needs Plans. BCBS of KC notably has no Special Needs Plans.

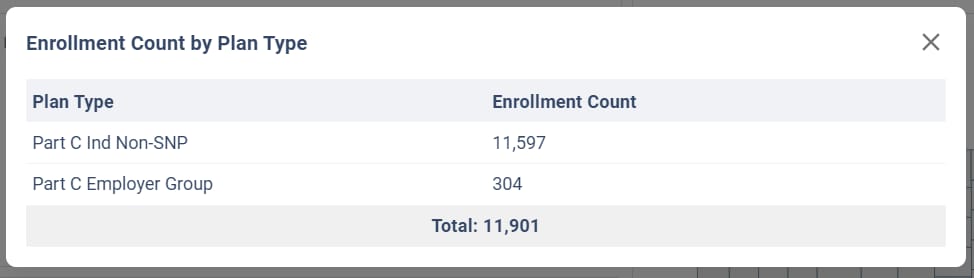

Kansas Enrollment

When including only the 4 counties in KS, BCBS of KC has the 3rd largest Market Share.

11,901 of 70,723 enrollees (16.8% of the MA market), with United and CVS leading the way.

Here is enrollment by county as of May 2024.

County | May 2024 MA Enrollment |

|---|---|

Johnson | 9,713 |

Wyandotte | 2,120 |

Leavenworth | 45 |

Miami | 23 |

Total: | 11,901 |

Nearly all of their members in KS are Individual/Non SNP.

Within the past year (May ‘23 to May ‘24), MA enrollment in these counties grew by ~4,400 (combined) with most of the growth going to CVS (with BCBS of KC second).

Similar to MO, a portion of the overall growth in the 4 county market was Special Needs Plans. And again, BCBS of KS has no Special Needs Plans.

Overall, BCBS of KC has had success in growing a decent size book of business in their footprint.

One area that stands out is the lack of Special Needs Plans. It’s likely the case that some of their members would be eligible for a Special Needs Plans which could be an opportunity for plans/agents this AEP.

Loss Ratio Analysis

Looking at recent Loss Ratio experience (as reported in NAIC A&H Experience Exhibits), it becomes more clear why the company has decided to exit the market.

Year | Earned Premium | Incurred Claims | Loss Ratio | Gross Profit/Loss |

|---|---|---|---|---|

2022 | $298,989,219 | $297,372,317 | 99.5% | $1,616,902 |

2023 | $356,848,104 | $394,737,263 | 110.6% | -$37,889,159 |

After adding in acquisition and other administrative expenses, the company lost a lot of money on their MA block over the last few years.

One thing that stands out about their loss ratio experience is the annual premium per member. It’s significantly lower than the other large carriers in these markets.

Here is the Per Member Annual Premium in Missouri.

Company | Per Member Annual Premium |

|---|---|

UNITEDHEALTH GRP | $ 15,424 |

HUMANA GRP | $ 14,095 |

CVS GRP | $ 15,089 |

Elevance Hlth Inc Grp | $ 13,514 |

Lumeris Grp Holdings Corp Grp | $ 15,617 |

BCBS OF KC GRP | $ 10,871 |

Grand Total | $ 14,849 |

It’s unclear why their revenue is lower than competitors. Could be related to risk adjustment, Stars and possibly lack of Special Needs Plans (DSNPs or CSNPs).

Special Needs Plans generate significantly higher premium revenue per member.

One thing is clear. Whoever picks up these members will need to generate revenue more in line with the rest of the market in order to lower loss ratios.

Bottom Line

The bottom line is this. There are 32,000 Medicare Advantage members who will be looking for a new plan at the end of 2024.

From a financial perspective:

→ For insurance carriers, this represents $350 million (at $11,000 PMPY) - $480 million (at $15,000 PMPY) in premium revenues.

→ For insurance agents, this represents at least $9.8 million in annual commission revenue (using $306).

But even more importantly, there are 32,000 individuals who will be making important choices for what Medicare coverage best meets their health insurance and health care needs.

We as leaders in the Medicare space need to make every effort to help them navigate this coming AEP with compassion, integrity and skill!

____

Note: MA Enrollment Data visuals above come from our soon to be released (and currently unnamed 😁) Medicare Advantage enrollment tool. Click here if you want to get early access:

Sources: CMS.gov Medicare Advantage enrollment statistics and NAIC A&H Experience Exhibits.

____

Can you do me a favor? Forward this to another leader in the Medicare space who could benefit from this info. Thanks!

Sponsor Snapshot 🚀: Modivcare

Modivcare’s NEW White Paper explores how collaborations can improve care coordination and bridge significant gaps in the healthcare system.

With the right data, they have seen:

Increased Member Engagement

Reduced Costs

Gaps in Care Closed

Reduced ER Utilization

Download the free White Paper here → (click)

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

COMPLIANCE CHATTER 📢

The Tri-Agency Rule, finalized by the Departments of Health and Human Services, Labor, and the Treasury, includes notice requirements for both Fixed Indemnity and Short-Term, Limited-Duration (STLDI) insurance policies and limitations on the duration of any newly issued STLDI plan.

The notice requirements for fixed indemnity insurance are effective January 1, 2025, while the notice and duration requirements for STLDI are effective September 1, 2024. For a quick recap, read our previous blog here.

With these deadlines approaching, states are starting to issue directives regarding this final rule.

Alabama issued Bulletin 2024-02 requiring carriers to submit revised forms and rates for review, effective immediately.

Iowa issued Bulletin 24-01 indicating carriers are expected to make all necessary changes to comply with the required federal changes.

Kansas provided notice via SERFF indicating carriers should update existing STLDI forms to comply with the required federal changes.

Meanwhile, Manhattan Life Insurance and Annuity Company has filed a lawsuit to challenge the final rule.

We anticipate more states will provide directives in the coming weeks and will keep you updated.

Exciting News!

You can now receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: