This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Capitated vs. FFS Payment Models ⚖

Compliance Chatter 📢 - How the courts could affect Medicare.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

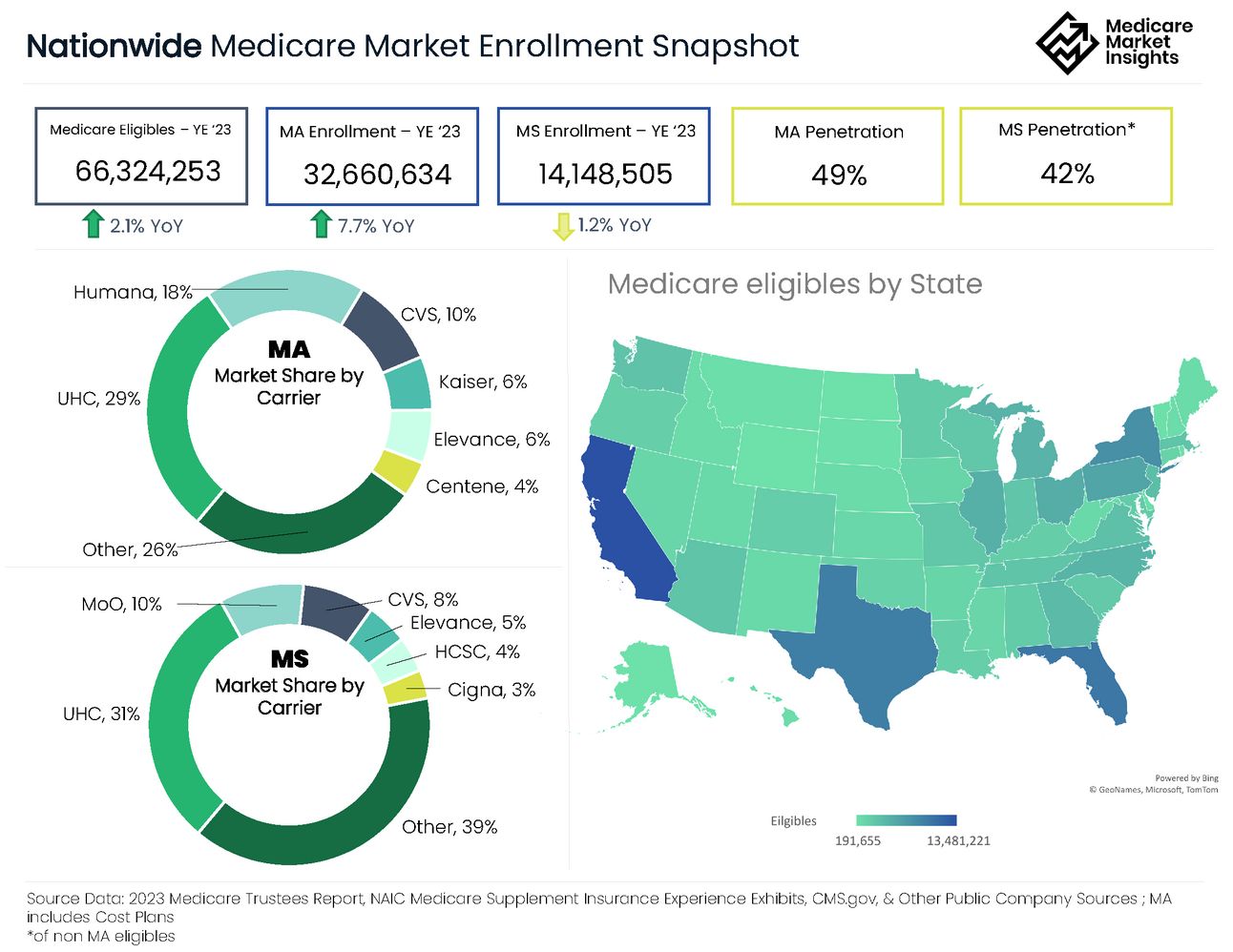

DATA VISUAL of the Week 📊 - Year end 2023 Medicare Enrollment Stats!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

CMS revised Medicare Advantage star ratings. Here’s which payers benefited. - (link)

Humana among potential buyers of Walmart clinics: Report - (link)

Insurers Pocketed $50 Billion From Medicare for Disease No Doctor Treated - (link)

7 Medicare Advantage plans snag 5-star ratings after CMS redo - (link)

Cano Health emerges from Chapter 11 bankruptcy with 80 care providers in FL, $200 million in funding - (link)

Health Insurer Financial Performance in 2023 - (link)

Why a ‘federal North Star’ is needed for Medicare Advantage prior authorization - (link)

Jared’s recent LinkedIn posts:

Medicare Market Insights is 1 year old! 🎂 - (link)

Who are the 18 publicaly traded companies focused on the Medicare Market? - (link)

News out of Texas related to MA agent/broker comp. changes. - (link)

OLD way vs. NEW way of selling Medicare products. - (link)

MA broker comp. is going up ~19% in 2025. Well, sort of… - (link)

DEEP DIVE 📚

Capitated vs. FFS Payment Models ⚖

Medicare has two primary payment models.

Fee-for-service (“FFS”) and Capitated.

If you are a leader in the Medicare ecosystem, it’s essential that you have a basic understanding of what these payment models are, the incentives, positives and negatives of each, and where these payment models are generally used.

All said, Medicare spends a trillion dollars a year, and the money is largely dispersed in these two ways. Fee-for-service or Capitated.

In today’s deep dive we are comparing and contrasting the two.

Fee-For-Service (“FFS”)

The FFS payment model is primarily what “Traditional Medicare” uses.

Definition: Fee-for-Service (FFS) is a payment model where healthcare providers receive a separate payment for each service or procedure they perform.

Providers bill Medicare for each service they perform and get reimbursed based on a pre-determined schedule.

There are fee schedules for physicians, ambulance services, clinical laboratory services, durable medical equipment, prosthetics, orthotics, and supplies all maintained and updated each year by CMS.

This payment model certainly has some positives and negatives.

Positives

Clarity →

There is a clear schedule of what gets paid for each service performed.

Providers generally know what they will get reimbursed by Medicare for the services they provide to the patient.

Access to care →

Providers widely accept Medicare fee-for-service, meaning patients can generally pick their own providers and see a wide array of providers without risk of being “out of network” or facing pre-authorization.

Providers are incentivized to provide a wide array of services

Negatives

Over utilization →

Providers are incentivized to perform more tests and complete more procedures even when not necessary.

Lack of coordination →

FFS doesn’t incentivize different providers working together to coordinate care, but instead to work in “silos”.

Treats the symptom instead of the overall lifetime health of the patient.

Billing Complexity →

There are tens of thousands of ICD-10 codes. There is significant administrative cost associated with billing appropriately.

Capitated Payment Model

The Capitated Payment Model is primarily what Medicare Advantage uses.

Definition: Payment model where payers and/or providers receive a fixed payment per beneficiary to deliver all necessary healthcare services over a specified period of time.

The capitated payment amount paid by CMS to specific payers and/or providers is set each year in the bidding process.

It’s important to note that in Medicare Advantage, the capitated payment amount is adjusted based on the risk (health status and demographics) of each patient.

In addition, there are bonuses associated with performance of the plans/providers (i.e. Star Ratings).

Positives

Spending Control →

Controls spending by setting a specific payment amount per member for a specific time period

Better predictability of spending

Focus on Member Health →

Encourages focus on preventative services and other support which leads to better overall health of the patient, which (in aggregate) ideally results in lower lifetime cost of care

Encourages a focus on overall health of the member, not simply services performed

Care Coordination →

Encourages coordination of care between different providers

Negatives

Service Reduction →

Incentivizes reducing the amount of care and services performed

Incentivizes pre-authorization and delay of services

In order to coordinate care, networks are typically required. This can be a downside to patients seeking care.

Upcoding →

The risk adjustment component of Medicare Advantage capitation incentivizes payers/providers to inappropriately “up-code” in order to increase the capitated payment. Essentially making their members appear sicker than they are. (example)

Complexity →

Coordination of care between providers, helping improve and manage the overall lifetime health of a patient is very complex

Some Other Thoughts

A few additional notes as it relates to Medicare payment models:

A notable difference between Traditional Medicare FFS and Medicare Advantage Capitated is the role of the “Payer/Carrier”.

In Traditional Medicare FFS, the provider bills Medicare directly, and the money flows from Medicare to a provider.

In Medicare Advantage, Insurance Carriers (“Payers”) receive the capitated payment from Medicare. They then contract with providers and pay providers. The money flows from Medicare to a Carrier, and then from the Carrier to a Provider.

There are other payment models in Medicare that are generally related to FFS or Capitated payments, including Alternative Payment Models and Accountable Care Organizations to name a few.

There has been recent news of a substantial number of health systems (providers) dropping Medicare Advantage plans due to the financial strain (link, link).

I found the quote below (from the first linked article) to highlight the push and pull nature of Medicare payment structures.

‘Former CMS Administrator Don Berwick, MD, told Becker's in February that the battle between hospitals and Medicare Advantage is a "manifestation of an underlying broken system in which everyone that gives care wants to give more, and everyone that pays for care wants to pay less."‘

This is not an easy situation. The Medicare population is large and will keep growing. Medicare spending is already substantial and will continue climbing into the future. Trying to curb spending growth, while also providing adequate service is a multi-faceted, complex situation that will take a village to solve.

Okay, that’s all for today. I hope you found this helpful!

Sponsor Snapshot 🚀: Modivcare

Modivcare’s NEW White Paper explores how collaborations can improve care coordination and bridge significant gaps in the healthcare system.

With the right data, they have seen:

Increased Member Engagement

Reduced Costs

Gaps in Care Closed

Reduced ER Utilization

Download the free White Paper 📄 here → (click)

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

COMPLIANCE CHATTER 📢

This week, we are providing links to current movements in the courts that could have an impact on Medicare products.

Challenge to CMS's agent/broker compensation and administrative payment regulatory changes

Challenge to federal agencies power to interpret and enforce regulations

Challenge to nondiscrimination in health programs and activities rule (Section 1557 of the Affordable Care Act)

You can receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter:

DATA VISUAL of the Week 📊

This week’s visual highlights Medicare Enrollment stats at the end of 2023.

Get our new eBook 2024 Medicare Enrollment State Pages for free by referring one person to this newsletter!

Making a referral is simple. Click the button below.

If you’d rather just buy the eBook instead click here!

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: