This week’s newsletter is Sponsored By: PolicyBind

Connect your sales staff with qualified Medicare Prospects → (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - CY '24 Medicare Carrier Financials Side-By-Side ❤️

Sponsor Snapshot 🚀 - brought to you by PolicyBind

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

What You Need to Know About Elon Musk's DOGE's Access to Medicare Systems - (link)

Medicare Advantage insurers lobby Trump for relief - (link)

Healthcare lobbying 2025: Here are the top policy issues for hospitals, payers, docs and tech - (link)

SelectQuote Announces $350 Million Strategic Investment… - (link)

Trump’s DOJ Takes Surprising Stance on Agent and Broker Payments in MA - (link)

Premium Rate Scorecard – February 2025 - (link)

Tri-Agency Rule: Where We Are and Where We Have Been - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

CY '24 Medicare Carrier Financials Side-By-Side ❤️

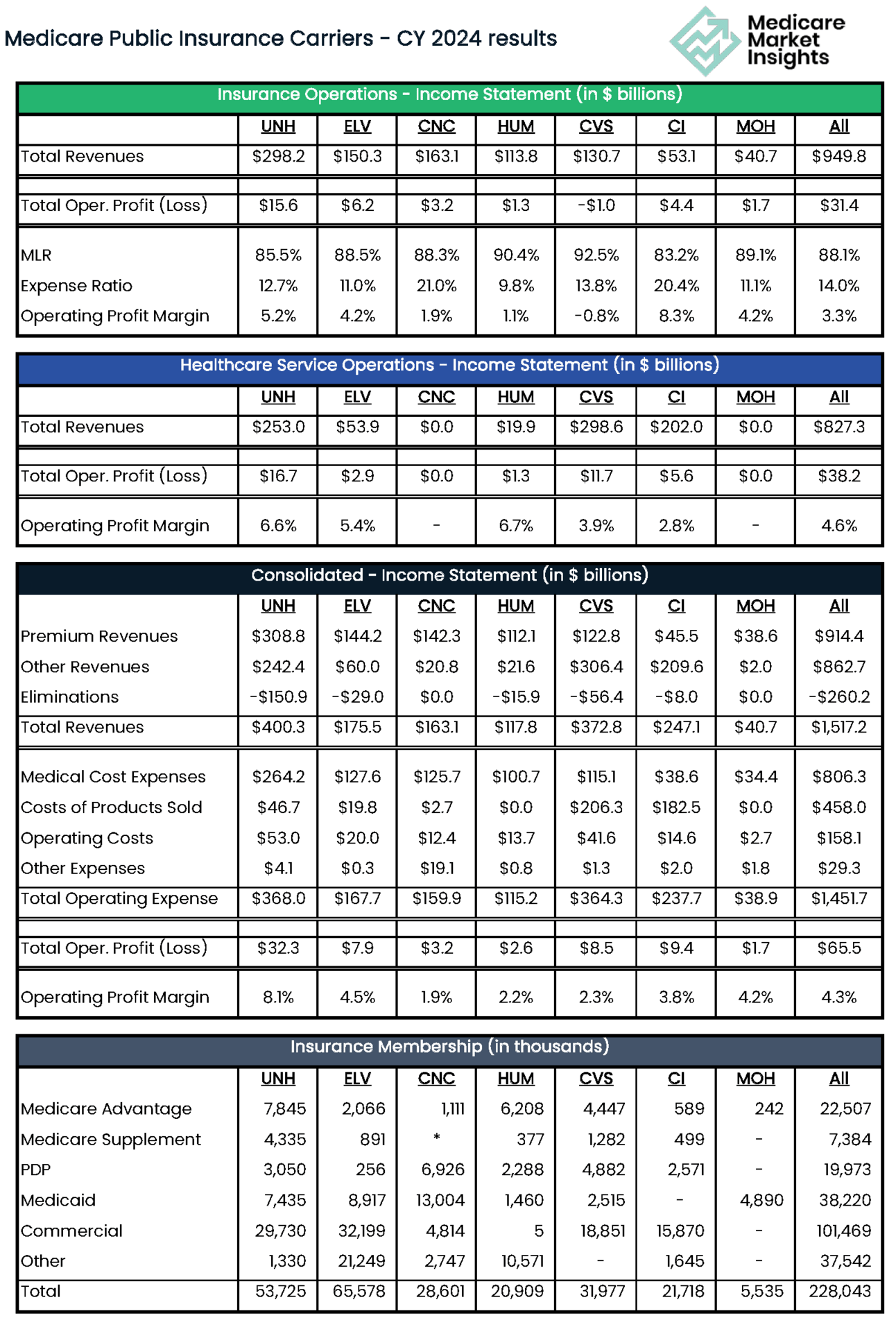

In this week’s deep dive, we are looking at publicly traded Medicare carrier calendar year (“CY”) 2024 financials side-by-side.

The insurance carriers included in this analysis are all trying to capture a piece of the growing Medicare market (along with other insurance markets), and do so profitably. Here they are:

Aside from Centene and Molina, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

Here is the split of 2024 revenues between these two segments for each carrier:

Income Statement & Membership Side-By-Side

To compare and contrast the calendar year 2024 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

YoY % Change

Here is the % change in key metrics from CY 2023 to CY 2024.

Current Valuation Metrics

Here are current valuation metrics for these carriers

Higher Loss Ratios

Higher Medical Loss Ratios (“MLR”) was a common theme in 2024 for these carriers (it was also a common theme in 2023!).

Generally speaking, they all saw higher loss ratios in their Medicare and Medicaid blocks specifically.

All Carriers ended 2024 with higher loss ratios than in 2023.

CVS up 6.3%, UNH up 2.4%, HUM up 2.4%, CI up 1.9%, ELV up 1.5%, MOH up 1.0%, and CNC up 0.7%.

Across the industry, rising utilization, Medicaid redeterminations, Medicare Advantage funding cuts, and higher pharmacy costs were common themes.

Several companies mentioned the higher loss ratios in their year-end financial earnings releases. Here is a sampling.

→ CVS: “driven by increased utilization, the unfavorable impact of the previously disclosed decline in the Company’s Medicare Advantage star ratings for the 2024 payment year and the impact of higher acuity in Medicaid.”

→UNH: “The increase was primarily due to previously discussed items, including the revenue effects of CMS’s Medicare funding reductions, member mix and timing of Medicaid redeterminations. Factors cited on the company’s third quarter earnings call, including increased hospital coding intensity and specialty medication prescribing, continued at similar levels in the fourth quarter…”

→ HUM: “continued impact of elevated Medicare Advantage and state-based contracts medical cost trends in 4Q24 and FY 2024, and lower favorable prior period medical claims reserve development… additionally, continue to reflect a shift in line of business mix, with growth in Medicare Advantage and state-based contracts and other membership, which can carry a higher benefit ratio.”

→ ELV: “driven primarily by higher Medicaid medical cost trends.”

→ CNC: “The increase was primarily driven by higher acuity in Medicaid resulting from the redetermination process as we continue to work with states to match rates with acuity. The increase was also driven by Medicare Star rating impacts. The increases were partially offset by Marketplace membership growth and improved margin through strong 2024 product design and execution”

Notable Observations

A few other notable observations.

Combined, these carriers generated $1.52 trillion in Revenues (up from $1.39 trillion) and $65.5 billion in operating income (down from $71.7 billion) in 2024.

Membership

6% Combined Medicare Advantage member growth (down from 8% last year)

led by CVS (29% growth) and MOH (41% growth due to acquisition of Bright Health block)

Centene lost 13% of Medicare Advantage members

Medicare Supplement membership flat

Humana saw 23% growth.

Overall, Medicaid saw 7% decline

Humana and Molina both grew their blocks.

PDP market shifted significantly with Centene growing 50% while Humana and CVS both declined 20%

Insurance Operations

Combined 8% revenue increase led by CVS, Molina and Humana

Combined Medical Loss Ratio increased 2.4%!

CVS (6.3%) saw the largest increases (they also had the largest increase of 2.9% in 2023)

Combined profit margin down 1.1%

Centene and Cigna grew profit margin very slightly, all other’s profit margins fell

CVS profit margin decreased 4.5%

Healthcare Services Operations

Combined 10% revenue increase led by Cigna (32%)

Combined profit margin down 0.3%

all Companies saw a decline in profit margin

Consolidated Results

Combined revenue up 9%

Cigna saw the largest increase of 27%

Combined operating profit down 9%

Combined profit margin down 0.8%

Final Thoughts

2025 will be pivotal as Medicare carriers continue to adjust to rising costs, potential regulatory changes, and the ongoing effects of Medicaid redeterminations.

Expect further pricing adjustments and potential shifts in plan design heading into 2026.

___

Sources: Carrier quarterly financial earnings releases, 10-Qs and 10-Ks.

SPONSOR SNAPSHOT 🚀: PolicyBind

Medicare Distributors often struggle to find qualified prospects, hindering business growth and increasing marketing costs.

PolicyBind connects your sales staff with qualified Medicare prospects.

Their dynamic filtering and real-time handoffs enhance conversion rates, enabling agents to expand their client base efficiently.

They’ve helped distributors write millions of premiums and grow their books of business.

Find out how they can help you grow your book today → (link)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter which includes several regulations and rules impacting Medicare Supplement, Dental, Medicare Advantage and more.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: