This week’s newsletter is Sponsored By: USA Senior Care Network

USA Senior Care Network gives Medicare Supplement carriers the ability to positively impact loss ratios, stabilize rates, lessen the severity of future rate increases, and helps to retain policyholders.

As the Silver Tsunami approaches, Medicare enrollment is going to skyrocket. Are you going to be able to stay competitive in the Medicare Supplement market?

Because all Medicare Supplement carriers provide the same plans and benefits, one of the few ways to differentiate is by providing competitive premium rates. USA Senior Care Network is an exclusive network of hospitals that have agreed to waive all or a portion of the Medicare Part A deductible, currently $1,600.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive explores the 2024 MA Landscape for FL, CA and TX

NEW SECTION!! Compliance Chatter 📢 - helpful reminders to keep you compliant.

Sponsor Snapshot 🚀 - brought to you by USA Senior Care Network

Data Visual of the week 📊 - Data Visual highlighting Medicare Enrollment stats for New York.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

The Private Plan Pitch: Seniors’ Experiences with Medicare Marketing and Advertising - (link)

Independence Blue Cross touts enhanced Medicare Advantage offerings for 2024 - (link)

Medicare enrollment begins in 2 weeks. Here's what major payers are offering for 2024- (link)

Physician group slams insurers for overcharging taxpayers for Medicare Advantage- (link)

Jared’s recent LinkedIn posts:

Deep Dive 📚

In Focus: Medicare Advantage 2024 Landscape across FL, CA & TX

This time of year there is a flurry of activity happening in preparation for AEP (only 3 days away).

For data nerds, this time of year is very exciting because CMS releases a bunch of data files with information on the Medicare Advantage and PDP plans available during AEP.

There are countless ways one could analyze this data.

In this deep dive we focus on the Medicare Advantage landscape for the top 5 organizations in the top 3 states (Florida, California, and Texas) based upon 2023 plan enrollment.

For each we compare 2024 to 2023 across:

Plan Availability

Plan Types

Plan Premiums

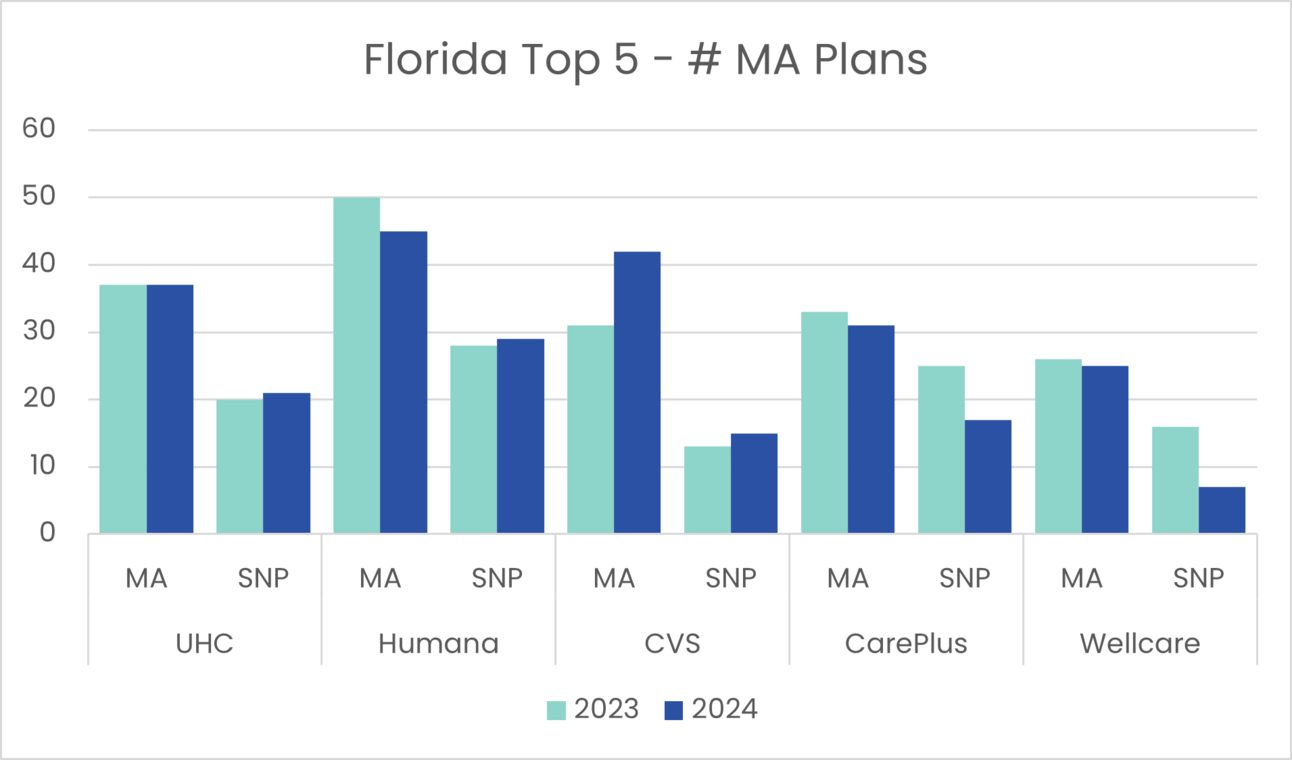

Florida

Plan Landscape

The top 5 organizations in Florida make up 75% of the Medicare Advantage market.

In 2024, 613 total Medicare Advantage plans are available to the estimated 5,017,693 Medicare eligibles.

Most notably, CVS added 13 new plans, while Wellcare reduced the number of SNP plans offered by 9.

Outside of Medicare Advantage plans, there are 21 stand-alone PDP plans available to Florida consumers.

Plan Type

Overall, there are 496 local HMO plans, 110 local PPO plans, and 7 Regional PPO plans available in Florida in 2024.

CarePlus offers exclusively local HMO plans, while CVS and Humana have decreased the number of local HMO plans in favor of local PPO plans.

Plan Premiums

The 2024 average MA premium in Florida is $3.83, while the average SNP premium is $19.65.

75% of all 2024 plans offered in Florida have a $0 premium.

Information for the top 5 is shown in the table below. MA plans offered by both CVS and CarePlus are all $0 premium, while Wellcare’s average SNP premium increased by $10 per month.

California

Plan Landscape

The top 5 organizations in California make up 69% of the Medicare Advantage market.

In 2024, 465 total Medicare Advantage plans are available to the estimated 6,770,232 Medicare eligibles.

Even though CVS is not included in our top 5, it’s worth mentioning they added 18 new plans.

Outside of Medicare Advantage plans, there are 23 stand-alone PDP plans available to California consumers.

Plan Type

Overall, there are 406 local HMO plans, and 59 local PPO plans available in California in 2024.

SCAN and Kaiser offer exclusively local HMO plans, while UHC and Humana have decreased the number of local HMO plans in favor of local PPO plans.

Plan Premiums

The 2024 average MA premium in California is $17.34, while the average SNP premium is $18.29.

59% of all 2024 plans offered in California have a $0 premium.

Information for the top 5 is shown in the table below. Humana and UHC decreased the number of $0 premium plans offered in 2024, while Humana’s single SNP plan in California had an almost $11 per month premium increase.

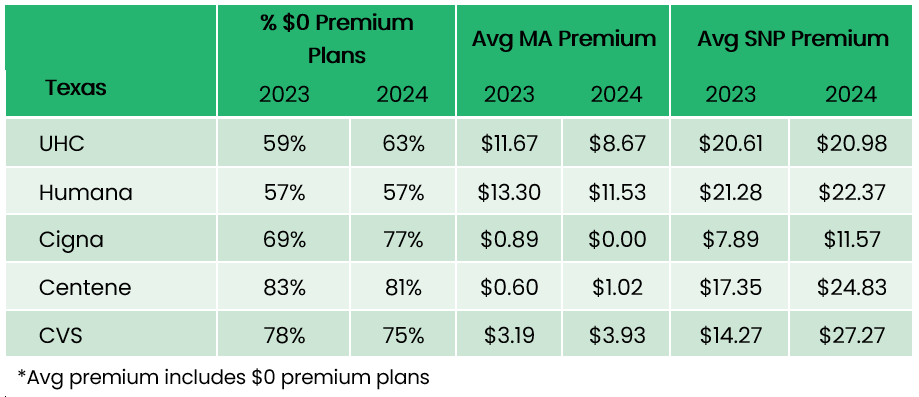

Texas

Plan Landscape

The top 5 organizations in Texas make up 85% of the Medicare Advantage market.

In 2024, 373 total Medicare Advantage plans are available to the estimated 4,629,883 Medicare eligibles.

UHC added 20 new plans, and while not included in the top 5, Amerigroup is expanding its SNP presence by adding 11 new SNP plans.

Outside of Medicare Advantage plans, there are 22 stand-alone PDP plans available to Texas consumers.

Plan Type

Overall, there are 262 local HMO plans, and 102 local PPO plans available in Texas in 2024.

Outside of local HMO and PPO plans, there are few “other” plan types (PFFS, MSA, and regional PPO) in Texas.

Plan Premiums

The 2024 average MA premium in Texas is $10.51, while the average SNP premium is $20.36.

65% of all 2024 plans offered in Texas have a $0 premium. Information for the top 5 is shown in the table below.

Cigna expanded its $0 premium offering by 5 plans, while the CVS SNP average premium increased by $13 per month.

Sources:

CMS Medicare Advantage/Part D Contract and Enrollment Data, 2023-09

CMS CY2024 Landscape File

CMS 2024 Part C&D Plan Crosswalk

Compliance Chatter 📢:

This week we bring you another helpful reminder to keep compliant during AEP, specifically focusing on marketing materials.

When creating marketing material or planning a campaign for Medicare Advantage or Part D, remember:

Marketing or communication material mentioning any benefits available to a Medicare beneficiary, including dental, vision, or hearing, must be submitted to HPMS through a carrier or TPMO.

Benefits cannot be marketed in a service area where those benefits are not available. Rule CMS-4201-F does make an exception if benefits are advertised in local media where distribution across plan service areas is unavoidable.

Marketing materials must include the names of the Medicare Advantage organization(s) or Part D sponsor(s) whose plan, benefits, or costs are being represented.

Marketing materials cannot describe potential savings an enrollee could experience by enrolling in a Medicare Advantage or Part D plan when compared to an uninsured beneficiary.

Rule CMS-4201-F was finalized by the Center for Medicare & Medicaid Services with marketing and communication provisions that went into effect September 30, 2023 and can be viewed here.

Sponsor Snapshot 🚀: Brought to you by USA Senior Care Network

As the US population ages, more than 80 million people will be Medicare eligible by 2030. The number of people who choose traditional Medicare with a Medicare Supplement is also projected to rise to close to 30% of all Medicare Eligible participants, or approximately 24 million.

CMS regulations related to Medicare Supplement plans mean that all carriers offer the same plans, with no differentiation in plan benefits. One of the few ways for a carrier to stand out, is through premium pricing. With premiums being determined primarily by plan costs, controlling Medicare Supplement expenditures is the most effective way to offer competitive rates. The challenge is the limitations on what carriers can do to control these expenditures.

Participating in USA Senior Care Network (USA SCN) offers carriers a powerful way to reduce plan costs with no impact on policyholders’ benefits. USA SCN’s network of hospitals have agreed to waive all or a part of the Part A Deductible for inpatient care. Carriers who participate in the program have seen lower premium increases vs carriers who are not participating.

Here are some current details of USA Senior Care Network:

Over 140 Medicare Supplement carriers are USA SCN clients and realize program savings which allow them to stay competitive.

11 million policyholders currently participate in the program.

This represents more than 75% of all Medicare Supplement Policyholders nationwide.

USA SCN carrier clients have saved more than $800 million by utilizing the program.

Medicare Supplement policyholders that participate in USA SCN are channeled to participating hospitals through a combination of an online hospital directory, US-based Customer Care call center, and carrier communications. With USA Senior Care Network, carriers benefit by reducing costs, hospitals gain new patients and policyholders see lower premium increases.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

Data Visual of the Week 📊

Data Visual of the week comes from Medicare Market Insights “2023 Medicare Enrollment State Pages” showing Medicare enrollment information for New York. If you want this information for all 50 states, click here.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: