This week’s newsletter is Sponsored By: HealthQuotes

HealthQuotes provides compliant inbound Medicare calls, is licensed in all 50 states, and is a proud member of Insurance Marketing Coalition.

Did you hear about the FCC’s recent $299,997,000 fine against an international robocaller?

Read more in the Sponsor Snapshot 🚀 section after the deep dive!

If you want to learn more about consumer generated inbound Medicare calls, please contact: [email protected]

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive looks at Medicare Part A.

Sponsor Snapshot 🚀 - The FCC’s $299,997,000 fine.

Data Visual of the week 📊 - Data Visual highlighting Medicare Part A projected funding depletion.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

Hospitals take aim at Medicare Advantage - Hospitals have been dropping Medicare Advantage plans over high claim or prior authorization denial rates since at least 2018… (link)

Select Health, Kroger team on co-branded Medicare Advantage plans - Select Health is teaming up with grocer Kroger to launch new co-branded Medicare Advantage (MA) plans… (link)

5 Considerations for Insurance Agencies When Choosing an FMO - Selecting an insurance FMO can make or break your success in the industry, so you should consider your choice carefully. (link)

Jared’s recent LinkedIn posts:

Deep Dive 📚

I’d Like to Buy a Vowel. “A”, please.

Back in July, we looked at how the Original Medicare or Medicare Fee-For-Service (“FFS”) program came into existence along with the major changes implemented since.

This week’s deep dive is going to take a closer look at one of the parts of Original Medicare. Today’s delicious batch of alphabet soup serves up Part A.

History

Original Medicare Part A (“Part A”) came into existence with the enactment of Title XVIII of the Social Security Act in 1965, which was signed on July 30th by President Lyndon Johnson.

Ironically, the Act was signed at the Harry S. Truman Presidential Library in Missouri. Former President Truman and wife Bess would later become the recipients of Medicare card numbers 1 and 2. Former President Truman had been the first president to publicly endorse a national health program.

Upon signing the Act, President Johnson stated that Truman had “planted the seeds of compassion and duty” that led to bringing Medicare into existence.

Administration

Part A is administered by the Centers for Medicare and Medicaid Services (“CMS”). CMS utilizes a network of Medicare Administrative Contractors (MACs) to process and pay claims for FFS beneficiaries.

Previously, Part A functions were managed by Fiscal Intermediaries until CMS replaced them with MACs in 2003.

There are currently 12 A/B MACs that handle FFS Part A claims for a specified geographic jurisdiction with 4 also handling home health and hospice claims.

In 2022 alone, MACs processed approximately 202 million Part A claims, which equates to over 3 claims per Part A beneficiary.

Eligibility

Part A is available to individuals that are age 65 or older, disabled, have ALS, or have end-stage renal disease.

Most beneficiaries that receive Part A do so for free and are not subject to a premium. These individuals are entitled to this free coverage based on their or their family's earnings, measured in quarters earned through FICA taxes during working years.

There are separate requirements to obtain premium free Part A if eligibility is due to disability or end-stage renal disease.

Additionally, if an individual does not qualify for premium free Part A, they are required to take additional steps to enroll.

Part A begins the month the beneficiary turns age 65 assuming they have filed an application for Part A, Social Security benefits, or Railroad Retirement Board benefits.

Coverage

Part A can be most simply thought of as hospital insurance. It provides coverage related to hospital inpatient care, skilled nursing facility care, hospice care, and some home health and nursing home care.

Some of the key benefits are as follows:

Part A makes use of a benefit period, which begins on the day a beneficiary is admitted as an inpatient in a hospital or skilled nursing facility.

The benefit period concludes when the beneficiary has not received inpatient hospital care for 60 consecutive days or 100 consecutive days for skilled nursing facility care.

Inpatient Hospital Care

After satisfying the deductible ($1,600 in 2023) for each benefit period, Part A pays the following:

Days 1-60: all costs

Days 61-90: all costs other than a $400 patient copayment each day

Days 91+: all costs other than an $800 patient copayment per “lifetime reserve day” after day 90

Part A provides up to 60 “lifetime reserve days” over the beneficiary’s lifetime and does not pay any costs after exhaustion.

Skilled Nursing Facility Care

A beneficiary becomes eligible for Part A benefits if they have days remaining in the benefit period and have a qualifying inpatient hospital stay. Part A pays the following:

Days 1-20: all costs

Days 21-100: all costs other than up to $200 coinsurance per day

Part A does not provide coverage for days beyond 100 within a benefit period.

Hospice Care

Once a beneficiary qualifies for and agrees to receive hospice care, Part A covers most of the costs.

The beneficiary may have a $5 copayment related to outpatient prescription drugs to treat pain and symptoms.

Additionally, the beneficiary may be responsible for 5% of the Medicare approved amount for inpatient respite care.

the copay cannot exceed the yearly deductible for inpatient hospital care.

Statistics

Within its first year of existence, Part A provided coverage to over 19 million individuals.

By the year 2000, this value more than doubled to over 39 million beneficiaries.

As of year-end 2022, Part A has swelled to covering nearly 65 million individuals.

According to the 2023 Medicare Trustees report, the Part A program will experience an average growth rate of 1.9% over the next decade bringing the total number of beneficiaries to over 76 million.

Funding

Part A is paid for by the Hospital Insurance (HI) Trust Fund. This funding is received through four primary sources:

Payroll taxes paid by employees, employers, and the self-employed

Taxes paid on Social Security benefits

Investment income from trust fund assets

Premiums from individuals not eligible for free Part A

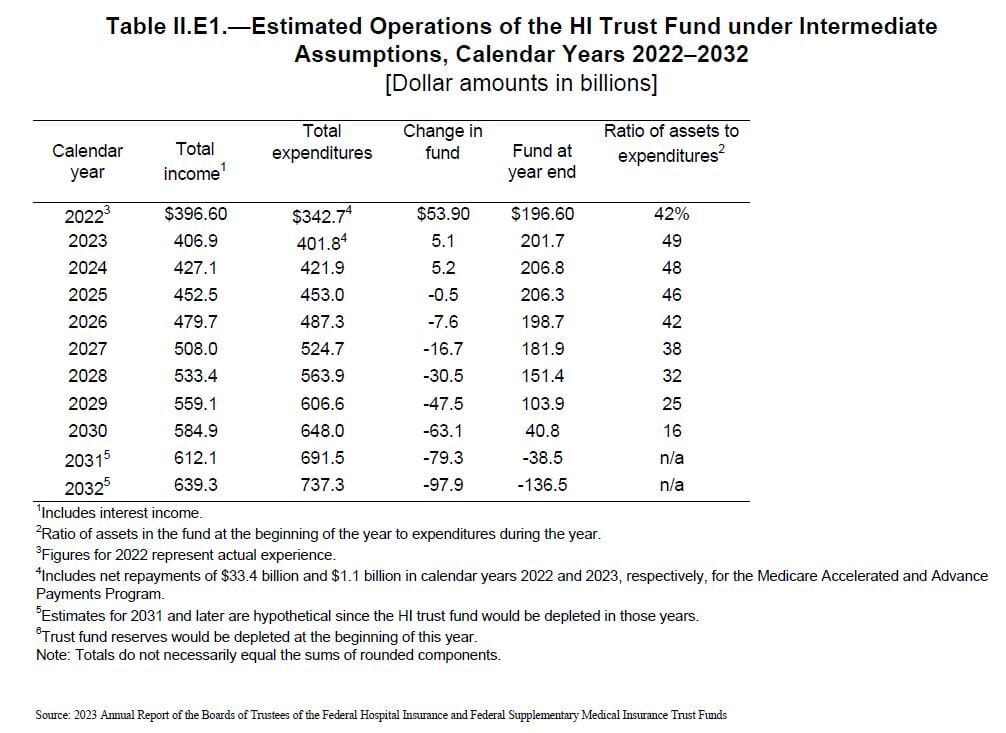

According to the 2023 Medicare Trustees report, it is currently estimated that the HI trust fund will be depleted in 2031. The primary reason for this depletion is that beginning in 2025, the HI income will be less than the HI expenditures, resulting in an annual deficit until depletion.

(Note: In addition to Original Medicare, Medicare Advantage (Part C) is partially funded by the HI Trust fund.)

Leaders in Washington have been “kicking the can down the road” on this topic for years, but changes will be needed to continue funding Medicare Part A. Raising taxes, reducing benefits, changing age of eligibility, and funding from other sources are all possible options.

With the continued rapid growth of the Medicare eligible population, Part A will continue playing an important role in insurance coverage well into the future.

Sponsor Snapashot 🚀

Hello Medicare Marketing Professionals,

As professionals engaged in outbound dialing with live or aged data leads, or handling warm transfers from call centers, the recent crackdown on illegal robocalling by the FCC must have captured your attention!

In July of this year, the FCC made a resounding statement with its largest-ever fine of $299,997,000 against an international auto warranty scam operation.

This action highlights the urgency of addressing rampant robocall malpractice. The scheme bombarded unsuspecting consumers with an astonishing five billion robocalls in just three months, cycling through over a million phone numbers and violating numerous regulations, including pre-recorded voice calls without consent, unauthorized telemarketing, and deception in caller ID.

But let’s pivot our focus to what truly matters – making informed choices in your Medicare marketing partnerships.

Transparency: More than just a buzzword, transparency is the bedrock of ethical marketing. The FCC’s recent case underscores the consequences of opacity. When selecting a marketing agency, prioritize those who openly communicate, meticulously document actions, and collaboratively ensure compliance. Transparent practices are the foundation of successful, ethical marketing that safeguards your reputation.

Consumer-Generated Calls: In a landscape crowded with robocalls, authentic consumer-generated calls stand out. Instead of pursuing sheer quantity, prioritize quality connections. Partner with agencies that emphasize genuine engagement and interest-driven interactions. These connections not only yield results but also align seamlessly with regulatory guidelines.

HealthQuotes: Holding licenses to sell insurance in all 50 states, HealthQuotes sets the gold standard for transparency, compliance, and authentic customer connections. Their dedication to value through consumer-generated calls is unparalleled. By teaming up with HealthQuotes, you embrace a partner committed to integrity, client satisfaction, and industry leadership.

Ready to Elevate Your AEP in 2023?

Contact HealthQuotes today to discuss your call requirements and empower your journey toward sales and growth excellence! Contact our sales team today at [email protected] to discuss further.

Data Visual of the Week 📊

This week’s Data Visual of the week comes from the Medicare Trustees Report showing the depletion of the HI Trust Fund by 2031.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: promote your product or services to leaders in the Medicare space. Let’s discuss. (link) Note: 6 slots already taken.

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market. Let’s discuss. (link)

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: