This week’s newsletter is Sponsored By: USA Senior Care Network

USA Senior Care Network gives Medicare Supplement carriers the ability to positively impact loss ratios, stabilize rates, lessen the severity of future rate increases, and helps to retain policyholders.

As the Silver Tsunami approaches, Medicare enrollment is going to skyrocket. Are you going to be able to stay competitive in the Medicare Supplement market?

Because all Medicare Supplement carriers provide the same plans and benefits, one of the few ways to differentiate is by providing competitive premium rates. USA Senior Care Network is an exclusive network of hospitals that have agreed to waive all or a portion of the Medicare Part A deductible, currently $1,600.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive explores MA Special Needs Plans

Compliance Chatter 📢 - Oklahoma’s new Birthday Rule for Medicare Supplement.

Sponsor Snapshot 🚀 - brought to you by USA Senior Care Network.

Data Visual of the week 📊 - Data Visual highlighting Demographics of AEP shoppers.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

2024 Medicare Deductibles & Copays - (link)

Medicare Advantage plan star ratings decline again in 2024 - (link)

Medicare lifts limit on brain scans for Alzheimer's patients - (link)

50-Cent Medicare Part D Premiums in 2024? Yes, Really! - (link)

Alignment Healthcare, Walgreens launch co-branded Medicare Advantage plans - (link)

Jared’s recent LinkedIn posts:

Deep Dive 📚

MA SNPs: A Closer Look at Special Needs Plans

Special Needs Plans (“SNPs”) are the fastest growing part of Medicare Advantage (“MA”). From Oct. ‘22 to Oct. ‘23 enrollment in SNPs grew 24%!

Without growth in SNPs, MA growth would be much more modest.

So, what are SNPs, and what are some of the recent trends?

What are SNPs?

Within the universe of MA plans, there is a subset of Special Needs Plans (SNPs). Each SNP is designed to meet the specific needs of a specific population. They may do that by providing tailored benefits, provider networks, and/or special drug formularies.

Like all Medicare Advantage (MA) plans, a SNP must submit a bid to the Centers for Medicare & Medicaid Services (CMS) and earn revenue according to the plan’s enrollment and risk adjustment methodology.

SNPs utilize either an HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization) chassis, and they cover Medicare Part A and Part B just like any other Medicare Advantage plan. Also similar to many Medicare Advantage plans, they often provide additional services beyond Part A and Part B. Carriers determine which MA plans they offer and where, so each type of SNP may or may not be available in some areas of the country. Further, SNP plan availability may change from year to year.

The following additional characteristics are common to all SNPs:

Provide Medicare drug coverage (Part D)

Use a care coordinator

Must submit a Model of Care (MOC) to CMS for review and approval.

More acronyms, more submission requirements: what’s a Model of Care (MOC)?

In addition to the “standard” MA bid, each SNP must have a Model of Care (MOC) approved by the National Committee for Quality Assurance (NCQA). CMS guidelines require that the model must include:

Specific population to be served – a description of the full continuum of care for the target population in the specific areas covered by the SNP.

Coordination of care plan – very broadly, this element describes how the SNP will assess health risks and address health needs for each plan enrollee.

Provider network – this element ensures that the SNP network includes expert providers in sufficient numbers and locations to provide quality care.

Quality measurement and improvement – this is intended to make sure each SNP delivers high-quality benefits to enrollees.

Depending on the score the MOC receives, a SNP plan may receive approval for one, two or three years. There is an exception to this for Chronic Care SNPs, which are limited to a one-year approval no matter what score they receive.

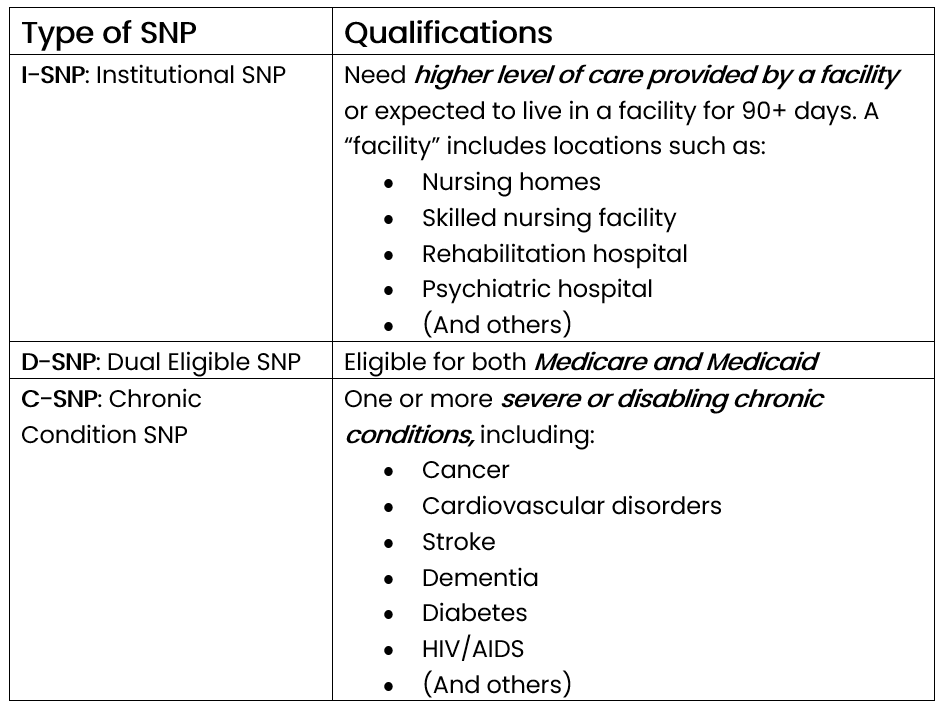

SNP Types and Qualifications

There are three distinct kinds of SNPs, each with different and unique requirements to qualify. The table below provides a summary:

If a beneficiary no longer meets the eligibility requirements for a SNP, the plan must provide at least a one-month grace period when coverage continues. At the end of the grace period, that beneficiary gets a Special Enrollment Period for two months after coverage under the prior SNP ends to enroll in a new plan.

SNP Trends

To complete our overview of Special Needs Plans, we will turn our attention to some SNP statistics and trends.

The proportion of MA enrollees covered by a SNP has steadily increased, from 15.5% in October 2021 to 19.8% in October 2023. Behind this are increases in both the number of SNP plans available and in total SNP enrollees.

Over just the past two years, SNP plan counts have increased by 32%, with most growth coming in the D-SNP segment:

Over the same period, the number of enrollees in SNP plans has also increased, by a whopping 49%. Most SNP enrollees (roughly 90%) are in a D-SNP plan, though both I-SNP and C-SNP plans have also seen total enrollment increase.

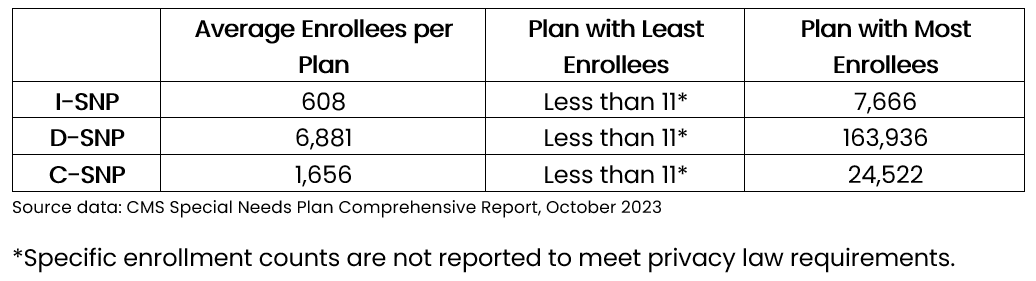

As you might guess, the number of enrollees in a specific SNP can vary dramatically:

That completes our SNP flyover for this week! You now have a view of the SNP landscape. More to come on the world of SNPs in a future Deep Dive!

Sources:

Compliance Chatter 📢:

Effective September 1, 2023, Medicare Supplement policyholders in Oklahoma will have a new opportunity to change Medicare Supplement plans without going through underwriting.

Section 365:10-5-129(f) of the Oklahoma Administrative Code was amended and further clarified in Bulletin No. 10-2023 (Revised) to include open enrollment language.

Medicare Supplement issuers must provide a new Medicare Supplement policy with equal or lesser benefits to any Medicare Supplement policyholder, including a policyholder under a different issuer, who has had no gap in coverage greater than 90 days since their initial enrollment.

Medicare Supplement issuers who offer a 60-day open enrollment period beginning on the policyholder’s birthday each year (“Birthday Rule”) will be deemed in compliance.

Medical underwriting and preexisting conditions exclusions must be waived.

In addition, Section 365:10-5-129(g) of the Oklahoma Administrative Code was amended to include a notification provision for policyholders under the age of 65, who are enrolled in Medicare due to a disability.

Medicare Supplement issuers must provide a notice of open enrollment eligibility.

The notice must be provided 60-90 days prior to the first day of the first month the policyholder turns 65.

Sponsor Snapshot 🚀: Brought to you by USA Senior Care Network

As the US population ages, more than 80 million people will be Medicare eligible by 2030. The number of people who choose traditional Medicare with a Medicare Supplement is also projected to rise to close to 30% of all Medicare Eligible participants, or approximately 24 million.

CMS regulations related to Medicare Supplement plans mean that all carriers offer the same plans, with no differentiation in plan benefits. One of the few ways for a carrier to stand out, is through premium pricing. With premiums being determined primarily by plan costs, controlling Medicare Supplement expenditures is the most effective way to offer competitive rates. The challenge is the limitations on what carriers can do to control these expenditures.

Participating in USA Senior Care Network (USA SCN) offers carriers a powerful way to reduce plan costs with no impact on policyholders’ benefits. USA SCN’s network of hospitals have agreed to waive all or a part of the Part A Deductible for inpatient care. Carriers who participate in the program have seen lower premium increases vs carriers who are not participating.

Here are some current details of USA Senior Care Network:

Over 140 Medicare Supplement carriers are USA SCN clients and realize program savings which allow them to stay competitive.

11 million policyholders currently participate in the program.

This represents more than 75% of all Medicare Supplement Policyholders nationwide.

USA SCN carrier clients have saved more than $800 million by utilizing the program.

Medicare Supplement policyholders that participate in USA SCN are channeled to participating hospitals through a combination of an online hospital directory, US-based Customer Care call center, and carrier communications. With USA Senior Care Network, carriers benefit by reducing costs, hospitals gain new patients and policyholders see lower premium increases.

For an overview of how USA Senior Care Network works, request our two-page handout by emailing [email protected].

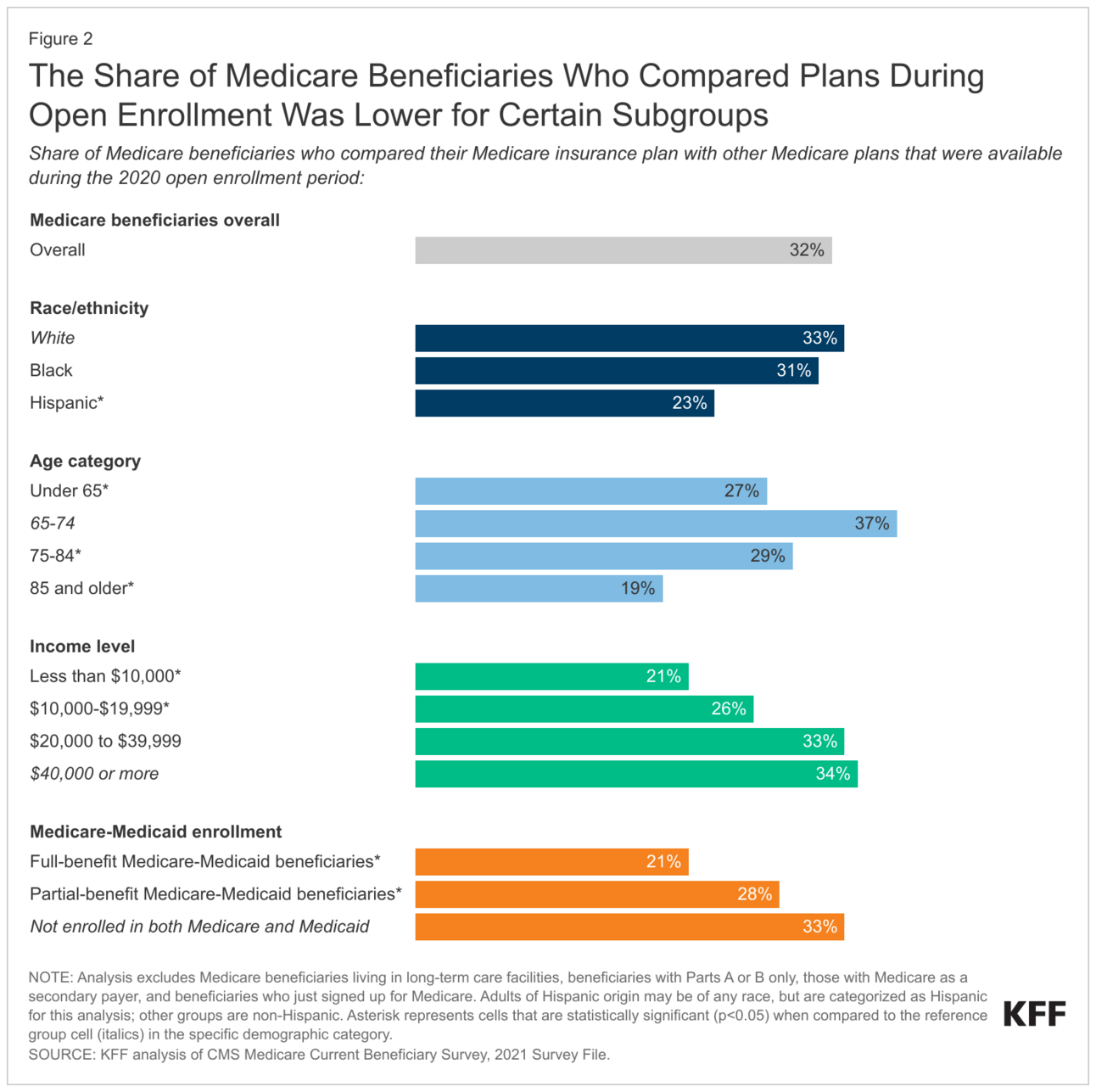

Data Visual of the Week 📊

Data Visual of the week comes from KFF article, “What to Know about the Medicare Open Enrollment Period and Medicare Coverage Options”, showing demographics of individuals who compare plans during Open Enrollment.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: