This week’s newsletter is Sponsored By: HealthQuotes

HealthQuotes provides compliant inbound Medicare leads, is licensed in all 50 states, and is a proud member of Insurance Marketing Coalition.

Are New CMS Regulations for Medicare Causing Concerns About Meeting Open Enrollment Targets?

As we approach this year’s AEP, Health Carrier CEOs/CMOs are keeping a close eye on three new CMS updates that have significant implications on Medicare Marketing.

Get access to HealthQuotes one-page guide outlining these important CMS updates by emailing [email protected].

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week we look at publicly traded Medicare Carrier Q2 results side-by-side.

Data Visual of the week 📊 - Data Visual highlighting MA market share by Carrier.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

Spending on Medicare Advantage Quality Bonus Payments Will Reach at Least $12.8 Billion in 2023 - analysis examines trends in bonus payments to Medicare Advantage plans, and more. (link)

Cano Health lays off 700 employees, now exploring sale as its cash dwindles - Primary care company Cano Health is exploring a sale as its cash dwindles and is laying off 700 employees, or 17% of its workforce… (link)

Judge blocks $15B Aetna Medicare Advantage contract for NYC retirees - A New York State Supreme Court judge has permanently blocked the implementation of New York City's plan to switch 250,000 retired city employees from traditional Medicare to an Aetna Medicare Advantage plan. (link)

Jared’s recent LinkedIn posts:

Deep Dive 📚

Medicare Carrier Q2 ‘23 Financials Side-By-Side

In this week’s deep dive, we are looking at publicly traded Medicare carrier Q2 2023 financials side-by-side.

It’s mainly numbers & data visuals so make sure to download pictures in your email!

If you are a numbers nerd 🤓 like me… you’re welcome!

As we’ve previously explored, the Medicare market is a growing market.

The insurance carriers included in this analysis are all trying to capture a piece of that market and do so profitably. Here they are:

Aside from Centene, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

Here is the split of revenues between these two segments for each carrier:

Income Statement & Membership Side-By-Side

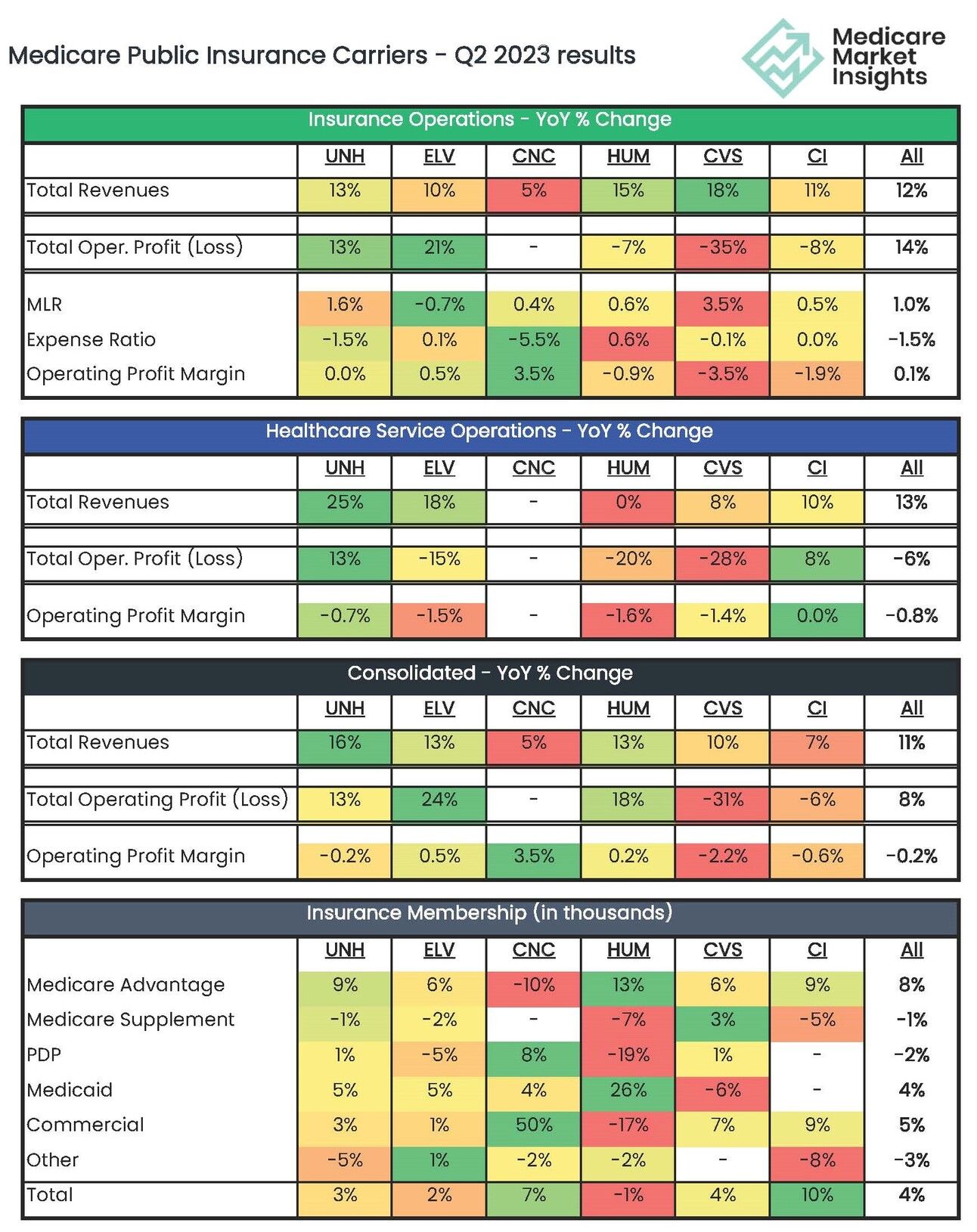

To compare and contrast the Q2 2023 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

*CNC combined MA and MS in one membership number. Based on other sources we know it’s nearly all MA.

YoY % Change

Here is the % change in key metrics from Q2 2022 to Q2 2023.

One Note: Centene went from a loss to a profit. Displaying % change is strange, so it was left out.

Bottom Line

A few notable observations.

Combined, these carriers generated $338 billion in Revenues and $18.7 billion in operating income during Q2 2023.

Combined, they make up more than 50% of the Medicare Advantage and Medicare Supplement markets.

Membership

8% Combined Medicare Advantage member growth

led by Humana (13% growth)

Centene lost 10% of Medicare Advantage members

Medicare Supplement membership down slightly

CVS grew 3% while all others declined

Insurance Operations

Combined 12% revenue increase led by CVS (18%)

Combined Medical Loss Ratio increase of 1%

UNH (1.6%) and CVS (3.5%) saw the largest increases

Combined profit margins flat (0.1%)

two outliers: CNC (3.5% increase), CVS (3.5% decrease)

Healthcare Services Operations

Combined 13% revenue increase led by UNH (16%)

Combined profit margins down (0.8%)

___

Sources: Carrier quarterly financial earnings releases and 10-Qs.

Data Visual of the Week 📊

This week’s Data Visual of the week comes from KFFs article on MA Enrollment Trends. MA market share by Carrier.

That’s it for this week. Let us know what you think.

Too much detail?

Not enough detail?

Just the right amount of detail?

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: