- Medicare Market Insights

- Posts

- Medicare SEPs (& Happy 🥧 Day)

Medicare SEPs (& Happy 🥧 Day)

Special Enrollment Periods are an important part of Medicare enrollment. We take a look at some of the key SEPs.

This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medicare SEPs (& Happy 🥧 Day)

Compliance Chatter 📢 - Maryland - Information Security & Risk Assessment - Certification of Compliance.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - AEP 2024 State Deep Dives.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Mounting headwinds in Medicare Advantage market haven’t stopped growth - (link)

CMS ups 4 Elevance Medicare Advantage star ratings - (link)

Less is the New More with Medicare Advantage Supplemental Benefits in 2024 - (link)

Medicare a Big Contributor to the Broken Health Payment System, Senators Told - (link)

Modernizing Medicare Risk Adjustment and Performance Measurement - (link)

Senior Hospital Indemnity Growth - (link)

Now Available: Medicare Supplement Essentials Guide! - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medicare SEPs (& Happy 🥧 Day)

Since the launch of the Medicare Market Insights newsletter, deep dives have presented numerous Medicare topics with a heavy focus on statistics and trends.

Simply speaking, they’ve focused on numbers.

If that style is more your cup of tea, apologies in advance, as this week’s deep dive is grammatical and not numerical. (A bit ironic since today is Pi Day!)

With that disclaimer out of the way, let’s get to it.

Medicare Enrollment

There are several enrollment periods associated with the Medicare program that allow individuals to enroll, change, or drop either a Medicare Advantage Plan (MA Plan) or Medicare drug plan (Part D Plan).

In general, these enrollment periods require that individuals:

have Medicare Parts A and B

reside within the plan’s service area

are a United States citizen or legal resident

have been assigned a Medicare number and Part A and/or B start dates

Here is a description of each of the enrollment periods:

Initial Enrollment Period

This is for individuals that are new to Medicare. It begins 3 months prior to when the individual gets Medicare and ends 3 months after. During this period, individuals can join any plan.

Initial Enrollment Period – New to Part B

This is for individuals that enroll in Part B after they have started to receive Part A. It lasts for the 3 months prior to Part B coverage beginning. These individuals can join any MA Plan with or without coverage for drugs.

Open Enrollment Period

This occurs annually from October 15 – December 7 and allows individuals to a) enroll, drop, or change to another MA Plan (or enroll/drop drug coverage); b) change from Original Medicare to an MA Plan or vice versa; or c) if already enrolled in Original Medicare, enroll, drop, or change Part D Plans.

Medicare Advantage Open Enrollment Period

This occurs annually from January 1 – March 31 for individuals that are already enrolled in an MA Plan. For individuals that are new to Medicare and enroll in an MA Plan, this Open Enrollment period runs from the month they are eligible to enroll in Parts A and B until the final day of the 3rd month they are eligible.

This period allows individuals to change to another MA Plan (with or without drug coverage) or drop their MA Plan and go back to Original Medicare. The latter group of individuals can also enroll in a Part D Plan.

Special Enrollment Periods

Outside of the previously listed enrollment periods, there are instances when individuals experience situations in their life that allow them to make changes to their MA or Part D Plan.

These instances are typically cases where an individual moves, loses their current coverage, can get other coverage, or their current plan has a change of contract with Medicare.

These instances can trigger a Special Enrollment Period (SEP).

The Medicare.gov website maintains a comprehensive list of available SEPs, but let’s look at a few key SEPs:

Individual moves to a new address that is still within their current MA Plan’s service area but has new plan options at their new address

In this situation, the individual can change to a new MA or Part D Plan. If this individual informs their current plan prior to moving, they can change plans starting the month before the move month up until 2 full months after the move. If they do not inform the plan until after the move, the opportunity to change plans starts the month the plan is notified plus 2 additional full months.

Individual has a condition and there is a Medicare Chronic Special Needs Plan (SNP) available for the condition

The individual may enroll in the SNP and can do so at any time. However, once enrolled, it ends the SEP.

Individual has a SNP but no longer has the eligible condition

The individual may enroll in an MA or Part D plan. The individual may enroll beginning the month that the special needs status is lost. It ends on the earlier date of the individual joining another plan or 3 calendar months after losing SNP coverage.

Individual wants to enroll in a plan with a 5-star quality rating

If one is available in their area, the individual can enroll in a MA, Part D, or Medicare Cost plan with a 5-start rating.

If the individual moves from a MAPD to Part D plan, they are disenrollment from the MA Plan and returned to Original Medicare for health benefits.

If the individual moves from a MAPD Plan to a MA Plan, they may lose drug coverage until the next enrollment opportunity and could potentially be subject to a Part D late enrollment penalty.

This SEP can only be used once and is available from December 8th until the following November 30th .

Individual becomes ineligible for Medicaid

This situation allows the individual numerous options:

Enroll in an MA Plan with drug coverage or a Part D Plan

Change to another MA or Part D Plan

Drop MA Plan and go back to Original Medicare

Drop Part D Plan

The individual has 3 full months to make a change from the later date of when they became ineligible for Medicaid or the date they were notified they became ineligible.

Individual drops their employer group coverage (including COBRA)

The individual may enroll in an MA or Part D plan. The individual has 2 full months following the month the group coverage ended.

Individual can get coverage offered by employer

The individual may drop their current MA or Part D plan to enroll in the employer’s plan, whenever the employer allows the individual to enroll in their plan.

Individual missed opportunity to sign up due to being impacted by a natural disaster or emergency

Individuals in this situation have a SEP that begins on the day that the Federal, state, or local government makes the declaration. The SEP is available until 6 months after the later of the end date in the declaration, end date of any declaration extensions, or date the government revokes the declaration. The Federal Emergency Management Agency (FEMA) maintains a searchable list of declarations.

___

Poll:

Which SEPs are most often used? |

___

3.14159

BTW. Happy Pi Day! Now that we’ve taken care of this week’s deep dive business, it’s time for a little fun!

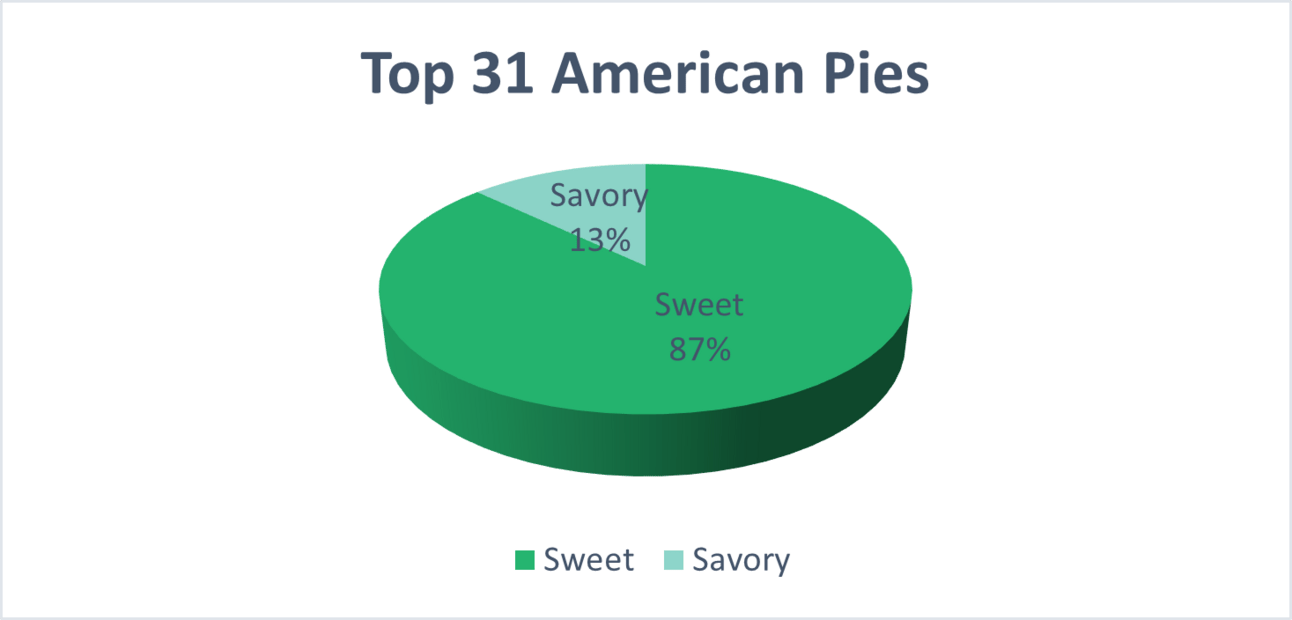

TasteAtlas recently updated its list of Top 31 American Pies. Unsurprisingly, sweet pies dominate the list.

TasteAtlas also updated its list of 23 Worst Rated American Pies. Ironically, #1 on this list was a savory entry, Spaghetti Pie 🤔, which was #31 on the Top 31 list.

What is your favorite slice of pie? (hit reply to let us know)

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

As evidenced by the recent cyberattack against Change Healthcare, information security plays a vital role in health insurance, and state insurance departments are taking notice.

For example, Maryland requires all insurers, nonprofit health service plans, health maintenance organizations, dental organizations, managing general agents, and third-party administrators doing business in Maryland to file a Certification of Compliance, certifying the carrier has a comprehensive written information security program based on the carrier’s risk assessment and a written incident response plan designed to promptly respond to, and recover from, a cybersecurity event.

The Certification of Compliance should be submitted by electronic form before April 15th annually.

Carriers who are domiciled in another state with substantially similar requirements are exempt from filing this certification in Maryland.

If you would like to learn more about our compliance services, reach out to [email protected].

DATA VISUAL of the Week 📊

The data visual of the week comes from Medicare Market Insights.

*NEW AEP 2024 Medicare Advantage State Deep Dives ebook available now! If you are a leader in the Medicare space you need this eBook. Buy yours here.

"One of the most VALUABLE ebooks I've bought in a long-time, ...you knocked it out of the park with this one. Sign me up for this ever year!"

- Russell Noga, CEO Medisupps.com

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)