Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medigap Market Updates - 2025 Q2

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Sweeping health agency cuts at FDA, CDC, CMS and more divisions begin (link)

Annual Enrollment Period Marketing 2026: Digital Trends and Insights - (link)

Pushing Medicare Advantage on Seniors : Unraveling the Complex Network of Marketing Middlemen - (link)

Key Senator Calls for Medicare Advantage Agents to Be Fiduciaries - (link)

Florida Blue, GuideWell CEO Pat Geraghty to retire - (link)

Some in Congress urge CMS to regulate MA plan marketing, prior authorizations - (link)

Medicare Supplement Rate Actions 2025 Q2 Updates - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medigap Market Updates - 2025 Q2

This week’s deep dive is an update to our quarterly Medigap Market Update and will cover recent happenings in the Medicare Supplement Insurance market.

__

New Products

Chubb has begun filing a new product under its “Insurance Company of North America” charter. The filings contain Plans A, F, G, HDG and N and will include a 7% household discount.

No other new multi-state product filings were submitted during Q1.

__

Rate Increases

Early 2025 rate filings are showing approved increases that are 2.5% - 3.0% higher than previous years.

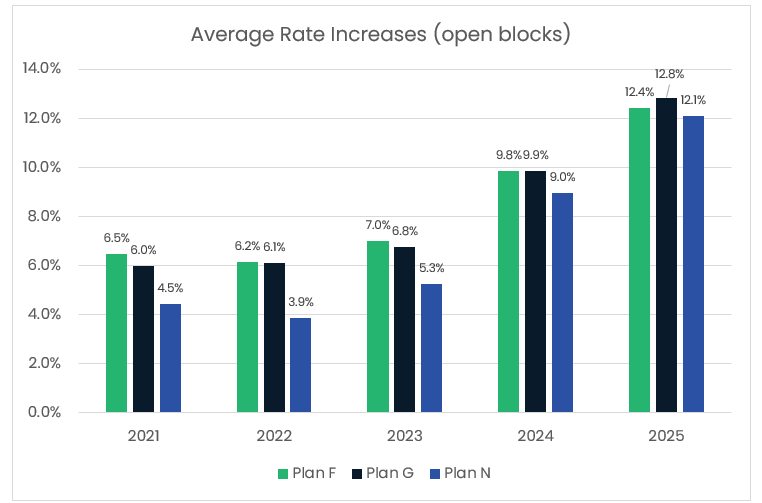

The following chart shows the average rate increases on open Medigap blocks for Plans F, G, and N over the past four years.

Double digit increases are going to be more common in 2025 than in previous years. This table shows the frequency of Plan G rate increases by different levels of increase.

The average rate increases in the new Birthday Rule states (i.e., KY, LA, and MD) ended 2024 about 1% higher than in states with normal underwriting rules. These higher rate increases are expected as companies continue to adjust their premiums to a level that is appropriate for the expected mix of business.

For more analysis on current rate increases go here.

__

Market Experience

Companies are required to report their Medigap experience as part of the annual statement process.

After combining reported results for the largest companies (with our estimates for the remaining companies), key results are as follows:

Earned Premium was up from $35.3 billion in 2023 to $36.7 billion in 2024 (up 4%)

Incurred Claims increased from $29.6 billion in 2023 to $30.9 billion in 2024 (up 4.4%)

Source: NAIC Annual Statement Exhibits

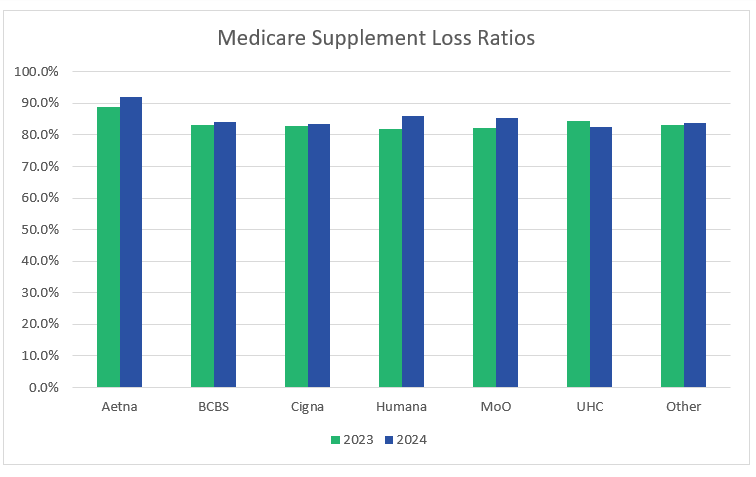

The following table shows estimated loss ratios for each the six largest carriers and all Other carriers the market. Note that some subsidiary experience was estimated for the larger companies.

Source: NAIC Annual Statement Exhibits

Note that UHC’s loss ratio decreased in 2024, while all other carrier’s increased.

More information will be provided as additional results become available.

—

Regulatory Updates

Virginia and Utah have finalized regulatory changes to introduce new Birthday Rule enrollment windows. Both states are targeting implementation for late spring 2025.

We are also watching progress on proposed regulations in the following states:

Under 65/Disability/ESRD -

→ California

→ Georgia

→ Illinois

→ Iowa

→ Ohio

→ Rhode Island

→ Texas

Open Enrollment Periods -

→ California

→ Vermont

→ Washington

Birthday Rule Guaranteed Issue -

→ Iowa

→ Indiana

→ Nebraska

→ New Mexico

→ Wisconsin

For more detailed information on Regulatory changes, you can check out our Insurance Regulatory Insights newsletter.

That is all for this quarter’s deep dive into the Medicare Supplement market. Thanks for reading!

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by accessing the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring – from digitally-enabled to clinician-led

Medication Management

E3 – Engage, Educate, Empower to address health literacy and support gap closure

See what Modivcare can do for you → (Link)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: