This week’s newsletter is Sponsored By: Telos Actuarial

Telos helps develop new Insurance products for the Medicare Market!

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medigap Market Updates for December 2023.

Compliance Chatter 📢 - Medicare Part D Benefit Changes in 2024 and 2025

Sponsor Snapshot 🚀 - brought to you by Telos Actuarial.

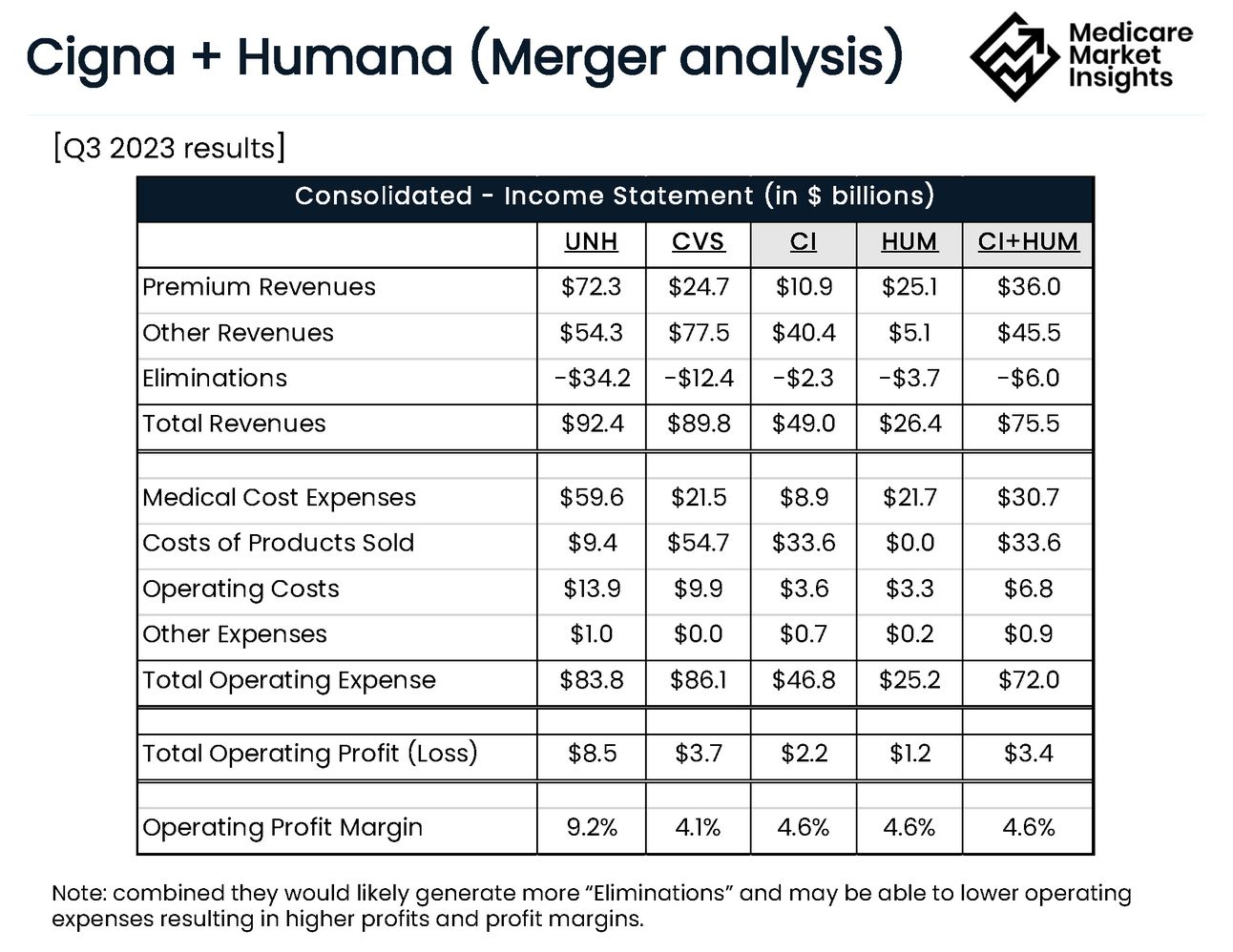

Data Visual of the week 📊 - Data Visual highlighting Cigna + Humana merger financial analysis.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Cigna and Humana in deal talks to create US health insurance giant - (link)

HCSC eyeing Cigna's Medicare Advantage business: Report - (link)

The next stage of Star Ratings evolution: 2025 Proposed Rule and beyond- (link)

…better outcomes in value-based care versus fee-for-service Medicare - (link)

Medicare Supplement December Premium Rate Score Card - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medigap Market Updates - ❄December 2023❄

This week’s deep dive is going to take a look at recent happenings in the Medicare Supplement Insurance market.

The format will be structured so that it is easy for you to read (and easy for us to write 😊). Our plan is to refresh this every few months so take a look and let us know if there are any other items that would be helpful to see!

1. New Products

There have been three new product releases that took place over the last several months:

Physicians Mutual has released a new product in several states. Years ago, they released an innovative version of Plan F where the High Deductible transitioned into the normal full coverage version of Plan F. They have kept that idea around with this new roll-out but this time it is only available on Plan G. They are also offering an optional rider that includes ‘benefits for preventive health services not covered by Medicare’.

Bankers Fidelity has also released a new Med Supp product. This offering includes several of the plans that are included in most programs plus Plan K. While not many companies offer Plan K, we have thought that there would be opportunities for carriers to offer this plan as a lower cost option to consumers that value the stability of a Medicare Supplement plan.

Humana has rolled out new pricing under the “Humana Achieve” brand in many states. The new plans are touted as offering a 12% household discount and higher agent compensation in many of the states.

We expect to see more new activity during early 2024 and into the summer as carriers and distributors look for ways to grow their Medicare Supplement blocks of business.

2. Rate Actions

Average rate increases on open blocks of business continue to be higher than recent years.

In 2023, the average approved rate increase on Plan F was 7.0% (vs 6.1% in 2022), Plan G was 6.8% (vs 6.0%) and Plan N was 5.3% (vs 3.7%). We have seen significant variance in rate actions by carrier and state.

Early indications are that 2024 rate actions will continue to trend higher. Approved rate increases are showing about a 2% increase from 2023.

Rate increases in the new Birthday Rule states (i.e., KY, LA and MD) are averaging 2.7% higher on Plan F, 3.5% higher on Plan G and 4.3% on Plan N than other states.

The following chart shows the average rate increase for Plans F, G and N:

3. Claim Trends

Medicare claim levels have been elevated in 2023, impacting both Medicare Supplement and Medicare Advantage[1].

Higher utilization of Part B Outpatient Hospital services

Higher utilization and larger claim size on Part B Coinsurance services

Top 5 Diagnosis categories (based on paid claims) for Telos client companies in 2023:

High Blood Pressure

Cancer treatments (chemotherapy + immunotherapy)

Degenerative joint diseases

Heart Disease

End-Stage Renal Disease

Telos client companies are seeing PMPM (“per-member-per-month”) increases ranging from 5% - 15% from 2022 levels.

Current expectation is that higher claim trends will continue into 2024. Companies looking to improve claims experience should be considering implementing population health and cost containment measures.

4. Regulatory Updates

Kentucky’s Birthday Rule regulation becomes effective on 1/1/2024. It allows current policyholders to switch to any other carrier without having to go through underwriting. The regulation requires carriers to use a 60-day application window based on the policyholder’s birthday. You can get additional details here from the Telos Actuarial OE-GI Guide.

Kentucky is also requiring carriers to reset the premiums for <65 coverage on 1/1/24. The new premiums will be calculated as an average of their inforce block of business. If a company doesn’t have a credible block of inforce policies, then they are required to use a prescribed mix that produces an average age of 70.

Virginia is requiring a Special Enrollment Period beginning on 1/1/24 that runs through 6/30/24 for individuals that are Medicare eligible due to disability. This SEP will allow eligible individuals to apply for coverage without having to go through underwriting. Carriers were also required to reset the premiums for <65 coverage so that they are not greater than the age 65 premium.

That is all for this week’s deep dive into the current happenings in the Medicare Supplement market.

Let us know if there are any other types of info that you want to see!

[1] https://www.fiercehealthcare.com/payers/humana-raises-ma-enrollment-projections-again-beats-eps-market-estimates

COMPLIANCE CHATTER 📢:

Medicare Part D Benefit Changes in 2024 and 2025

Beginning January 1, 2024, the Inflation Reduction Act of 2022 eliminates Medicare Part D beneficiary cost-sharing once out-of-pocket spending reaches $8,000.

Payments between the beneficiary, drug manufacturer, and insurer apply to the out-of-pocket spending threshold, and according to an analysis conducted by KFF, beneficiaries themselves will pay $3,300 out-of-pocket for brand name drugs.

In 2023, Medicare Part D beneficiaries who reached the out-of-pocket spending threshold were required to pay the greater of 5% coinsurance or a $4.15 copay for their drug costs the remainder of the year, capping beneficiaries’ maximum out-of-pocket drug costs at $3,100 for brand name drugs (KFF).

Beginning January 1, 2025, Medicare Part D beneficiaries out-of-pocket drug costs will be capped at $2,000 with annual adjustments thereafter.

If you would like to learn more about our compliance services, reach out to [email protected].

Sponsor Snapshot 🚀: Telos Actuarial

Telos helps insurance carriers launch new products for the 65+ market.

Market Research → Pricing → Benchmarking → DOI Approval → LAUNCH 🚀

We help at every step.

Send us a note if you want to launch your own product: (link)

DATA VISUAL of the Week 📊

This week’s data visual comes from us! It shows Q3 2023 financials for Cigna and Humana combined. For more info on their potential merger check out this LinkedIn post (link).

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: