This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medicare Beneficiary Knowledge and How They Get It

Compliance Chatter 📢 - Approved bill revises Nebraska’s Medicare Supplement Insurance Minimum Standards Act

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - increased MA utilization trends.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

UnitedHealth Group’s Optum is shutting down its virtual care business - (link)

1 in 4 Medicare beneficiaries with obesity could get Wegovy despite coverage ban - (link)

Humana confirms 2024 guidance even as it beats the Street in Q1 - (link)

Gaps in Medicare Advantage Data Remain Despite CMS Actions to Increase Transparency | KFF - (link)

CMS Changes Medicare Advantage and Part D Plans’ Agent/Broker/TPMO Compensation Landscape - (link)

Medicare’s Push To Improve Chronic Care Attracts Businesses, but Not Many Doctors - MedCity News - (link)

Percentage of Older Adults With Both Private Health Insurance and Medicare Decreased From 2017 to 2022 - (link)

Jared’s recent LinkedIn posts:

Akin Gump Straus Hauer & Feld analysis of CMS's new MA/Part D Broker Comp Rules... 👀 - (link)

MA enrollment grew ~28,000 during AEP in Indiana. Up 4.4%. - (link)

MA plans medical expenses and utilization was up significantly in 2023.

Where did utilization increase the most? - (link)Elevance Health ("ELV") reported Q1 2024 last week. Here are 11 key stats and financial metrics you should know - (link)

MA enrollment grew ~71,000 during AEP in Florida. Up 2.5%. - (link)

DEEP DIVE 📚

Medicare Beneficiary Knowledge and How They Get It 🧠

In a November 2023 edition, we introduced the Medicare Current Beneficiary Survey (MCBS). The MCBS releases data three times (fall, winter, summer) annually and includes survey results from Medicare beneficiaries on various topics such as access to and satisfaction with healthcare, and medical conditions.

One component of the annual winter data release is around how Medicare beneficiaries obtain information about the program and their level of understanding of Medicare.

If you were to speak to individuals who are approaching Medicare eligibility or recently signed up for Medicare, you would likely hear a wide variety of answers regarding Medicare knowledge or how they got that information.

Most of these individuals have likely started to do some research as they approach signing up, including:

talking to family members

individuals in their social circle that have recently joined Medicare

insurance agents

internet searches

Given the lag that exists between the time the MCBS information is collected and released, let’s take a look at the most recent release on this topic from the winter 2021 data collection period.

These questions were originally included within the 2017 MCBS, so we’ll compare with that data to see what’s changed.

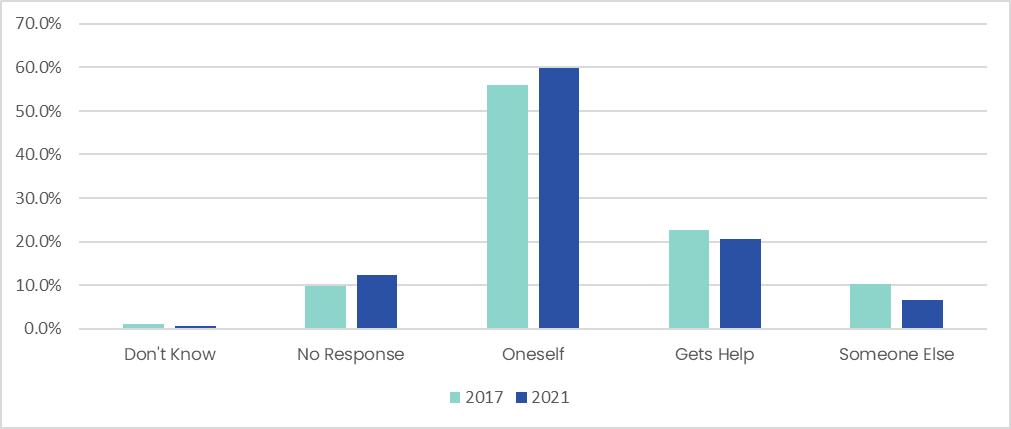

Decision Making

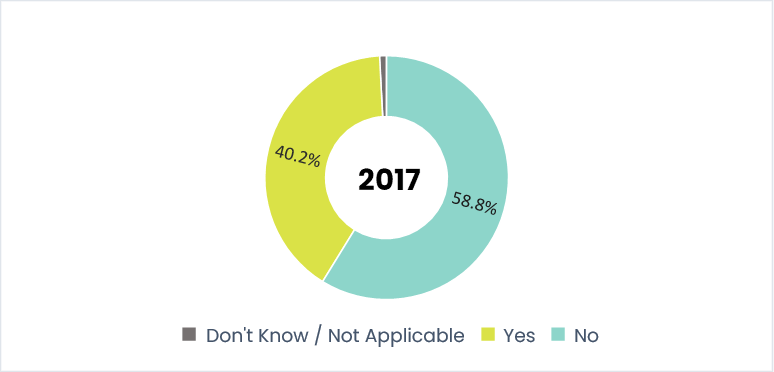

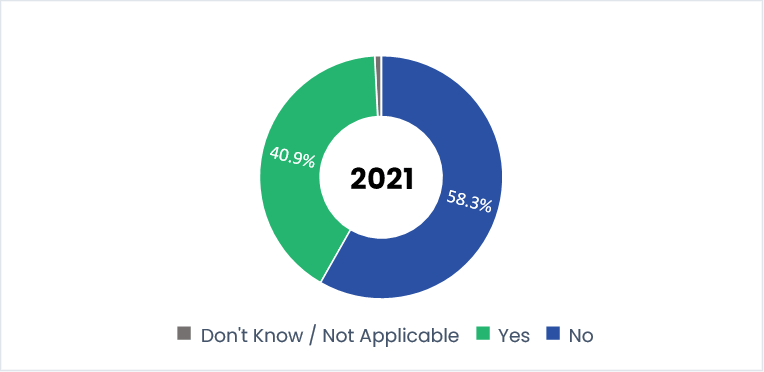

When asked about who makes the health insurance decisions for the beneficiary, nearly 60% in the 2021 survey indicated they make it on their own, representing an increase of nearly 4% from 2017.

In 2021, 27% acknowledged that they either get help or someone else makes the decision for them, which decreased by 6% from 2017.

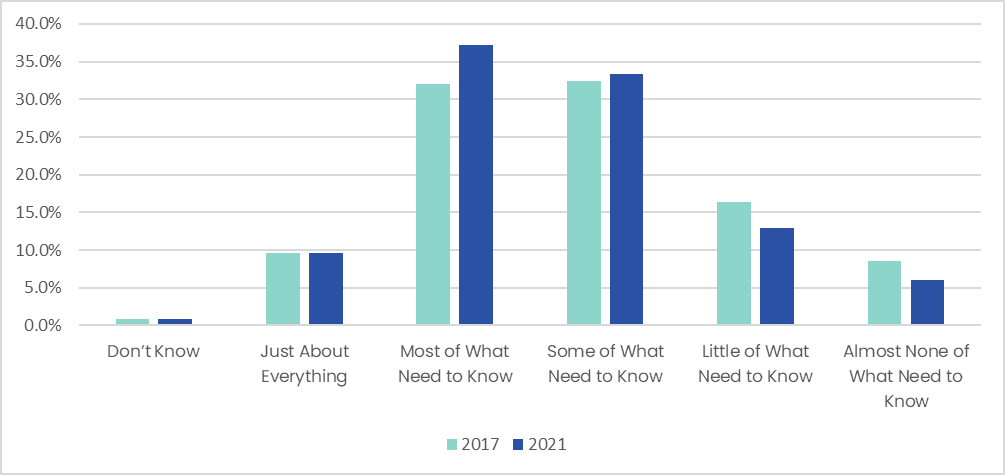

Understanding Medicare

With most beneficiaries believing that Medicare was easy to understand, it was somewhat surprising to see that only 47% of beneficiaries in 2021 felt they knew just about everything or most about what they need to know, which increased 5% from 2017.

Additionally, in 2021, 19% of beneficiaries indicated that they either knew little or almost none of what they needed to know, which was a decrease of 6% from 2017.

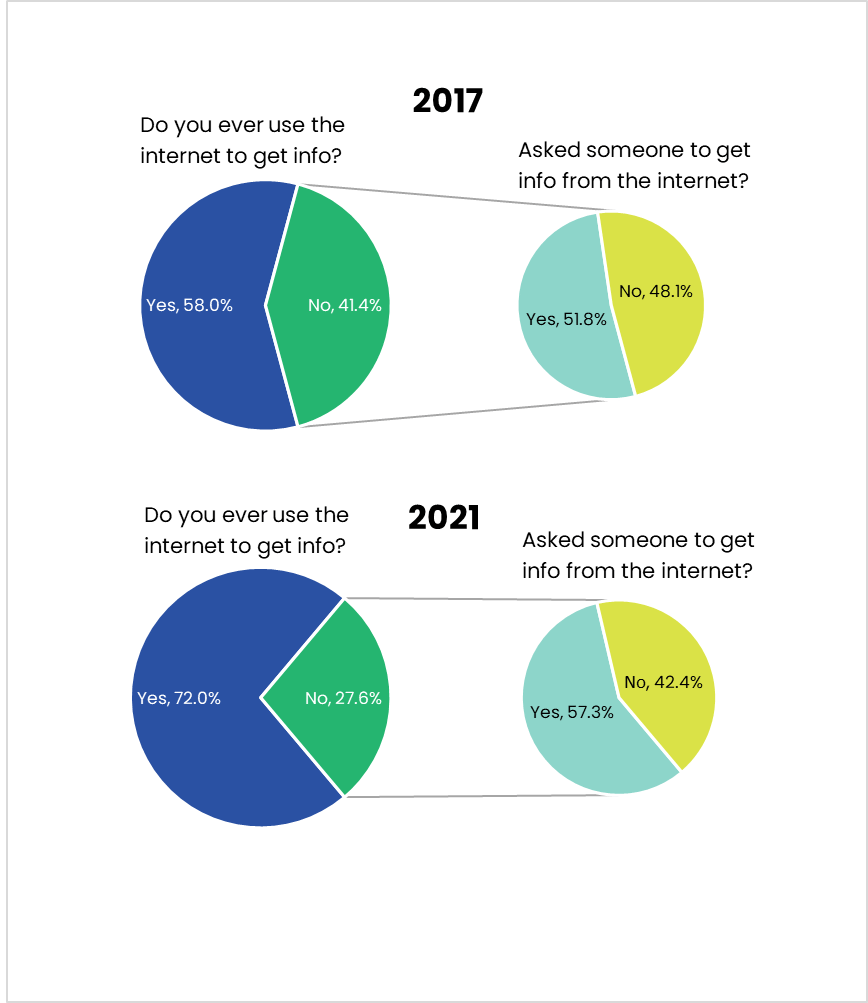

Internet

With the continued expansion of technology usage in our society, it is not surprising that the internet has become a popular source for individuals to obtain information.

When asked in 2021, these percentages of survey respondents indicated they own:

63% a desktop or laptop computer

72% a smartphone

44% a tablet

In 2017, MCBS survey respondents were only asked if they owned a personal computer, which 65% indicated they did.

Given these ownership statistics, it is not surprising to see that 72% of 2021 beneficiaries have used the internet to get information of any kind, which was up by 14% from 2017.

Additionally, for the 41% in 2017 that indicated they do not use the internet, nearly 52% indicated they asked someone to get information from the internet for them, which increased to 57% in 2021.

Given this level of internet usage, it was surprising to see that only 40-41% of beneficiaries indicated they visited the official Medicare website for information.

Did the results from the MCBS align with your experiences with Medicare beneficiaries and their understanding of Medicare?

How can CMS, combined with Carriers, Agents, and other third parties, improve information delivery so that nearly 100% of beneficiaries can confidently respond that they know what they need to about the Medicare program?

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

On April 15th, Nebraska’s Governor approved LB852, which revises Nebraska’s Medicare Supplement Insurance Minimum Standards Act to include requirements for individuals eligible for Medicare under the age of 65.

Effective January 1, 2025, Medicare Supplement carriers must make at least one Medicare Supplement policy available to individuals under the age of 65 and eligible for Medicare due to disability. Carriers may not charge premium rates greater than 150% of the premium rates charged to individuals who are 65 years of age.

Telos Actuarial can help revise policy forms and rates to comply with this requirement. Reach out to find out more.

DATA VISUAL of the Week 📊

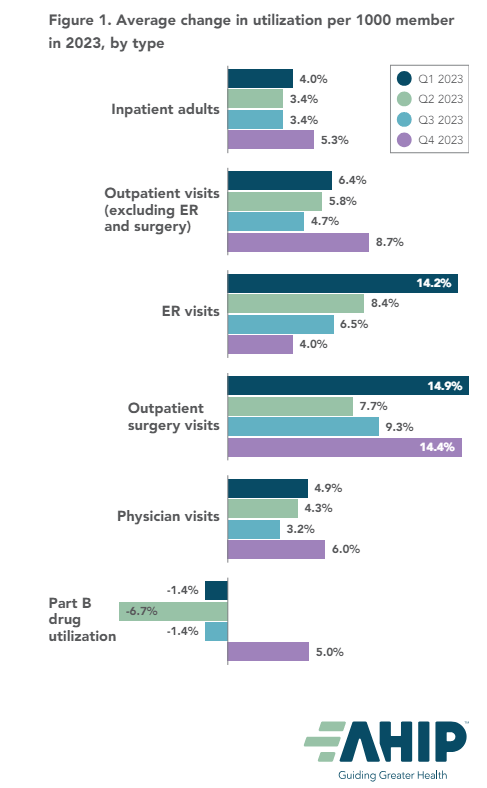

The data visual of the week comes from AHIP, highlighting increased utilization by type in Medicare Advantage during 2023.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: