This week’s newsletter is Sponsored By: 2023 Medicare Enrollment State Pages

57 page eBook (by Medicare Market Insights) full of Medicare enrollment statistics for each State.

Get your copy now: link

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive explores Supplemental Benefits available to seniors.

Data Visual of the week 📊 - Data Visual highlighting the availability of nonmedical supplemental benefits in MA plans.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

Jared’s recent LinkedIn posts:

Deep Dive 📚

Seniors and Supplements (not the kind from GNC)

This week, we’re drilling down on supplemental benefits available to seniors – what are they, what do they provide, how are they delivered, and who can access them?

What do you mean by supplemental benefits?

The easiest way to define them is to point out what they are not. Most grasp the general idea of what is meant by “major medical” coverage. The Affordable Care Act (ACA) codified 10 essential health benefits:

Ambulatory patient services (outpatient care you get without being admitted to a hospital)

Emergency services

Hospitalization (like surgery and overnight stays)

Pregnancy, maternity, and newborn care (both before and after birth)

Mental health and substance use disorder services, including behavioral health treatment (this includes counseling and psychotherapy)

Prescription drugs

Rehabilitative and habilitative services and devices (services and devices to help people with injuries, disabilities, or chronic conditions gain or recover mental and physical skills)

Laboratory services

Preventive and wellness services and chronic disease management

Pediatric services, including oral and vision care (but adult dental and vision coverage aren’t essential health benefits)

Most employer-provided health coverage also provides these essential services at a minimum (potential exceptions for self-insured plans). Some plans may provide more benefits, but these elements can generally be considered the “floor” for major medical coverage today.

So, our working definition for supplemental benefits today will be “not those things.” This could include dental, vision, or hearing services; additional benefits to help fill in where major medical coverage does not pay; condition-specific benefits; or preventive/self-care services.

Do seniors have coverage for supplemental benefits?

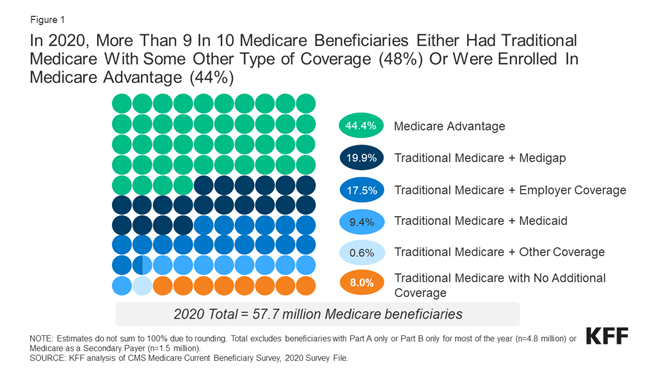

The short answer to this question is “it depends.” First, we will take a quick look at coverage among seniors – the chart below shows where Medicare beneficiaries get their “major medical” coverage. The majority (92%) have Medicare + some other coverage or are enrolled in a Medicare Advantage plan.

The prevalence of supplemental benefits provided by each of these sources of coverage varies. We will touch on the key ones here.

Medicare Advantage

Medicare Advantage (MA) plans may provide supplemental benefits in addition to the required “major medical” coverage.

The last few years have been a whirlwind when it comes to MA supplemental benefits!

An abbreviated history: prior to 2019 a more limited definition for supplemental benefits was applied, and those supplemental benefits had to be offered to all enrollees. Since then, the definition has been expanded, allowing carriers to add various non-medical services to MA plans. In addition to that change, MA plans can also provide specialty benefits to those with chronic conditions.

In the end, a clear trend in increasing prevalence and types of supplemental benefits embedded in MA plans has emerged. Numerous sources (link, link) have provided an even deeper dive on this.

These supplemental benefits can provide a way for MA plans to differentiate themselves and provide some marketing “sizzle”, though today having some supplemental benefits is table stakes.

Those with MA coverage can also purchase separate supplemental policies.

Traditional Medicare + Medigap

The clear reason for purchasing a Medigap plan is to get coverage that fills in the “gaps” where traditional Medicare does not pay – hence the Medigap label.

While benefits in addition to the standardized set are allowed, those “innovative benefits” are uncommon. Since adding benefits generally also adds cost, these plans tend to attract less attention in the highly competitive, premium-sensitive Medigap market.

Medigap policyholders can purchase separate supplemental policies.

Traditional Medicare + Employer Coverage

Medicare beneficiaries in this category are often those who choose to work after enrolling in Medicare, or those with a former employer that provides health coverage to retirees.

There are also some group MA plans out there that primarily provide coverage to retirees. Both primary and supplemental benefits provided by any of these employer-provided plans can vary widely.

Those with an employer plan can purchase separate supplemental policies.

Traditional Medicare + Medicaid

The Medicaid program was established to provide medical care for those with low incomes or certain health conditions.

Seniors eligible for both Medicare and Medicaid are known as “dual eligibles.”

(This is an extremely simplified description – there are MANY nuances to the Medicaid program and dual eligibility that could take up multiple articles!)

Funding for Medicaid programs is provided by both individual state governments and the federal government. States have some flexibility in how they determine eligibility and what benefits they provide. As a result, supplemental benefits vary widely from state to state, and there can even be variation among specific Medicaid enrollees within a state.

Dual eligibles can purchase separate supplemental policies.

Stand-Alone Supplemental Health Policies

Picking up a theme? Any senior with the means can purchase separate supplemental policies!

This visual below comes from a Telos blog, showing data on individual sales of supplemental health insurance products.

Data reported for these products does not get very granular, so we do not have specific ages to go with these premiums. There are indications that many of these products are sold to seniors, often at the same time as the purchase of a Medigap or MA policy.

A very brief explanation of each type of benefit shown in this chart. Many variations exist!

Dental: helps pay for various dental services, may also include vision/hearing coverage

Critical Illness: common designs provide lump sum payment upon diagnosis of a listed disease or condition

Hospital Indemnity: pays fixed amount for hospital confinement, often to offset deductibles or copays

Accident: pays (usually fixed) benefit for treatment/services needed as the result of an accident

Short-Term Care: provides benefits to help pay for rehab services after a major injury or accident

The need differs for each senior, as does the ability to purchase a supplemental health policy. Some distributors are more intentional about assessing needs and making seniors aware of these products.

One upside of purchasing a separate policy providing supplemental health benefits is portability – the benefits provided by a stand-alone policy will be available while the policy remains in force. Changes to supplemental benefits in the MA or employer-provided plan will not unexpectedly alter (or remove) supplemental coverage.

Seniors have a lot of choices to make when it comes to healthcare – the first is generally how they will get their “primary health” coverage. After that, there are many options for adding coverage for supplemental benefits if appropriate. Ideally, sorting through needs, risks, priorities, finances, and available options will help clarify next steps for each individual.

Data Visual of the Week 📊

Data Visual of the week comes from ATI Advisory. We’ve primarily been discussing health-related supplemental benefits in this week’s Deep Dive, but this looks at the availability of nonmedical supplemental benefits in MA plans, which includes things like food, in-home support services, and transportation services. MA plans have been allowed to include these types of benefits since 2019.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: promote your product or services to leaders in the Medicare space. Let’s discuss. (link) Note: 8 slots already taken.

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market. Let’s discuss. (link)

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: