This week’s newsletter is brought to you by Telos Actuarial. Telos helps companies develop new insurance products for the 65+ market that are designed to sell.

If you need help getting a Medicare Supplement, Senior HIP, Dental, Critical Illness, Short-term care product developed, approved, and launched 🚀 start a conversation with their team here.

Here is what you’ll find in this week’s newsletter!

Three links 🔗 - the best articles we found this week about the Medicare Market.

Deep Dive 📚 - This week we look at UnitedHealth Group’s historical financials and key metrics.

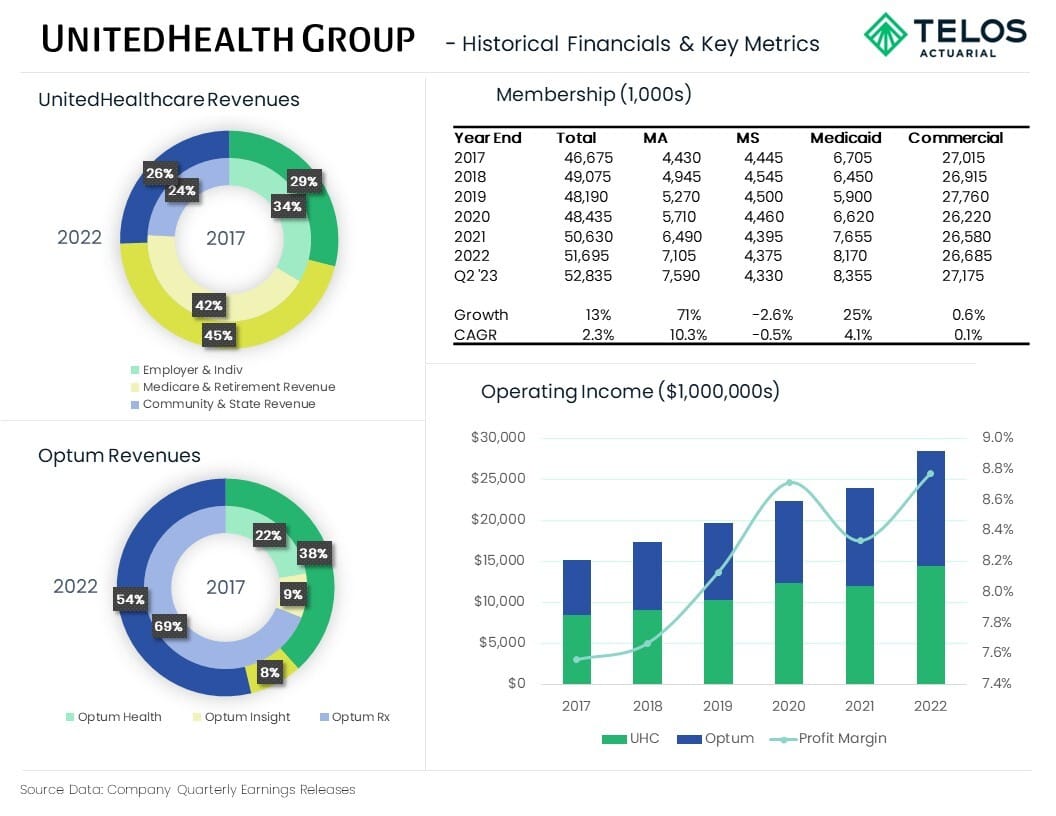

Data Visual of the week 📊 - UnitedHealth Group - Historical Financials & Key Metrics

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Three links 🔗 for the week:

2023 Supplemental Benefit Trends - insights into prevalence and trends in Supplemental Benefits attached to MA plans. (link)

Medicare Advantage Compliance Audit of Specific Diagnosis Codes That Excellus Health Plan, Inc. (Contract H3351) Submitted to CMS - Office of Inspector General reviewed high risk diagnosis codes finding the majority did not comply with CMS requirements. (link)

Sweeping changes to Medicare Advantage - How payers could respond: - details the changes coming to the MA market, and how payers can respond. (link)

Deep Dive 📚

UnitedHealth Group - the Medicare GIANT

When it comes to companies focused on the Medicare market, UnitedHealth Group (NYSE: UNH) is the giant. They are like the Alabama Crimson Tide football team consistently dominating year after year (or is it Georgia now?).

But, they didn’t simply hit the scene over night.

It’s been a long consistent growth over time along with vertical integration that has resulted in their consistent dominance.

Last week UNH released Q2 ‘23 financials. As expected they posted impressive year-over-year growth in all areas, including 16% revenue growth and 13% growth in operating profit.

In this week’s deep dive I wanted to look closer at the past 5 years of growth to better understand their strategy.

Before we get to the numbers it’s important to understand their two main business units, UnitedHealthcare and Optum.

UnitedHealthcare is an insurance carrier, providing health insurance benefits. They collect premiums, pay health insurance benefits, and make a profit on what’s left over.

Optum is (for the most part) a healthcare provider. This includes doctors, hospitals, value-based care clinics, technology and pharmacies. They receive revenues via health insurance benefits, pay expenses associated with running health provider systems, and make a profit on what’s left over.

This is what is called vertical integration!

Okay, now let’s look at some numbers.

Membership

Surprisingly, overall membership growth has been very modest over the last 5.5 years.

YE ‘17 membership: 46.68 million

Q2 ‘22 membership: 52.84 million

Overall Growth: 13%

CAGR: 2.3%

The largest membership segment is their Commercial line. But that segment has been flat.

YE ‘17 membership: 27.02 million

Q2 ‘22 membership: 27.18 million

Overall Growth: 0.6%

CAGR: 0.1%

UNH is the market leader in the Medicare Supplement market, but the membership in that line of business has decreased in recent years.

YE ‘17 membership: 4.45 million

Q2 ‘22 membership: 4.33 million

Overall Growth: -2.6%

CAGR: -0.5%

The Medicaid line has seen steady growth.

YE ‘17 membership: 6.71 million

Q2 ‘22 membership: 8.36 million

Overall Growth: 25%

CAGR: 4.1%

The Medicare Advantage line has seen significant growth. UNH is the market leader in Medicare Advantage enrollment.

YE ‘17 membership: 4.43 million

Q2 ‘22 membership: 7.59 million

Overall Growth: 71%

CAGR: 10.3%

Revenues

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Revenues (the insurance Carrier segment) have grown steadily over the past 5 years.

2017 Revenues: $163.3 billion

2022 Revenues: $249.7 billion

Overall Growth: 53%

CAGR: 8.9%

The growth has been led by the Medicare & Retirement segment (11.5% CAGR), followed by Community & State segment (11.2% CAGR), and Employer & Individual Segment (6.8% CAGR).

Optum Revenues (the healthcare provider segment) have doubled over the past 5 years.

2017 Revenues: $91.2 billion

2022 Revenues: $182.8 billion

Overall Growth: 100%

CAGR: 14.9%

The growth has been led by the Optum Health segment (28.2% CAGR), followed by Optum Insights segment (12.5% CAGR), and Optum Rx Segment (9.4% CAGR).

Revenue eliminations have grown steadily over the past 5 years. This is indicating that there is more vertical integration today than there was 5 years ago. More of the insurance company benefit expense is going to Optum providers and pharmacies as revenue. (Since they already recognized the revenue in the insurance company, they can’t also recognize it as revenue in the provider company.)

2017 Revenue Eliminations: $53.3 billion

2022 Revenues Eliminations: $108.3 billion

Overall Growth: 103%

CAGR: 15.3%

Combining UnitedHealthcare, Optum, and including eliminations results in the company’s Total Revenues.

2017 Revenues: $201.2billion

2022 Revenues: $324.2 billion

Overall Growth: 61%

CAGR: 10.0%

Operating Income

Okay, so membership is growing, revenues are growing. What about operating income (profit)?

Again, these are reported by vertical.

UnitedHealthcare’s Operating Income (the insurance Carrier segment) has grown steadily over the past 5 years.

2017 Operating Income: $8.5 billion

2022 Operating Income: $14.4 billion

Overall Growth: 69%

CAGR: 11.1%

Optum’s Operating Income (the healthcare provider segment) has doubled over the past 5 years.

2017 Operating Income: $6.7 billion

2022 Operating Income: $14.1 billion

Overall Growth: 109%

CAGR: 15.9%

The growth has been led by the Optum Health segment (27.0% CAGR), followed by the Optum Insights segment (15.2% CAGR), and Optum Rx Segment (7.3% CAGR).

Combined, UnitedHealth Group’s Operating Income has nearly doubled over the last 5 years, and is now split evenly between the two verticals.

2017 Operating Income: $15.2 billion

2022 Operating Income: $28.4 billion

Overall Growth: 87%

CAGR: 13.3%

Likely spurred by vertical integration, UNH’s profit margin has steadily increased. Going from 7.6% (‘17) to 8.8% (‘22).

Bottom Line

The majority of membership growth has come from the Medicare Advantage and Medicaid lines of business.

UnitedHealthcare’s revenues have grown faster than membership growth. This is mostly due to shifting to more Medicare Advantage membership which boasts higher premium per member.

Optum’s revenues have grown even faster, which is likely due to expansion of the Optum footprint along with serving more customers under value-based care payment arrangements.

Vertical integration has increased. More of their insurance members are also using their health services.

The result is an increasing profit margin which is currently sitting at a significant 8.8%.

Given the expected continued growth in Medicare Advantage membership over the next 10 years I expect UnitedHealth Group to continue dominating.

One other note: As you can see above, UNH is steady. They sort of just keep doing the same thing year after year and doing it well. Even their Earnings Release Summaries are the same every single quarter going back years. If things are working, why change?

Sources: Company Quarterly Earnings Releases

Data Visual of the Week 📊

This week’s Data Visual of the week summarizes the deep dive into one page.

That’s it for this week. Let us know what you think.

Too much detail?

Not enough detail?

Just the right amount of detail?

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: