Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Up-and-Coming MA Carriers

Sponsor Snapshot 🚀 - brought to you by Modivcare

It’s only a 6 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Tea Leaves - AEP 2026 🍂 - (link)

HCSC to offer MA plans in 30 states - (link)

Prior auth catches congressional heat - (link)

N.H. Medicare Advantage market is 'collapsing,' commissioner says - (link)

Medicare Advantage penetration doesn’t translate to lower hospital margins: MedPAC - (link)

Association between changes in Medicare Advantage enrollment and hospital finances - (link)

Docs warn that Medicare payment rates put them in a precarious financial situation - (link)

Individual Supplemental Health Insurance Market Earns Nearly $10 Billion in Premium during 2024 - (link)

Personal Emergency Response Program Reduces Total Cost of Care for Individuals with a History of Falls - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Up-and-Coming MA Carriers

About a year ago, we took a look at some of the smaller, fast-growing companies making strides in the oligopolistic Medicare Advantage market.

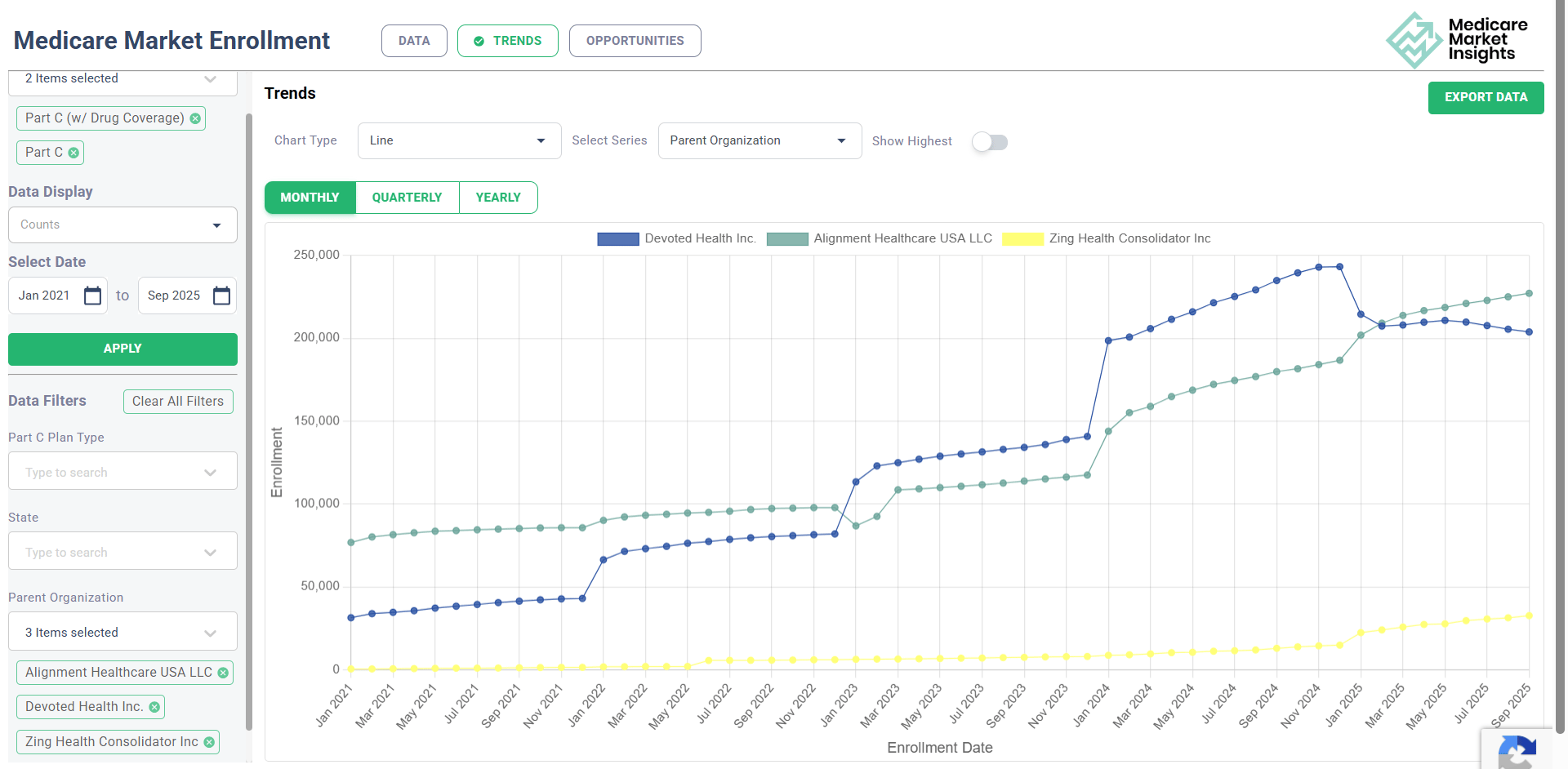

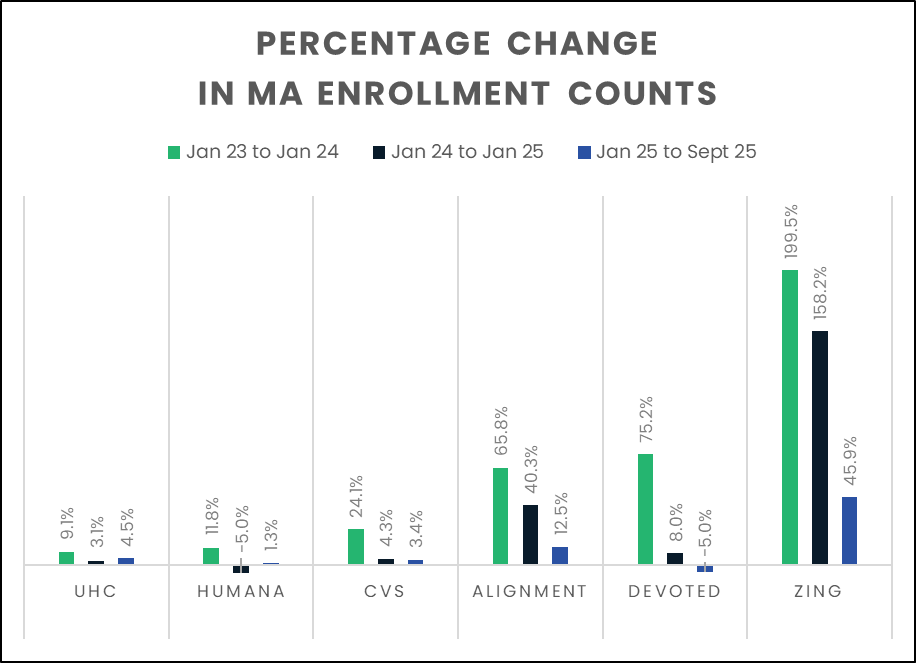

Alignment Health, Devoted Health, and Zing Health were 3 companies that had significant enrollment growth rates in 2024, far outpacing the big national carriers that dominated the market.

source: unless otherwise noted, all data is pull from the MMI+ MA Web App

This week’s MMI checks in on how these companies have fared so far in 2025 and what lies ahead for them in 2026. Let’s dive in!

The Big Little Picture

It’s no surprise that the MA market has been turbulent this year as we’ve seen with market exits, commission revisions, and carrier responses to high loss ratios.

The largest MA carriers have experienced slow (or no!) growth rates in 2024 & 2025. Our underdogs, on the other hand, generally seem to have weathered the market waves better, albeit to varying degrees.

Alignment & Zing are still pacing well above the growth rates for the 3 largest national carriers in 2025. While Devoted’s growth rate remained solid in 2024, they are losing counts in 2025.

Alignment Health

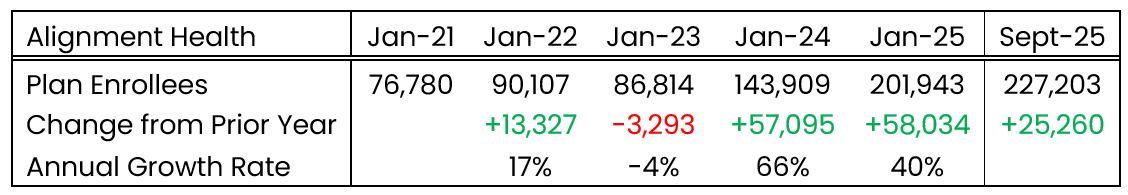

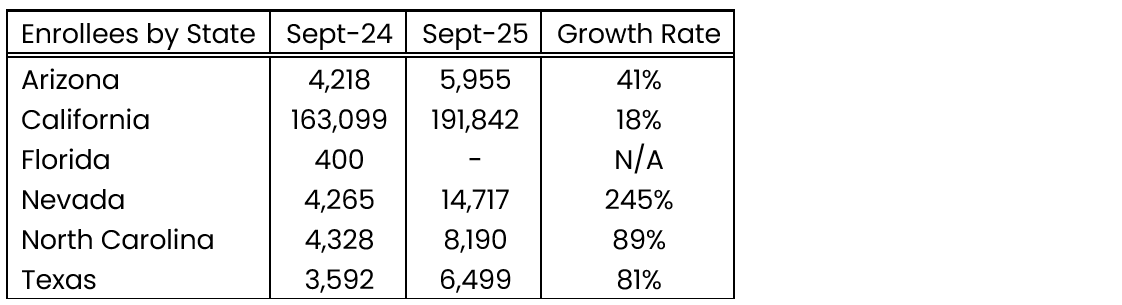

Alignment Health has nearly tripled its enrollment count from Jan 2021 to Sept 2025, despite a small dip in total enrollment from 2022 to 2023.

CA remains their largest state by far, comprising almost 85% of their members. NC, NV, and TX are showing strong 2025 growth trends for Alignment.

Alignment Health’s footprint and enrollment count by state as of September 2025 compared to September 2024:

Alignment is reporting strong financial results this year. Q1 and Q2 membership and revenue have surpassed expectations, and Alignment increased their projections for the second half the year.

Looking ahead, Alignment hasn’t announced plans to expand their footprint in 2026. They look to be continuing last year’s growth plan that focused on building penetration in existing states before expanding into new ones (link).

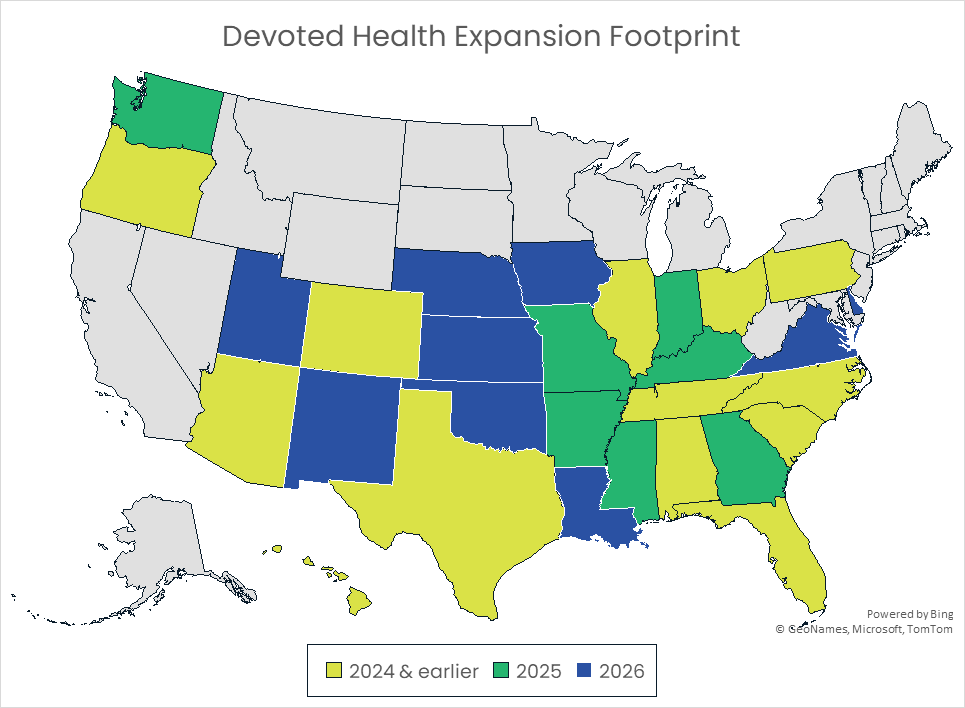

While Alignment is staying focused on penetration, Devoted is taking a different approach: wide geographic expansion.

Devoted Health

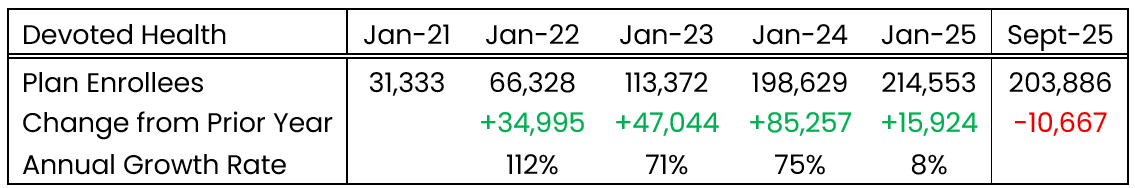

Devoted Health showed strong growth from 2021 through 2023. That growth slowed in 2024 and enrollment counts have decreased during 2025.

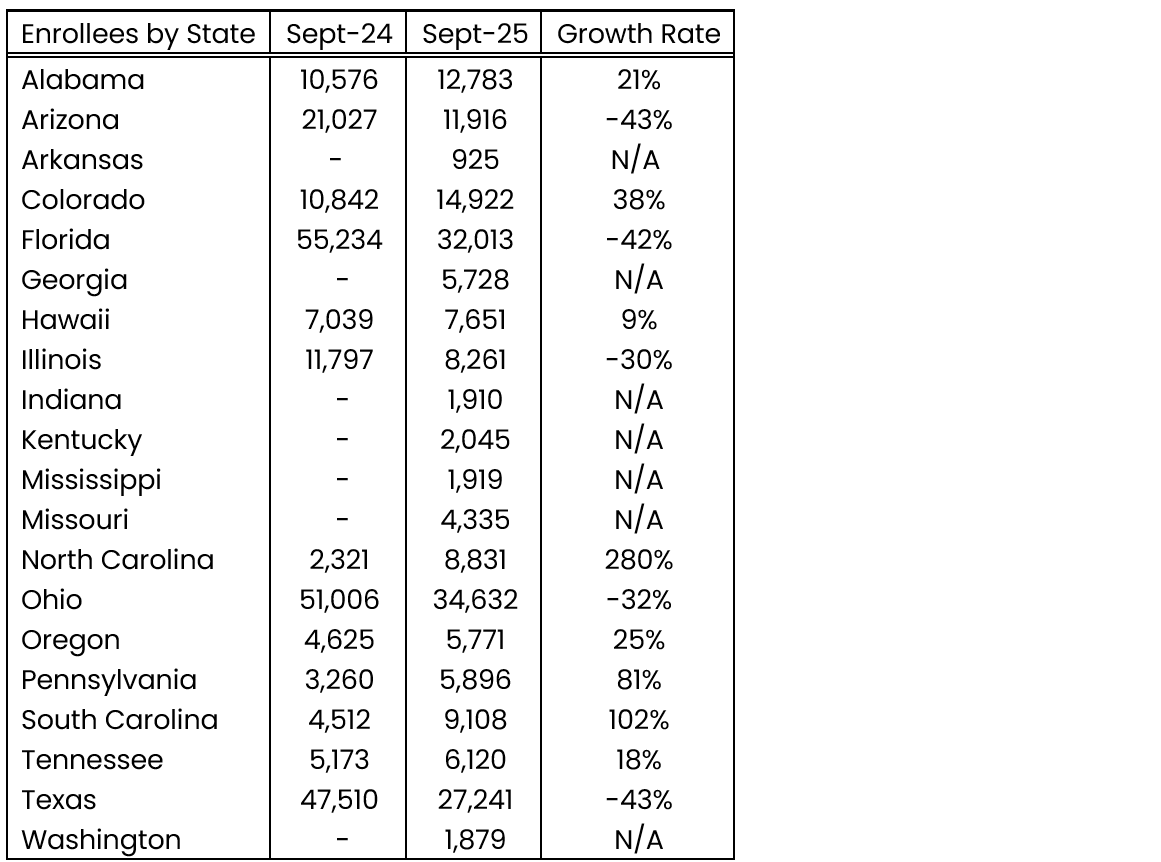

In 2025, Devoted expanded into 7 new states, which now account for just under 10% of their total enrollment. Growth rates by state from September 2024 to September 2025 vary widely from -43% (AZ & TX) up to 280% (NC).

data pulled from MMI+ MA Web App

Despite the lower enrollment numbers to date in 2025, Devoted looks ready to continue expansion heading into 2026 – adding plans in 9 new states! This will bring their total footprint to 999 counties across 29 states.

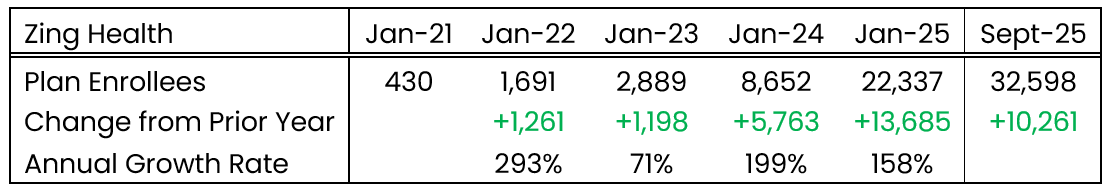

Zing Health

While they have a smaller total member count than Alignment or Devoted, Zing Health has shown solid growth rates since 2021. Their enrollment counts more than doubled from 2023 to 2024 and 2024 to 2025!

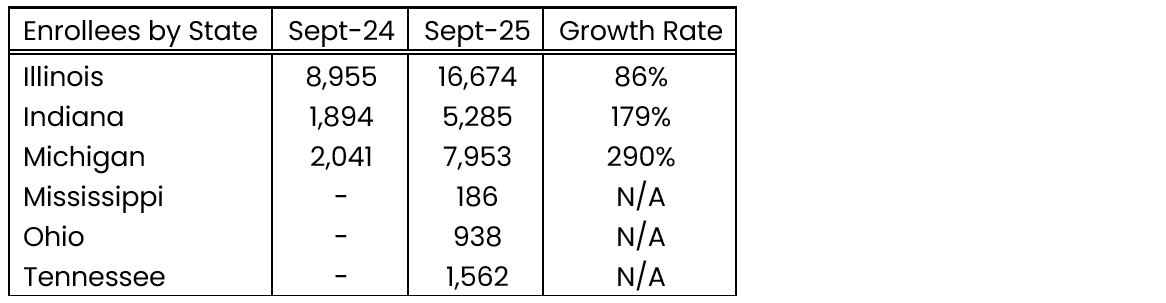

Zing Health’s footprint and enrollment count by state as of September 2025 compared to September 2024:

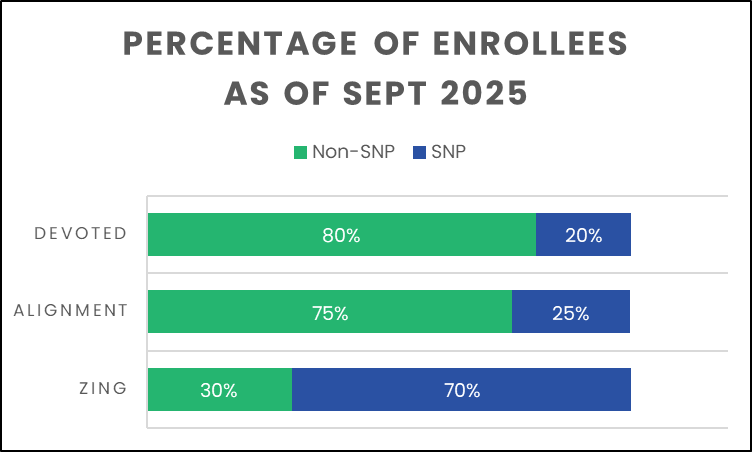

A key difference between Zing and the 2 carriers discussed above is the distribution of members between non-SNP and SNP plans.

Zing’s business focuses on chronic special needs plans (C-SNPs) which is reflected in the high percentage of enrollment in SNP (70%) for Zing, compared to Alignment and Devoted (20% and 25% respectively).

After several years of very strong growth results, Zing’s plans for 2026 may seem modest.

They are adding coverage options in additional counties for several existing states (MI, OH, and TN) but haven’t announced plans to enter any new states for 2026.

What to watch for

As we head into AEP season, the MA waters remain choppy—commission cuts, market exits, and margin pressures aren’t going away. But smaller carriers are showing that there’s still room to grow if you find the right niches.

Alignment is staying focused on deepening penetration in its core states. Devoted is pressing forward with a wide footprint expansion despite near-term enrollment losses. Zing continues to prove the C-SNP model can scale quickly.

And while we didn’t analyze them above, it is also worth noting that SCAN—already one of the largest regionals—is expanding into new territories this AEP (link).

The common thread? Incremental wins, compounded year after year, can add up to meaningful disruption in a market where the giants look stuck in neutral.

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by enabling them to access the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn now Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring - from digitally-enabled to clinician-led

Medication Management

E3 - Engage, Educate, Empower to address health literacy and support gap closure

Download The Power of PERS White Paper → (Link)

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: