This week’s newsletter is sponsored by: Spark

See trends and recommendations for boosting AEP production → check out the Spark blog

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - 10% of Medicare Advantage enrollees are losing their plan in 2026! 👋

Sponsor Snapshot 🚀 - brought to you by Spark

It’s only a 6 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

AEP 2026 halftime trends — broker production and beneficiary insights - (link)

Medicare Commission Changes and Regulatory Response - (link)

White House nears deal to lower prices for weight loss drugs - (link)

Remote monitoring boosts Medicare revenue by 20% for primary care practices, study finds - (link)

2026 Part C&D Plan Crosswalk - (link)

CY2026 Medicare Advantage Trends in Supplemental Benefits - (link)

CMS highlights medical-dental integration in 2026 Medicare Physician Fee Schedule - (link)

Wellcare Commission Suppressions - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

10% of Medicare Advantage enrollees are losing their plan in 2026! 👋

This week’s deep dive breaks down insights from the newly released CMS Crosswalk and Landscape files.

We’ll highlight where enrollment is being displaced due to plan terminations and service area reductions (“SAR Terminated”), and what this means for carriers, distributors, and agents heading into the 2026 plan year.

(Individual MA/MAPD plans only. Excludes 1876 Cost, MSA, and PACE. Enrollment as of September 2025 based on CMS plan/county data.)

The Big Picture

Roughly 2.9 million enrollees are impacted by terminated plans in 2026 (including both terminated and SAR-terminated plans) — up from about 2 million last year.

For context, ATI Advisory research shows that from 2021–2024, the share of members affected by terminations or SARs ranged from 0.4% to 1.5%. That jumped to 7% last year (AEP 2025) and now stands at 10% for AEP 2026.

Most of this year’s impact stems from contract non-renewals, though service area reductions also represent a growing share.

👉 Throughout this analysis, “Terminated” refers to both non-renewed and SAR-terminated plans combined.

With this background in mind, let’s drill down into more details…

By Plan Type

Local PPOs once again lead in total disruption (~1.5 million enrollees), while HMO/HMOPOS plans saw their termination counts double compared to last year.

Plan Type | Current Enrollment | Total Terminated | % Terminated |

|---|---|---|---|

HMO/HMOPOS | 18,671,149 | 1,296,942 | 7% |

Local PPO | 10,048,182 | 1,502,610 | 15% |

Medicare-Medicaid Plan | 226,311 | 37,107 | 16% |

PFFS | 37,038 | 2,360 | 6% |

Regional PPO | 196,972 | 31,757 | 16% |

Grand Total | 29,179,652 | 2,865,812 | 10% |

Local PPO plan types are seeing the largest disruption from a pure count standpoint (~1.5 million), after seeing the largest disruption last year as well (~1.2 million).

The HMO/HMOPOS disruption doubled from last year (~620,000).

Regional PPOs, Medicare-Medicaid Plans and Local PPO are seeing similar percentage of current enrollees impacted (15-16%).

—

By SNP Plan Type

Plan Type | Current Enrollment | Total Terminated | % Terminated |

|---|---|---|---|

Non SNP | 21,574,680 | 2,683,862 | 12% |

D-SNP | 6,124,676 | 134,524 | 2% |

C-SNP | 1,357,674 | 50,485 | 4% |

I-SNP | 122,622 | 1,905 | 2% |

Grand Total | 29,179,652 | 2,865,812 | 10% |

As with last year, Non-SNP plans are driving nearly all of the member disruption, accounting for 94% of total terminations.

D-SNP, C-SNP, and I-SNP plans remain relatively stable.

By Carrier

There are two “slices” worth highlighting.

The first view highlights the top 15 Parent Companies with the most terminations.

The largest four carriers — UnitedHealthcare, CVS, Elevance, and HCSC — account for 46% of total terminations.

By contrast, last year’s concentration was higher, with Humana, CVS, UHC, and Centene making up 75%.

This year’s exits are more dispersed, impacting a wider range of regional and mid-sized carriers.

—

The second view highlights the top 15 Parent Companies with the highest termination %.

Parent Organization | Total Terminated | % Terminated |

|---|---|---|

The Carle Foundation | 30,517 | 100% |

Avian Health Holdings LLC | 23,333 | 100% |

University of Michigan Health | 8,612 | 100% |

Ochsner Clinic Foundation | 5,769 | 100% |

PHSI Inc. | 1,672 | 100% |

Gemstone Holdings Inc. | 73,975 | 95% |

INDEPENDENT HEALTH ASSOCIATION INC. | 48,892 | 91% |

UCARE MINNESOTA | 156,972 | 87% |

Samaritan Health Services Inc. | 11,955 | 87% |

Sentara Health Care (SHC) | 40,813 | 82% |

BMC Health System Inc. | 8,833 | 78% |

MVP Health Care Inc. | 44,429 | 75% |

USABLE MUTUAL INSURANCE COMPANY | 15,603 | 68% |

Lifetime Healthcare Inc. | 142,790 | 59% |

Blue Cross and Blue Shield of Massachusetts Inc. | 47,787 | 50% |

By State & County

State and county-level disruption varies widely.

You can explore localized impacts, including by carrier, plan type, and enrollment volume, using the Medicare Advantage Enrollment Insights web app (available to MMI+ subscribers).

The tool allows you to drill down across markets, and allows you to export data to excel.

🎥 Watch this 2-minute walkthrough → (link)

Upgrade to MMI+ here → (link)

Bottom Line

The 2026 AEP marks the second consecutive year of major Medicare Advantage contraction. Roughly 1 in 10 enrollees are currently needing to select a new plan, creating both disruption for carriers and opportunity for agents and distributors.

The pullback is especially concentrated in Local PPOs and Non-SNP plans, signaling a continued reshaping of the MA landscape toward tighter, more profitable footprints.

SPONSOR SNAPSHOT 🚀: Spark

Enrollment data is rolling in for AEP 2026, providing insights into agents’ production and how they’re handling this year’s disruptions. Spark — the fastest-growing Medicare platform in the country — analyzed data from their 8K+ agents. Here are the key trends:

1. Top field agents are growing their books 45% year over year.

Agents are writing more this year because plan disruption is increasing the number of beneficiaries looking for new plans. New tools like automated Plan Cheatsheets are also improving agent efficiency. The top 10% of Spark brokers have written an average of 166 apps.

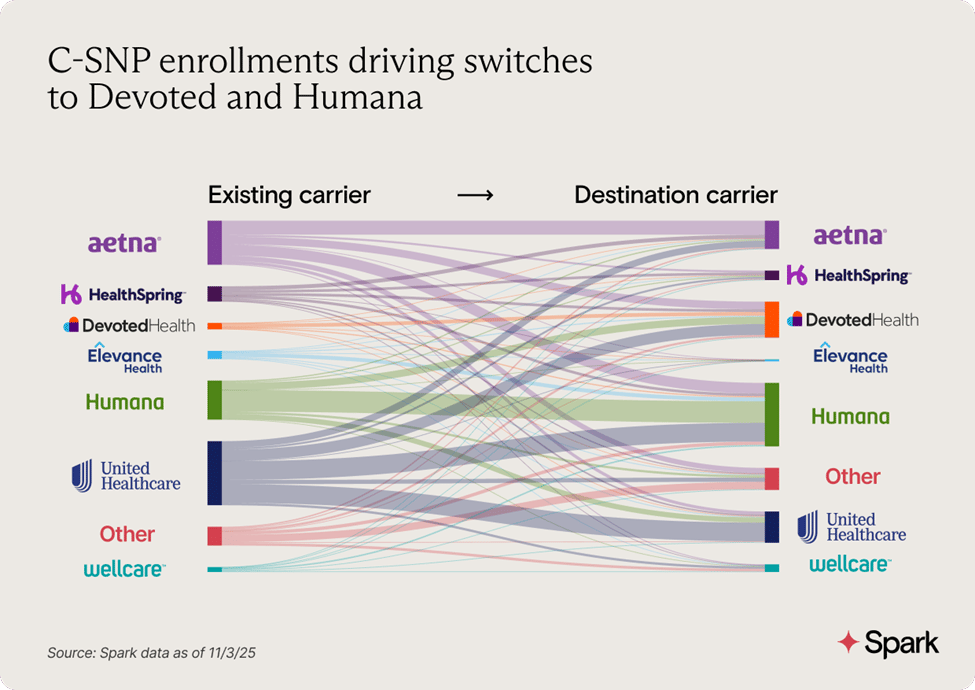

2. C-SNP enrollments are growing the fastest across all plan types.

C-SNP application count is already 69% higher than its total for all of last AEP. Humana, UnitedHealthcare, and Devoted Health are the most popular carriers for C-SNPs.

3. Cost increases are the biggest disruption this year, impacting 75% of Spark beneficiaries.

These increases, along with other disruptions like canceled plans, are driving many beneficiaries to switch carriers. Humana is leading AEP enrollments with 37% of applications, followed by UnitedHealthcare and Devoted Health.

See more trends and recommendations for boosting AEP production → check out the Spark blog.

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: