This week’s newsletter is Sponsored By: Telos Actuarial

Download our FREE 📄 2024 White Paper here → (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - 2024 Q2 Medigap Market Updates ☝

Compliance Chatter 📢 - Indiana commission clarification

Sponsor Snapshot 🚀 - brought to you by Telos Actuarial

Data Visual of the week 📊 - Distribution of Medicare Supplement policies by plan.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage Plans To Be Squeezed Next Year, Reduce Benefits - (link)

Medicare Advantage Plans Provide No Substantial Cost Savings Over Traditional Medicare - (link)

Bipartisan lawmakers call for increased AI oversight in Medicare Advantage coverage decisions - (link)

IRA Could Lead to Higher Out-of-Pocket costs for 3.5 Million Medicare Patients - (link)

Amazon expands drug subscription program to Medicare members - (link)

Jared’s recent LinkedIn posts:

D-SNP enrollment growth has slowed down significantly in 2024 - (link)

The state with the biggest increase in C-SNP enrollment this year is FL. - (link)

Risent Health recently purchased Geisinger in PA. - (link)

A Look at Medical Loss Ratio (“MLR” or “Loss Ratio”) - (link)

Want to increase your Medicare book of business 3.4x? - (link)

MA/MAPD June enrollment results... - (link)

DEEP DIVE 📚

2024 Q2 Medigap Market Updates ☝

This week’s deep dive is an update to our quarterly Medigap Market Update and will cover recent happenings in the Medicare Supplement Insurance market.

1. New Products

a. We have seen two new Medicare Supplement products filed with the state insurance departments over the last quarter.

Med Mutual Protect has started filing a new set of forms. These forms are being filed under their “MedMutual Life Insurance Company” charter and the initial submissions include Plans A, D, F, G, HDG, and N.

Heartland National Life Insurance Company has a new set of forms that are being submitted in several states. The filings are under their existing Heartland National Life charter and are being filed for use under a Direct-to-Consumer distribution system.

b. Some market intel suggests that carriers are waiting to see how claim trends progress through the year before finalizing new product decisions. Gaining additional info about the expected level of claims in 2025 and 2026 will help with entry level pricing decisions.

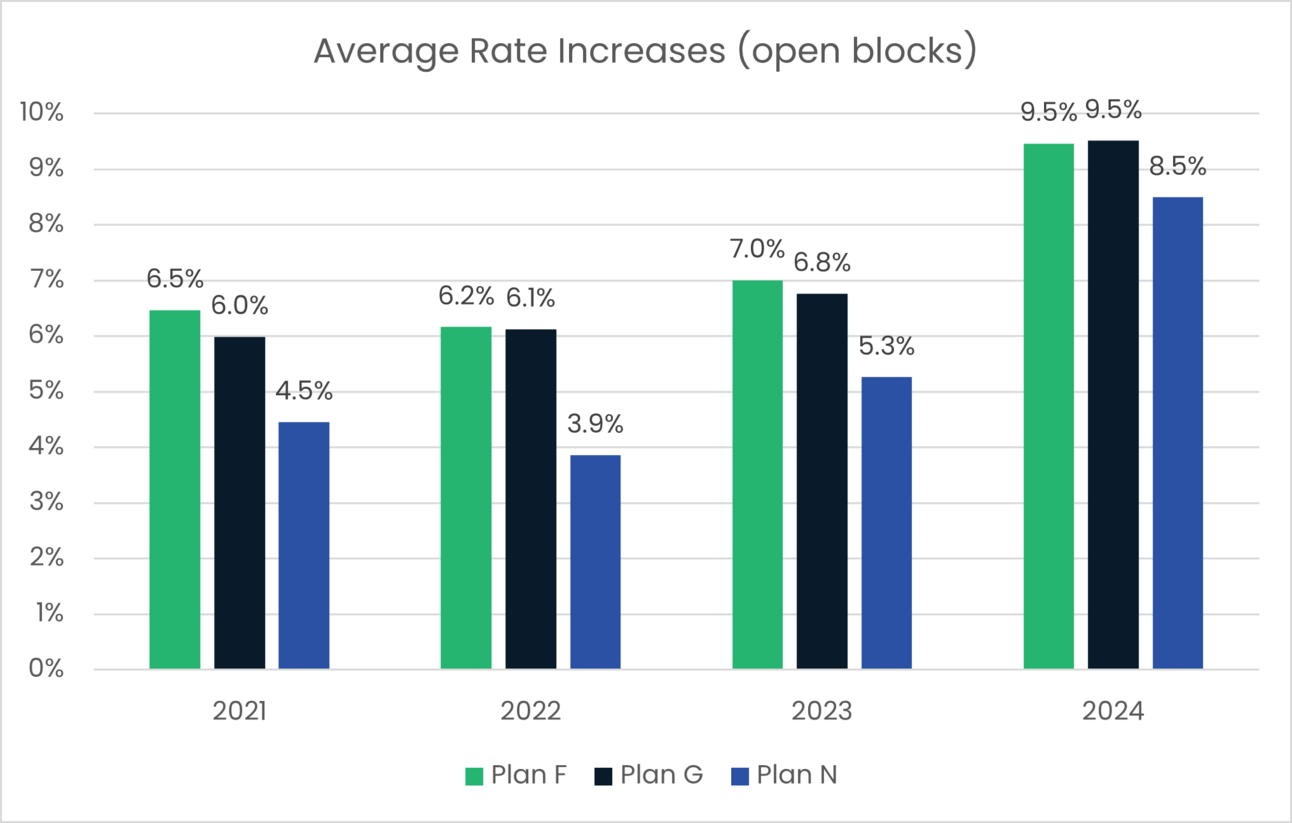

2. Rate Increases

a. 2024 rate increases continue to trend higher than previous years. Approved rate actions are continuing to show a 2% - 3% increase from 2023. The following chart shows the average rate increases on open Med Supp blocks for Plans F, G, and N over the past four years.

b. Double digit increases are going to be more common in 2024 than in previous years. This table shows the frequency of Plan G rate increases by different levels of increase.

Increase Amounts | 2022 | 2023 | 2024 |

|---|---|---|---|

10%+ | 19% | 17% | 33% |

5 - 9.9% | 45% | 48% | 55% |

<5% | 36% | 35% | 12% |

Data for 2024 has changed slightly since last quarter as more rate increases have been approved. Previously the results showed 31%, 55% and 14%, so there has been an upward shift in the allocation between these buckets.

c. Rate increases in the new Birthday Rule states (i.e., KY, LA, and MD) are now running about 1% higher than in states with normal underwriting rules. These higher rate increases are expected as companies continue to adjust their premiums to a level that is appropriate for the expected mix of business.

3. Claim Trends

a. An updated look at Telos Actuarial client company experience showed higher 2023 claim trend on Plan G than previously reported. Higher than expected claim run-out resulted in a 17.3% claim trend vs the 16% in our report from last quarter. The four-year average is now at 9.8% on Plan G.

b. Plan F experienced favorable claim run-out of about 0.2% versus last quarter’s update. The 2023 trend now stands at 10.8% vs 11.0%. The four-year average trend is now 8.3% on Plan F.

c. The largest source of claims are related to cancer treatments. Chemotherapy, Immunotherapy and Radiation treatments are top sources of Med Supp claims in 2024.

d. High blood pressure, sleep apnea and knee replacements are other high claims categories for early 2024.

4. Regulatory Updates

a. Nebraska has finalized rules for new under age 65 coverage requirements on Medicare Supplement policies that go into effect on 1/1/2025. Carriers will need to update at least one plan to include coverage for individuals that are Medicare eligible due to disability or End Stage Renal Disease (“ESRD”) status. Premiums for the under age 65 class will be limited to 150% of the age 65 premiums.

b. We are also watching progress on proposed Open Enrollment regulations in CA, IA, IL, NJ and VA. Expanded Open Enrollment proposals in Wisconsin have failed to pass through committee.

c. Several states also have proposed changes to under age 65 requirements: GA, OH, RI, SC and TX. These proposal regulations are in various phases of the implementation process and not all are likely to be implemented.

For more detailed information on Regulatory changes, you can check out our Insurance Regulatory Insights newsletter.

That’s all for this quarter’s deep dive into the Medicare Supplement market.

Sponsor Snapshot 🚀: Telos Actuarial

Telos helps insurance carriers create, launch and manage Med Supp Blocks for the 65+ Market.

We help at every step.

Market Research → Pricing → Benchmarking → DOI Approval → LAUNCH 🚀

Send us a note to get started: (link)

📄The Future of Medicare Supplement ~ 14th Annual Market Projection Digital Report is available now for FREE! Download (here)! 👇

COMPLIANCE CHATTER 📢:

Back in March, Indiana amended their Medicare Supplement regulations requiring carriers to make all plans available to individuals under age 65 (Click here for a quick refresh). As Medicare Supplement carriers are making changes to their plans in Indiana to prepare for the January 1, 2025 effective date, we have received clarification from the Indiana Department of Insurance regarding commissions.

Full commission rates must be paid on under age 65 new business effective January 1, 2025. Indiana currently allows under age 65 commissions up to 2.0%.

You can receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

DATA VISUAL of the Week 📊

This week’s data visual comes from “The Future of Medicare Supplement” by Telos Actuarial. It shows the distribution of Medicare Supplement policies by plans sold in the “most recent 3 years”.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: