This week’s newsletter is Sponsored By: Telos Actuarial

Download their (free) Medicare Supplement Essentials Guide here → (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medigap Market Updates - March 2024 🌼

Compliance Chatter 📢 - Indiana’s new Medicare Supplement under 65 requirements

Sponsor Snapshot 🚀 - brought to you by Telos Actuarial.

Data Visual of the week 📊 - Data Visual highlighting expected higher MLRs for major Medicare Insurers.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

The future of Medicare Advantage - (link)

Ending Overpayment in Medicare Advantage - (link)

Report to the Congress - Medicare Payment Policy - March 2024 - (link)

State of the 2024 Medicare Advantage industry: Dual-eligible plan valuation and benefit offerings - (link)

Medigap Policyholders Forecast - (link)

Jared’s recent LinkedIn posts:

Little value was added to regular MA plans in 2024. D-SNP? A different story. - (link)

How many years do your Medicare customers stick around?- (link)

Moving? There is a Special Enrollment Period for that… - (link)

GoHealth (GOCO), a Medicare eBroker, released Q4 results yesterday.- (link)

MA enrollment grew ~24,000 during AEP in South Carolina. Up 4.6%. - (link)

DEEP DIVE 📚

Medigap Market Updates - March 2024 🌼

This week’s deep dive is our 2nd quarterly Medigap Market Update and will cover recent happenings in the Medicare Supplement Insurance market.

[Here is the December update → (link)]

1. New Products

There have been three new product filings that have been submitted to state insurance departments.

These products should be released later this spring or in early summer months.

Lumico has started filing a new product in several states under their American Sentinel Insurance Company charter.

This will be the third charter that they have used in the Medicare Supplement market and the early filings include Plans A, F, G, HDG and N.

Cigna has also started filing a new Medicare Supplement product that also includes Plans A, F, G, HDG and N.

The rate structure includes a tiered Household Discount where the applicant can qualify for up to 20% discount if there is a second Cigna Medicare Supplement policy in the household.

There is some uncertainty around how the pending HCSC acquisition of Cigna’s Medicare business will impact currently marketed products.

Wellabe has started filing a new Medicare Supplement product that includes an optional Dental benefits rider.

The filings include Plans A, F, HDG, G, HDG and N.

The Dental benefit rider will pay a $150 per visit indemnity benefit for every covered office visit.

We expect to see additional new product activity over the coming months as carriers and distributors look for ways to grow their Medicare Supplement blocks of business.

2. Rate Increases

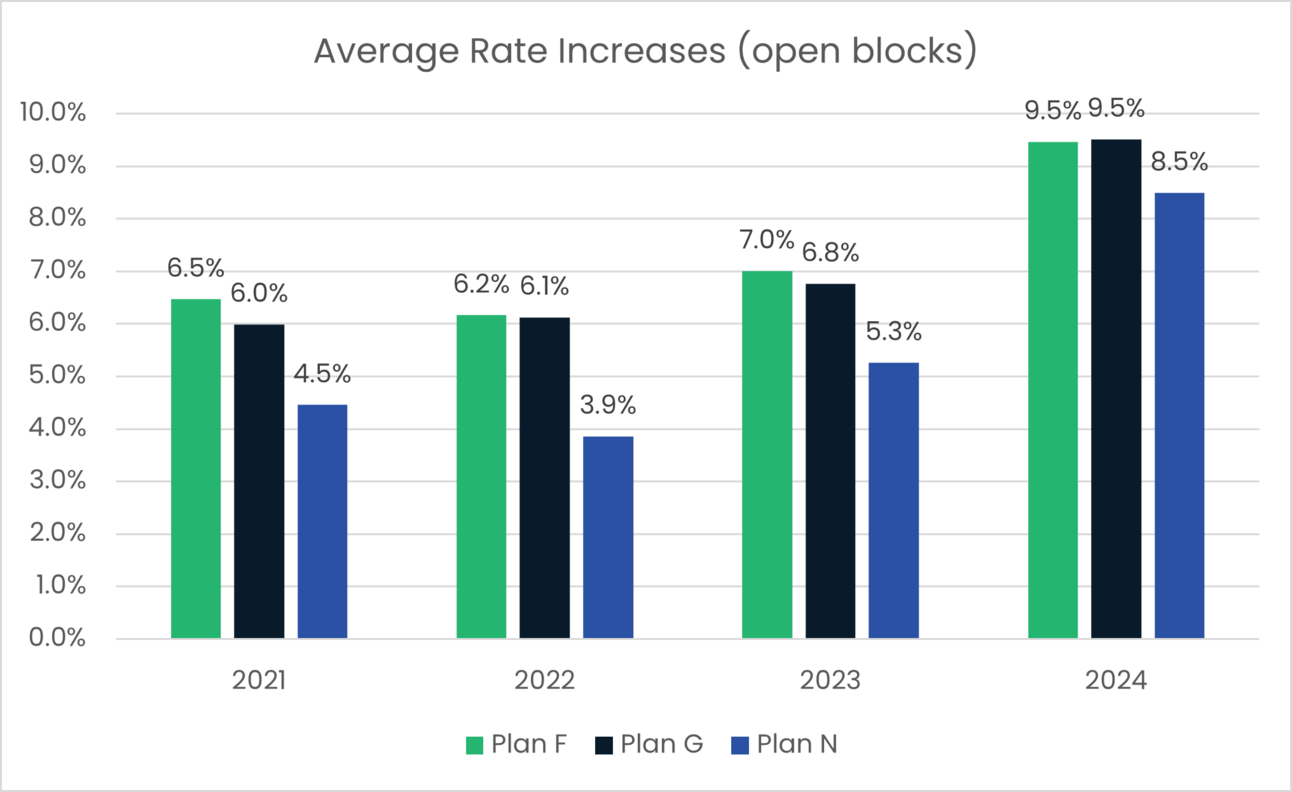

2024 rate increases continue to trend higher than previous years.

2024 approved rate actions are running 2.5% - 3% higher than 2023.

The following chart shows the average rate increases for Plans F, G, and N over the past four years.

Double digit increases are going to be more common in 2024 than in previous years.

This table shows the frequency of Plan G rate increases by different levels of increases. (Note: this is only analyzing open blocks)

2022 | 2023 | 2024 | |

10%+ | 19% | 17% | 31% |

5 - 9.9% | 45% | 48% | 55% |

<5% | 36% | 35% | 14% |

Rate increases in the new Birthday Rule states (i.e., KY, LA, and MD) are running about 1% - 1.5% higher than in states with normal guaranteed issue rules.

These higher rate increases are expected as companies continue to adjust their premiums to a level that is appropriate for the expected mix of business.

3. Claims Trends

Telos Actuarial client companies experienced 2023 claim trend of 11% on Plan F and 16% on Plan G. The 2023 results push the four-year average trends up to 8.6% and 9.6%, respectively.

Recent rate increase filings by larger companies confirm that they also saw increased claims levels in 2023.

January showed a continuation of the higher claim levels from 2023. But the breach at Change Healthcare will disrupt reporting for February and March so we will have a clouded picture of q1 results for several more weeks.

Recent estimates indicate that claims submitted by providers to payors could be 33% lower than under normal conditions.

4. Regulatory Updates

The only major regulatory change that has been finalized since last quarter occurred in Indiana.

They have implemented new under age 65 requirements to expand the plans that are required to be available and have codified the limitations on premium limits for these new rate classes.

Check out the Compliance Chatter section below for more details on the new requirements.

We are also watching progress on proposed Open Enrollment regulations in CA, IA, IL, NJ and VA, along with proposed changes to under age 65 requirements in GA, NE, OH, RI, SC and TX.

These proposal regulations are in various phases of the implementation process and not all are likely to be implemented.

That is all for this quarter’s deep dive into the Medicare Supplement market.

__

Looking ahead… Next Week’s Deep Dive → Medicare eBroker CY 2024 Results Side-by-Side

Sponsor Snapshot 🚀: Telos Actuarial

Telos helps insurance carriers develop and launch new Medicare Supplement products.

Market Research → Pricing → Benchmarking → DOI Approval → LAUNCH 🚀

We help at every step.

Send us a note if you want to launch your own product: (link)

COMPLIANCE CHATTER 📢

Last week, Indiana’s Governor signed Senate Bill 215, which amends the current Medicare Supplement regulation making plans available to individuals under age 65.

Currently the state requires that carriers make Plan A available to individuals eligible for Medicare due to disability, if applied for within six months of Part B enrollment.

After December 31, 2024, all plans offered by a Medicare Supplement carrier must also be made available to an individual eligible for Medicare by reasons of both disability and end-stage renal disease.

Medicare Supplement carriers may not charge a higher premium rate for individuals under age 65 compared to an individual who is 65 years of age for Plans A, B, and D.

For all other plans, carriers cannot exceed 200% of the premium rate for an individual who is 65 years of age. In addition, carriers cannot impose waiting periods or pre-existing condition limitations for the under 65 eligibles.

If you would like to learn more about our compliance services, reach out to [email protected].

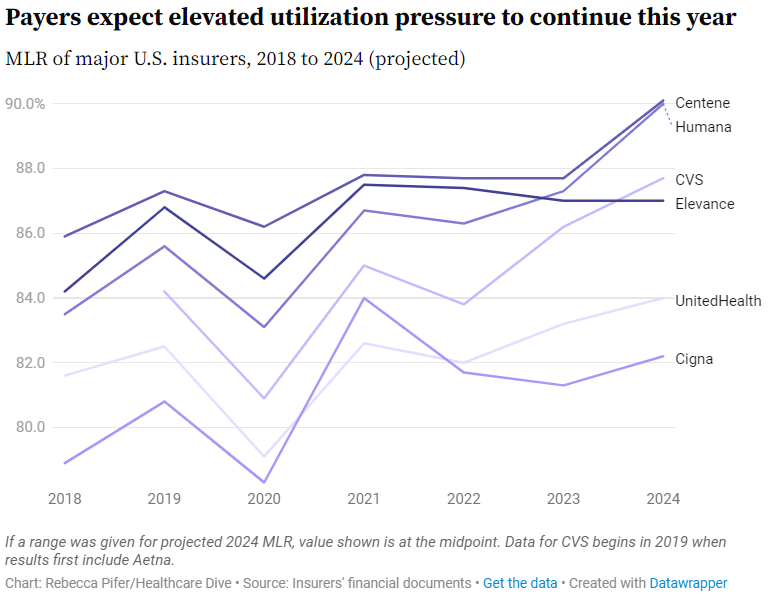

DATA VISUAL of the Week 📊

The data visual of the week comes from Healthcare Dive. It shows expected continued increases in MLRs for major Insurers in the Medicare space.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: