Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - AEP 2025 (part ✌) → MA/MAPD Enrollment Growth by Plan

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

UnitedHealth Wins Ruling Over $2B in Alleged Medicare Advantage Overpayments - (link)

RFK Jr. orders HHS to end 'extra-statutory' notice, public comment process in rulemaking - (link)

Congress Faces March 31 Deadline to Extend Medicare Telehealth Coverage - (link)

Rewarding Medicare Advantage D-SNPs That Provide The Best Value - (link)

Trump maintains legal pressure on Medicare Advantage insurers- (link)

Medicare Regulatory Compliance Updates - (link)

Jared’s recent LinkedIn posts:

Clover Health ("CLOV") - an MA Carrier - reported Q4 2024 results. - (link)

Alignment Health ("ALHC") - an MA Carrier - reported Q4 2024 results. - (link)

PA saw the biggest MA/MAPD increase in enrollment during AEP 2025. - (link)

MA/MAPD enrollment increased 1.3% during AEP 2025. - (link)

GoHealth (GOCO), a Medicare eBroker, released quarterly results today. - (link)

DEEP DIVE 📚

AEP 2025 (part ✌) → MA/MAPD Enrollment Growth by Plan

MA/MAPD enrollment growth slowed during the most recent AEP.

Total MA/MAPD enrollment increased by approximately 450,000 members, compared to 1 million+ in each of the last four AEPs.

It’s clear that Health plans prioritized profitability over aggressive enrollment growth.

Why? → Loss Ratios were up and profits were down for Medicare Carriers in 2024 (link).

As a result, fewer consumers switched from original Medicare to MA/MAPD during this AEP than had done so in prior AEPs.

Last week we looked at AEP ‘25 enrollment increase by Geography and Health Plan.

This week we are looking at AEP ‘25 enrollment increase by Plan Types.

As a reminder, the definition of “AEP ‘25 enrollment increase” is the change in enrollment counts from December 2024 to February 2025.

—

Employer Group vs Individual Plans

The majority of this year’s enrollment growth came from individual plans, while employer group plan growth nearly stalled:

Plan Type | AEP Growth | % Change |

|---|---|---|

Individual (non SNP & SNP) | 429,393 | 1.5% |

Employer Group | 21,004 | 0.4% |

Grand Total | 450,397 | 1.3% |

For context, last year’s AEP saw employer group enrollment grow by 267,000 (4.9%), a stark contrast to this year’s minimal increase.

__

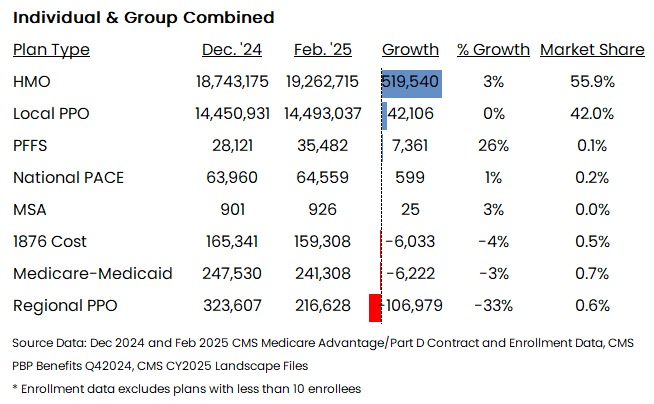

Plan Type

HMO plans were the primary driver of growth during this year’s AEP and now make up 56% of the market.

This shift aligns with insurers’ focus on profitability, as HMOs typically offer lower costs and better care management compared to PPOs.

Local PPOs, the dominant driver of last year’s growth (+927,000 members, 7%), saw slower growth this AEP.

Regional PPOs continued their decline, following last year’s drop of ~84,000 (-19%).

—

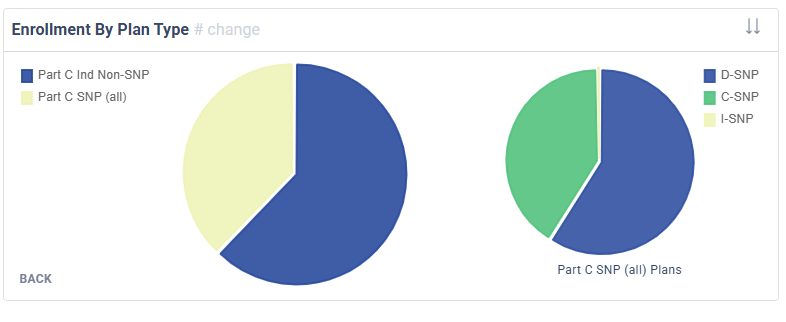

Special Needs Plans (“SNPs”)

This AEP saw a major shift in SNP enrollment trends.

C-SNPs (Chronic Special Needs Plans) dominated growth this year.

This is a change compared to last year when Non SNPs and D-SNPs dominated the growth:

Enrollment Count Change from Dec. 23 to Feb. ‘24, pulled from MMI+ Medicare Enrollment web app (link)

While it does vary by state, UnitedHealth Group ($UNH ( ▲ 0.02% )) led the charge, adding ~180,000 C-SNP members (+49%)—a significant increase over other Health Plans.

C-SNP enrollment over time, pull from MMI+ Medicare Enrollment web app (link). Note: “Trends” section will be released soon!

__

That’s all for today. Next week, we’ll break down Medicare eBroker financials side by side. Stay tuned!

__

Source Data: Medicare Market Insights MA/MAPD/PDP Enrollment Web App. which uses Dec 2024 and Feb 2025 CMS Medicare Advantage/Part D Contract and Enrollment Data, CMS PBP Benefits Q42024, CMS CY2025 Landscape Files

Note: Enrollment data excludes plans with less than 10 enrollees

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by accessing the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring - from digitally-enabled to clinician-led

Medication Managment

E3 - Engage, Educate, Empower to address health literacy and support gap closure

Find out how they can help you today. → (link)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter which includes several important Medicare Supplement and Dental regulatory updates.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: