Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - C-SNP Enrollment Surged in 2024 🚀

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Musk’s DOGE team mines for fraud at Medicare, Medicaid - (link)

Out Last Week: A Paper Offering Medicare Advantage Policy Clarity From The Right, Our Analysis - (link)

Bipartisan bill offers big Medicare physician pay hike - (link)

Optum study: Accountable Medicare Advantage models reduce admissions, ER visits - (link)

Medicare Supplement Broker Incentives- 2025 Q1 Update - (link)

Medicare Supplement Premium Rate Scorecard – February 2025 - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

C-SNP Enrollment Surged in 2024 🚀

Last week our deep dive looked at 2024 month-over-month D-SNP enrollment.

(MMI+ subscribers got a additional D-SNP deep dive with a downloadable data set)

The D-SNP market slowed to 6% growth in 2024, a sharp decline from 24%+ growth in prior years.

In contrast, C-SNP enrollment surged 61% from Dec. ‘23 to Dec. ‘24, up from 28% in 2023, after being flat in 2021 and 2022.

[Note: I used the Medicare Market Insight MA web app tool available to MMI+ subscribers for this research which utilizes county level MA enrollment data from CMS. “Trends” section (seen above) coming soon!]

__

Where did the C-SNP Growth Happen?

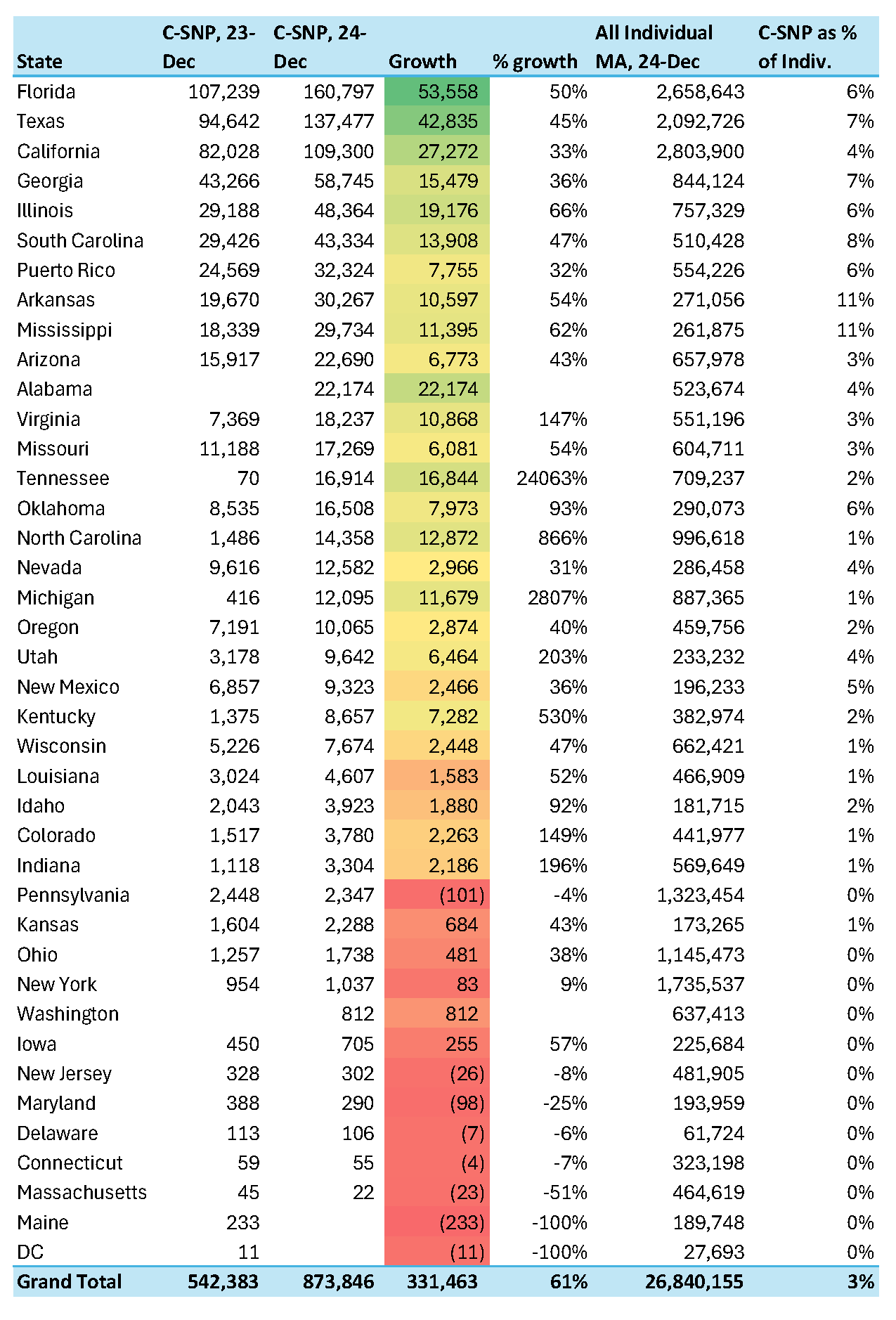

C-SNP By State

An analysis of C-SNP enrollment and growth by State is quite interesting.

First of all, not every state has C-SNP enrollment. In the map below, the grey states have no recorded enrollment.

(Note: CMS data excludes counties with fewer than 11 enrollees, so some states may have small but unreported enrollment.)

Here is a snapshot of a few key enrollment data points for the states that do have C-SNP enrollment:

Key Insights:

Large MA states dominate C-SNP enrollment: Florida, Texas, California, Georgia, and Illinois lead, aligning with high Individual MA enrollment.

Surprising gaps: Pennsylvania, Ohio, and New York have large MA populations but minimal C-SNP enrollment, suggesting untapped market potential.

High-growth states in 2024: Alabama, Tennessee, North Carolina, Michigan, Utah, Kentucky, Colorado, and Indiana experienced standout % increases.

C-SNP Penetration Rate: While nationwide penetration is only 3%, Arkansas and Mississippi reached 11%, showing the high potential

💥 If all states were at 11% the C-SNP market would be 3 million!

__

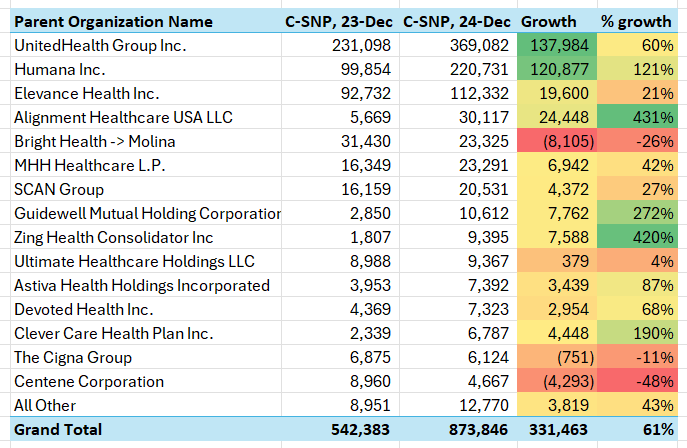

Carrier Level C-SNP Trends

The usual market leaders—UnitedHealth Group and Humana—top the list, but several smaller regional carriers also stand out.

Key Insights:

UnitedHealth and Humana grew significantly, with United expanding across state markets and adding new ones (notably, all growth in AL & TN came from UHC).

Molina acquired Bright Health’s block in 2024, but its enrollment declined throughout the year.

Fastest-growing smaller carriers: Alignment, GuideWell Mutual, and Zing grew the most on a percentage basis.

Elevance underperformed compared to market growth but still ended 2024 in the top 3.

__

Final Observations

There are some C-SNP State markets with only one carrier…

Examples:

AL → 22,000 C-SNP enrollees; 100% UnitedHealth Group

MS → 29,000 C-SNP enrollees; 100% Humana

Other states where there are a number of Carriers, but 1 dominates…

Examples:

TX → 137,000 C-SNP enrollees; 82% UnitedHealth Group

And a few “mature” markets where there are a number of Carriers with significant share…

Examples:

CA → 109,000 C-SNP enrollees; 25% Alignment, 21% Molina, 18% SCAN

FL → 160,000 C-SNP enrollees; 55% Elevance; 26% Humana, 11% UnitedHealth

—

The C-SNP market remains small, immature, and primed for continued expansion.

With new state-level entrants, shifting carrier strategies, and changes to the D-SNP SEP, will more carriers shift focus to C-SNPs in 2025 continuing the impressive growth, and how will the elimination of VBID impact C-SNP plans?

This will be a key trend to watch. Stay tuned!

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way patients connect to care through remote patient monitoring.

We’re there to help members live more confidently and get care at home, so they can continue living independently. The results prove Modivcare Monitoring’s ability to close gaps in care and show our commitment to excellent service, with an average response time of 10 seconds and a net promoter score of 89.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Vitals Monitoring

Medication Management

E3 – Engage, Educate, Empower

Learn More About Remote Patient Monitoring here → (Link)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter which includes several regulations and rules impacting Medicare Supplement, Dental, Medicare Advantage and more.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: