This week’s newsletter is Sponsored By: HealthSherpa for Medicare

Sign up for your FREE Account Here → (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - D-SNP monthly enrollment trends in 2024 📈

Sponsor Snapshot 🚀 - brought to you by HealthSherpa

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Trump freezes federal grants with big potential impact on providers, Medicaid - (link)

Trump’s funding pause not ‘across-the-board’ freeze: White House - (link)

A Healthcare Excellence Agenda for the New Administration - (link)

Administration directs federal health agencies to pause communications - (link)

CMS Withdraws Appeal in UnitedHealthcare Medicare Advantage Star Ratings Case, Paving the Way for Recalculation - (link)

RFK Jr. grilled on Medicare: What is Medicare Part A… - (link)

Medicare Advantage Insurers Made Nearly 50 Million Prior Authorization Determinations in 2023 - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

D-SNP monthly enrollment trends in 2024 📈

I have to admit that I wasn’t planning to write on this topic this week.

The original plan was to provide early thoughts on January 2025 Medicare Advantage enrollment data.

But, as of Wednesday afternoon, that data hasn’t been released by CMS. They released the files like normal on January 15th, removed them a few hours later due to issues with the data, and said they would release updated files the week of January 20th.

The files were never posted. Then we saw news that the Trump administration told federal health agencies to temporarily pause communications.

We suspect that’s why the data is delayed. Hopefully, CMS releases it soon!

Okay, now on to the actual topic for this week!

—

One of the main topics of conversation amongst Medicare distributors, and those that support them, is the topic of D-SNP SEP changes in 2025.

I won’t go into the details here. You can go read our previous deep dive instead. (D-SNPs and C-SNPs: What’s changing for AEP 2025 🔍).

But, as a reminder:

Before 2025: D-SNP members had a quarterly SEP, allowing them to switch plans every three months.

Starting in 2025: D-SNPs will no longer have a quarterly SEP. Instead, a monthly SEP will apply, but only for a limited subset of D-SNP members.

The result? Fewer mid-year sales opportunities and improved retention in 2025 and beyond.

While we don’t yet know exactly what the sales impact or retention improvements will look like, I decided to analyze 2024’s month-by-month enrollment data for both D-SNPs and Individual Non-SNPs to establish a benchmark.

[Note: I used the Medicare Market Insight MA web app tool available to MMI+ subscribers for this research which utilized county level MA enrollment data.]

It will give us a good benchmark to compare against as we go throughout 2025.

__

D-SNP Enrollment Data Indicates More Switching

The main thing I wanted to parse out was whether the enrollment data supports the notion that the D-SNP market has more switching throughout the year, particularly between March and December.

We already know that Annual Enrollment Period (AEP) drives significant movement, with some additional shifting during the Open Enrollment Period (OEP). But what about the rest of the year?

Since the data we have access to only reports total enrollment counts by month at the Contract, State, Plan, County level, and not at the individual member level there is no exact way of calculating sales and lapses. They are all mixed together in one number.

But by observing month-over-month changes per carrier, we can get a strong indication of switching activity.

Here’s what the data says about 2024:

📊 D-SNP switching remains higher even after AEP ends. While overall D-SNP Medicare Advantage enrollment appears stable from March to December, individual carriers experience significant month-to-month fluctuations.

📌 Carriers with major enrollment shifts: Even in months when the net market change is small, some plans gain thousands of members while others lose thousands.

This suggests that much of the movement in D-SNPs is not from new members but from members switching between plans.

The table below displays month-over-month enrollment changes by carrier, highlighting which plans gained and lost the most members:

Note: Carriers with small changes are grouped together in “All Other Carriers”.

Observations:

UnitedHealth Group enrollment declined each month until November and December where it increased.

CVS was the opposite. Increasing Enrollment each month until December where they say enrollment decrease.

Humana was fairly volatile swinging from increases to decreases to increases.

__

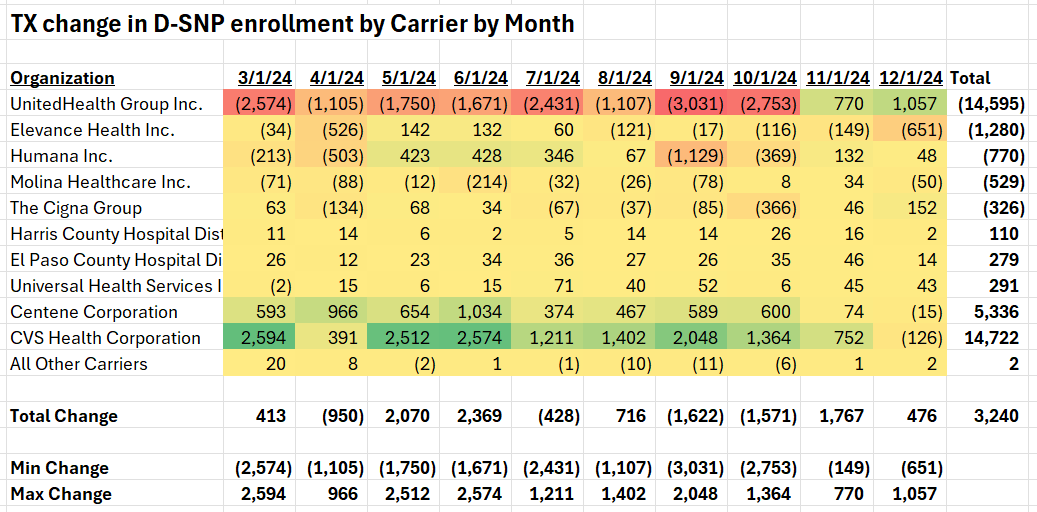

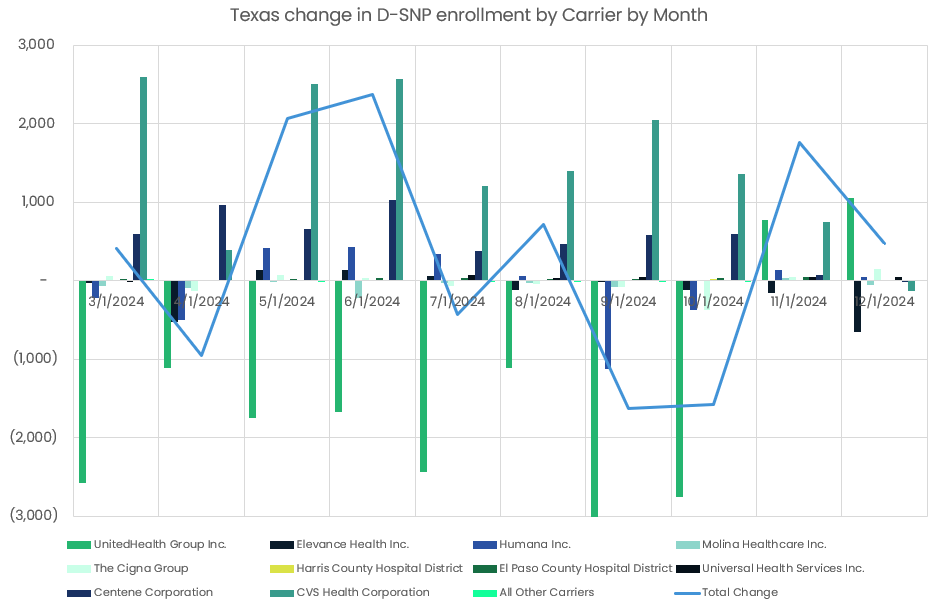

State-Level Analysis: Does Texas Follow the Same Pattern?

I also took a look at the State of Texas to see if the logic held when narrowed down to a smaller market.

Here is the same table for Texas only.

Note: Carriers with small changes are grouped together in “All Other Carriers”.

Interestingly:

The same carrier trends held in Texas, reinforcing that this isn’t just a national-level anomaly.

UnitedHealth, CVS, and Humana followed similar switching patterns at the state level, confirming that D-SNP volatility is widespread.

The visual below illustrates how some carriers experience major declines while others gain members, with overall market movement remaining relatively stable.

__

D-SNP vs. Individual Non-SNP

📉 Individual Non-SNP plans are far more stable. When comparing D-SNPs to Individual Non-SNP plans, the latter sees lower volatility in enrollment, implying less frequent switching compared to D-SNPs.

One way of observing this is to look at the % change in enrollment each month. In particular, comparing Individual Non SNP to D-SNP for the same Carriers.

As you can see the D-SNP market had lot more volatility in enrollment from month-to-month in 2024 than the Individual non SNP market. This supports the notion that switching between carriers was higher in the D-SNP cohort.

This really isn’t a surprise.

But the more interesting thing will be to continue this analysis into 2025 to see if volatility goes down, which would point to improved retention and fewer sales in the D-SNP cohort.

That’s all for today. Thanks for reading!

SPONSOR SNAPSHOT 🚀: HealthSherpa for Medicare

Introducing HealthSherpa for Medicare!

The all-in-one Medicare platform for brokers to shop, enroll, and track clients in a single platform.

FMO-neutral • Multi-carrier • No cost

Trusted by 50,000 brokers – now transforming Medicare.

→ We built the largest ACA platform for brokers, processing over 10 million annual enrollments. Now we're bringing that experience to Medicare.Shop plans across carriers

→ Shop MAPD, MA, Part D, SNP, and Supp plans.FMO-neutral

→ We're not an FMO, so use our platform no matter which uplines you have.Drugs and providers

→ Check drug and provider networks across plans and save them to client profiles.Streamlined enrollment

→ Our enrollment forms pre-fill to reduce data entry and save you time.Track your book

→ Store client details, enrollments, drugs, providers, and SOAs in one place.

What MMI + Subscribers read this week…

December '24 MA/MAPD and PDP enrollment data - December enrollment data has been loaded. Here are a few observations. (link)

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter which includes several regulations and rules impacting Medicare Supplement, Dental, Medicare Advantage and more.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: