This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - D-SNPs and C-SNPs: What’s changing for AEP 2025 🔍

Compliance Chatter 📢 - Excepted Benefits guidance provided by Colorado and Virginia.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare data breach bared info of nearly 1M people - (link)

Medicare Advantage Needs More Oversight, Less Overpayment - (link)

New tracker finds 5.4M likely dementia cases - (link)

Humana exiting Medicare Advantage in 13 markets- (link)

New Study from Humana Healthcare Research and Harvard University Reveals Better Access to Primary Care for Seniors Receiving Care from Senior-Focused Primary Care Organizations - (link)

The official U.S. government Medicare handbook - (link)

The Medicare Supplement Application: Lookback Periods - Part 2 - (link)

Jared’s recent LinkedIn posts:

We launched Medicare Market Insights - Plus this week (MMI+)! - (link)

Astrana Health (ASTH) - a value based care provider - recently reported Q2 2024 results. - (link)

5 Thursdays meant 5 MMI publications! - (link)

Agilon Health (AGL) - a Medicare value based care provider - recently reported Q2 2024 results. - (link)

GoHealth is acquiring e-TeleQuote. - (link)

DEEP DIVE 📚

D-SNPs and C-SNPs: What’s changing for AEP 2025 🔍

A few weeks ago I wrote about the “Wild Medicare Market”. We looked at all the moving pieces leading up to AEP 2025.

But, I missed one important change in the MAPD market heading into AEP.

A smart LinkedIn follower reminded me that special enrollment periods (“SEPs”) for Dual-eligible special needs plans (“D-SNPs”) are changing in 2025.

And another follower mentioned that C-SNPs will be a big focus area going forward.

Then, last week, Humana’s CFO mentioned their D-SNP plans were not facing the same profitability headwinds as some of their other plans (link).

So, this weeks deep dive focuses on D-SNPs and C-SNPs.

What are they?

What does current enrollment look like, and how has it changed?

What is changing for D-SNP special enrollment periods in 2025?

What is the impact?

__

What are D-SNPs and C-SNPs?

But as a reminder.

Special Needs Plans (SNPs): SNPs are a subset of Medicare Advantage plans designed to meet the specific needs of certain populations.

The two largest subsets are D-SNPs and C-SNPs.

Dual-Eligible SNPs (“D-SNPs”): individuals eligible for both Medicare and Medicaid.

It’s important to note that there are 3 types of D-SNPs (this will be important when discussing the changes to special-enrollment periods):

Coordination-Only D-SNPs (CO): provide Medicare-covered services and are required to coordinate the delivery of benefits with the Medicaid program, contract with state Medicaid programs, and notify states when enrollees are admitted as an inpatient.

Highly Integrated D-SNPs (HIDE) must meet the requirements of COs and must also have a Medicaid plan operating in the same counties as the D-SNP. The carrier provides both Medicare and Medicaid services, but there is no requirement that people enroll in both plans.

Fully Integrated D-SNPs (FIDE) must meet the requirements of COs and must also offer an aligned Medicaid plan that integrates the Medicare and Medicaid benefits. Medicare pays the plan for Medicare-covered services and Medicaid pays the plan for Medicaid-covered services.

Chronic SNPs (“C-SNPs”): C-SNPs cater to individuals with one or more specific chronic conditions (cancer, cardiovascular disorders, stroke, etc.), offering specialized care and benefits to manage their health more effectively.

Because both D-SNPs and C-SNPs cover a higher risk population, and the intent is to provide better care leading to better outcomes, the cost associated with covering these members is significantly higher.

And therefore, the revenue that payers generate to cover these populations is also significantly higher leading to the potential for higher profits.

This is why there has been, and will continue to be, focus on growing and retaining membership on these plans.

__

What does current enrollment look like, and how has it changed?

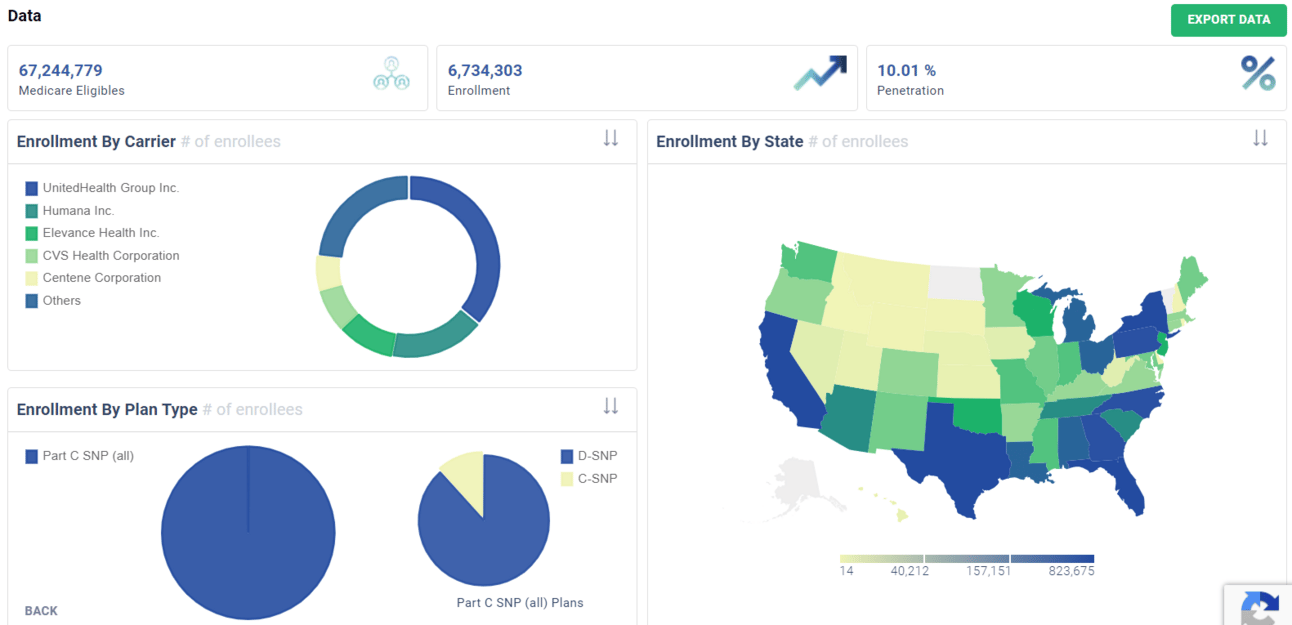

Overall, D-SNP and C-SNP account for 6,734,303 enrollees in August 2024.

Both segments have outpaced non SNP growth over the past 3 years, with C-SNP accelerating this year.

The typical Large carriers have the largest share of D-SNP enrollees.

With United, Humana and Elevance making up the majority share of C-SNP enrollees.

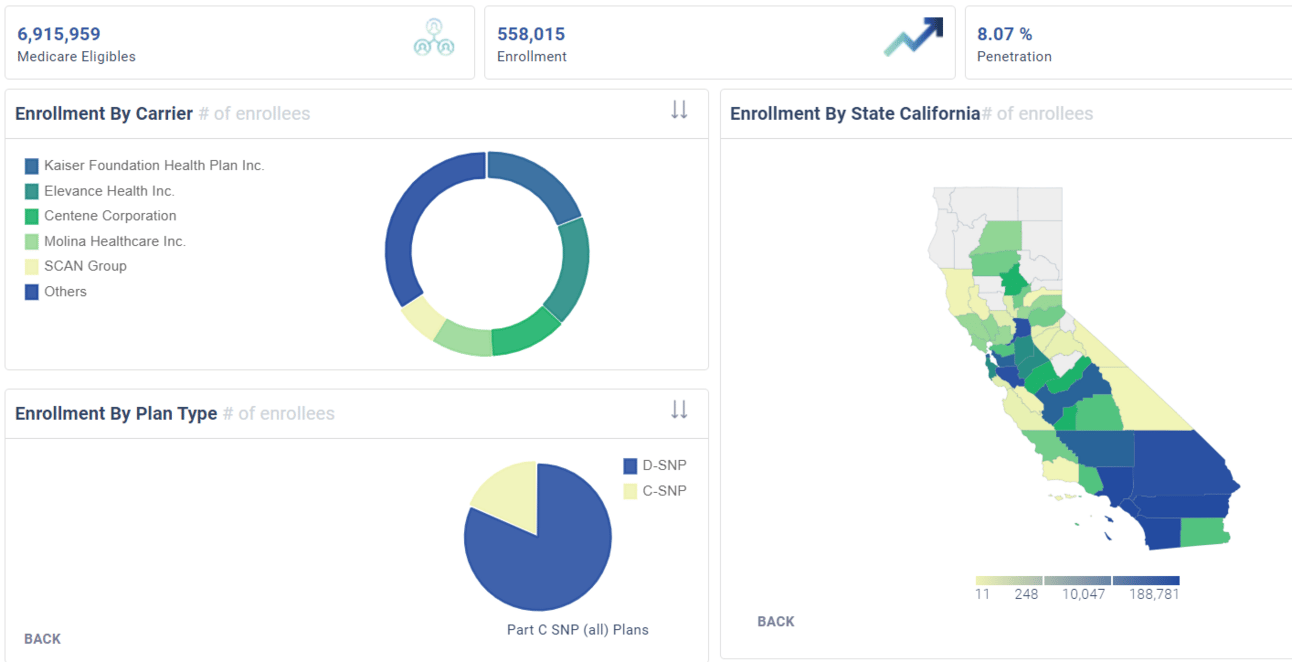

This does vary by state. For example, SNP enrollment by Carrier in CA looks quite a bit different.

__

What is changing for D-SNP special enrollment periods in 2025?

First, the long term goal of CMS is to move more individuals to D-SNP plans where both the D-SNP and Medicaid benefits are with the same organization.

As part of that goal, special enrollment periods are changing for D-SNPs in 2025.

Today, all D-SNPs have a quarterly special enrollment periods (“SEP”).

This means all D-SNP enrollees can change plans every quarter. The result is that there is significant switching happening in the D-SNP population throughout the year.

In 2025, the quarterly SEP goes away, and a new monthly SEP is introduced, but only for a subset of D-SNPs.

The new monthly SEP is only for the following scenarios:

All D-SNPs can disenroll from MA and go to Traditional Medicare / Stand-alone PDP (one time per year)

Full-Benefit D-SNPs can enroll or change between aligned or fully integrated plans

Importantly, partial-benefit D-SNPs no longer have SEPs

… AND….

Coordination only D-SNPs no longer have SEPs

From a number standpoint, here is what that means.

Currently, all 5,949,230 D-SNP enrollees can switch every quarter.

Under the new rules only a subset of those would be able to switch.

~2.04 million who are estimated to be fully-eligible and in the HIDE or FIDE plans will be able to switch monthly

~the 2.7 million who are fully-eligible, but in a Coordination Only plan will be able to switch during the year, but only if they are switching to a HIDE or FIDE D-SNP plan

~1.2 million would not have a SEP.

Based on information from Chapter 14 of the “March 2024 Medpac Medicare Payment Policy Report to Congress”.

__

What is the impact?

Here are my thoughts on what this means as we head into AEP.

Plans with Medicaid contracts and D-SNP plans in the same state will gain more market share

The new SEPs favor FIDE and HIDE D-SNPs.

Over time there will be fewer D-SNP plans available

Payers that do have D-SNPs will be competing to gain and keep market share

Because there will be fewer D-SNP plans, those that are in the market will be trying to attract and retain members. So, if there is an area where benefits actually increase this AEP, it could be here.

There will be fewer D-SNP sales opportunities throughout the year

As already discussed, fewer D-SNP enrollees will be eligible for SEPs

In addition, those that are eligible for a monthly SEP will have fewer switching options

But, that also means there will be less switching/better retention on these plans going forward.

For Coordination only D-SNPs, switching can only happen during AEP & OEP (unless switching to a FIDE or HIDE.

C-SNPs will be the new area of potential growth for payers.

Based on recent growth, and new SEPs for D-SNPs, will C-SNPs be the new frontier for plans in the coming years?

Okay, that’s all for this week. I hope it’s helpful!

Sponsor Snapshot 🚀: Modivcare

Managing the complexity of chronic care conditions is compounded by social determinants of health, which is why Modivcare focuses on removing barriers to critical health services and connecting members to their care teams.

By addressing factors such as transportation and remote monitoring support, we bridge the gap between members, their health plan, and their care team to improve condition management and quality of life.

Learn how Modivcare can fit into your members’ coordinated care ecosystem with solutions such as:

Non-emergency medical transportation

Virtual & remote patient care

In-home & personal care solutions

Integrated supportive care solutions

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which looks at recent Excepted Benefits guidance provided by Colorado and Virginia.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: