- Medicare Market Insights

- Posts

- Dive into D-SNPs - This Fastest Growing MA Segment 🚀

Dive into D-SNPs - This Fastest Growing MA Segment 🚀

Deep dive on D-NSPs, the fastest growing segment in Medicare Advantage

This week’s newsletter is Sponsored By: 2023 Medicare Enrollment State Pages

57 page eBook (by Medicare Market Insights) full of Medicare enrollment statistics for each State.

Get your copy now: (link)

Use discount code MMI25 for 25% off (only available for the next few days)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Dive into D-SNPs

Compliance Chatter 📢 - New FCC rules impacting lead generation.

Sponsor Snapshot 🚀 - brought to you by 2023 Medicare Enrollment State Pages.

Data Visual of the week 📊 - Data Visual highlighting Group MA plans.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

The cities with the most competitive Medicare Advantage markets 2023 - (link)

Toolkit To Help Decrease Improper Payments in Medicare Advantage… - (link)

National Health Expenditures 2022 Highlights- (link)

Who Really Benefits From Medicare Advantage Plans? - (link)

The $2.5B Elevance Health, BCBSLA merger is back from the dead - (link)

Molina, Bright Health agree to lower sale price of embattled insurtech's MA business - (link)

Average Medicare Supplement Rate Increases Trend Higher in 2023 and January 2024 - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Dive into D-SNPs - The Fastest Growing Medicare Advantage Segment 🚀

In October, we took a closer look at Medicare Advantage “Special Needs Plans” (SNPs), learning what they are and looking at overall plan count and enrollment trends (click the link for a quick refresher). SNP plan enrollment grew 24% in 2023, with 5.66 million Medicare beneficiaries enrolled in Dual Eligible (D-SNP) plans.

Today, we will dive into these D-SNP plans, which only enroll beneficiaries that are eligible and enrolled in both Medicare and Medicaid.

D-SNP plans are the largest (and growing) SNP type.

Market Share

In 2023, 63% of all D-SNP beneficiaries were enrolled with the following 5 carriers:

United Healthcare (UHC)

Humana

Wellcare

Aetna

Healthfirst

Shown in the graph below, UnitedHealthcare’s D-SNP market share is 37%, equal to that of the additional 161 carriers in the market.

D-SNP Landscape

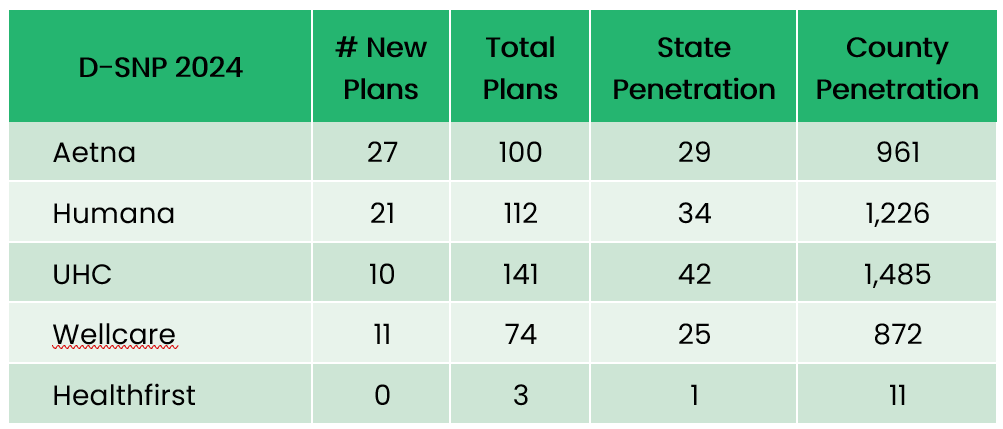

There are 874 D-SNPs available from 203 carriers in 2024, including 134 new plans.

UHC has the most plans (141) available in 42 states and 1,485 counties.

Even though UHC had the largest D-SNP enrollment percentage in 2023, they are only introducing 10 new plans in 2024.

Aetna is introducing 27 new plans, while Humana has 21 new plans.

Interestingly, while Healthfirst holds 4% of the marketshare, they only have 3 total plans available to Medicare D-SNP eligibles in select New York counties in 2024.

Premiums

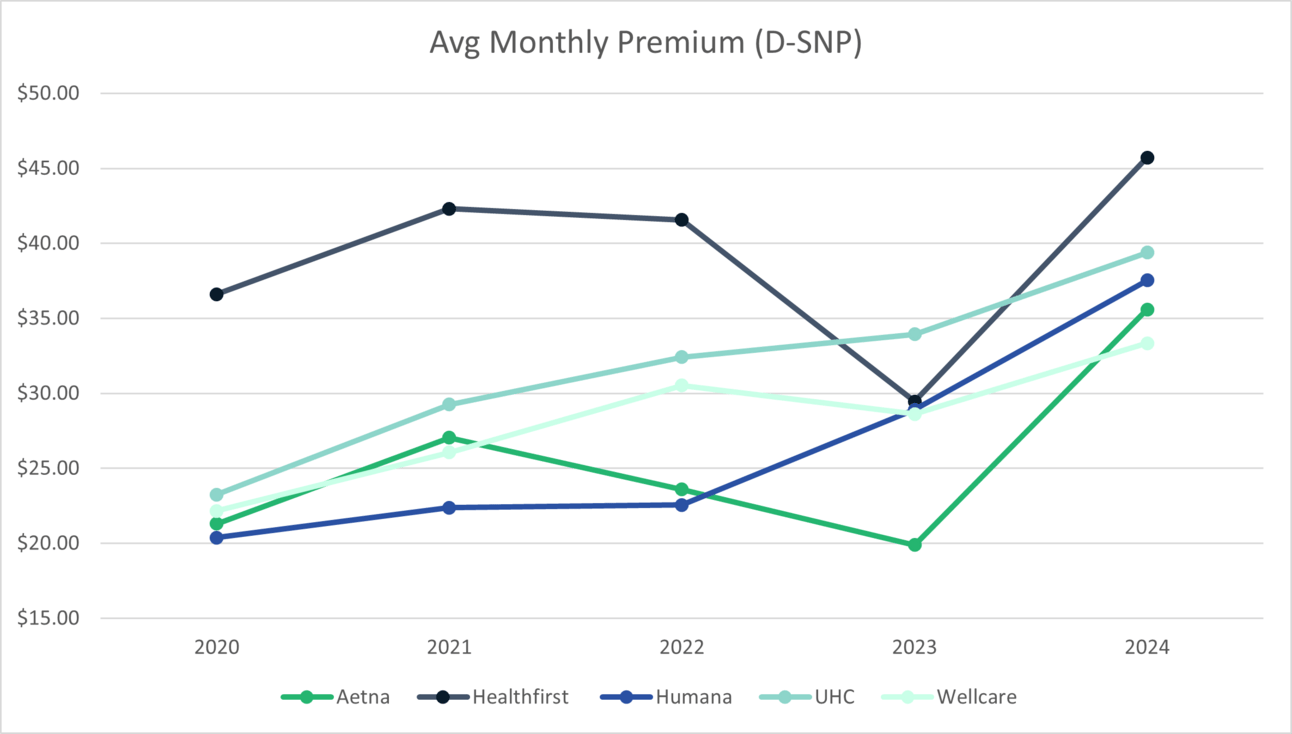

The average D-SNP monthly premium for all plans in 2024 is $34.42, which is a 20% increase from 2023.

While Humana, UHC, and Wellcare are in-line with this premium increase, Aetna and Healthfirst have implemented much larger increases.

Aetna’s average monthly premium in 2024 is $35.59, which is a 79% increase from an average premium of $19.89 in 2023.

Healthfirst’s average monthly premium in 2024 is the highest of the 5 market leaders at $45.73, which is a 55% increase from an average premium of $29.45 in 2023.

Drug Deductible

The 5 market leaders have an average annual drug deductible of $545 in 2024, which is the maximum allowed drug deductible by CMS.

When compared to the average annual drug deductible for all types of SNPs, Humana and United Healthcare have lower deductibles of $473 and $463 respectively.

When compared to the average annual drug deductible for Medicare Advantage plans offering prescription drug coverage, D-SNPs have significantly higher deductibles.

Integration Status

On November 11, 2023, CMS introduced a Proposed Rule for Contract Year 2025 plans, that includes regulatory changes to D-SNP plans. CMS has acknowledged that many D-SNP plans do not meaningfully integrate Medicare and Medicaid care, mainly because the D-SNP carrier does not also provide the enrollee’s Medicaid services. Here are the different types of integration status:

Coordination-Only D-SNPs (CO): provide Medicare-covered services and are required to coordinate the delivery of benefits with the Medicaid program, contract with state Medicaid programs, and notify states when enrollees are admitted as an inpatient.

Highly Integrated D-SNPs (HIDE) must meet the requirements of COs and must also have a Medicaid plan operating in the same counties as the D-SNP. The carrier provides both Medicare and Medicaid services, but there is no requirement that people enroll in both plans.

Fully Integrated D-SNPs (FIDE) must meet the requirements of COs and must also offer an aligned Medicaid plan that integrates the Medicare and Medicaid benefits. Medicare pays the plan for Medicare-covered services and Medicaid pays the plan for Medicaid-covered services.

Since 2023, CMS includes integration status in the SNP publicly accessible landscape files. Around 65% of all D-SNP plans are coordination-only D-SNPs (CO). Compared to CO plans which are offered in 39 states, FIDE plans are available in 14 states in 2024, while HIDE plans are available in 17 states.

The proposed rule is focused on increasing enrollment in D-SNP types (FIDE and HIDE) that more meaningfully integrate Medicare and Medicaid services than coordination-only D-SNPs (CO).

Watch for a more detailed explanation of this proposed rule in an upcoming Compliance Chatter!

Sources:

CMS Medicare Advantage/Part D Contract and Enrollment Data, 2023-09

CMS CY2020-2024 SNP Landscape Files

CMS 2024 Part C&D Plan Crosswalk

COMPLIANCE CHATTER 📢:

Do you purchase or generate Medicare leads?

On December 13, 2023, the Federal Communications Commission has adopted new rules that will impact lead generation. Previously lead-generation platforms could connect consumers with multiple businesses without distinct, individual consent for each. These new rules specify that:

text messages are required to comply with the TCPA Do Not Call (DNC) rules,

prior express written consent, meeting all E-SIGN requirements, must be obtained from a consumer one seller at a time (1:1 consent), and

calls and texts to a consumer must be logically and topically related to the website/transaction where consent was provided.

These changes will become effective 6 months after being published in the Federal Register, potentially impacting marketers this summer.

If you would like to learn more about our compliance services, reach out to [email protected].

Sponsor Snapshot 🚀: Medicare Market Insights - State Pages 2023

Get 25% off our 2023 Medicare Enrollment State Pages eBook.

Use discount code MMI25 at checkout.

Don’t miss out… the discount code is only available for the next few days!

Get your copy here: (link)

DATA VISUAL of the Week 📊

This week’s data visual comes from kff.org! It shows the percentage of firms offering Medicare Advantage as part of their retiree benefits.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)