This week’s newsletter is Sponsored By: Medicare Market Insights - Plus

Click here for more info (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - The Wild Medicare Market 🤠- AEP 2025

Compliance Chatter 📢 - Section 1557 of the ACA and more…

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights - Plus

DATA VISUAL of the Week 📊 - MA enrollment since 2010 for the largest Carriers

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage in 2024: Enrollment Update and Key Trends - (link)

Feds Killed Plan To Curb Medicare Advantage Overbilling After Industry Opposition - (link)

Medicare Advantage consensus waning ahead of 2024 election - (link)

Payer Roundup - Devoted Health raises $112M; L.A. Care eliminates prior auth codes - (link)

PODCAST - Agent Boost - What Does an Actuary Do? - (link)

Individual Supplemental Health Insurance Market produces $9.02 billion in premium - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

The Wild Medicare Market 🤠- What it Means for AEP 2025

The next 4 months in the Medicare industry are shaping up to be wild.

There are so many moving pieces that it’s daunting to try and summarize it in one place.

But, that’s my goal. To provide a summary of what got us to this point, and what it means for AEP 2025.

___

Medicare Carriers are experiencing Higher Loss Ratios and Lower Profit Margins.

Last week’s deep dive looked at Medicare Carrier Q2 financials side-by-side.

We highlighted the fact that Carriers (sometime referred to as “Payers”) are experiencing higher loss ratios, driven by higher utilization leading to lower profit margins.

Combined, the companies highlighted saw a 1.8% increase in loss ratios and a 9% drop in profits.

Going into 2025 this pressure will remain or worsen.

Here’s why:

Small change in MA reimbursement rate increase for 2025

Overall payments are expected to increase 3.7%, less than the Industry argued would be adequate (link)

Shift to V28 risk adjustment model

The V28 model is expected to decrease Medicare Advantage risk scores by 3-8% (link)

Inflation Reduction Act shifting more Part D cost to Carriers and requiring added administrative burden (link)

Changes to pre-authorization rules

While good for consumers, likely increases (and speeds up) medical cost to payers (link)

The result is Payers are exiting the MA/PDP space altogether, reducing service areas, squeezing benefits, increasing cost sharing, increasing premiums, or combinations of all of these.

Here are a few examples:

Agents are getting “first looks” as we speak, and with some exceptions, it’s clear that we’re generally seeing reductions.

We won’t know the full scope of specific changes until late September or Early October.

This fall consumers will be receiving communication letting them know about changes to their plans.

Annual Notice of Change (ANOC): By September 30th each year, MA plans must send an Annual Notice of Change (ANOC) to their members letting them know what is changing (link).

Some consumers will get notice that their plan is not being renewed.

These communications are not new, but it’s likely more seniors will be seeing “bad news” this fall. The logical result is that more consumers will be shopping.

So, Carriers, Agents, FMOs, Call Centers should be ready to help even more people this year.

… In the Meantime ….

Distributors (Agents, FMOs, Call Centers) face uncertainty and changes with how they will be compensated this fall.

In most years, distributors know exactly what their compensation contracts and marketing allowances look like by this time of the year. It’s been reported that this year these have not been ironed out yet. Making it hard for distributors to finalize their strategy for this AEP.

Part of the uncertainty is due to the new Broker Compensation rule released by CMS in April (link).

This rule caused a lot of uncertainty in the industry

Carriers spent significant time considering how to apply the rules.

But, a Texas court issued a Stay on the new rule and so compensation rules remain unchanged for now (link).

Carriers still have to navigate how to handle this going forward which may be impacting current plans.

The Inflation Reduction Act shifts Part D costs to Carriers.

The result of this is that Part D products will likely see reduced benefits and higher premiums this AEP (link).

Some Carriers are indicating they will not be paying commissions on standalone PDP products.

Combine this will the fact that Medicare Supplement rate increases have been elevated significantly (link). Likely leading to a higher number of consumers who currently have Medicare Supplement with a Stand-alone PDP shopping this AEP.

So, in addition to more Medicare Advantage shoppers, there will also likely be more Medicare Supplement/PDP shoppers.

All combined, a large number of seniors will be reviewing their plan options this fall.

If this wasn’t enough, we also have a presidential election going on this fall. (Sorry to remind you!)

—

With all these changes, it’s important that you as a leader in the Medicare space stay informed, come up with a plan, but be ready to adjust as things play out over the next several months.

Because, the reality is, all of the moving pieces will cause opportunities in the Market.

Opportunities for you to help numerous consumers.

Opportunities for distributors to grow books of business.

Opportunities for Carriers to add new members.

Opportunities for Investors to invest in companies solving problems in the changing Medicare space.

What are you going to do to take advantage?

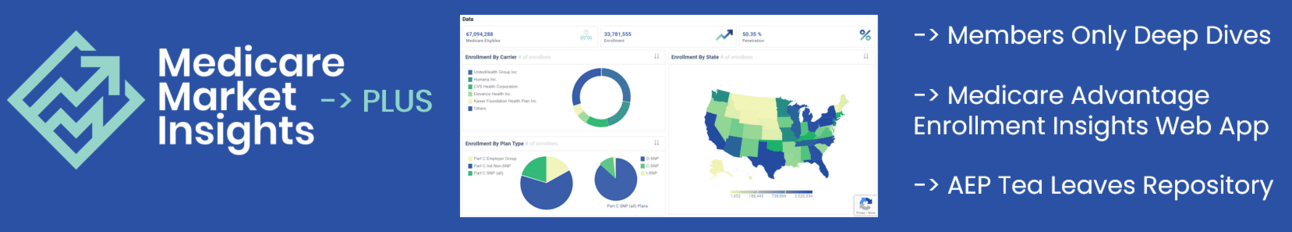

Sponsor Snapshot 🚀: Medicare Market Insights - Plus

We are happy to announce Medicare Market Insights - Plus.

Launching early next week.

The Medicare market is filled with data, but pulling it all together, interpreting it, and making it actionable takes time—time that busy leaders don’t have.

Plus, with the expected wave of market exits in the Medicare Advantage space this AEP, the pressure to stay informed is greater than ever.

The Solution: Medicare Market Insights Plus offers you the advantage you need:

Exclusive Medicare Advantage Insights Web Application: Instantly access critical data and trends with our easy-to-use tool. Drill down into enrollment by state, payer, county, and plan type, and uncover opportunities that others miss.

Members-Only Deep Dives: Stay ahead with in-depth analyses of market shifts and strategic opportunities. Our content is designed to help you find the next big win.

Expertly Curated: Our data is combined with analysis from experienced actuaries and presented in a way that’s easy to digest, even for the busiest executives.

Click here for more info → (link)

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which looks at Section 1557 of the ACA and the application of Non-Discrimination Rules to Medigap and includes a poll regarding the Fixed Indemnity Notice required by the Tri-Agency Rule.

DATA VISUAL of the Week 📊

This week’s visual comes from KFF.org and looks at the change in MA enrollment since 2010 for the largest Carriers.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: