Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Q2 2024 Medicare Carrier Financials Side-By-Side 💵

Compliance Chatter 📢 - Medicare drug price negotiations

Sponsor Snapshot 🚀 - brought to you by PX

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage consensus waning ahead of 2024 election - (link)

Medicare coverage would change under new bill - (link)

Biden admin to spend billions to blunt spike in Medicare drug premiums - (link)

Fair Square Medicare rolls out Ai voice agents to help enroll seniors into insurance plans - (link)

Humana pays $90M to settle whistleblower allegations of Medicare Part D fraud - (link)

Medicaid overtakes Medicare Advantage as health insurers’ bogeyman in Q2 - (link)

Medicare Supplement Broker Incentives- 2024 Q3 Update - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Q2 2024 Medicare Carrier Financials Side-By-Side 💵

In this week’s deep dive, we are looking at publicly traded Medicare carrier Q2 2024 financials side-by-side.

Not the best quarter for the insurance business, but pretty good for healthcare services business.

As we often talk about, the Medicare market is a growing market. So, the long term underlying market remains strong for these companies.

The insurance carriers included in this analysis are all trying to capture a piece of the growing Medicare market (along with other insurance markets), and do so profitably. Here they are:

Aside from Centene and Molina, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

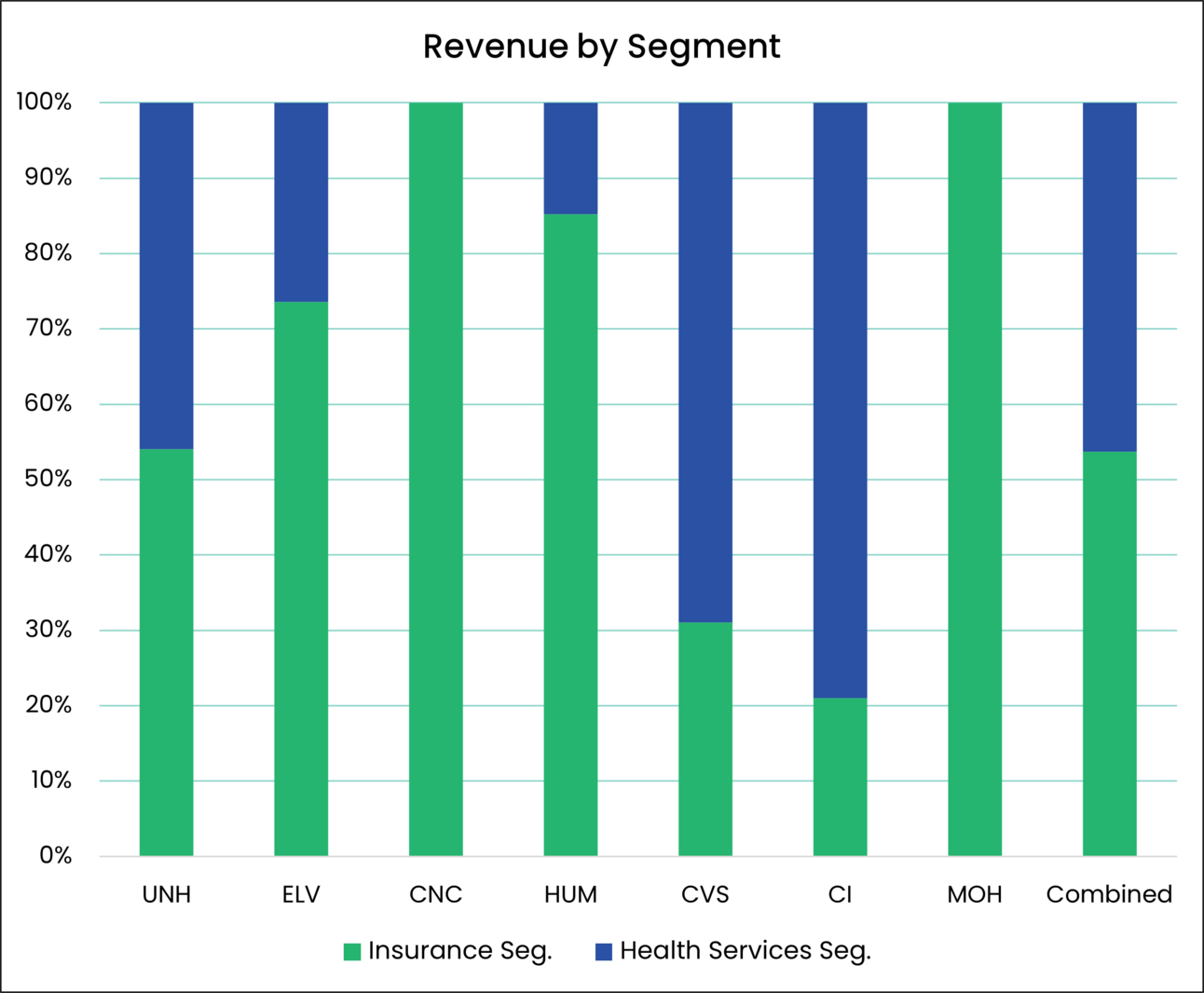

Here is the split of Q2 2024 revenues between these two segments for each carrier:

As you can see, UNH, ELV and HUM have a larger insurance segment while CVS and CI have a larger services segment.

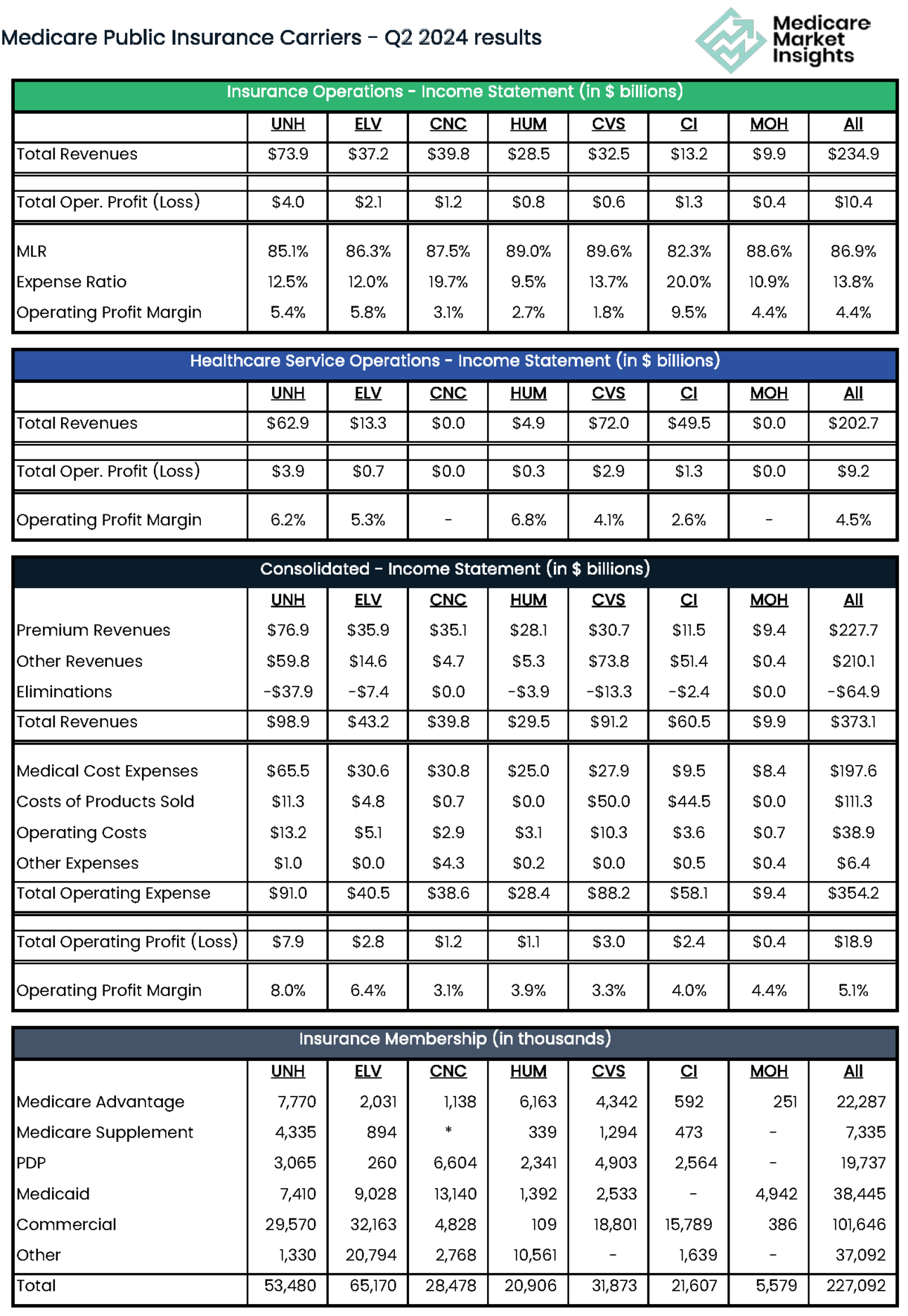

Income Statement & Membership Side-By-Side

To compare and contrast the Q2 2024 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

YoY % Change

Here is the % change in key metrics from Q2 2023 to Q2 2024.

Current Valuation Metrics

Here are current valuation metrics for these carriers.

Higher Loss Ratios / Lower Profits

The overall theme for the quarter was lower profits driven by higher loss ratios.

The higher loss ratios are a function of lower Medicare Advantage funding combined with higher utilization.

Several carriers signaled Medicare Advantage “2025 pull-back” due to headwinds associated with Part D IRA changes, lower funding, and continued higher loss ratios.

See more here:

→ CVS warns it could lose up to 10% of its Medicare members next year (link)

→ Centene Becomes Latest Insurer To Pull Back On Medicare Advantage Footprint (link)

Observations

Membership

Overall Medicare Advantage grew 7% combined

CVS & MOH both saw significant growth in Medicare Advantage Membership (see more on Aetna’s big AEP here). MOH’s growth due to acquiring Bright Health members.

Overall Medicaid membership dropped significantly (likely due to Medicaid “unwinding”)

Commercial grew overall and saw market share shift between carriers (due to growth in ACA market, and Humana exiting the Employer Group market)

Insurance Operations

Overall, Revenues Up (7%), Operating Profit Down (9%)

CVS & Humana with a drastic example of both!

As previously mentioned, overall loss ratios were up 1.8% combined!

Notable that only ELV saw their loss ratio decline

UNH, HUM and CVS all saw significant increases in loss ratios

Healthcare Services Operations

Overall, Revenues Up (9%), Operating Profit Up (19%)

Everyone saw increases in Operating profit

The diverging operating profits between insurance operations (profit down), and healthcare services operations (profit up), is the business case for vertical integration.

Consolidated Results

Revenues Up (8%), Profits Down (2%)

… and, AEP is right around the corner…. Let the games begin!

__

Sources: Carrier quarterly financial earnings releases, 10-Qs and 10-Ks.

__

Can you do me a favor? Forward this to another leader in the Medicare space who could benefit from this info. You’ll get a free eBook if you do!

Sponsor Snapshot 🚀: PX

Every year, your policyholders are shopping around in search of a better plan.

What if you could identify them before they switch, and retain them?

Try Our Free Retention Savings Calculator To see how much annual revenue you could retain:

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which looks at Medicare drug price negotiations released last week. Click button to read!

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: