This week’s newsletter is Sponsored By: Modivcare

Minimize risk with our PERS offering → (Learn More)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - CY '25 Medicare Carrier Financials Side-By-Side ❤️

Sponsor Snapshot 🚀 - brought to you by Modivcare

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Limits on care denials in Medicare stall again - (link)

Study finds outdated Medicare rule delays nursing care, wastes hospital resources - (link)

PBM markets for Medicare Part D or Medicaid are highly concentrated in nearly every state - (link)

Medicare prescription payment plan may ease financial burden of cancer, improve adherence - (link)

Whistleblowers’ warnings lead to landmark $556M Kaiser settlement: A Q&A with coding expert Gloryanne Bryant - (link)

Physician Network Breadth in Medicare Advantage Plans Offering Part B Premium Givebacks - (link)

Elizabeth Warren and Josh Hawley a bipartisan Senate duo aiming to break up "Big Medicine" - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

CY '25 Medicare Carrier Financials Side-By-Side ❤️

In this week’s deep dive, we are looking at publicly traded Medicare carrier calendar year (“CY”) 2025 financials side-by-side.

The insurance carriers included in this analysis are all trying to capture a piece of the growing Medicare market (along with other insurance markets), and do so profitably. Here they are:

UnitedHealth Group - $UNH ( ▲ 1.96% )

Elevance Health - $ELV ( ▲ 1.75% )

Centene Corp. - $CNC ( ▼ 3.09% )

Humana - $HUM ( ▲ 1.96% )

Molina - $MOH ( ▲ 3.31% )

CVS - $CVS ( ▲ 1.18% )

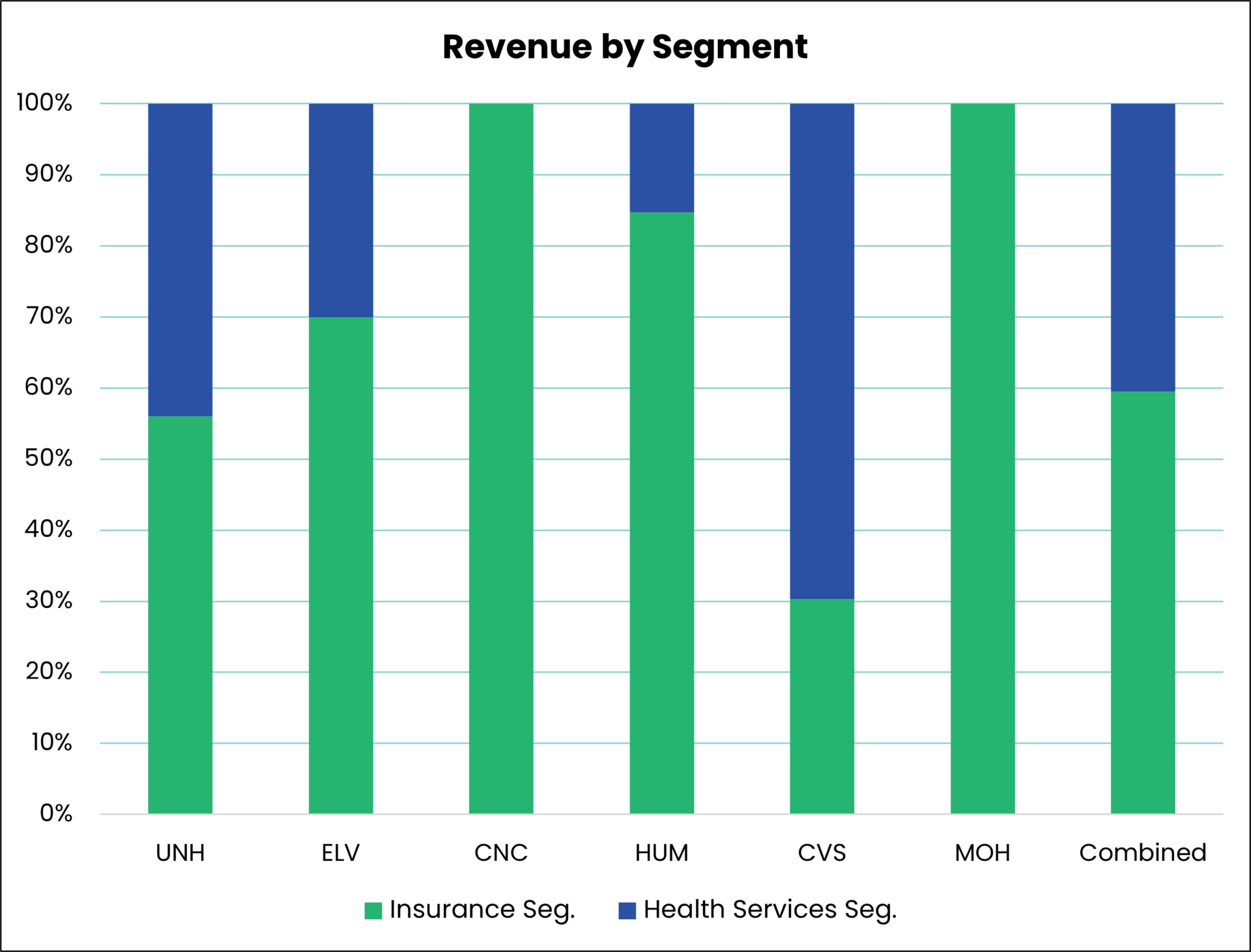

Aside from Centene and Molina, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

Here are the split of 2025 revenues between these two segments for each carrier:

—

Income Statement & Membership Side-By-Side

To compare and contrast the calendar year 2025 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

—

YoY % Change

Here is the % change in key metrics from CY 2024 to CY 2025.

—

Current Valuation Metrics

Here are current valuation metrics for these carriers

—

Observations

Combined, these carriers generated $1.42 trillion in revenues (down from $1.52 trillion) and $26.7 billion in operating income (down from $65.5 billion) in 2025.

Centene had the largest percentage increase in revenues, 19% YoY. They also had the largest decrease in total operating profit, -340% YoY.

The Medical Loss Ratio continued to climb. After increasing 2.4% in 2024 (all Carriers combined), it increased another 2.0% in 2025 with UNH and CNC increasing the most. CVS saw a decrease.

Humana saw a 29% increase in total Insurance Operations profit YoY

Elevance saw a 17% increase in total Healthcare Services Operations profit YoY

Humana saw the largest increase (32% YoY) in Medicare Supplement membership.

UnitedHealth, Elevance, and Molina all saw an 8% increase YoY in Medicare Advantage membership.

Final Thoughts

2026 will be pivotal as Medicare carriers continue to adjust to rising costs, potential regulatory changes, and pressure on rate reimbursement.

Expect further pricing adjustments and potential shifts in plan design heading into 2027.

___

Sources: Carrier quarterly financial earnings releases, 10-Qs and 10-Ks.

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access care through home and community-based solutions. We’re there to help members live more confidently by enabling them to access the care they need - and our solutions deliver: we measurably address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Device enabled virtual care management

Medication Management

Community Health Stations

E-3 - Engage, Educate, Empower to address health literacy and support gap closure

Extending access for your most complex populations → (Explore Our Solutions)

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: