This week’s newsletter is Sponsored By: Modivcare

White Paper: “The Impact of High Blood Pressure and the Benefits of an in-Home Program on Improving HEDIS Control” → (Read White Paper)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Elevance Pulls Back on Marketing Medicare Advantage Plans 🌦️

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

NABIP Responds to Major Carrier Policy Change Impacting Medicare Beneficiaries - (link)

Medicare Advantage Insurers Often Use Rewards and Incentives to Encourage Enrollees to Complete Health Risk Assessments (HRAs) - (link)

Elevance Health to slash Medicare Advantage marketing - (link)

Humana’s exit of some ‘unprofitable’ Medicare plans helps fuel a big profit beat - (link)

PODCAST: Episode 87: Are Agents Getting a Raise?- (link)

Medicare Supplement Rate Filings – May 2025 - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Elevance Pulls Back on Marketing Medicare Advantage Plans 🌦️

Shortly after UnitedHealth Group’s disappointing quarterly release (more on that here), Elevance ($ELV ( ▲ 0.56% ) ) reported Q1 results—delivering solid growth and hitting expectations.

They grew MA membership by 11.8%, Revenues by 15.4% and Operating Profit by 5.1%.

See my LinkedIn post on ELV Q1 results here → (link)

On Medicare Advantage, here is what they said in their Earnings Call:

"In Medicare Advantage, performance was consistent with expectations, retention remains strong, and growth was targeted and disciplined, supporting both margin and membership sustainability.

We remain confident in the long-term outlook for MA. Stronger retention not only improves member satisfaction, it's associated with better care coordination, fewer inpatient stays, and lower overall Medicare spending.”

If you googled Elevance the days that followed, here is what you would have found:

So, all is well, right? Well, maybe not…

Late last week I saw this pop up on LinkedIn.

It quickly became the dominant topic across the Medicare ecosystem. It sounds like the plans remain available, and commissions will still be paid—but agents must now submit applications manually.

AgentBoost discussed it in their recent podcast (listen here).

It’s clear, that Elevance continues to be concerned with adding to much new MA membership onto their current plans. They already stopped paying commission on certain plans mid AEP.

Now they are effectively cutting off new sales for the rest of the year (likely until new plans are developed for 2026).

What's Behind the Decision?

Elevance’s recent move has raised questions across the industry. While the company hasn’t shared detailed public reasoning, several experts point to operational and financial stress from faster-than-expected membership growth as likely drivers.

John Selby, President of Rebellis Group, believes the decision is a response to capacity challenges and risk management concerns:

“Elevance is responding to greater than expected growth which can stress basic resources (customer service, care management) at a minimum. And since we are now outside of AEP, most members will be new to Medicare, which means they will be a drag on risk scores for the near future, further stressing the financial balance necessary to succeed.”

Selby adds that this could signal a broader trend heading into 2026:

“Looking ahead to 2026, we believe that local and regional plans in particular are considering how to mitigate similar challenges in situations where they grew exponentially greater than planned in 2025. We would not be surprised to see more plans take actions to limit new membership growth by suppressing enrollment options and/or withdrawing initial enrollment commissions in 2026.”

That concern around new-to-Medicare enrollees was echoed by Roshan Desai, VP of Product and Financial Strategy at Rebellis, who noted that lower initial risk scores translate into higher medical loss ratios (MLRs):

“New-to-MA do tend to have higher MLRs primarily because the risk scores are so low. It’ll take Elevance 1–2 years to get the risk scores to reflect the medical and supplemental benefit costs of the member more appropriately.”

Desai also raised another possible factor: commission structure. With most enrollees now being new to MA, Elevance would be paying the full first-year commission rather than a pro-rated or renewal rate—raising acquisition costs at a time when member profitability is already under pressure.

Bottom line: Elevance grew enrollment significantly during AEP—but they appear uninterested in further growing non-D-SNP membership for the remainder of the year.

—

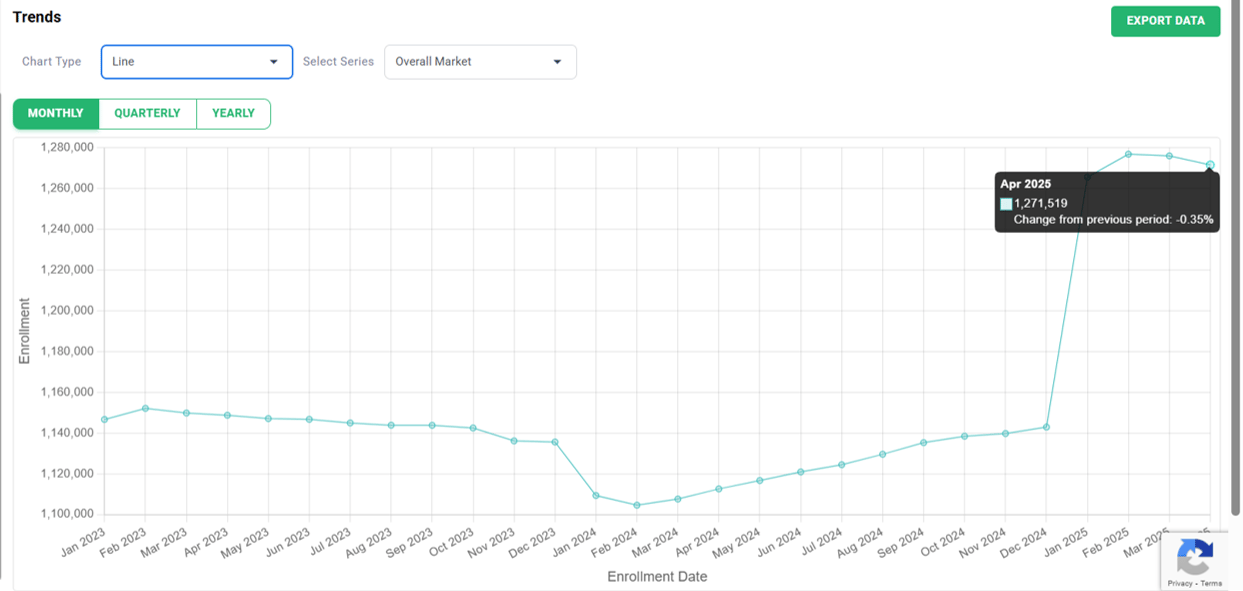

Recent Enrollment Trends

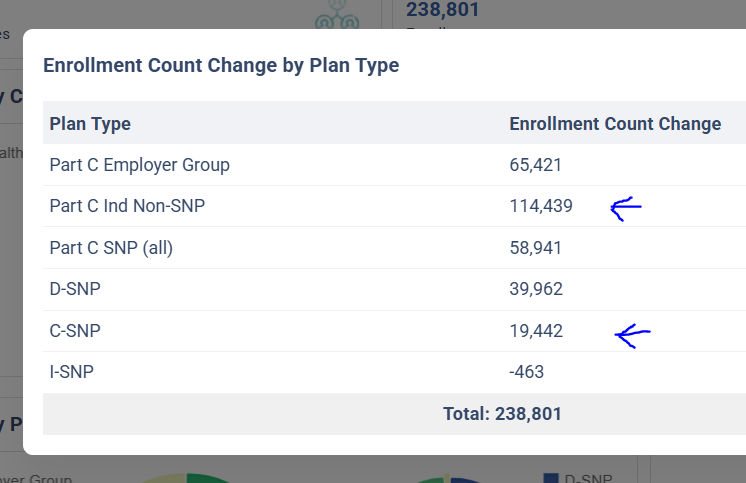

As discussed in our AEP breakdown (link), Elevance grew MA enrollment by 12% during AEP. Up 240,000.

__

The AEP growth was a mix of Employer Group, Individual Non SNP and SNP.

count change from Dec. ‘24 to Feb. ‘25 → MMI+ MA Enrollment Insights Web App

Based on the messaging, Elevance seems comfortable with their D-SNP growth, but is pulling back on Individual Non-SNP and likely C-SNP as well.

Looking at enrollment for Individual Non-SNP and C-SNP combined we can see the large AEP increase, with a decrease in enrollment since.

So, there’s no evidence of a post-AEP enrollment surge, but they must be concerned nonetheless.

—

State Impacts

There are some states that may be impacted by this move more than others.

Looking at Elevance’s AEP enrollment growth by state, reveals that in Indiana, Virginia, and Wisconsin they outpaced competitor growth by a lot.

📽️Elevance AEP Growth - IN, VA, WI (watch video clip)

This indicates they have especially attractive plans in those states.

Going forward, consumers and agents will have a harder time applying for plans in these (and all other) states!

—

Final Thoughts

Elevance’s decision to pause new MA sales isn’t a reaction to poor Q1 results—it’s a strategic recalibration.

After an aggressive AEP with strong growth, the company appears to be prioritizing operational stability and margin over continued near-term expansion.

This move reflects broader pressure facing MA carriers in 2025. It’s also a signal to watch heading into 2026. If Elevance is pulling back, other regional and local carriers may follow suit.

That said, cutting off new applications midyear—even if technically still available through manual submission—risks chipping away at the goodwill they’ve built with agents and brokers. Distribution partners value consistency and clarity, and sudden shifts like this make it harder to plan, sell, and serve clients.

For distributors and agents, it’s a reminder that even top-performing plans can pivot fast—and those decisions ripple downstream quickly.

__

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by enabling them to access the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring – from digitally-enabled to clinician-led

Medication Management

E3 – Engage, Educate, Empower to address health literacy and support gap closure

See what services they can help you with. → (Modivcare)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: