This week’s newsletter is Sponsored By: Medicare Market Insights +

Check out the latest “Trends” feature→ (Link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - UnitedHealth Group: 7 Years of Growth, 1 Quarter of Pain

Sponsor Snapshot 🚀 - brought to you by MMI+

Compliance Chatter 📢 - Check out the latest regulatory changes.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

UNH’s Disastrous Q1 - (link)

Lowering Drug Prices by Once Again Putting Americans First - (link)

CMS denies Humana's Medicare Advantage star ratings appeal - (link)

A Call for Reform: Fraud, Waste & Abuse in Medicare Requires Sweeping Action - (link)

UnitedHealth to Ask for Higher 2026 Prices - (link)

Medicare Advantage state of play - (link)

Danbury Hospital sues health insurance giant for repeatedly failing to pay Medicare Advantage claims - (link)

Medicare Supplement Average Claim Amount per Policy by Plan and Year - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

UnitedHealth Group: 7 Years of Growth, 1 Quarter of Pain

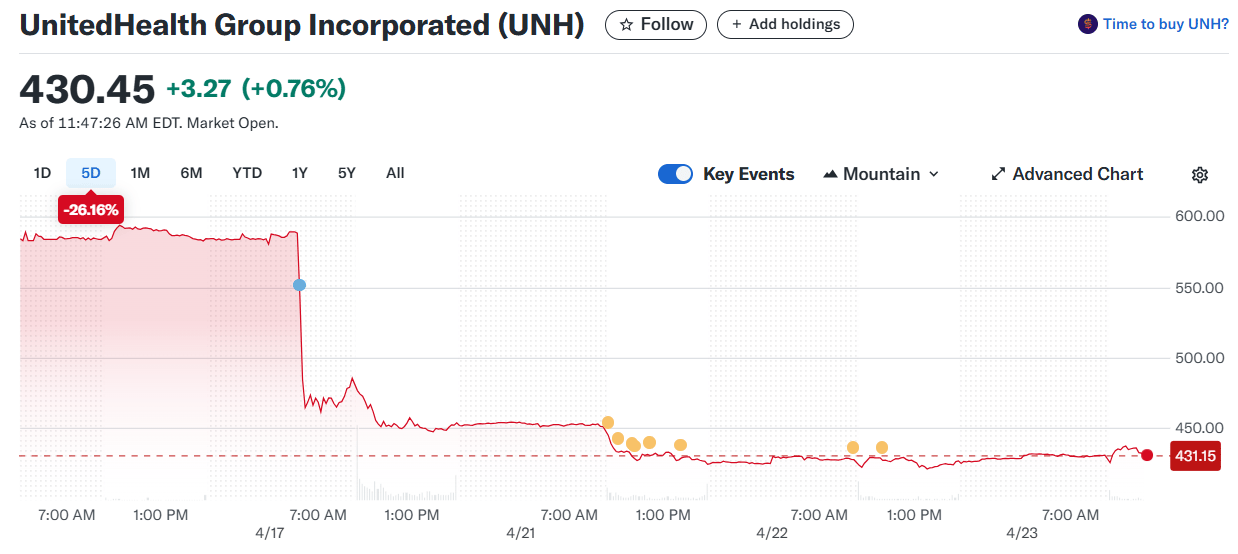

UnitedHealth Group ($UNH ( ▲ 0.6% )) released Q1 2025 earnings last week, sending the stock down sharply after it cut full-year EPS guidance by over 10%—from $29.50–$30.00 to $26.00–$26.50.

Why are they adjusting EPS outlook down? You can read their commentary here. The summary is…

Higher-than-expected Medicare Advantage utilization

Care activity—especially outpatient and physician services—ran at nearly 2x forecasted levels.New Optum Health patients under-reimbursed

Many newly enrolled MA members had little prior care history in 2024, leading to lower risk scores and payments in 2025.CMS risk model transition challenges

Execution issues in adapting to CMS’s new risk adjustment model affected revenue accuracy.

Why did the stock get hammered?

largely due to the miss on earnings and the full year adjustment down

But, I also note that UNH has had a significantly higher P/E ratio than competitors, and higher than their historical averages. This what it looked like in mid February.

After the significant drop in stock price they are more in-line with peers. So, some of the movement is probably just natural.

In spite of the recent drop in stock price and headwinds noted by UNH executives, United is the biggest player in the Medicare space, and their growth over the past 7 years (and beyond) is impressive.

Let’s take a look at Membership, Revenues, Profits, and Loss Ratios over the last 7 years.

__

Membership Trends

Membership growth was mixed across business lines. Medicare Advantage stood out.

Membership in Medicare Supplement declined, continuing a longer term trend.

Medicaid decline continues, while Commercial growth slows compared to the prior year.

One additional note on Medicare Advantage growth. United’s growth was primarily driven by C-SNP enrollment:

Source: MMI+ Web App “Trends”

I wonder if the influx of C-SNP business is causing some of the utilization and reimbursement issues that they’re seeing?

—

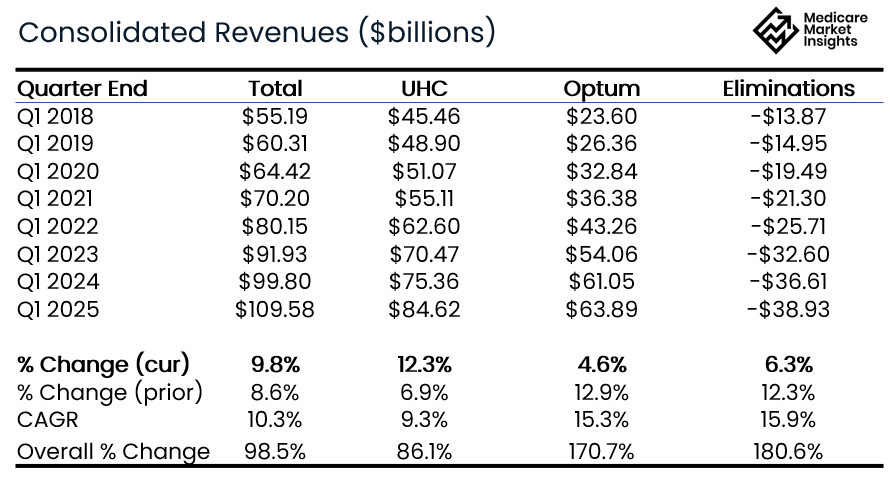

Revenue Trends

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Q1 Revenues (the insurance Carrier segment) have grown steadily over the past 7 years.

UnitedHealthcare Revenues increased substantially YoY driven by significant revenue growth in the Medicare & Retirement segment.

—

Optum Q1 Revenues (the healthcare provider segment) have grown 2.7x over the past 7 years.

Overall Revenue growth down significantly compared to the prior year and the CAGR.

Driven by decline in Optum Health Revenue

Partially offset by strong growth in Optum Rx

—

Combining UnitedHealthcare, Optum, and including eliminations, results in the company’s Total Consolidated Q1 Revenues.

As you can see, overall revenue growth was strong

UHC was stronger than prior, and higher than CAGR

Optum lagged significantly

—

Operating Income Trends

The combined UnitedHealth Group’s Q1 Operating Income has grown steadily over the past 7 years.

Aside from a 15% drop at Optum Health, operating income growth was strong and well above long-term trends.

One note: Q1 2024 results were impacted by the Change Healthcare cyber attack. So, some of the YoY growth is simply due to 2024 being lower than it would have been.

—

Medical Loss Ratio Trends

The Medical Loss Ratio has been a major topic point in the Medicare industry over the past year with most companies reporting higher utilization in Medicare products resulting in higher loss ratios.

[Note: elevated Medicaid loss ratios are also contributing]

You can see in the chart below that the Q1 2025 loss ratio of 84.8% was down from Q4, but is higher than Q1 2024 (84.3%).

Loss ratios tend to be higher in Q3 and Q4 of each year, and UNH expects their full year loss ratio to be 87.5%, compared to 85.5% for full year 2024.

It’s one of the key metrics we will be watching throughout 2025.

—

Bottom Line

EPS Cut Drove the Selloff

UnitedHealth lowered 2025 EPS guidance due to higher MA utilization and risk score issues.Valuation Reset?

The stock correction reflects both the earnings miss and a return to more peer-aligned P/E levels.MA Growth Still a Strength

C-SNP enrollment led Medicare Advantage gains—United outpaced all competitors this AEP.Revenue Growth Mixed

UHC performed well; Optum Health dragged overall growth despite strength in Optum Rx.Profitability Mostly Intact

Operating income held up, except for a notable 15% decline at Optum Health.MLRs Remain Elevated

Full-year MLR expected at 87.5%—a key pressure point for insurance margins.Still the Industry Leader

Despite short-term headwinds, United remains the dominant force in Medicare.

__

SPONSOR SNAPSHOT 🚀: Medicare Market Insights +

We’re excited to let you know the “Trends” section of the Medicare Market Enrollment web app is now available!

Now you can see how MA & PDP enrollment has changed over time.

By State, Parent Org, Plan Type and more…

See “Trends” in action → (Video)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: