This week’s newsletter is Sponsored By: Modivcare

Download free white paper on “Closing Gaps in Care”→ (Download)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Local vs Regionals vs National Carriers: MA AEP results

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage market growth slows amid intensified headwinds - (link)

CMS punts on Medicare Advantage AI prior authorization, marketing - (link)

How Medicare Advantage contracts are squeezing rural hospitals - (link)

Sutter Health and SCAN Group Announce Strategic Collaboration to Enhance Medicare Advantage Services in Northern California - (link)

Assessing the utilization and delivery of Medicare Advantage supplemental benefits - (link)

Part D Trend insights - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Local vs Regionals vs National Carriers: MA AEP results

In past deep dives, we’ve already unpacked the overall AEP 2025 enrollment trends.

This week I sliced the enrollment data by size of Company to see how Local and Regional Carrier AEP results compared to the National Carries.

—

Local vs. Regional vs. National

Here’s how we grouped carriers based on the number of states with MA/MAPD enrollment:

National = Parent Org (“Carrier”) with >30 states with MA/MAPD enrollment

Regional = Parent Org with <=30 & >2 states with MA/MAPD enrollment

Local = Parent Org with <= 2 states with MA/MAPD enrollment

[Note: The enrollment data shown below includes all MA/MAPD plans (individual, group, SNP, etc.]

—

Based on these definitions, here are the overall AEP results:

data source: downloaded from MMI+ MA web app

Observations:

There are only 9 National Carriers, but those Carriers make up over 70% of the market, even after seeing the smallest % increase during AEP.

Regional Carriers saw the biggest increase in enrollment during AEP, and also had the largest % increases

There are 240+ local Carriers (80% of the Carrier representation). Those Carriers account for just 10% of the overall enrollment, but outpaced the National Carriers in AEP % growth.

—

National Carriers

National Carriers get most of the headlines, and naturally show up in most analysis of MA enrollment, because they make up the largest market share.

Below, you can see how the Nationals stacked up to one another this past AEP.

data source: downloaded from MMI+ MA web app

Observations:

UnitedHealth Group led all Carriers in AEP growth.

While overall percentage growth for this group was small, much of the drag came from declines at Humana, CVS, and Centene.

—

Regional Carriers

Regional Carriers saw the most AEP Growth as a group and also had the higher growth %.

Let’s take a look at the top and bottom 20 (in terms of AEP growth) for Regional Carriers.

Top 20:

data source: downloaded from MMI+ MA web app

Bottom 20:

data source: downloaded from MMI+ MA web app

Observations:

Lifetime Healthcare’s growth is primary driven by the acquisition of CDPHP’s MA block

Kaiser, Alignment and SCAN are all in the top 5 in terms of AEP growth. They all have most of their market share in CA.

—

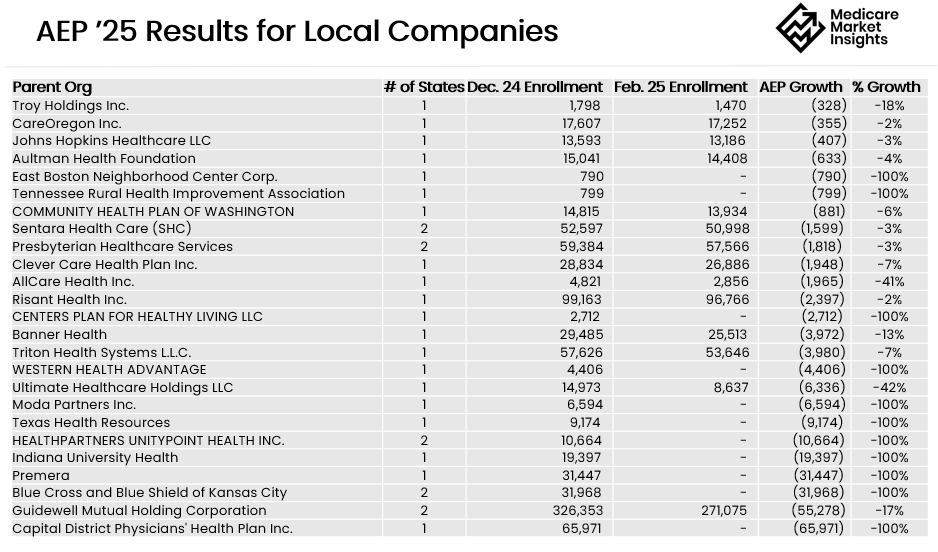

Local Carriers

Finally, we take a look at the most numerous group of Carriers.

The Local Carriers. Those that have <=2 states with enrollment.

On average, these 243 Carriers have ~15,000 MA/MAPD members.

Let’s take a look at the top and bottom 25 (in terms of AEP growth) for Local Carriers.

Top 25:

data source: downloaded from MMI+ MA web app

Bottom 25:

data source: downloaded from MMI+ MA web app

Observations:

Medical Mutual of Ohio led all Local Carriers in AEP growth — their surge was so strong they reportedly paused commissions mid-AEP.

Many Local Carriers are BCBS affiliates, several of which capitalized on market retrenchments by National plans.

Local Carriers also had several market exits during AEP. BCBS of KC, Premara, Texas Health Resources to name a few.

—

Final Thoughts

With major National Carriers pulling back last AEP, many Regional and Local Carriers experienced outsized growth — some likely beyond expectations. At the same time, several Local plans exited the market due to rising pressures.

With the strong 2026 rate increases now in place, all eyes are on how carriers at every level will adjust their products and strategies heading into AEP 2026.

__

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by accessing the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring – from digitally-enabled to clinician-led

Medication Management

E3 – Engage, Educate, Empower to address health literacy and support gap closure

Download free white paper on “Closing Gaps in Care”→ (Download)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: