Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - HCSC + Cigna Medicare: The Post-Deal Landscape

Sponsor Snapshot 🚀 - brought to you by Quote Velocity

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Contract Year 2026 Agent and Broker Compensation Rates - (link)

Insurers Pledge to Fix Controversial Pre-Authorization Process - (link)

Treasury Releases Social Security and Medicare Trustees Reports - (link)

The MAHA Movement Already Has An Army. It Just Needs To Mobilize It - (link)

Seven Million People with Medicare Spend More Than 10% of Income on Part B Premiums – The Reconciliation Bill Could Drive the Number Higher - (link)

Mayor Adams will not switch city retirees to Medicare Advantage plan - (link)

Medicare Supplement Claim Review - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

HCSC + Cigna Medicare: The Post-Deal Landscape

In early 2024, Health Care Service Corporation (HCSC)—the Blue Cross and Blue Shield licensee for Illinois, Texas, Oklahoma, New Mexico, and Montana—announced it would acquire Cigna’s Medicare business for $3.3 billion (link).

That transaction closed in March 2025 (link).

While HCSC has long been a major player in the group and individual commercial markets, its Medicare Advantage footprint has remained modest…until now. With this acquisition, HCSC more than triples its Medicare Advantage enrollment, adds significant PDP and Med Supp scale, and picks up CareAllies, a provider enablement platform serving risk-bearing physician groups.

This deep dive explores how HCSC’s health insurance profile changes after the deal, using historical NAIC data to track membership, premium, and claims before and after the acquisition. We highlighted key shifts in risk mix, geographic reach, and strategic positioning.

__

🧾 Transaction Overview: Cigna → HCSC

Acquirer: Health Care Service Corporation (HCSC)

Seller: The Cigna Group

Announced: January 31, 2024

Closed: March 19, 2025

Purchase Price: $3.3 billion

Assets Acquired:

Medicare Advantage plans (~700,000 members)

Medicare Supplement business (~500,000 members)

Medicare Part D (PDP) (~2.9 million members)

Ancillary Products (DVH, CI, Accident, HIP, etc.) (estimated ~390,000 members)

CareAllies, Cigna’s provider enablement subsidiary

Additional Terms:

Evernorth (Cigna’s services arm) retains the PBM and will continue to provide services to HCSC for several years post-acquisition.

__

To assess the impact of the acquisition, we used 2024 NAIC Accident & Health (“A&H”) Experience Exhibit data for both HCSC and Cigna.

In other words, we are looking at past results (before the acquisition), to gain some understanding of what their combined results will look like going forward. (Naturally, future performance will vary.)

—

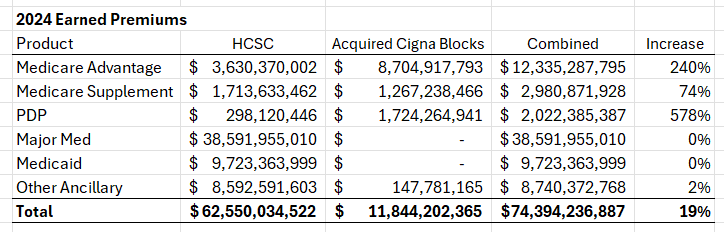

Based on our analysis of the NAIC’s A&H experience data, the Cigna blocks acquired by HCSC earned $11.8 billion in Premium in 2024.

When combined with HCSC’s A&H 2024 Premium, the acquisition increases total A&H earned Premiums by ~19%.

source: NAIC A&H Experience Exhibits data

Note: the $3.3 billion purchase price is ~0.27 x the 2024 earned premium of the acquired block.

—

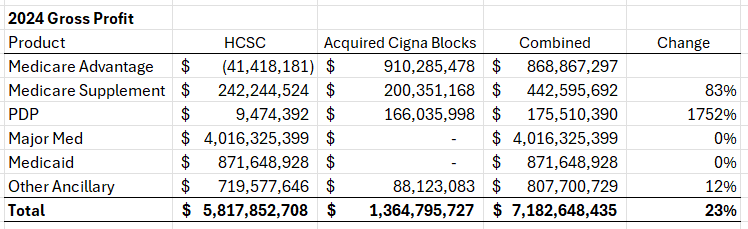

The acquired Cigna blocks generally reported lower loss ratios than HCSC, resulting in a slight improvement when combined.

source: NAIC A&H Experience Exhibits data

—

When combined with HCSC’s A&H 2024 Gross Profit, the acquired block increases HCSC’s A&H gross profit (Earned Premium - Incurred Claims) by ~23%.

source: NAIC A&H Experience Exhibits data

Note: the $3.3 billion purchase price is ~2.4 x the 2024 gross profit (of the acquired block).

—

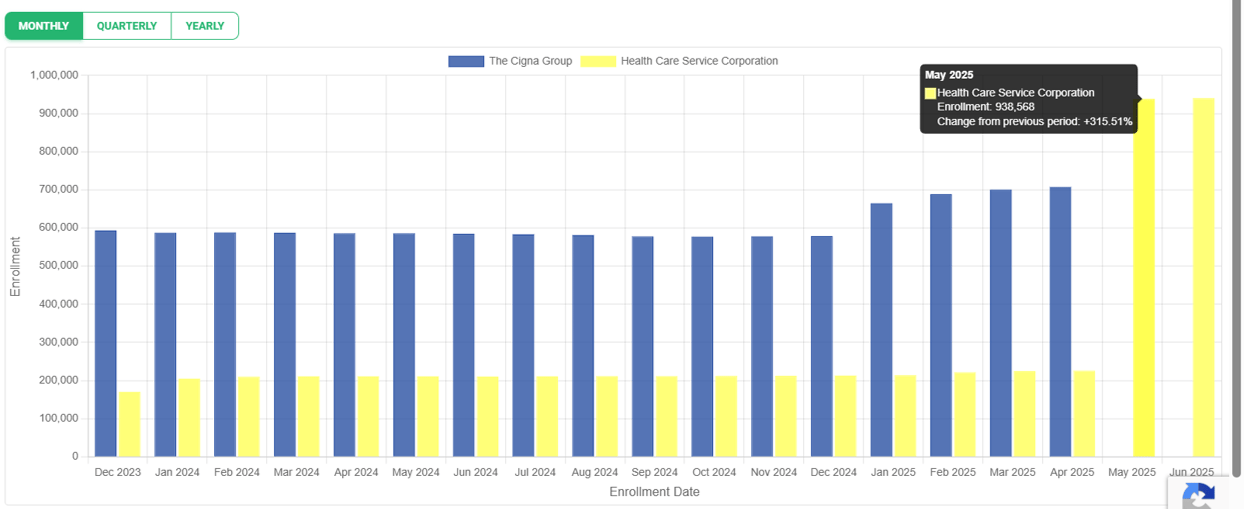

Medicare Advantage enrollment

The Medicare Advantage business unit is the largest component of the acquisition.

The acquisition moves HCSC from 0.65% market share pre acquisition (~225,000 enrollees) to the 2.7% market share (~940,000 enrollees) post acquisition.

Source: Medicare Market Insights + which uses cms.gov data.

HCSC is now the 7th largest MA carrier Nationally!

Footprint expansion: From 5 states to 33 states with individual MA enrollees.

—

Medicare Supplement enrollment

The acquisition moves HCSC from 4% market share (~565,000 enrollees) to 7% (~1.06 million enrollees) (based on 2024 results).

source: NAIC A&H Experience Exhibits data

This move makes HCSC the 3rd largest Med Supp carrier.

Footprint expansion: From 5 states to 50 states with individual MS enrollees.

—

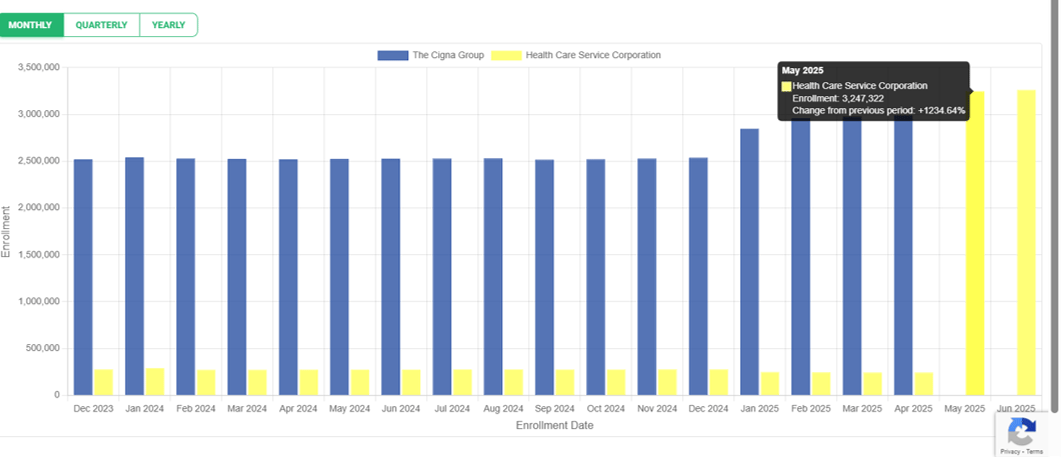

PDP enrollment

The acquisition moves HCSC from 1% market share pre acquisition (~240,000 enrollees) to the 14% market share (~3,260,000 enrollees) post acquisition.

Source: Medicare Market Insights + which uses cms.gov data.

HCSC is now the 4th largest Carrier in the PDP market!

Footprint expansion: From 5 states to 50 states with individual PDP enrollees.

—

HCSC’s $3.3 billion acquisition of Cigna’s Medicare business is more than just a scale play, it’s a strategic shift. With the deal now closed, HCSC’s Medicare Advantage enrollment more than triples, its PDP book becomes one of the largest in the country, and its Med Supp block vaults into the top three nationally.

The data shows that Medicare now makes up nearly a quarter of HCSC’s total health insurance premium—up from ~10% pre-deal—and the organization’s risk profile is meaningfully more diversified across funding sources and geographies.

While integration challenges lie ahead—particularly aligning quality scores, managing dual PBM relationships, and improving the profitability of the acquired MA block—HCSC is now positioned to compete more directly with national incumbents like Humana and CVS.

The next phase will be telling: Can HCSC maintain underwriting discipline, accelerate STARS improvement, and turn the Cigna MA block into a strategic asset rather than a financial drag?

For the first time, HCSC is not just a dominant Blues plan in five states—it’s a national Medicare competitor.

SPONSOR SNAPSHOT 🚀: Quote Velocity

Your Trusted Partner in Medicare Growth

Quote Velocity connects carriers and agencies with high-intent consumers actively seeking Medicare plan options. We offer both consumer-initiated inbound calls and real-time warm transfers.

Warm transfers come from our U.S.-based outreach specialists, who clarify each beneficiary’s needs and establish trust before seamlessly handing them off to your licensed sales agents for enrollment and plan shopping.

We deliver customized, compliant acquisition campaigns tailored by geography, plan type, and seasonality—driving more efficient enrollments and lowering your cost per acquisition.

Beyond acquisition, we support optimization and retention efforts to help you maximize lifetime value and strengthen member satisfaction.

Known for our integrity, adaptability, and results, Quote Velocity is the go-to partner for Medicare-focused growth.

Learn more at QuoteVelocity.com/Insight

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: