Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - A look at the 8 Trends You Can’t Ignore

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Cigna, HCSC close $3.3B Medicare Advantage sale - (link)

Dr. Oz vows to scrutinize Medicare Advantage as CMS head - (link)

UnitedHealth sees coming fight over Medicare Advantage - (link)

Trump Administration Ends Medicare's $2 Drug Project - (link)

Dr. Oz describes changes he would bring to Medicare, Medicaid as CMS administrator - (link)

Anthem Medicare D-SNP in Kentucky update - (link)

PODCAST: Industry Insights with Thought Leader Sam Melamed CEO of NCD - (link)

AmeriLife Finalizes Acquisition of Crump Life Insurance Services - (link)

MedPAC Grapples with Higher Cost of Medicare Advantage to Taxpayers - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

March Medicare Madness: 8 Trends You Can’t Ignore 🏀

For many of us, March = madness.

Usually that’s 🏀 basketball related, but you may also feel spun around by the whirlwind of results, headlines, and possible changes related to Medicare dominating market conversations these days.

This week’s newsletter wades through Medicare market happenings from early 2025 and what we’re watching for throughout the rest of the year. We’ll look at what we learned from 2024, what regulatory signals we’re seeing, and what else may be on the horizon.

What did 2024 show us – AEP Results and 2024 Financials

1) MA/MAPD Slowdown in Enrollment Growth

There was a significant slowdown in enrollment growth across the total Medicare Advantage market this past AEP compared to other recent AEP years. (link)

The numbers:

AEP Year | MA Enrollment Growth Rate |

|---|---|

2022 | 4.8% |

2023 | 3.7% |

2024 | 3.1% |

2025 | 1.3% |

source: CMS enrollment data

2) AEP ‘25 Switching Up

While overall growth slowed, the percentage of MA enrollees switching carriers or plans continued upward.

Whether driven by carrier withdrawals, plan terminations, service area reductions, supplemental benefit changes, or simply savvier plan shoppers – beneficiaries were on the move. (link, link)

The numbers:

AEP Year | Med Supp Switch Rate | MA Switch Rate |

|---|---|---|

2022 | 9% | 12% |

2023 | 7% | 15% |

2024 | 10% | 16% |

2025 | 9% | 23% |

source: Deft Research Study

3) Increased Medical Loss Ratios

Carriers continued to feel the pressure of higher medical loss ratios (MLRs) – citing rising utilization, Medicaid redeterminations, Medicare Advantage funding cuts, and higher pharmacy costs as drivers of the higher levels. (link)

The numbers:

Carrier | 2024 MLR | 2024 MLR compared to 2023 |

|---|---|---|

CVS Health | 92.5% | +6.3% |

UnitedHealth Group | 85.5% | +2.4% |

Humana | 90.4% | +2.4% |

Cigna Healthcare | 83.2% | +1.9% |

Elevance Health | 88.5% | +1.5% |

source: Company 10-Ks and 10-Qs

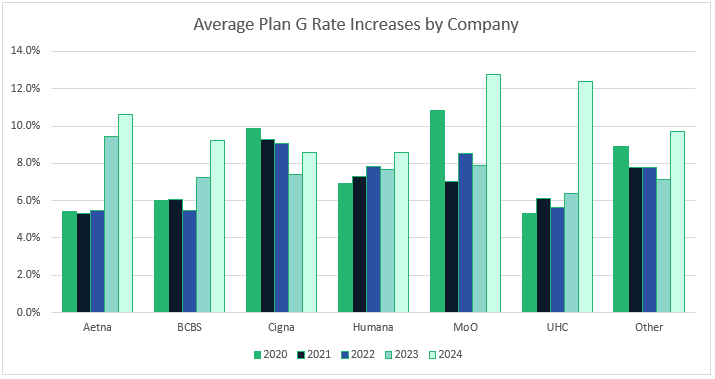

4) Higher Medicare Supplement Rate Increases

In the Med Supp market, this loss ratio pressure resulted in sustained higher rate increase levels seen during 2024 for many carriers. (link)

The numbers:

source: Carrier rate filings

—

CMS Proposals & Increased State Legislative Activity

AEP results and carrier year-end financial reporting gave us a sense of where we ended 2024. As we rolled into 2025, federal and state regulators started signaling their priorities for the near term.

—

5) 2026 Proposed MA/MAPD Rule

The proposed rule covering MA policy and technical changes for 2026 was issued in late 2024. (link)

It reads like a mini-course in Medicare hot topics, touching on-

Anti-obesity medications (link)

The numbers:

Year | |

|---|---|

2019 | $552 Million |

2023 | $9.2 Billion |

source: OIG Report

-

Prior authorization/coverage decision guardrails & limiting the use of AI algorithms

The numbers:

source: KFF - Medicare Limited data set

-

Behavioral (Mental) health care access

The numbers:

-

The proposed rule also included more expected items like –

Star Rating formula revisions

Consumer protections focused on marketing and transparency

Prescription drug affordability & generic drug access

MLR reporting changes

It’s worth noting that the proposed rule was issued by the Biden administration, and the final rule will be issued by the new administration very soon.

6) Medicare Supplement State Regulation Changes

There’s also been steady activity across state legislatures related to Medicare Supplement plans. Several states have pending bills to create annual open enrollment windows. Other states are looking at expanding Medicare Supplement plan availability to individuals under age 65 who qualify for Medicare. See a list of states’ regulatory activity here. (link)

7) The Great Unknown - The New Administration

There are headlines everywhere about the new administration’s efforts to reduce spending and increase efficiency across many areas of government. For Medicare, the talking points indicate benefit cuts aren’t on the table but there is a serious interest in clamping down on waste and fraud issues. (link)

What’s changed so far?

→ Leadership changes include:

Robert F. Kennedy, Jr confirmed as Secretary of Health and Human Services (HHS)

Dr. Mehmet Oz nominated as Administrator of the Centers for Medicare & Medicaid Services (CMS). Dr. Oz has long been an advocate for Medicare Advantage but in his first confirmation hearing, he did point out concerns he’d like to tackle as head of the CMS – upcoding and prior authorizations, in particular.

→ Efforts by the Department of Government Efficiency (DOGE) to cut spending and optimize government efficiency related to Medicare to date have primarily impacted workforce staffing.

Some federal workers with the HHS department were offered buyouts and some probationary workers with CMS were terminated.

The DOGE team is signaling its intent to find and rectify significant waste and fraud areas within Medicare and Medicaid. There’s sure to be more to come on this topic in the months ahead!

The numbers:

100% - Probability DOGE will investigate Medicare overspending and fraud

Light-heartedness aside, some specific actions related to Medicare taken by the administration thus far include:

→ Hospice industry oversight paused (link)

→ Prescription drug price caps reversed (link)

Speculation on the administration’s next moves are rampant and varied.

Maybe it’s a sweeping change, like Medicare Advantage for All, or maybe a flurry of smaller directives. This administration has shown a willingness to part decisively with how things have been, in efforts to streamline government work.

Negotiating the administration’s appetite for change with the existing CMS policy initiatives will be no small challenge for the new CMS and HHS leaders.

8) Looking Ahead - what to anticipate in 2025 and 2026

Continued carrier focus on profitability over growth, along with more MA plan revisions and benefit changes

Another heavily shopped AEP this fall

Disruptions to the status quo from the administration/DOGE/new agency leadership

—

That’s all for this week.

We hope you get to take a break from the Medicare madness and enjoy a 🏀 game or two.

We’ll be cheering on our local men’s and women’s teams - Go Jays! Go Mavs! Go Huskers!

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more comfortably by accessing the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring - from digitally-enabled to clinician-led

Medication Management

E3 - Engage, Educate, Empower to address health literacy and support gap closure

See what Modivcare can do for your members. → (Get Started)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: