Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Med Supp: Growth Returns, But Underlying Risks Remain 📈

Sponsor Snapshot 🚀 - brought to you by Modivcare

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

UnitedHealth Group CEO Andrew Witty steps down, company suspends 2025 outlook - (link)

What Trump's Executive Order Means for Medicare, Medicaid - (link)

Digital Health: There is No Exit - (link)

Top Biotech Halozyme Undercuts Its Breakout On Bad Medicare News - (link)

Bon Secours and UnitedHealthCare negotiating contracts set to expire this year - (link)

New Data Show CCS’s Predictive Analytics and Intervention Platform Is Highly Effective in Driving Continuous Glucose Monitoring Adherence in Medicare Population - (link)

Bumps AHEAD: Trump administration evaluating Maryland’s authority to set Medicare rates - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Med Supp: Growth Returns, But Underlying Risks Remain 📈

Over the past several weeks, the Deep Dive has focused on Medicare Advantage.

This week’s Deep Dive will turn its attention to another important and popular product within the Medicare ecosystem - Medicare Supplement.

This week’s focus will be on the experience sourced from the Medicare Supplement Insurance Experience Exhibit (MSIEE), which carriers provided within their Annual Statements submitted to the National Association of Insurance Commissioners (NAIC).

The MSIEE contains Premium, Claims and Covered Lives experience data and is split by Plan, Issue State and “New Business” vs “Seasoned Business”.

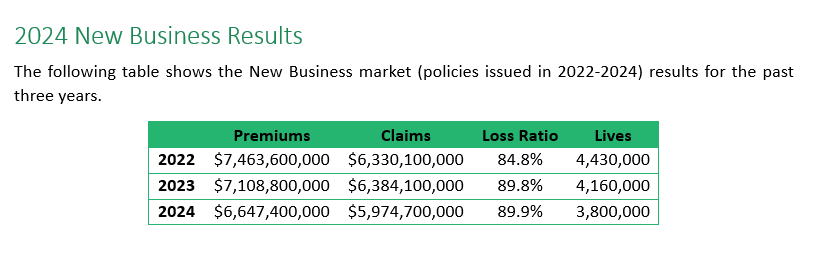

The New Business refers to business that was issued within the most recent three calendar years. For example, the 2024 New Business experience reflects policies that were issued in 2022-2024 while the 2024 Seasoned Business represents policies issued in 2021 and prior.

Companies that have Medicare Supplement business are required to complete this exhibit as part of their Annual Statement submission. However, there are some companies that report to the California Department of Managed Healthcare (CDMHC) and are not required to submit the MSIEE to the NAIC. You may see other data or reports that paint a slightly different picture – the CDMHC data is the likely source of those differences. The data presented here utilizes it as it was received from the NAIC.

The following graph shows total loss ratios for the past 10 calendar years:

Key statistical take-aways:

Premiums grew by $2.25 billion from 2023 to 2024. This represents a growth rate of 6.4%, which far outpaced the growth of 1.5% ($536 million) realized from 2022 to 2023. Going back to 2007, 2024 represented the 2nd highest growth since 2017 when premiums increased by $2.27 billion (8.2%).

Claims increased by $2.10 billion from 2023 to 2024. This represents a growth rate of 7.1%, which exceeded the growth of 5.9% ($1.65 billion) realized from 2022 to 2023. Going back to 2007, 2024 represented the highest dollar amount increase in claims. The previous high was $2.096 billion (8.6%) in 2021.

Covered Lives increased by 130,000, representing a 1.0% increase from 2023. This ended two consecutive years of decline as 2022 experienced a decrease of 290,000 lives (-2.1%) and 2023 declined by 180,000 lives (-1.3%).

The Loss Ratio increased by 0.6% from 2023 to 2024. This is significantly lower than the increase of 3.4% realized from 2022 to 2023. Excluding calendar year 2020, which was heavily impacted by COVID, the year over year change in loss ratio has not been below 1% since 2017, when the Loss ratio decreased by 0.1%.

What is driving these results?

The recent increases in Premium are primarily attributable to the regular annual premium increases on Medicare Supplement policies. These increases come in two forms:

(1) Many plans have premiums that are based on the current age of the policyholder, so they automatically increase every year; and

(2) Carriers pursue premium increases every year to account for medical trend and experience deviations.

Related to the latter point, the increasing loss ratios in recent years have led to carriers filing for higher premium rate increases. This information was presented within our most recent Medigap Market Updates and a blog post.

Over the past several years the Medicare market has seen a shift towards more beneficiaries choosing to enroll in a Medicare Advantage plan instead of the combination of Original Medicare and a Medicare Supplement plan. This trend is generally attributed to the lower premium (often marketed as $0 premiums) and access to ancillary benefits within Medicare Advantage plans. This movement toward Medicare Advantage is the primary contributor to the decrease in the number of Covered Lives realized in 2022 and 2023. The well documented headwinds that the Medicare Advantage market has experienced regarding increased utilization, etc. has caused carriers to make changes to their plan offerings or leave markets altogether. This has likely contributed to the increase in lives that the Medicare Supplement market realized in 2024.

Like the Medicare Advantage market, Medicare Supplement plans have not been immune to the increased claim experience in recent years. Despite the higher rate increases being implemented, the Loss ratio has continued to increase, albeit by a lesser amount.

The following graph shows New Business loss ratios for the past 10 calendar years:

Key statistical take-aways:

The $6.6 billion of New Business premium represents approximately 18% of the total market premium. Going back to 2016, this represents the lowest proportion of New Business premium. The proportion has been decreasing steadily since its peak of 32% in 2017. Additionally, the $6.6 billion of New business premium is the lowest since 2010, when it was $5.8 billion. These lowered values are likely due to the rise in Medicare Advantage popularity over the same horizon.

Covered Lives for the New Business cohort decreased by 360,000, representing an 8.7% decrease from 2023. This cohort of business has experienced decreases in Covered Lives going back to 2020. The 3.8 million Covered Lives represents the lowest point since the 3.76 million lives in 2010. Like the New Business premium, this reduction is likely due to the rise in Medicare Advantage popularity.

The Loss Ratio increased by 0.1% from 2023 to 2024. This is significantly lower than the increases of 2.7% and 5.0% realized in 2022 and 2023, respectively. Excluding calendar year 2020, which was heavily impacted by COVID, the change in loss ratio is the lowest since 2017, when it decreased by 1.8% from 2016.

The following graph shows Seasoned Business loss ratios for the past 10 calendar years:

Key statistical take-aways:

The $30.9 billion of Seasoned Business premium represents approximately 82% of the total market premium. Going back to 2016, this represents the highest proportion of Seasoned Business premium and its climb has been driven by the decline in the New Business premium.

Covered Lives for the Seasoned Business cohort increased by 490,000, representing a 5.2% increase from 2023. Going back to 2007, the 490,000 Covered Lives increase has only been exceeded by the 700,000 Covered Lives added in 2018. The 2024 growth rate of 5.2% has significantly outpaced the recent growth rates of 0.9% and 1.0% realized in 2022 and 2023, respectively.

The Loss Ratio increased by 0.9% from 2023 to 2024. This is significantly lower than the increases of 3.4% and 3.1% realized in 2022 and 2023, respectively. Excluding calendar year 2020, which was heavily impacted by COVID, the change in loss ratio is the lowest since 2018, when it increased by 0.87% from 2017.

With all the changes impacting the Medicare market including Medicare Advantage (e.g., increased loss ratios, carrier/plan compression) and Medicare Supplement (e.g., increased loss ratios, higher rate increases, state expanding guaranteed issue rights), how do you think the 2025 markets will shake out?

If you found this week’s Deep Dive into the Medicare Supplement Insurance Experience Exhibit interesting, stay tuned over the coming weeks as we’ll be diving back into some additional layers of detail from the MSIEE.

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access their care through remote monitoring and virtual care management. We’re there to help members live more confidently by enabling them to access the care they need to live independently. Our results speak for Modivcare Monitoring’s ability to address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Acuity-based vitals monitoring – from digitally-enabled to clinician-led

Medication Management

E3 – Engage, Educate, Empower to address health literacy and support gap closure

See what services they can help you with. → (Modivcare)

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: