This week’s newsletter is Sponsored By: 2023 Medicare Enrollment State Pages

57 page eBook (by Medicare Market Insights) full of Medicare enrollment statistics for each State.

Get your copy now: link

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - This week’s deep dive explores Medicare eBroker’s Financials Side-By-Side.

Data Visual of the week 📊 - Data Visual highlighting Medicare Enrollment stats for the entire US.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are Important links 🔗 for the week:

Jared’s recent LinkedIn posts:

Deep Dive 📚

Medicare Public eBroker’s Q2 2023 Side-by-Side Financial Results

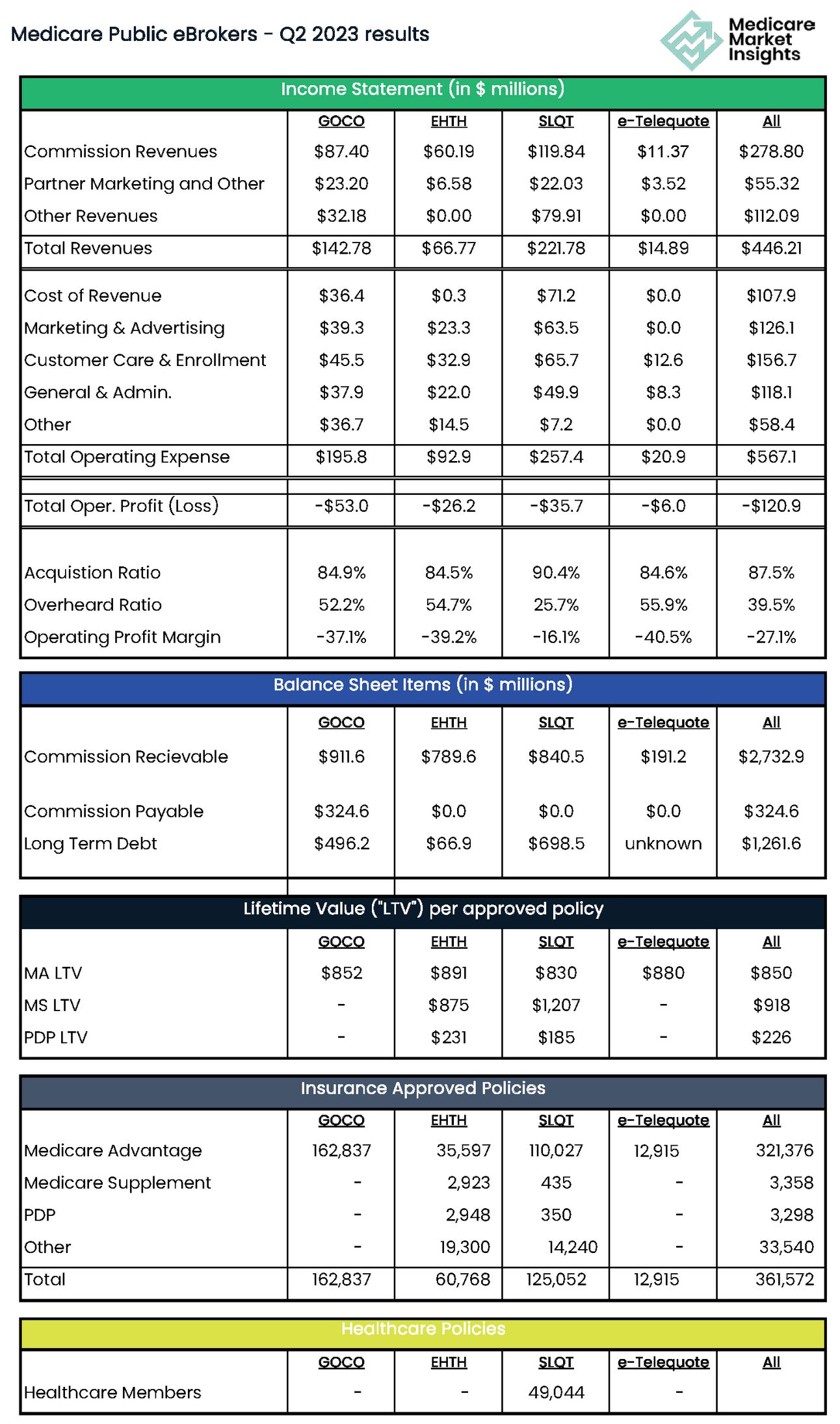

Publicly traded Medicare eBrokers (or sometimes called “Direct-to-Consumer distributors”) collectively sold 361,572 policies, generated $446 million in Revenues, and spent $561 million during Q2 2023.

Last month we looked at Medicare Carrier financials side-by-side. As part of that analysis we saw that Carriers increased their Medicare advantage membership by 9% year-over-year (“YoY”). But, how do those Carriers acquire new customers?

Well, at least partially through eBrokers! Today we are going to look at the following company’s Q2 2023 financial results side-by-side.

[make sure you allow content or pictures to be downloaded in this email or you won’t see the side-by-side!]

Note: There are a few other large eBrokers that are part of publicly traded companies, but they do not report segment financials. Two examples being:

Tranzact - part of Willis Towers Watson

AssuranceIQ - part of Prudential

What are eBrokers?

Each of these companies have fairly similar business models.

First, they generate and/or purchase leads through numerous marketing methods. Consumer facing websites, social media, television, mail, search, to name a few.

Second, the majority of these leads go to large call centers where agents help consumers pick plans among numerous products, carriers, and plan types.

Finally, the agent helps the consumer complete and submit an application to the chosen insurance carrier.

Note: There is a small but growing portion of consumers who submit applications on their own through the broker’s online application without the help of an agent.

If the policy is approved and sticks, the eBroker gets paid commissions. In the traditional model, the commissions include both initial year, and renewal commissions for the life of the policy.

Recent Results

In recent years, these company’s stock prices and market caps have suffered. Partially due to general economy dynamics, but also due to the following.

The cost to acquire new customers has gone up ⬆

The Lifetime Value (“LTV”) of each new customer has gone down⬇

note: LTV = commission revenues expected to be earned over the life of a policy

In addition, capital is needed to generate new sales. The cost of capital (as we all know) is significantly higher now than 2 years ago.

Because of this reality, all of these companies have been focusing on improving customer acquisition costs along with customer retention (to improve LTV).

In addition, there have been some tweaks to strategies.

GOCO has pivoted to a model where they are not the agent of record, don’t receive agent commission, but instead get paid an up-front fee to generate warm leads to carrier partners. They refer to this model as Encompass.

SLQT has added a healthcare vertical in order to increase revenue per customer by cross selling Rx benefits.

Okay, let’s look at the numbers already… 😀

Side-By-Side Results

To compare and contrast Q2 2023 results we are looking at the Income Statement, a few key Balance Sheet items, LTV metrics, and Sales metrics.

Note the following:

Other Revenues: for GOCO this is revenues earned under Encompass model; for SLQT this is revenues earned from SelectRx

Cost of Revenues: for GOCO this is commissions paid to "downlines"; for SLQT this is cost of goods sold under SelectRx

LTV: GOCO no longer reports LTV for separate product lines. It's assumed the majority of products fall under MA

Insurance Approved Policies: GOCO no longer reports for separate product lines. It's assumed the majority of products fall under MA

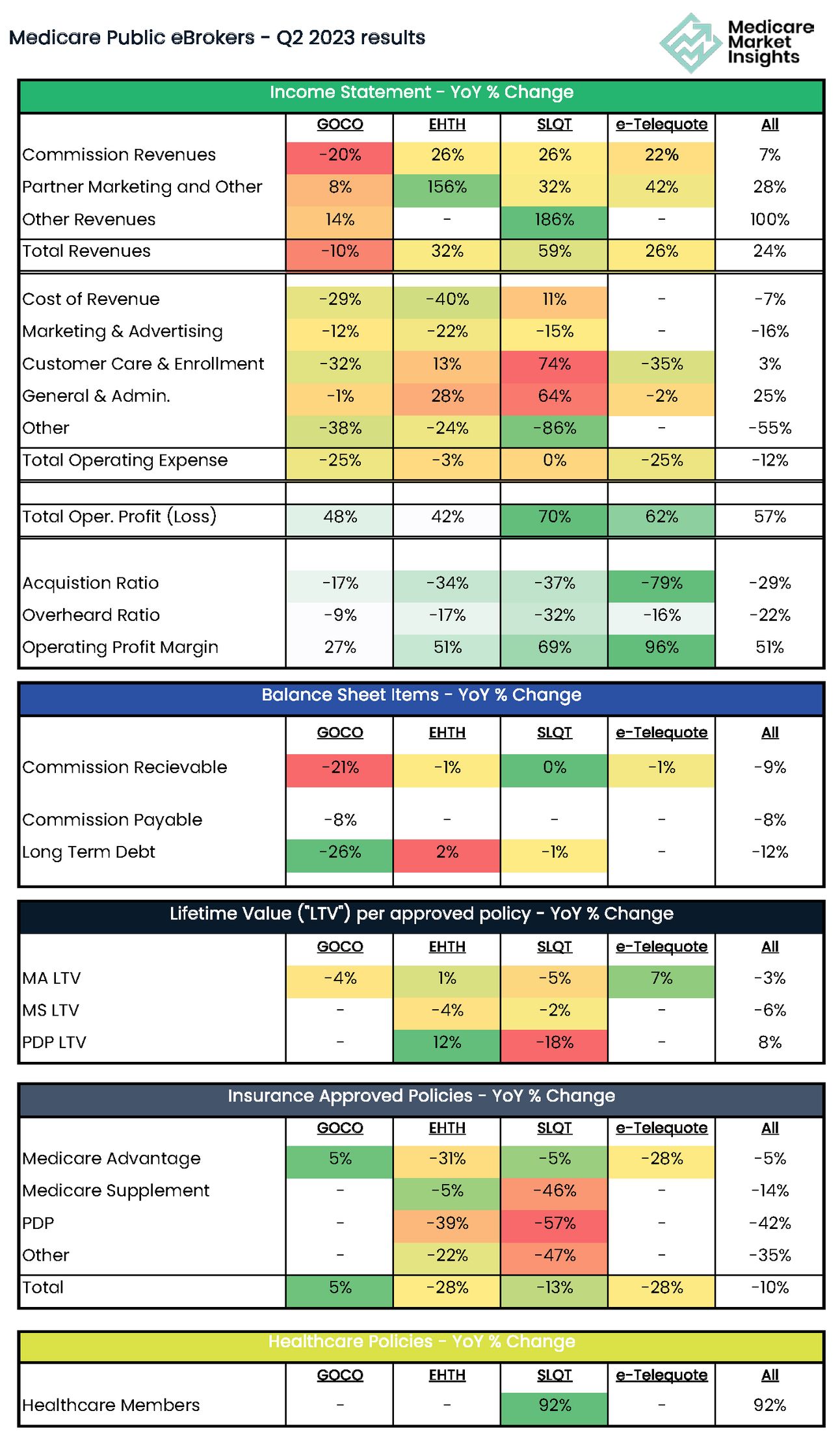

YoY % Change

Now, let’s look at the year-over-year (“YoY”) % changes.

Observations & Trends

It should be noted that Q2 does not typically look great for these companies because they are ramping up agent counts leading into AEP.

With that said, here are a few general observations and trends:

Revenues Up Overall

SLQT increased Healthcare services revenues significantly (Other Revenues)

GOCO’s commission revenue is down while Encompass revenues (Other Revenues) are up, showing the pivot to their new model

Expenses Down

Everyone has successfully lowered acquisition costs (Marketing & Advertising, Customer Care & Enrollment combined)

Profitability Improved

Everyone is still generating operating losses, but things look significantly better than a year ago (up 57% YoY).

LTV down slightly

Overall MA LTV down slightly overall, though 2 of the 4 reported higher MA LTV

Approved Policies down

Overall approved policies down. This is likely driven by focus on efficiency over growth.

It will be interesting to see how these companies continue to improve efficiency and also adjust their business models and strategies. The reality is, they continue to be important partners for Carriers who want to grow their Medicare membership. Therefore, they should continue to be an important part of the overall Medicare ecosystem.

Data Visual of the Week 📊

Data Visual of the week comes from us! This is displaying overall Medicare enrollment stats for the entire US. You can find this visual, along with one for all 50 states in our recently released book here.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: promote your product or services to leaders in the Medicare space. Let’s discuss. (link) Note: 8 slots already taken.

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market. Let’s discuss. (link)

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: