This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Q1 2024 Medicare eBroker Financials Side-By-Side 🤸♀️

Compliance Chatter 📢 - Does HHS’ final nondiscrimination rule impact Medigap?

Sponsor Snapshot 🚀 - brought to you by Modivcare.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

UnitedHealth 'really comfortable' with Medicare Advantage as competitors sweat - (link)

Uber Health to roll out new caregiving solution to simplify benefits, logistics for families - (link)

Medicare Could Save $500 Million With Coverage Change - (link)

The Biden Administration’s Final Rule on Section 1557 Non-Discrimination Regulations Under the ACA - (link)

Medigap Policies Face New Federal Nondiscrimination Rule - (link)

2023 Medicare Supplement Loss Ratios by State - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Q1 2024 Medicare eBroker Financials Side-By-Side 🤸♀️

This week, we will explore Q1 2024 financials for publicly traded Direct-to-Consumer distributors, also known as eBrokers.

The following companies’ Q1 2024 financial results will be compared below, side-by-side. (note: Calender Year 2023 results are here, and a section on “What are eBrokers?” section can be found here.)

Note: There are a few other large eBrokers that are part of publicly traded companies, but they do not report segment financials. Three examples are:

Tranzact - part of Willis Towers Watson

AssuranceIQ - part of Prudential [NOTE: Prudential announced they are shutting down the AssuranceIQ segment]

HealthMarkets - part of UnitedHealth Group

It is important to note that there have been some tweaks to strategies for some of these eBrokers.

GOCO continues to utilize a model where they are not the agent of record, don’t receive agent commission, but instead get paid an up-front fee to generate warm leads to carrier partners. They refer to this model as Encompass.

SLQT has added a healthcare vertical in order to increase revenue per customer by cross selling Rx benefits. They now generate a significant amount of revenue from this vertical.

Let’s dive right in…

Side-By-Side Results

To compare and contrast Q1 2024 results we are looking at the Income Statement, a few key Balance Sheet items, LTV metrics, and Sales metrics.

Note the following:

Other Revenues: for GOCO this is revenues earned under Encompass model; for SLQT this is revenues earned from SelectRx

Cost of Revenues: for GOCO this is commissions paid to "downlines"; for SLQT this is cost of goods sold under SelectRx

LTV: GOCO no longer reports LTV for separate product lines. It's assumed the majority of products fall under MA

Insurance Approved Policies: GOCO no longer reports for separate product lines. It's assumed the majority of products fall under MA

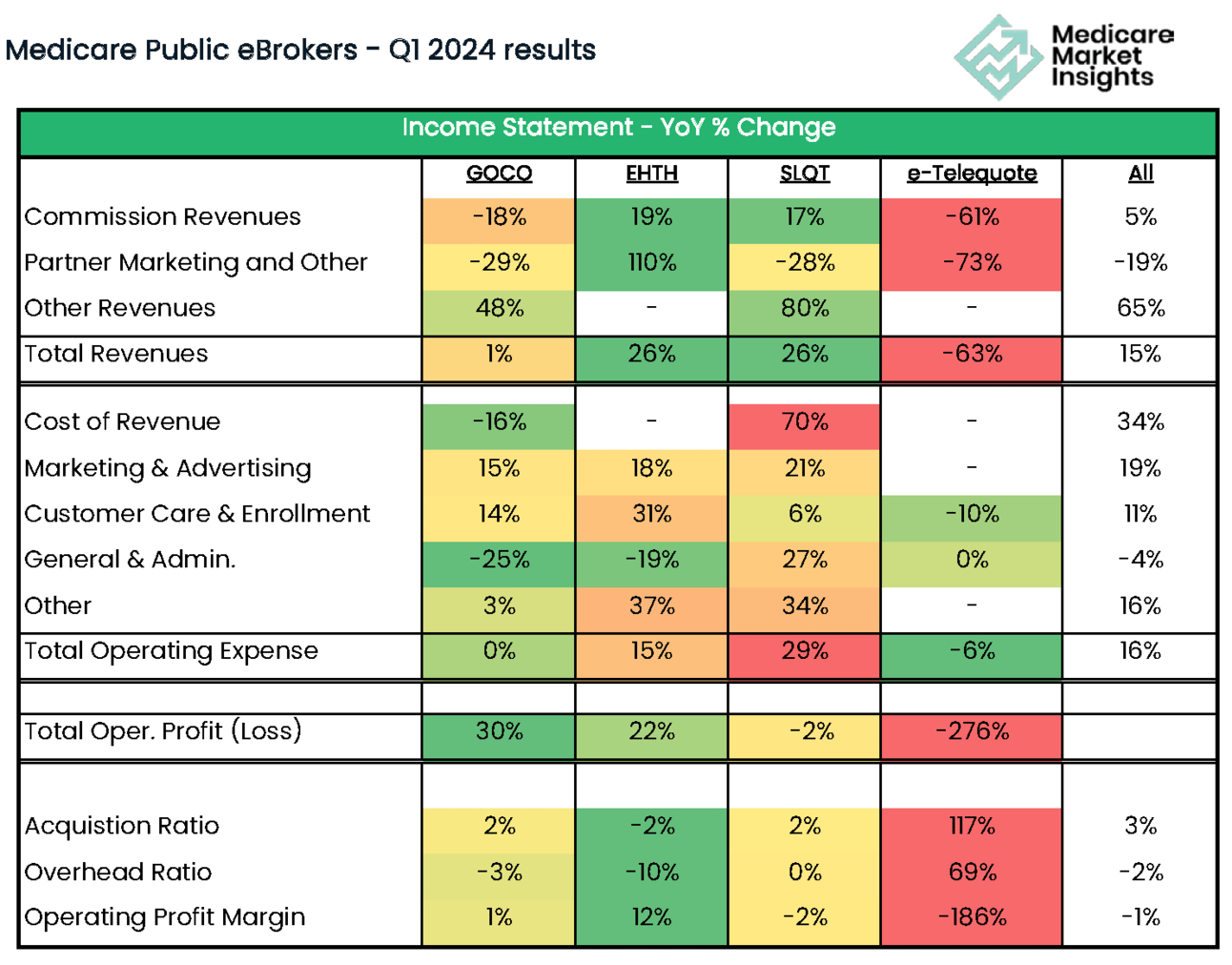

YoY % Change

Let’s observe and discuss the year-over-year (“YoY”) Income Statement % changes.

Revenues

e-Telequote Revenue was greatly impacted by a “negative tail adjustment” of $7.8 million... (had to reduce revenue this quarter to account for lower that expected LTV in prior cohorts)

GOCO continues shift to non Commission Revenue

SLQT continues significant growth in SelectRx Revenue

Operating Income (Loss)

SLQT was the only company with Operating Income and held steady YoY. Adding revenues from SelectRx without increasing acquisition expenses (they already have the customers) looks to be working well.

Both GOCO and EHTH saw Operating Losses in the quarter, but improved YoY (losses weren’t as bad).

Now let’s take a look at the year-over-year (“YoY”) Balance Sheet and KPI items % changes.

LTV

up across the board as a result of increasing commission amounts combined with better customer persistency

Approved Policies

EHTH and SLQT led the way in increasing MA approved policies

though still a small portion, EHTH increased MS approved policies 35%

SLQT grew SelectRx customers 67% YoY

Bottom Line

AssuranceIQ shutting down operations highlights the difficulty these companies face in operating profitably. LTV / CAC, and positive cash flow continues to be a focus of these companies.

SelectQuote’s strategy of increasing Revenue through their SelectRx offering to already acquired customers seems to be paying off.

Aside from e-Telequote which had a tough quarter due to the negative tail adjustment, the other eBrokers improved profitability, continuing to trend in the right direction.

That’s all for today. I hope this is helpful!

__

Can you do me a favor? Forward this to another leader in the Medicare space who could benefit from this info. Thanks!

Sponsor Snapshot 🚀: Modivcare

Modivcare’s NEW White Paper explores how collaborations can improve care coordination and bridge significant gaps in the healthcare system.

With the right data, they have seen:

Increased Member Engagement

Reduced Costs

Gaps in Care Closed

Reduced ER Utilization

Download the free White Paper here → (click)

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

COMPLIANCE CHATTER 📢

Does HHS’ final rule (Nondiscrimination in Health Programs and Activities) regarding Section 1557 of the Affordable Care Act impact Medigap plans?

Short answer = Yes

However, the “how” is much more complicated. Section 1557 prohibits discrimination on the basis of race, color, national origin, sex, age, or disability in health programs and activities. Many states allow Medigap carriers to utilize medical underwriting and assign rates based on gender, age, and tobacco status.

While HHS does not provide guidance or explicitly prohibit medical underwriting or rating based on gender, age, and tobacco status for Medigap in the final rule, they do state that:

they would evaluate a covered entity's legitimate, nondiscriminatory reason for the challenged discriminatory feature;

they will work with the covered entity to achieve compliance to help ensure that issuers do not leave the Medigap market or lower quality of products for consumers;

Section 1557 would preempt a State law Medigap requirement; and

covered entities must comply by January 1, 2025.

Like the rest of you, we will be watching closely to see how HHS administers this rule in relation to Medigap plans and will keep you informed!

You can now receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: