This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - CY 2023 Medicare eBroker Financials Side-by-Side

Compliance Chatter 📢 - How to respond to the recent cyberattack against Change Healthcare.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - 2024 AEP Results - What the Data Says

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Medicare Advantage plans of seniors could lose $30 to $50 in value - Washington Examiner - (link)

UnitedHealth Tackles $14 Billion Claims Backlog From Cyberattack - (link)

Medicare Advantage Is Under Fire. What It Means for Your Health - and Wallet - (link)

WSJ: CMS broadens Part D coverage for obesity drugs - (link)

Nearly half of health systems are considering dropping Medicare Advantage plans - (link)

Jared’s recent LinkedIn posts:

Medigap Market Updates! - March 2024 - (link)

D-SNP plans added $50 of value (on average) in 2024. - (link)

How many years do your Medicare customers stick around? - (link)

Special Enrollment Periods that individuals can use to enroll in Medicare Advantage. - (link)

6 important highlights from GoHealth (GOCO), a Medicare eBroker - (link)

DEEP DIVE 📚

CY 2023 Medicare eBroker Financials Side-by-Side

This week, we will explore calendar year (“CY”) 2023 financials for publicly traded Direct-to-Consumer distributors, also known as eBrokers.

The following companies’ 2023 financial results will be compared below, side-by-side. (note: Q3 results along with a “What are eBrokers?” section can be found here.)

Note: There are a few other large eBrokers that are part of publicly traded companies, but they do not report segment financials. Three examples are:

Tranzact - part of Willis Towers Watson

AssuranceIQ - part of Prudential

HealthMarkets - part of UnitedHealth Group

It is important to note that there have been some tweaks to strategies for some of these eBrokers.

GOCO has pivoted to a model where they are not the agent of record, don’t receive agent commission, but instead get paid an up-front fee to generate warm leads to carrier partners. They refer to this model as Encompass.

SLQT has added a healthcare vertical in order to increase revenue per customer by cross selling Rx benefits. They now generate a significant amount of revenue from this vertical

Let’s dive right in…

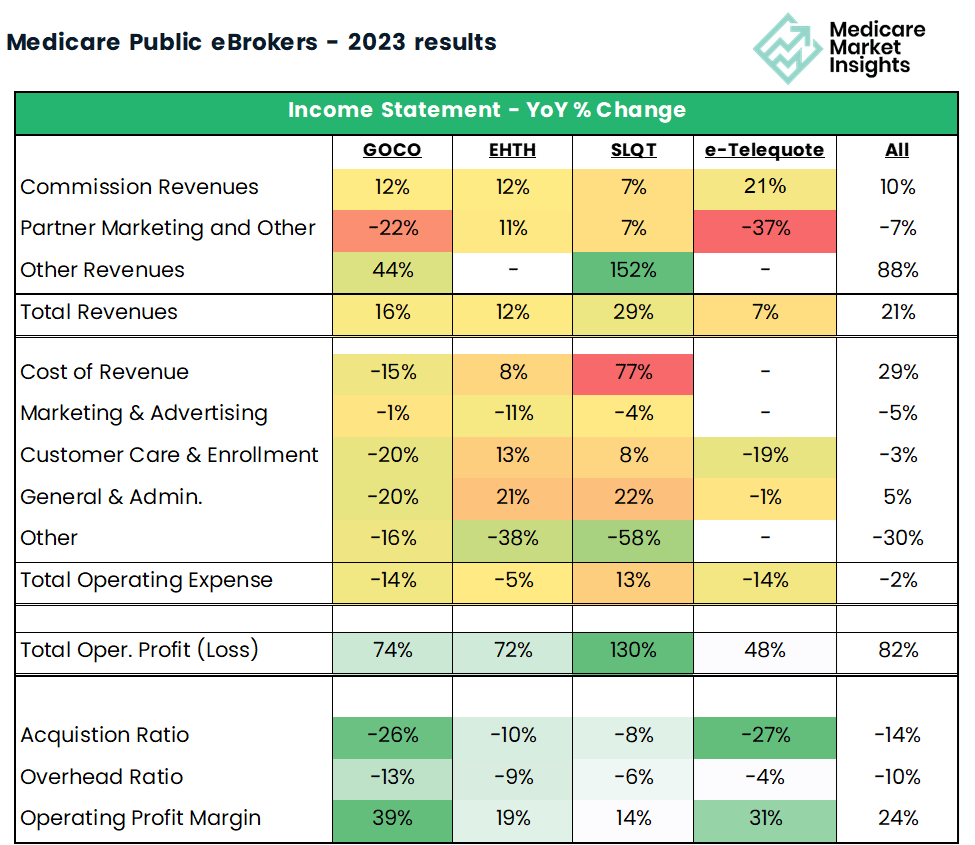

Side-By-Side Results

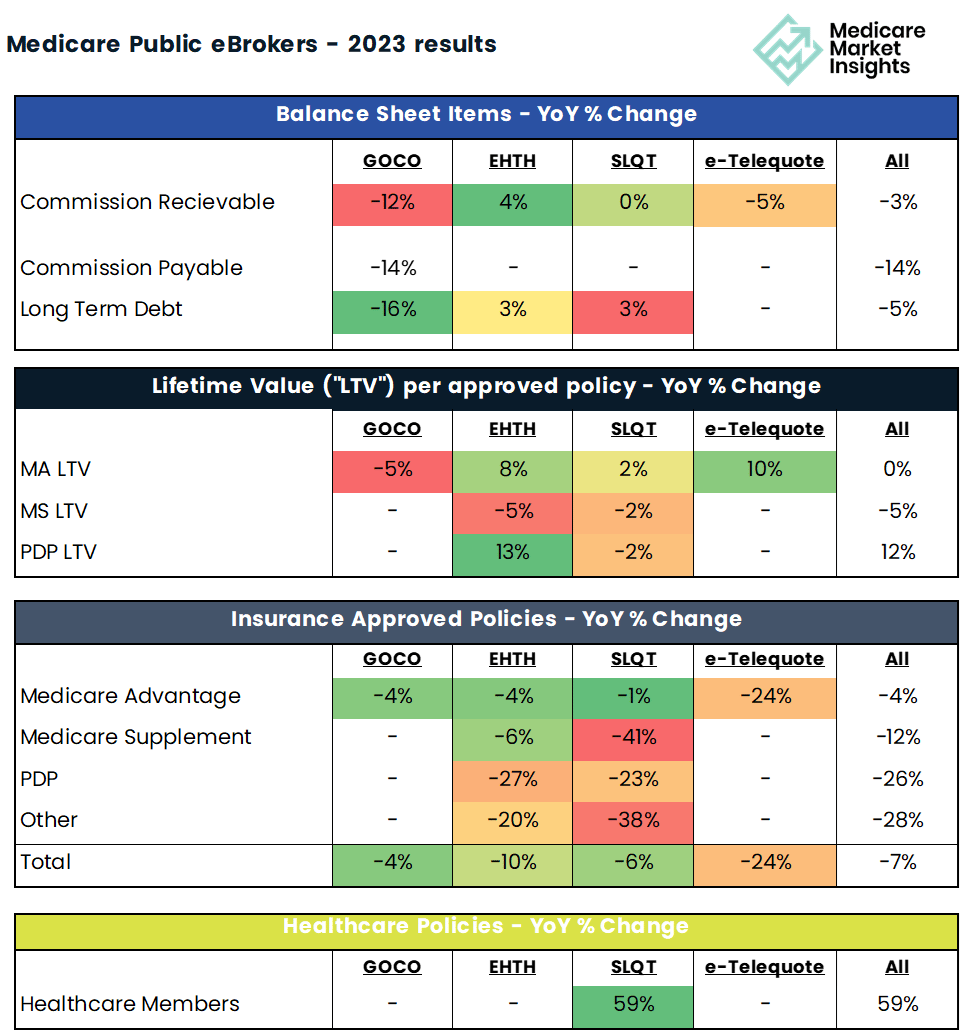

To compare and contrast CY 2023 results we are looking at the Income Statement, a few key Balance Sheet items, LTV metrics, and Sales metrics.

YoY % Change

In recent years, the stock prices and market capitalizations of these companies have faced challenges.

While influenced by broader economic trends, they’ve also grappled with a consistent pattern: rising Customer Acquisition Costs (CAC) and declining Lifetime Values (LTV) for new customers.

Improving CAC and LTV remain top priorities. The good news is these companies took meaningful steps in the right direction in 2023.

Let’s observe and discuss the year-over-year (“YoY”) % changes.

Total Revenues Up for Each eBroker

Revenue growth led by GOCO and SLQT

SLQT increased Healthcare Services revenues significantly (Other Revenues)

GOCO increased Encompass revenues significantly (Other Revenues)

Decrease in Partner Marketing Revenues driven by GOCO and e-Telequote

Expenses Down Overall

Improved efficiency in nearly all areas

Large increase is SLQT Cost of Revenue, directly related to growth in Healthcare Services division

Acquisition ratio down 14% overall

Overhead ratio down 10% overall

Profitability Improved

Overall profit is up a substantial 82%

SLQT generated positive operating profit, driven by their Healthcare Services division

Others still generating operating losses, but things look significantly better than a year ago

LTV Changes

Overall MA LTV is steady YoY

Overall MS LTV is down YoY

Overall PDP LTV is up YoY

Approved Policies Down

Overall approved policies down in 2023

MA continues to be the significant majority of approved polices

In summary, each company demonstrated progress toward enhancing profitability and operational efficiency in 2023.

Notably, the most substantial growth during this period came from verticals distinct from the traditional eBroker business models.

Specifically, SLQT’s Healthcare services division emerged as a standout performer, with an influx of over 23,000 new members and a 152% surge in revenue.

GOCO’s Encompass model achieved a notable 44% increase in revenue.

We look forward to monitoring how each company continues to adapt strategically in 2024.

It is also worth noting that while overall Medicare Advantage enrollment growth was lower during AEP 2024 compared to prior years (see more info here), these four eBrokers collectively experienced a 2% growth in approved policies during Q4, YoY.

For more information on state specific AEP data check out Telos Actuarial’s "2024 AEP Medicare Advantage State Deep Dives"!

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

A few weeks ago we shared Maryland's directive to insurers in response to the recent cyberattack against Change Healthcare.

Utah has also provided guidance in Bulletin 2024-4, requesting insurers to:

Provide prompt assistance to consumers and healthcare providers in the coming weeks.

Update websites with instructions and materials on:

- how consumers can get help accessing benefits

- how healthcare providers can verify eligibility and get assistance submitting pre-authorizations, claims, and supporting documents.

Provide flexibility for appeal processes, prior authorizations, and other situations where the insurer and healthcare provider cannot electronically share information.

Extend proof of loss filing deadlines to all healthcare providers affected by the cyberattack for healthcare claims with dates of service February 1, 2024 through when providers' systems are fully restored.

If you would like to learn more about our compliance services, reach out to [email protected].

DATA VISUAL of the Week 📊

The data visual of the week comes from Milliman.

It highlights the amount of “value” added to D-SNP plans over the past 3 years.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: