This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Q1 '24 Medicare Carrier Financials Side-By-Side ⛈

Compliance Chatter 📢 - DHHS final rule prohibiting discrimination in certain health programs

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - stock performance for Medicare focused Carriers.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

2024 AEP Drips Performance Report - (link)

UnitedHealth CEO Warns of 3-Year Medicare Squeeze - (link)

CVS stock crashes after Aetna Medicare Advantage hit - (link)

HHS Releases New Data Showing Over 10 Million People with Medicare Received a Free Vaccine Because of the President’s Inflation Reduction Act; Releases Draft Guidance for the Second Cycle of Medicare Drug Price Negotiation Program - (link)

Medicare Trustees Report & Trust Funds (CMS) - (link)

The State of Medicare Supplement Coverage (AHIP) - (link)

Jared’s recent LinkedIn posts:

eHealth (EHTH), a Medicare eBroker, released Q1 '24 results yesterday. - (link)

Alignment Health ("ALHC") - an MA Carrier - reported Q1 2024 results. - (link)

Cigna (CI) - reported Q1 2024 results last week. - (link)

UnitedHealth Group ("UNH") is the giant in the Medicare space. But, they didn't become that over night. - (link)

CVS Health Corp (CVS)- parent of Aetna - reported Q1 2024 yesterday. - (link)

DEEP DIVE 📚

Q1 2024 Medicare Carrier Financials Side-By-Side ⛈

In this week’s deep dive, we are looking at publicly traded Medicare carrier Q1 2024 financials side-by-side.

Not the best quarter for Medicare focused carriers.

But as we often talk about, the Medicare market is a growing market. So, the long term underlying market remains strong for these companies.

The insurance carriers included in this analysis are all trying to capture a piece of the growing Medicare market (along with other insurance markets), and do so profitably. Here they are:

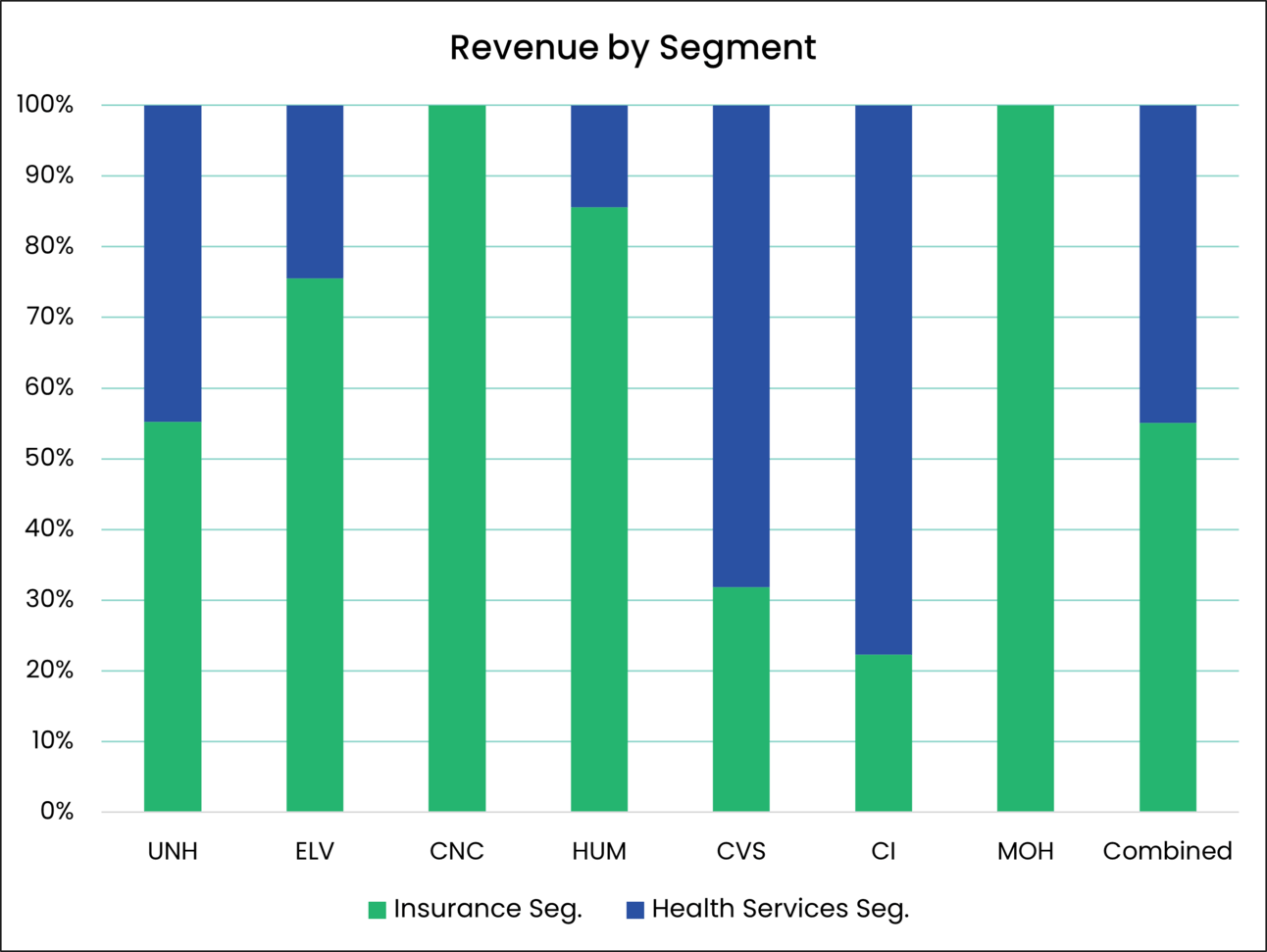

Aside from Centene and Molina, these carriers have both health insurance operations and healthcare services operations (providers, PBMs, pharmacies, etc.).

Here is the split of Q1 2024 revenues between these two segments for each carrier:

As you can see, UNH, ELV and HUM have a larger insurance segment while CVS and CI have a larger services segment.

Income Statement & Membership Side-By-Side

To compare and contrast the Q1 2024 results for each carrier, the Income Statement is split between “Insurance Operations” and “Healthcare Service Operations”. The consolidated statement is also displayed.

One Note: Healthcare Service Operations is different for each carrier, but generally includes providers, pharmacies, PBMs, and technology.

YoY % Change

Here is the % change in key metrics from Q1 2023 to Q1 2024.

Current Valuation Metrics

Here are current valuation metrics for these carriers.

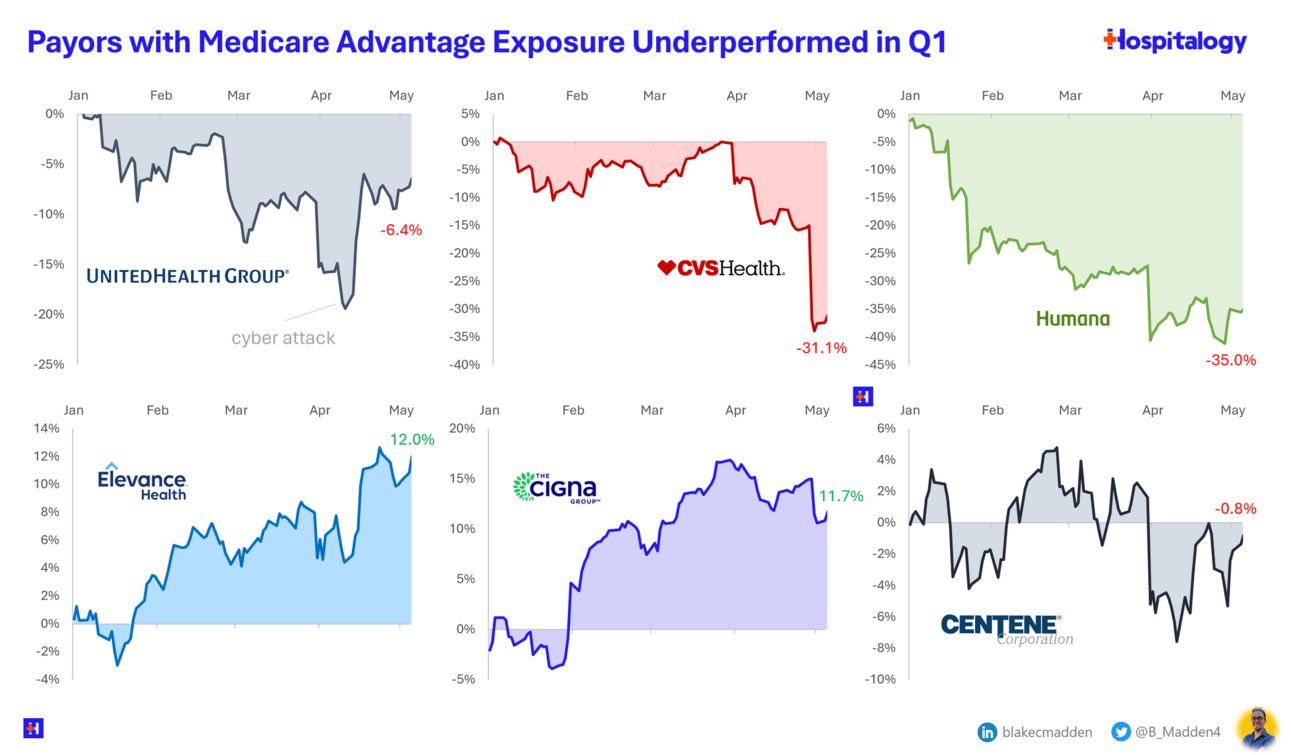

Higher Loss Ratios / Lower Profits

The overall theme for the quarter was lower profits driven by higher loss ratios.

The higher loss ratios are a function of lower Medicare Advantage funding combined with higher utilization.

Another theme was the Change Healthcare cyber attack which caused major disruption throughout the industry.

Several carriers signaled Medicare Advantage “2025 pull-back” due to headwinds associated with Part D IRA changes, lower funding, and continued higher loss ratios.

See more here:

→ Humana pulls back 2025 guidance following MA rate cut (link)

→ CVS reports $900M cost, lower projections due in large part to high Medicare Advantage utilization (link)

→ UnitedHealth CEO Warns of 3-Year Medicare Squeeze (link)

Notable Observations

Membership

Overall Medicare Advantage grew 6% combined

CVS & MOH both saw significant growth in Medicare Advantage Membership (see more on Aetna’s big AEP here) (UPDATE: MOH’s growth due to acquiring Bright Health members)

Overall Medicaid membership dropped significantly (likely due to Medicaid “unwinding”)

Commercial grew overall and saw market share shift between carriers (due to growth in ACA market, and Humana exiting the Employer Group market)

Insurance Operations

Overall, Revenues Up (8%), Operating Profit Down (10%)

CVS with a drastic example of both!

As previously mentioned, overall loss ratios were up 2.0% combined!

Notable that both ELV and CI saw their loss ratios decline

UNH, HUM and CVS all saw significant increases in loss ratios

Healthcare Services Operations

Overall, Revenues Up (8%), Operating Profit Down (1%)

UNH and Humana had notable declines in Operating profit

ELV and CI saw increases in Operating profit

Consolidated Results

Again… Revenues Up (8%), Profits Down (8%)

… and, more headwinds ahead… will be interesting to see how these companies navigate the next few years…⛈

__

Sources: Carrier quarterly financial earnings releases, 10-Qs and 10-Ks.

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

COMPLIANCE CHATTER 📢

The Department of Health and Human Services issued a final rule regarding section 1557 of the Affordable Care Act (ACA), prohibiting discrimination in certain health programs (including excepted benefit plans and every health program or activity which receives Federal financial assistance, directly or indirectly) based on race, color, national origin, sex, age, or disability.

The rule requires covered entities with 15+ employees to designate a Section 1557 coordinator, have written policies and procedures, provide training, provide beneficiaries with notices of nondiscrimination and availability of language services and auxiliary aids, and mitigate risk of discrimination with patient care decision support tools.

Dates by which covered entities must comply range from 120 days to within 1 year of the rule effective date.

Exciting News!

You can now receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

DATA VISUAL of the Week 📊

The data visual of the week comes from Blake Madden’s newsletter “Hospitalogy”, highlighting a drop in stock prices for publicly traded carriers.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: