This week’s newsletter is brought to you by Telos Actuarial. Telos helps companies develop new insurance products for the 65+ market that are designed to sell.

Download their “Future of Medicare Supplement” white paper here.

Here is what you’ll find in this week’s newsletter!

Three links - the best articles we found this week about the Medicare Market.

Deep Dive - This week we look at the “big picture” enrollment statistics you need to know about the Medicare Market.

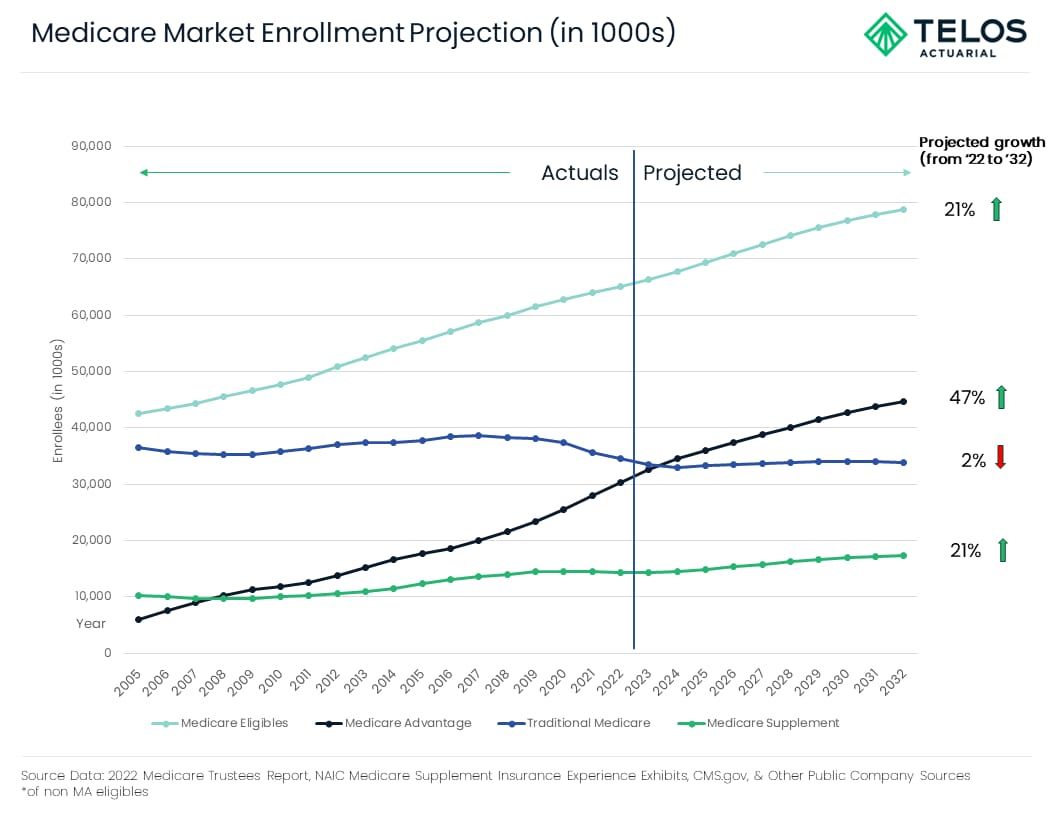

Data Visual of the week - Medicare enrollment snapshot.

It’s only a 5 minute read, but it will make you a better leader in the Medicare industry.

Here are 3 links related to the Medicare Industry for the week:

MA enrollees see fewer inpatient stays, ER visits than those in traditional Medicare: report - provides information on inpatient & ER utilization between MA and Traditional Medicare (link)

CMS Office of the Actuary Releases 2022-2031 National Health Expenditure Projections - provides projected growth in National Health Expenditures for Medicare, Medicaid, Part D and more (link)

Stolen Medicare records used in fraudulent billing schemes- Stolen Medicare numbers used to bill Medicare for COVID-19 tests! (link)

Deep Dive

Big Picture Medicare Enrollment Statistics!

In order to be an effective leader in the Medicare industry it’s important to understand the big picture of the market.

Today’s deep dive gives you the important enrollment statistics that will help you wrap your arms around the overall Medicare market. Understanding these big picture statistics will help you put other topics into proper context, make good decisions, and help you anticipate future trends.

Since this is the first Medicare Market Insights newsletter we wanted to set a good foundation for future editions where we will dive into more specific segments and slivers of the market.

Alright, here we go!

Medicare Eligibles

It all starts with Medicare eligibles.

Driven by the “Baby Boomer” generation (those born between 1946 and 1964) the Medicare eligible population has grown significantly over the last 10 years, and is expected to continue growing for the next 10 years.

Here are the numbers:

Year-end ‘12 Medicare Eligibles: 50,874,000

Year-end ‘22 Medicare Eligibles: 65,042,000 / 28% growth

Year-end ‘32 Medicare Eligibles: 78,739,000 / 21% expected growth

Medicare Advantage (“MA”) Enrollees

As the number of individuals eligible for Medicare has been growing, those choosing Medicare Advantage (over traditional Medicare) for their insurance coverage has grown significantly.

This growth is likely driven by heavy marketing, low premiums, and additional ancillary benefits.

Here are the numbers:

Year-end ‘12 MA Enrollees: 13,877,000

Year-end ‘22 MA Enrollees: 30,322,000 / 119% growth

Year-end ‘32 MA Enrollees: 44,709,000 / 47% expected growth

Medicare Advantage penetration of Medicare Eligibles went from 27% in ‘12 to 47% in ‘22 and is expected to grow to 57% by 2032.

Traditional Medicare Enrollees

Because MA has grown faster than the underlying Medicare eligible population, the number of enrollees in Traditional Medicare decreased over the last 10 years, and is projected to continue to shrink over the next 10 years.

Here are the numbers:

Year-end ‘12 non-MA Enrollees: 36,997,000

Year-end ‘22 non-MA Enrollees: 34,720,000 / 6% decrease

Year-end ‘32 non-MA Enrollees: 34,030,000 / 2% expected decrease

Penetration of Medicare Eligibles went from 73% in ‘12 to 53% in ‘22 and is expected to shrink to 43% by 2032.

Medicare Supplement (“MS”) Enrollees

Even while the share of Medicare eligibles choosing Traditional Medicare has been shrinking, Medicare Supplement (which fills gaps of Traditional Medicare) has seen healthy growth over the last 10 years, and is expected to continue to grow.

This growth is likely driven by marketing, comprehensive benefits, flexibility and ease of use.

Here are the numbers:

Year-end ‘12 MS Enrollees: 10,555,000

Year-end ‘22 MS Enrollees: 14,330,000 / 36% growth

Year-end ‘32 MS Enrollees: 17,398,000 / 21% expected growth

Penetration of non-MA Eligibles went from 29% in ‘12 to 41% in ‘22 and is expected to grow to 51% by 2032.

Bottom Line

The underlying Medicare market is a growing market. Some aspects faster than others. But regardless, this is a good market to do business in!

How will you as a leader in this market take action to solve problems, help seniors, and grow your business?

What are you doing today in order to take advantage of the opportunities in the Medicare market over the next 10 years?

Source Data: 2022 Medicare Trustees Report, NAIC Medicare Supplement Insurance Experience Exhibits, CMS.gov, & Other Public Company Sources

Data Visual of the Week

This week’s data visual of the week summarizes the deep dive into one chart.

That’s it for this week. Let us know what you think (you can simply respond to this email).

Too much detail?

Not enough detail?

Just the right amount of detail?