- Medicare Market Insights

- Posts

- UnitedHealth Group 2025 Calendar Year Results 📊

UnitedHealth Group 2025 Calendar Year Results 📊

A look at UHC's CY 2025 financial results. Membership, Revenues, Loss Ratios, Profits.

This week’s newsletter is Sponsored By: Modivcare

Extending access for your most complex populations → (Explore Our Solutions)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - UnitedHealth Group 2025 Calendar Year Results 📊

Sponsor Snapshot 🚀 - brought to you by Modivcare

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Congress pitches bipartisan health package: 8 things to know - (link)

An Updated Analysis of Coding Pattern Differences in Medicare Advantage - (link)

Oklahoma Executive Order 2026-01 - (link)

2027 Medicare Advantage and Part D Advance Notice - (link)

AHA Comments on CMS CY 2027 Proposed Rule for Policy and Technical Changes to Medicare Advantage and Part D Programs - (link)

US health insurers slump after 2027 Medicare Advantage payments proposal disappoints - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

UnitedHealth Group 2025 Calendar Year Results 📊

2025 was a difficult year for UnitedHealth Group ( $UNH ( ▲ 4.0% ) ).

Despite continued revenue growth and long-term strategic positioning, the company faced meaningful pressure on margins, operating income, and medical cost trends.

In this week’s deep dive we are analyzing year-over-year (“YoY”) and past 7 years results to better understand recent trends.

Before we get to the numbers it’s important to understand their two main business units, UnitedHealthcare and Optum.

UnitedHealthcare is an insurance carrier, providing health insurance benefits. They collect premiums, pay health insurance benefits, and make a profit on what’s left over.

Optum is primarily a healthcare services and delivery platform, spanning providers, pharmacies, and health technology.

They receive revenues via health insurance benefits, pay expenses associated with running health provider systems, and make a profit on what’s left over.

This is what is called vertical integration!

Okay, now let’s look at some numbers.

__

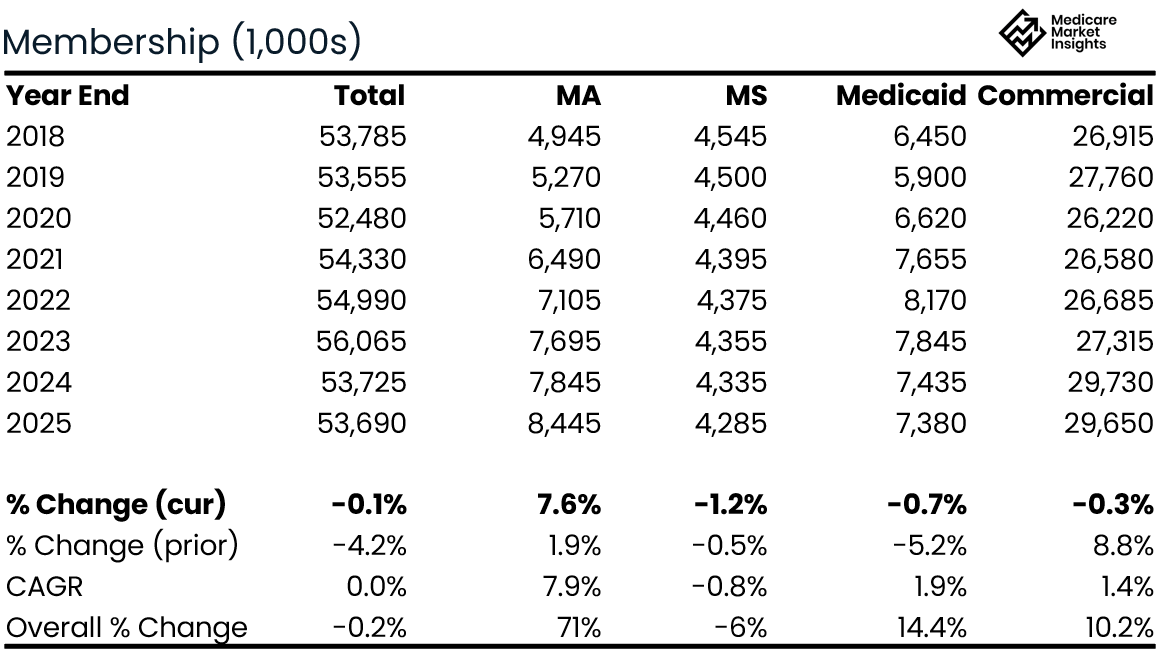

Membership

Surprisingly, overall membership growth has been flat over the last 7 years.

YE 2018 membership: 53.79 million

YE 2025 membership: 53.69 million

Overall Growth: -0.2%

% Change (current yr.): -0.1%

% Change (prior yr.): -4.2%

CAGR: 0.0%

Flat total membership masks a significant mix shift, with Medicare Advantage growth offset by declines in other lines of business.

Medicare Advantage has been the strategic focus over the past 7 years growing 71% in total.

Led the MA market in growth during 2025, but expects to reduce MA membership by 1.3 - 1.4 million in 2026.

Note: the primary decrease in lives over the prior 7 years is in “international” membership and Part D (not displayed above).

__

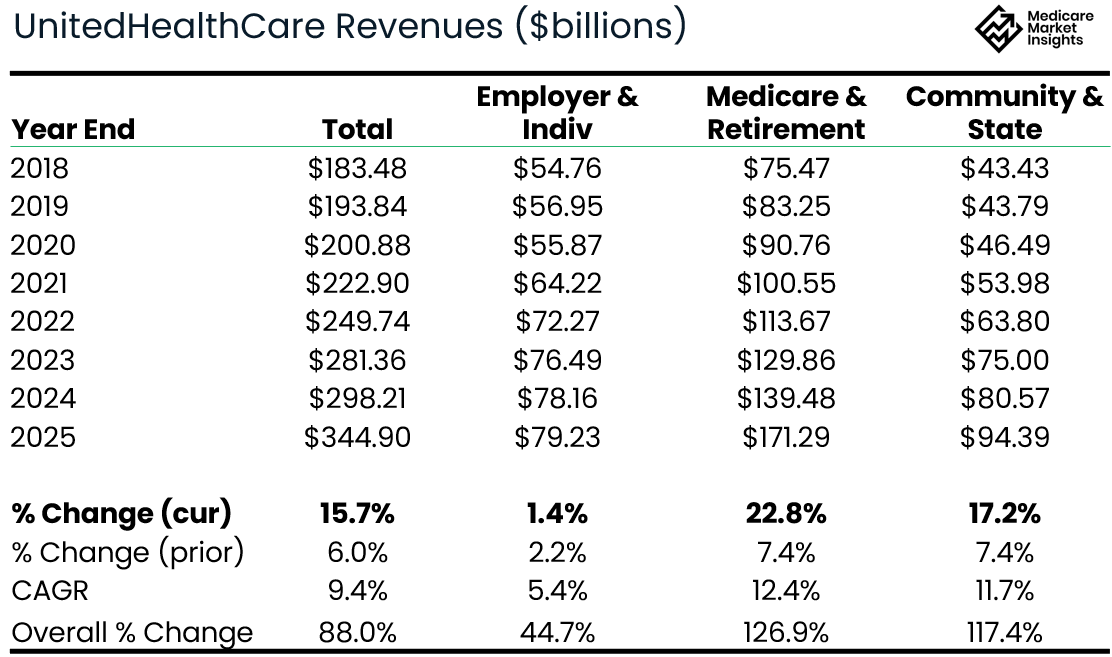

Revenues

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Revenues (the insurance Carrier segment) have grown steadily over the past 7 years, with 2025 outpacing the prior year and the 7 year CAGR.

2018 Revenues: $186.5 billion

2025 Revenues: $344.9 billion

Overall Growth: 88%

% Change (current yr.): 15.7%

% Change (prior yr.): 6.0%

CAGR: 9.4%

The Medicare & Retirement segment led the way with a 23% growth in Revenue in 2025, followed by Community & State segment (17%).

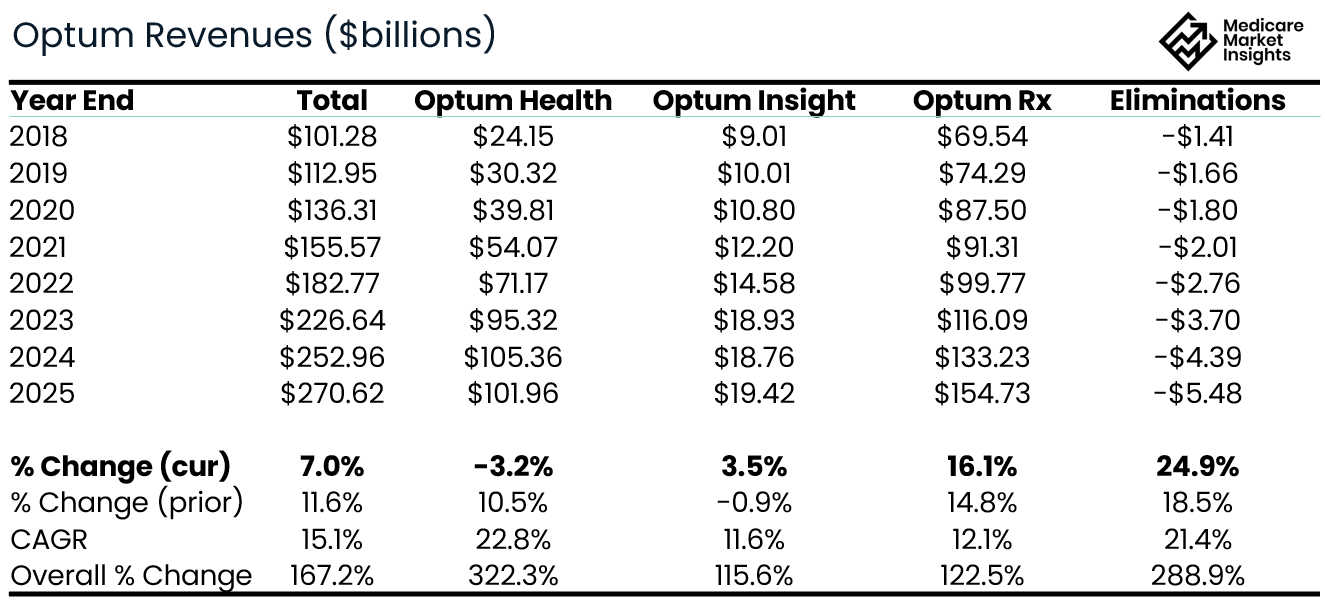

Optum Revenues (the healthcare provider segment) have grown 2.7x over the past 7 years.

2018 Revenues: $101.3 billion

2025 Revenues: $270.6 billion

Overall Growth: 167%

% Change (current yr.): 7.0%

% Change (prior yr.): 11.6%

CAGR: 15.1%

Optum Health revenue down 3% in 2025, while Optum Rx grew 16%.

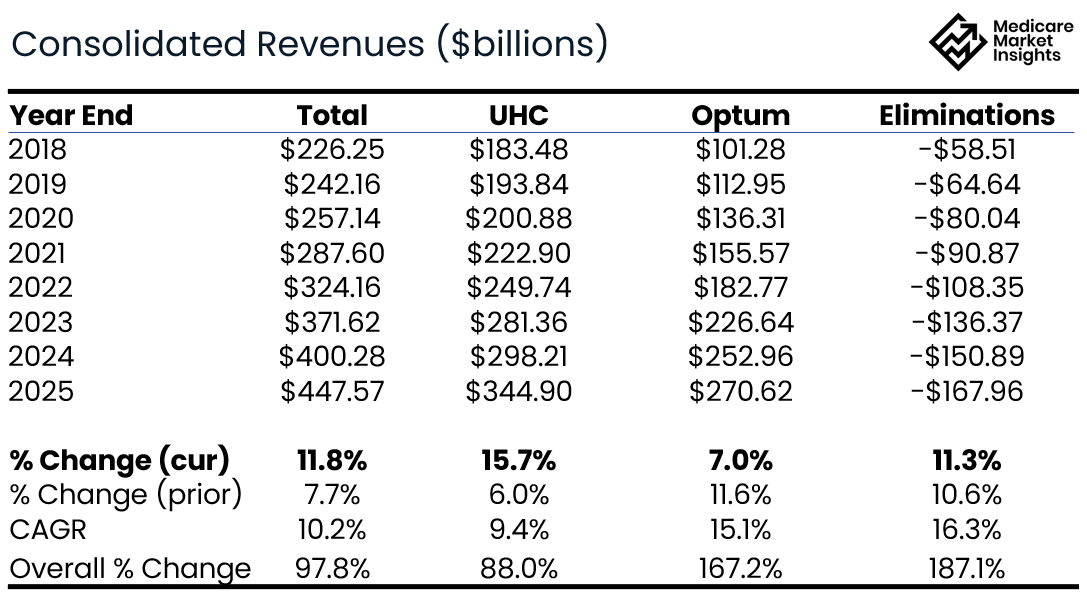

Combining UnitedHealthcare, Optum, and including eliminations, results in the company’s Total Consolidated Revenues.

2018 Revenues: $226.25 billion

2025 Revenues: $447.57 billion

Overall Growth: 98%

% Change (current yr.): 11.8%

% Change (prior yr.): 7.7%

CAGR: 10.2%

As you can see, revenue eliminations have grown steadily over the past 7 years, and have grown faster than overall top line revenue.

This indicates materially more vertical integration today than 7 years ago, with a growing share of medical spend staying inside the UnitedHealth ecosystem.

More of the insurance company benefit expense is going to Optum providers and pharmacies as revenue. (Since they already recognized the revenue in the insurance company, they can’t also recognize it as revenue in the provider company.)

__

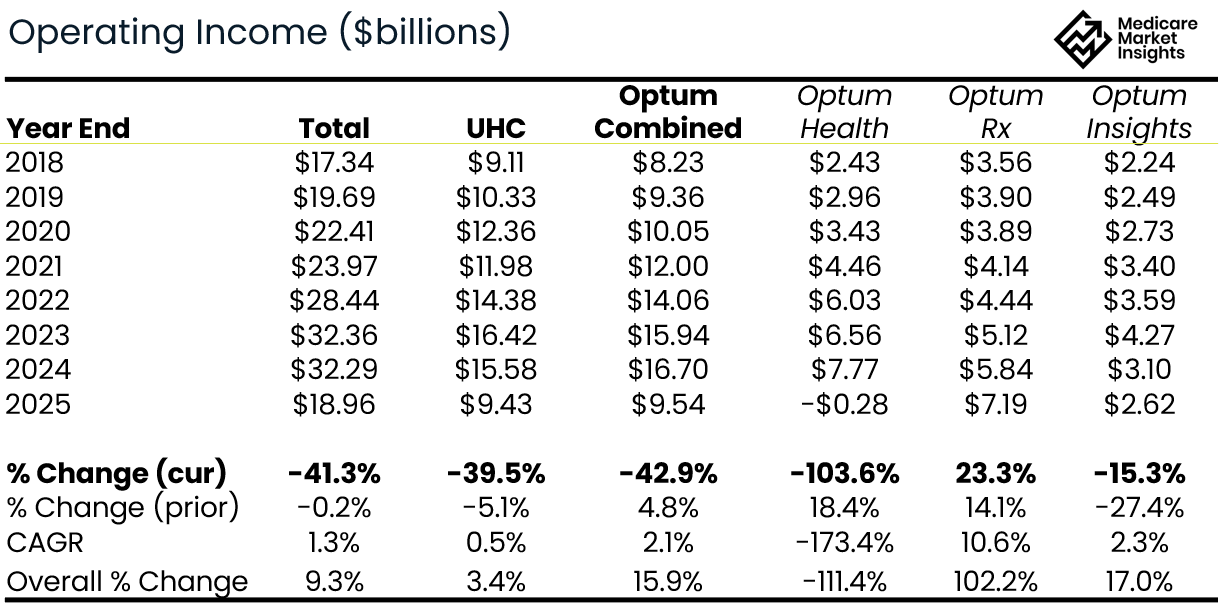

Operating Income

Okay, so membership is growing, revenues are growing. What about operating income (profit)? Again, these are reported by vertical.

The combined UnitedHealth Group’s Operating Income had grown steadily until hitting a wall in 2025. While operating income is modestly higher than 2018 levels, 2025 represents a sharp step-down from 2024, effectively erasing several years of incremental profit growth.

2018 Operating Income: $17.34 billion

2025 Operating Income: $18.96 billion

Overall Growth: 9.3%

% Change (current yr.): -41.3%

% Change (prior yr.): -0.2%

CAGR: 1.3%

Significant declines in operating income in all segments except Optum Rx.

roughly 50/50 split in operating income between UHC and Optum

__

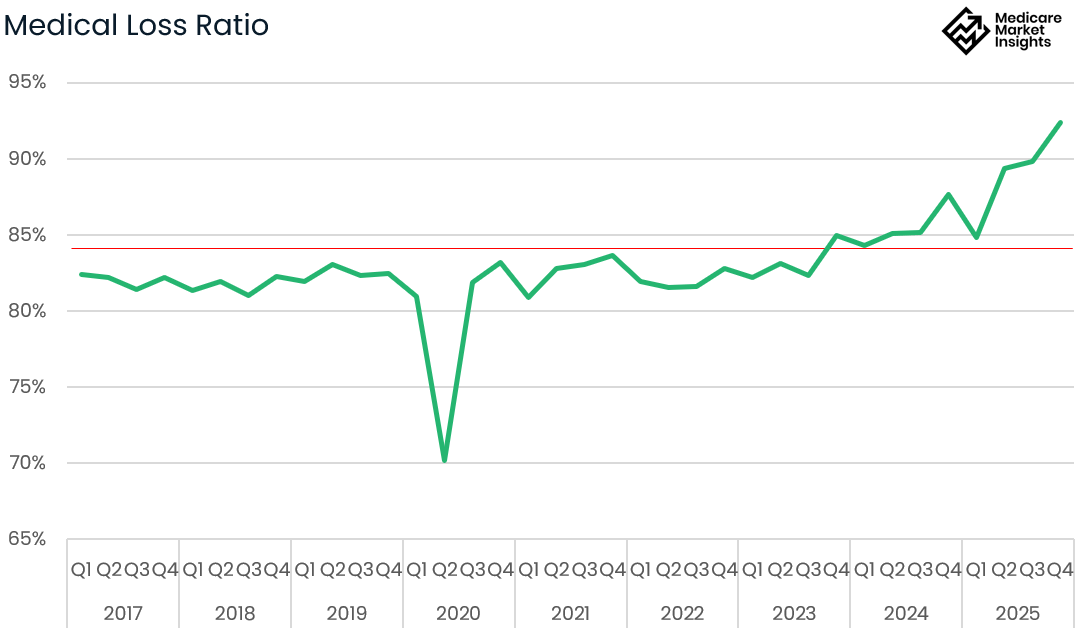

Medical Loss Ratio

The profit margin in 2025 (4.2%) shows a significant decline over 2024 (8.1%). The decrease in profit margin was primarily driven by higher loss ratios. You can see in the graph below that the Q4 2025 loss ratio of 92% is the by far the highest quarterly loss ratio in the past eight years.

__

Bottom Line

Medicare Advantage has been the primary growth engine, with MA membership up ~71% over the past seven years; however, the company expects to reduce MA membership by 1.3–1.4 million in 2026 as it prioritizes margin discipline over scale.

Revenue growth remains robust, driven by Medicare & Retirement at UnitedHealthcare and pharmacy services at Optum.

Vertical integration continues to deepen, as evidenced by eliminations growing faster than consolidated revenue.

2025 was a profitability reset, with operating income declining sharply year over year despite higher revenues.

Medical cost pressure is the core issue, culminating in an unusually high Q4 2025 loss ratio. (The Recent Advance Notice adds more pressure to this)

SPONSOR SNAPSHOT 🚀: Modivcare

Modivcare is transforming the way members engage in and access care through home and community-based solutions. We’re there to help members live more confidently by enabling them to access the care they need - and our solutions deliver: we measurably address cost and close gaps in care across our services.

Learn how Modivcare Monitoring can fit into your members’ coordinated care ecosystem with solutions such as:

Personal Emergency Response Systems (PERS)

Device enabled virtual care management

Medication Management

Community Health Stations

E-3 - Engage, Educate, Empower to address health literacy and support gap closure

Extending access for your most complex populations → (Explore Our Solutions)

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter? |

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)