- Medicare Market Insights

- Posts

- Centene Leads Part D Growth in 2025

Centene Leads Part D Growth in 2025

Top of the market in both enrollment and growth

This week’s newsletter is Sponsored By: Medicare Market Insights +

Now includes access to Insurance Regulatory Insights → (Learn More)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Centene Leads Part D Growth in 2025

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights +

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

An Uneven Playing Field: Why Smaller Plans Are Calling for Stronger Guardrails on Medicare Advantage Marketing - (link)

UnitedHealth to accelerate Medicare Advantage payments to some rural hospitals - (link)

Kaiser Permanente affiliates to pay $556 million to resolve US claims alleging Medicare fraud - (link)

Medicare-funded medical residencies falling short of goals: Report - (link)

JPM26: How Alignment Healthcare's focus on the senior is driving growth - (link)

Clover Health News Release - January 14, 2026 - (link)

Directing Medicare: Past, Present, and Future - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Centene Leads Part D Growth in 2025

Last week we spotlighted the fastest‑growing Medicare Advantage carrier in 2025. This week, we’re shifting gears to see who topped the charts in the Part D market.

Since CMS won’t release AEP enrollment data until mid‑February, now’s a great time to look back at what happened last year.

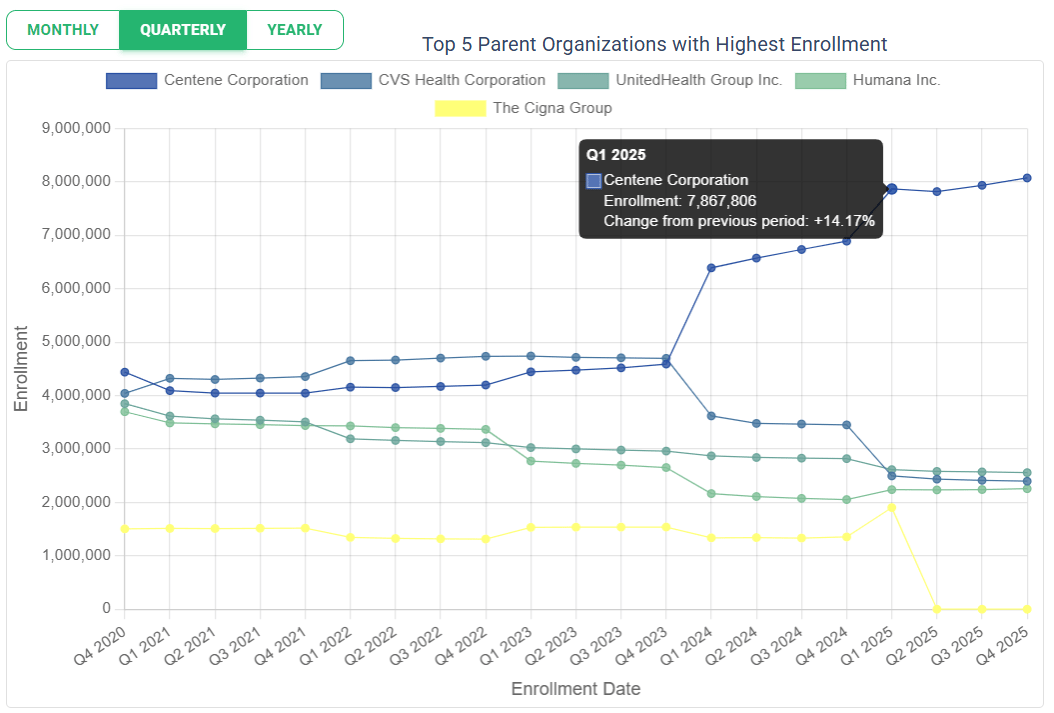

With around 8.1M enrollees, Centene Corporation (“Centene”) topped the Part D market in both enrollment and growth, increasing 17% (1,182,732 enrollees) in 2025 (Dec. ‘24 - Dec. ‘25).

Let’s break this down to determine why Centene saw the most growth and what contracts and states this growth occurred in.

Note: Our analysis utilizes data obtained from the MMI+ Medicare Advantage Insights web app.

Why Centene?

The graph below demonstrates that Centene’s growth has outpaced other carriers in the individual Part D market since its acquisition of WellCare in 2019.

The 2022 Inflation Reduction Act introduced several provisions impacting Part D plans (read more here) causing some insurers to scale back Part D plan offerings.

Going into 2025, we saw 204,713 individuals impacted by terminated Part D plans. This amount doubled going into 2026, with 478,491 individuals impacted by terminated Part D plans.

Notably, Centene did not terminate any Part D plans in 2025 and 2026. However, in an effort to save “hundreds of millions of dollars”, Centene did stop paying Part D commissions to brokers and agents starting with the 2025 plan year, and continued that into 2026.

Top Contracts

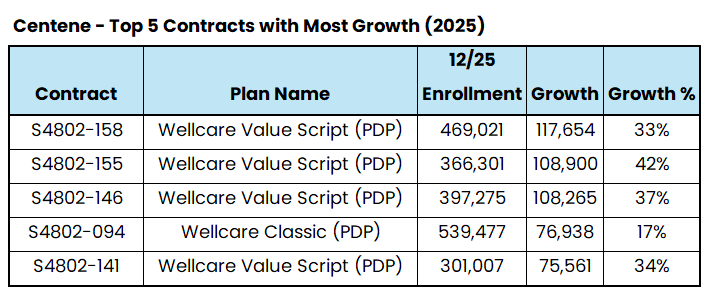

Wellcare Value Script contracts dominated the top 5 contracts with the most growth for Centene in 2025.

These 4 Wellcare Value Script contracts are enhanced drug benefit plans with $0 total premiums in the following markets:

|

|

Wellcare Classic (S4802-094) is a basic drug benefit contract (actuarially equivalent standard) in California with a total premium of $16.80.

Top Growth States

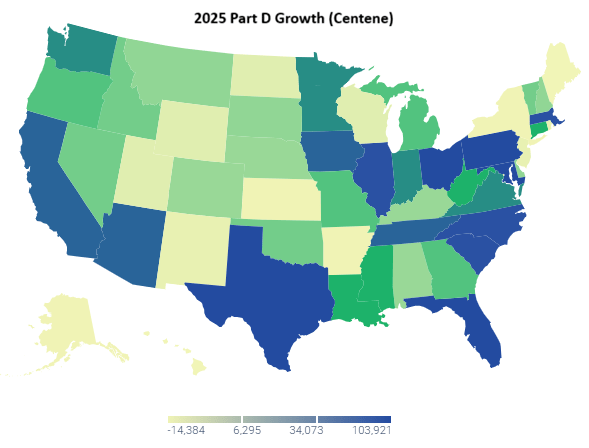

Now, let’s dive deeper and see where the largest growth occurred.

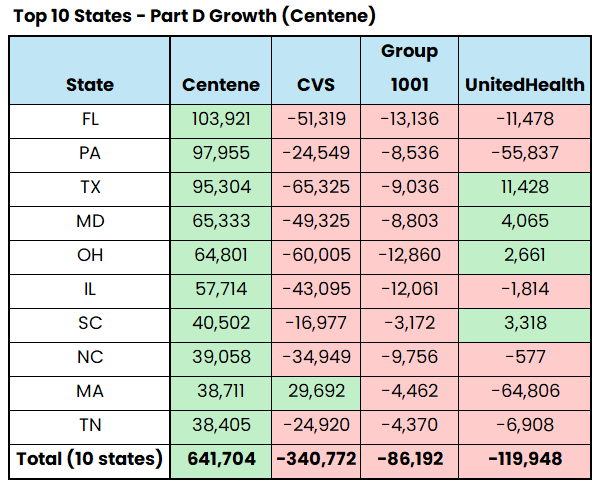

Ten states accounted for half of Centene’s overall Part D growth in 2025. As you can see from the chart below, Centene’s growth in these states likely came from CVS, Group 1001 (Clear Spring Health), and UnitedHealth Group.

We’ll continue to track and report Part D enrollment growth trends for 2026!

MMI+ users can generate these visuals and data in the Medicare Enrollment Insights web app. → UPGRADE

SPONSOR SNAPSHOT 🚀: Medicare Market Insights Plus

What is Medicare Market Insights - Plus?

Medicare Advantage Insights Web Application tool

Members-Only Content

Insurance Regulatory Insights + Reg Tracker

All the moving pieces in the Medicare market result in opportunities!

Opportunities for you to help more consumers.

Opportunities for distributors to grow books of business.

Opportunities for Carriers to add new members.

Opportunities for Investors to invest in companies solving problems in the changing Medicare space.

What are you going to do to take advantage?

Stop guessing. Start making informed decisions.

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter? |

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)