This week’s newsletter is Sponsored By: Medicare Market Insights +

Now includes access to Insurance Regulatory Insights → (Learn More)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - UnitedHealth Group Leads Medicare Advantage Growth in 2025

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights +

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Courts and CMS So Far Agree: States Are Preempted from Acting on MA Plan Marketing - (link)

Alignment Healthcare Reports 31% Year-Over-Year Membership Growth to 275,300 as of Jan. 1, 2026 - (link)

Former White House advisor on the real reason your health care costs are going up: Medicare’s doctor pay gap - (link)

UnitedHealth used aggressive Medicare tactics, Senate committee report says - (link)

The MedSupp Market is Changing: 25 Shifts To Be Aware of In 2026 - (link)

Mass General Brigham to buy Fallon Health in plan merger - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

UnitedHealth Group Leads Medicare Advantage Growth in 2025

While we wait for AEP 2026 enrollment results to be released by CMS in mid-February, we thought it would be a good opportunity to dive deeper into United Healthcare’s 2025 growth (Dec. ’24 – Dec. ’25).

All signs point to UnitedHealth Group’s enrollment declining in 2026, but in 2025, they led the way. Let’s take a look.

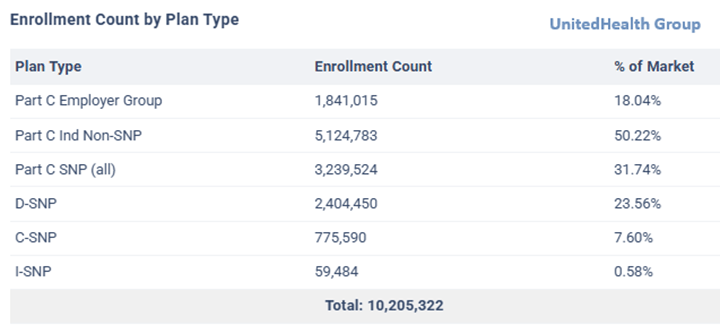

With over 10.2M enrollees, UnitedHealth Group topped the market in both enrollment and growth, increasing 8% (763,589 enrollees) in 2025.

Let’s break this growth down to determine the what, how, and where.

Note: Our analysis utilizes data obtained from the MMI+ Medicare Advantage Insights web app.

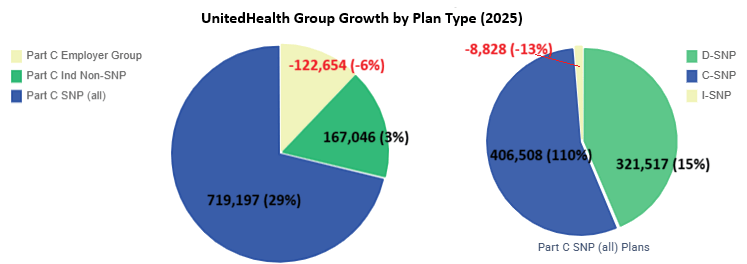

The What

As you can see from the graph below, UnitedHealth Group’s growth in 2025 was largely attributed to increasing enrollment in C-SNP and D-SNP plans.

C-SNP: 110% increase (406,508 enrollees)

D-SNP: 15% increase (321,517 enrollees)

Special Needs Plans (SNP) accounted for 32% of UnitedHealth Group’s total Medicare Advantage enrollment in 2025.

Want to learn more about the SNP market? Check out these MMI newsletters:

The How

According to this news release from UnitedHealth Group in October 2024, the company expanded their footprint in 2025 to offer more affordable coverage options for people managing chronic conditions.

UnitedHealth Group introduced 139 new plans in 2025, including 43 C-SNP and 50 D-SNP plans.

Enrollment in those new SNP plans accounted for 9% (872,153 enrollees) of United Health Group’s overall Medicare Advantage enrollment. These new SNP plans had $0 Part C premiums.

UnitedHealth Group’s top 5 contracts with the most growth in 2025 included 3 D-SNP plans and 4 new plans.

The Where

Now, let’s dive deeper into UnitedHealth Group’s SNP plans and see where the largest growth occurred.

C-SNP

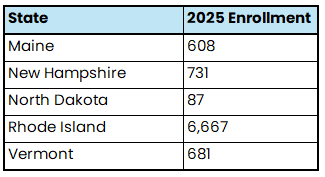

UnitedHealth Group entered the C-SNP market in 19 new states in 2025. One of these new states, North Carolina, had the second largest C-SNP growth. Texas and South Carolina also saw significant growth.

In Texas, UnitedHealth Group was the only C-SNP carrier in most counties.

In North Carolina and South Carolina, UnitedHealth Group and Humana competed against each other in most counties, with UnitedHealth Group’s plans having lower In-Network Maximum Out-of-Pocket (MOOP) Amounts than Humana.

In addition, UnitedHealth Group entered the C-SNP market in the following states where other carriers offered C-SNP plans in 2025:

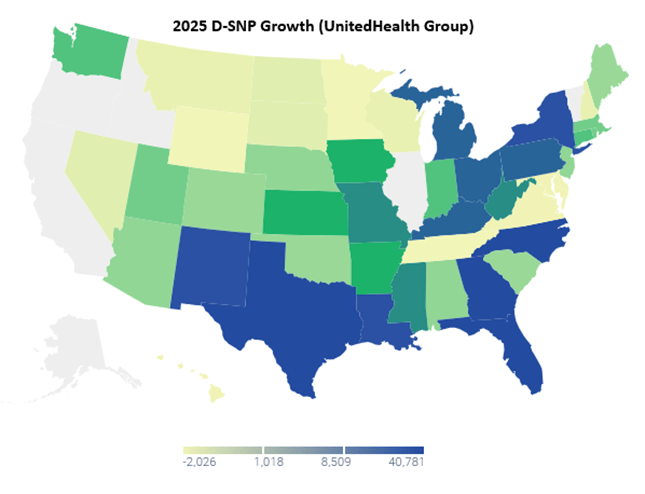

D-SNP

Florida, Georgia, and North Carolina saw the biggest growth for UnitedHealth Group’s D-SNP plans. In addition, UnitedHealth Group entered the D-SNP market in New Mexico, which also saw significant growth.

Read how this enrollment growth impacted UnitedHealth Group’s Q3 2025 financial results here.

We’ll be looking forward to analyzing enrollment growth trends for 2026!

MMI+ users can generate these visuals and data in the Medicare Enrollment Insights web app. → UPGRADE

SPONSOR SNAPSHOT 🚀: Medicare Market Insights Plus

What is Medicare Market Insights - Plus?

Medicare Advantage Insights Web Application tool

Members-Only Content

Insurance Regulatory Insights + Reg Tracker

All the moving pieces in the Medicare market result in opportunities!

Opportunities for you to help more consumers.

Opportunities for distributors to grow books of business.

Opportunities for Carriers to add new members.

Opportunities for Investors to invest in companies solving problems in the changing Medicare space.

What are you going to do to take advantage?

Stop guessing. Start making informed decisions.

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: