This week’s newsletter is Sponsored By: Agent Boost 🚀

Our industry is down, learn how to THRIVE, not just survive.

Grow in 2026 - Attend our Free Elite Agent Training or Agency Accelerator Masterclass → (Register Now)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - AEP 2026 → Medicare Advantage Enrollment Growth 🪴

Sponsor Snapshot 🚀 - brought to you by Agent Boost

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Will AI Replace Agents? - (link)

The Budget and Economic Outlook: 2026 to 2036 - (link)

Humana CEO says insurer is ready to adapt if 2027 MA rates stay flat - (link)

Ripple effects of Medicare Advantage rate freeze - (link)

Novo Nordisk CEO sees 15 million patient opportunity in Medicare coverage for obesity drugs - (link)

Oracle Cloud Infrastructure to Support Centers for Medicare and Medicaid’s Modernization Initiative- (link)

Jared’s recent LinkedIn posts:

MA plans without drug coverage grew during AEP - (link)

AEP ‘26 results available in web app for MMI+ subscribers - (link)

Public Insurance Carriers increased Revenue 12% in 2025 - (link)

MA market grows during AEP - (link)

CVS Health Corp 2025 Q4 results - (link)

Humana 2025 Q4 results - (link)

Centene Corp 2025 Q4 results - (link)

DEEP DIVE 📚

AEP 2026 → Medicare Advantage Enrollment Growth 🪴

The work of AEP has been over for a while, but we are just now able to see the results of the activity. February 2026 enrollment data is now available.

This AEP saw:

What was the overall impact on MA/MAPD AEP enrollment?

That is what we are going to start looking at today. Enjoy!

__

Medicare Advantage (“MA”) enrollment increased 0.3% during AEP 2026.

A sharp slowdown in growth—less than one fourth of the enrollment increase of last year. The 0.11M new enrollees pale in comparison to the growth seen in each of the past four AEPs.

AEP '22 enrollment increase → ~1.33 million (4.8%)

AEP '23 enrollment increase → ~1.10 million (3.7%)

AEP '24 enrollment increase → ~0.99 million (3.1%)

AEP '25 enrollment increase → ~0.45 million (1.3%)

AEP ‘26 enrollment increase → ~0.11 million (0.3%)

[NOTE: this utilizes enrollment by Contract, Plan, State, County which excludes some enrollment counts.]

The shifts happening in the Medicare Advantage market indicate more consumers might have opted for Original Medicare or Medicare Supplement plans this AEP compared to prior enrollment periods.

In today’s deep dive we will look at the makeup of the 0.11 million member growth.

First, we will explore Geography and Health Plan. Next week we will explore Plan Types.

The definition of “AEP enrollment increase” is the change in enrollment counts from December 2025 to February 2026.

Geography

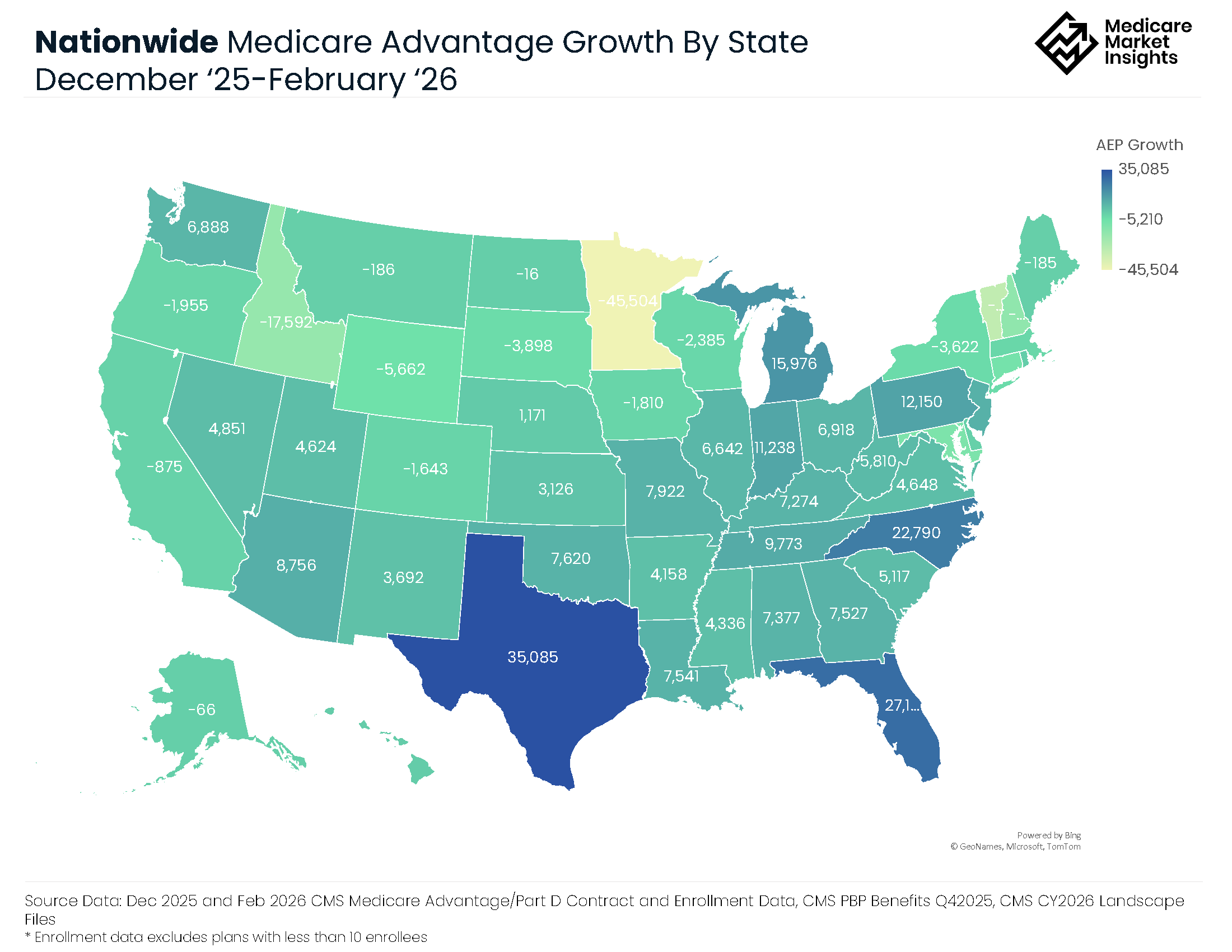

To start off we will look at AEP results by state.

The amount of growth in each state is influenced by how many (or little) Medicare eligibles there are in the state, how high or low the MA penetration is, where Health Plans expanded or removed their product offerings, how strong (or weak) networks are, and many other factors.

The map below shows the enrollment growth during AEP 2026 by state.

Data pulled from the MMI+ MA Enrollment Web App.

The top 10 states in terms of overall AEP growth are:

State | AEP Growth | % Growth |

|---|---|---|

Texas | 35,085 | 1.3% |

Florida | 27,195 | 0.9% |

North Carolina | 22,790 | 1.8% |

Michigan | 15,976 | 1.1% |

Pennsylvania | 12,150 | 0.8% |

Indiana | 11,238 | 1.6% |

Tennessee | 9,773 | 1.2% |

Arizona | 8,756 | 1.1% |

New Jersey | 8,187 | 1.1% |

Missouri | 7,922 | 1.1% |

There were a few states where enrollment declined during AEP:

State | AEP Growth | % Growth |

|---|---|---|

Minnesota | -45,504 | -6.4% |

Vermont | -30,845 | -61.1% |

Idaho | -17,592 | -8.7% |

New Hampshire | -15,648 | -12.6% |

Maryland | -9,787 | -3.3% |

—

One factor in a state market’s ability to grow MA membership is the level of penetration the state is already at.

(Note: “penetration” = count of MA members / count of Medicare eligibles)

There is a point in which MA growth tends to slow down once a certain penetration % is achieved.

The chart below shows AEP growth % by state compared to that state’s penetration %, and it looks a lot different this year.

In previous years when the market was more stable, carriers expanded into markets with lower penetration, correlating to a chart that showed states with lower penetration had higher % growth.

With a more volatile market this year, we are seeing states with lower penetration and low growth.

We are seeing some outliers (Maryland, South Dakota, Minnesota, Connecticut) due to health plans exiting certain markets where they were less profitable. Contributing to the decline in Minnesota was UCare’s exit of the non-SNP market in 2026.

[This excludes Alaska because it messed up the chart. AK enrollment declined 3.2% and started with a 1.7% penetration]

Data pulled from the MMI+ MA Enrollment Web App.

—

Health Plans

There was one Health Plan that clearly “won” in terms of membership growth during AEP 2026.

Compared to previous AEP’s, we had a shake-up of carriers both leading and declining in growth.

Here is a look at the top and bottom 10 Health Plans by growth (including both Individual and Employer Group combined).

Data pulled from the MMI+ MA Enrollment Web App.

Humana “won” AEP growing 1,185,801 members.

Smaller health plans focused on specific markets also saw significant growth this AEP. Devoted expanded into 9 new states in 2026, likely contributing to their growth.

UnitedHealth went from leading the market in growth last AEP to experiencing the steepest decline this AEP.

The health plans with the largest declines in growth also had the most impacted enrollees with plan terminations in 2026.

When excluding Employer Group plans, we see that AEP growth (and decline) was primarily due to shifts in the Individual market.

Data pulled from the MMI+ MA Enrollment Web App.

—

In addition to looking at Health Plans that had the highest overall member growth, it’s also interesting to look at Health Plans with the highest growth percentage.

The table below shows the top 10 growth % companies (excluding any that have <10,000 membership).

Data pulled from the MMI+ MA Enrollment Web App.

With the exception of Devoted Health, these carriers have a relatively smaller market share, but still saw significant growth.

—

That’s all for today! Next week will be Part 2 where we will take a closer look at AEP results by Plan Types.

—

Source Data: Medicare Market Insights MA/MAPD/PDP Enrollment Web App. which uses Dec 2025 and Feb 2026 CMS Medicare Advantage/Part D Contract and Enrollment Data, CMS PBP Benefits Q42025, CMS CY2026 Landscape Files

Note: Enrollment data excludes plans with less than 10 enrollees

SPONSOR SNAPSHOT 🚀: Announcing Agent Boost!

The health insurance industry is facing unprecedented headwinds. Commissions are changing, plans are going non‑commissionable, and many agents are finding it harder than ever to grow.

That’s why Agent Boost Marketing exists—one of the largest and fastest‑growing FMOs in the country specializing in Medicare, ACA, and Ancillary products. We help agents offer value and expertise to their clients and develop multiple streams of revenue.

🎓 Free, In‑Person Agent Trainings

These trainings are open to all agents and agency owners, and you do NOT need to be affiliated with Agent Boost to attend. We focus on high‑quality, in‑person learning, hands‑on workshops, group dinners, and a group activity to network and build relationships.

Over 80% of agents who attend become high‑performing agents or agency owners within the same year.

👉 Register here: https://www.agentboost.com/events

🔥 2‑Day Training: Become an ELITE Agent in 2026

Join us for immersive training covering key industry insights, critical business skills, and what top agents are doing right now to write high‑volume, high‑quality business.

🏢 For Agency Owners: The Accelerator Masterclass Workshop

Join Dan and Mike Hardle for a powerful two‑day workshop on starting, scaling, and elevating your agency. Learn how Agent Boost Marketing was built and had one of the largest Health FMO acquisitions in the recent years, and what it takes to grow—and eventually sell—your agency. Perfect for current or aspiring agency owners.

🎙️ Don’t Miss Our Weekly Podcast

Subscribe to the Agent Boost Marketing Podcast—one of the most popular insider sources for industry breakdowns, up‑to‑date news, and real talk about what’s happening in the health insurance industry.

What MMI + Subscribers read this week…

👉 Join before March 5th and get 25% off your first 12 months — $75/month instead of $100.

This special AEP Results discount ends March 5.

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: