Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - C-SNP Continues to Surge in 2025 🚀

Sponsor Snapshot 🚀 - brought to you by Telos Actuarial

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Most Medicare Advantage Markets are Dominated by One or Two Insurers - (link)

CMS proposes 3.6% pay bump for docs, takes aim at chronic conditions in physician fee schedule - (link)

How the One Big Beautiful Bill Will Impact Your Clients: What Agents and Advisors Need to Know - (link)

A Closer Look at the $50 Billion Rural Health Fund in the New Reconciliation Law - (link)

Joint Health and Oversight Subcommittee Hearing on Medicare Advantage: Past Lessons, Present Insights, Future Opportunities - (link)

Medicare Supplement Rate Actions – 2025 Q3 Update - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

C-SNP Continues to Surge in 2025 🚀

Last week our deep dive gave an update on D-SNP enrollments (read it here).

While D-SNP growth has cooled, the C-SNP market is growing fast - rapidly expanding access for beneficiaries with complex chronic needs and reshaping the competitive MA landscape.

(Note: Chronic Condition Special Needs Plans (C-SNPs) serve Medicare beneficiaries with qualifying chronic conditions like diabetes, cardiovascular disorders, and certain autoimmune diseases — an often underserved segment of the MA market.)

So far in 2025, the D-SNP market has grown 2.4% (Dec. ‘24 - July ‘25), down from 5.2% last year (Dec. ‘23 - July ‘24), and 19.4% the prior year (Dec. ‘22 - July ‘23).

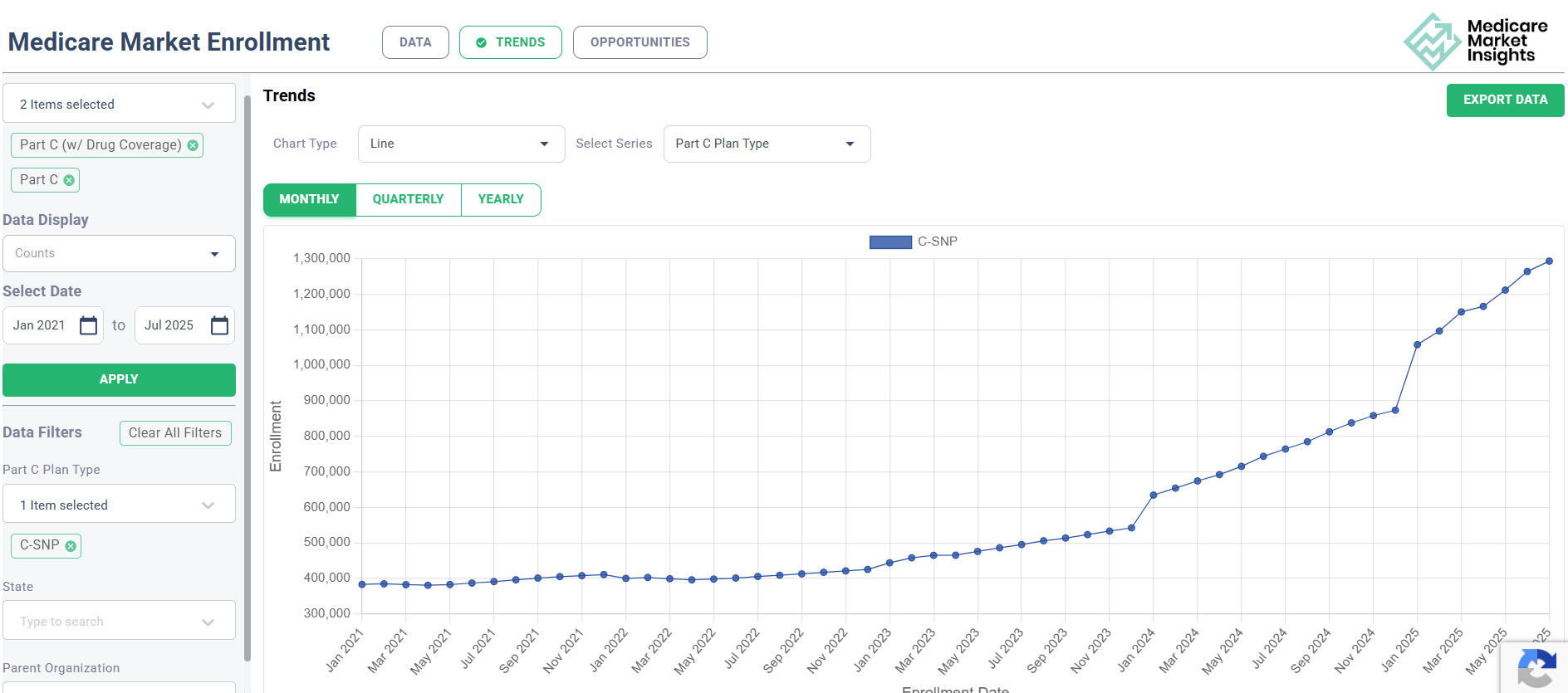

At the same time, the C-SNP market has grown 48% (Dec. ‘24 - July ‘25), up from 41% last year (Dec. ‘23 - July ‘24), and 16.5% the prior year (Dec. ‘22 - July ‘23).

source: MMI+ MA Web App

You can see the large increase in enrollment during AEP, and then the continued surge throughout 2025.

—

Where did the C-SNP Growth Happen?

C-SNP By State

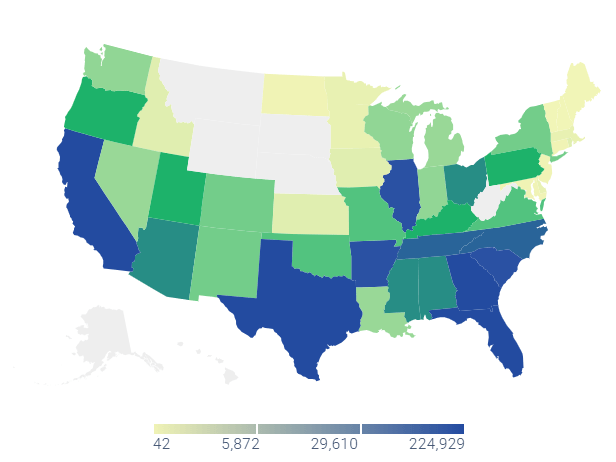

First of all, not every state has C-SNP enrollment. In the map below, the grey states have no recorded enrollment.

(Note: CMS data excludes counties with fewer than 11 enrollees, so some states may have small but unreported enrollment.)

source: MMI+ MA Web App

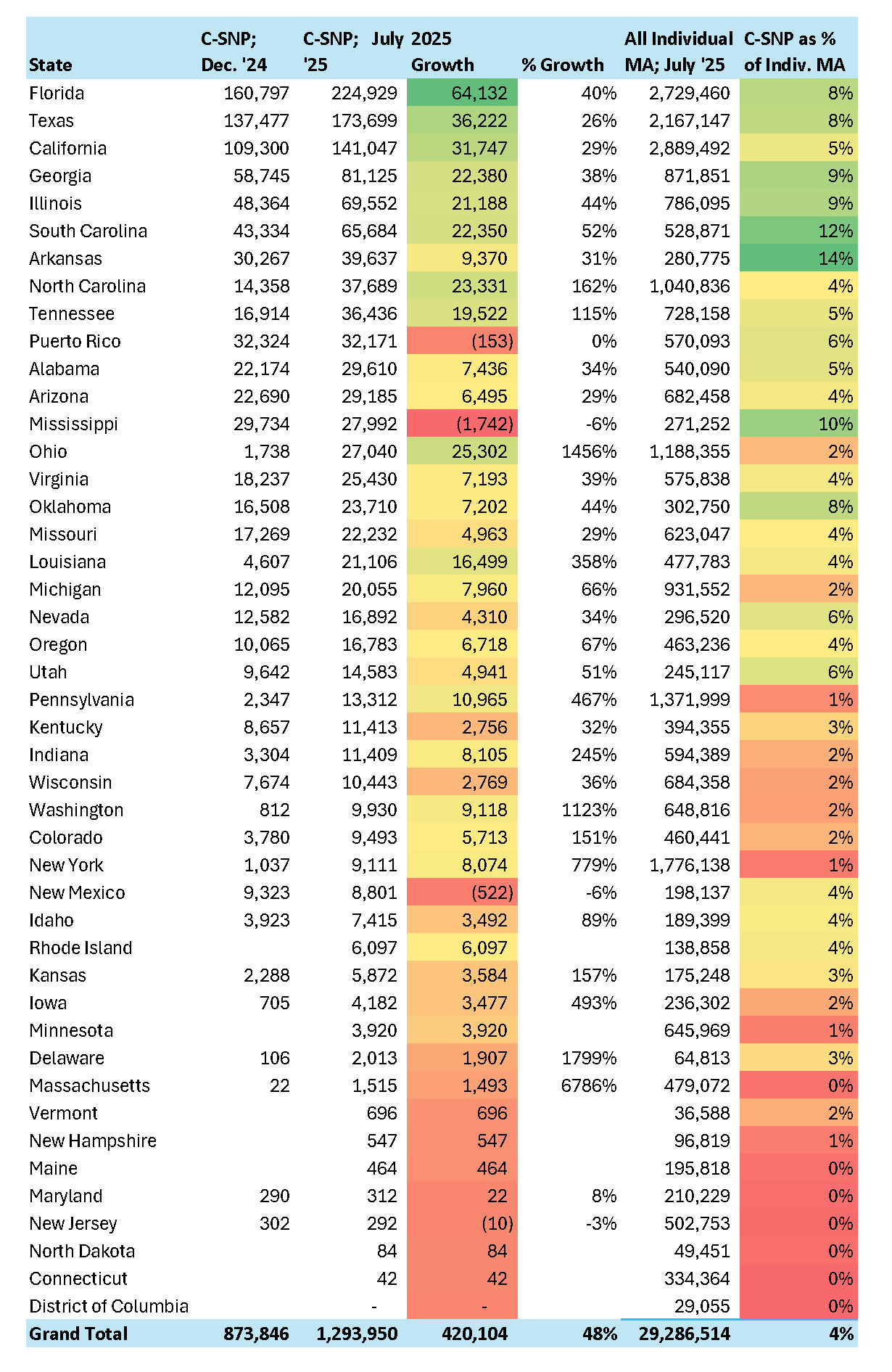

Below is the C-SNP enrollment growth from Dec. 2024 to July 2025.

Source: data pulled from MMI+ MA Web App

Key Insights:

Large MA states (Florida, Texas and California) continue to lead the market in C-SNP enrollment and have all seen impressive growth in 2025

Opportunities? New York, Pennsylvania, Ohio and Michigan. Large MA populations with minimal C-SNP enrollment, suggesting untapped market potential. This is true even after seeing explosive growth so far in 2025.

C-SNP Penetration Rate: Nationwide penetration has grown to 4.4%, and Arkansas reached 14%, showing the high potential.

💥 If all states were at 14%, the C-SNP market would be 4 million (nearly 4x current)!

__

Carrier Level C-SNP Trends

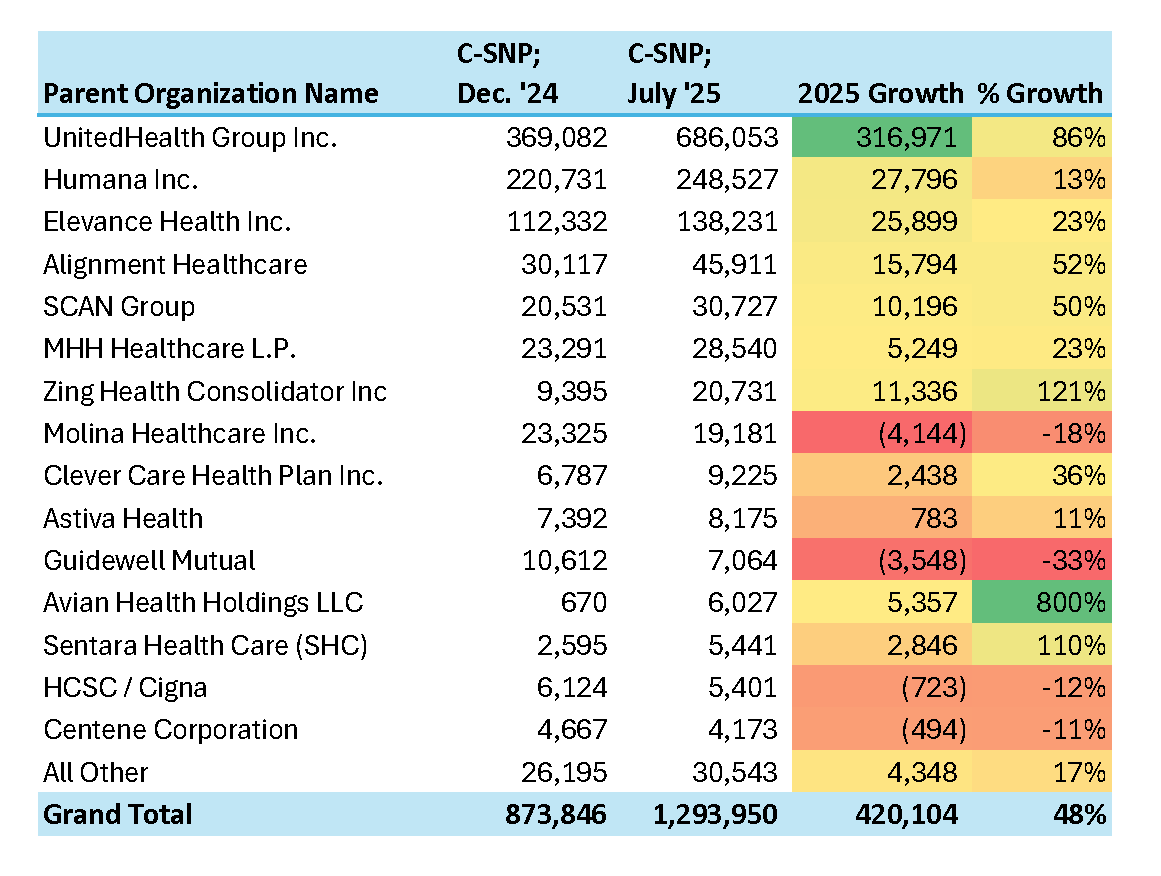

UnitedHealth Group has dominated C-SNP enrollment growth in 2025. But several smaller regional carriers also stand out.

Key Insights:

United led growth and has been the clear leader in expanding C-SNP nationwide.

Humana and Elevance round out the top 3 but have grown slower than the overall C-SNP market.

Alignment, SCAN, Zing, Avian and Sentara all grew at a faster rate than the overall market.

—

Final Observations

While United has dominated the C-SNP growth, it’s worth mentioning that each state is it’s own unique market.

There are some C-SNP State markets that still only have one Carrier with enrollment.

→ 13 states only have one Carrier with Enrollment

For Example:

AL → 30,000 C-SNP enrollees; 100% UnitedHealth Group

UT → 14,500 C-SNP enrollees; 100% UnitedHealth Group

NJ → 300 C-SNP enrollees; 100% Elevance

Note: In most of the 13 states, United is the only Carrier with enrollment

Other states where there are a number of Carriers, but 1 dominates…

For Example:

TX → 174,000 C-SNP enrollees; 81% United, 14% Humana, 2% Elevance

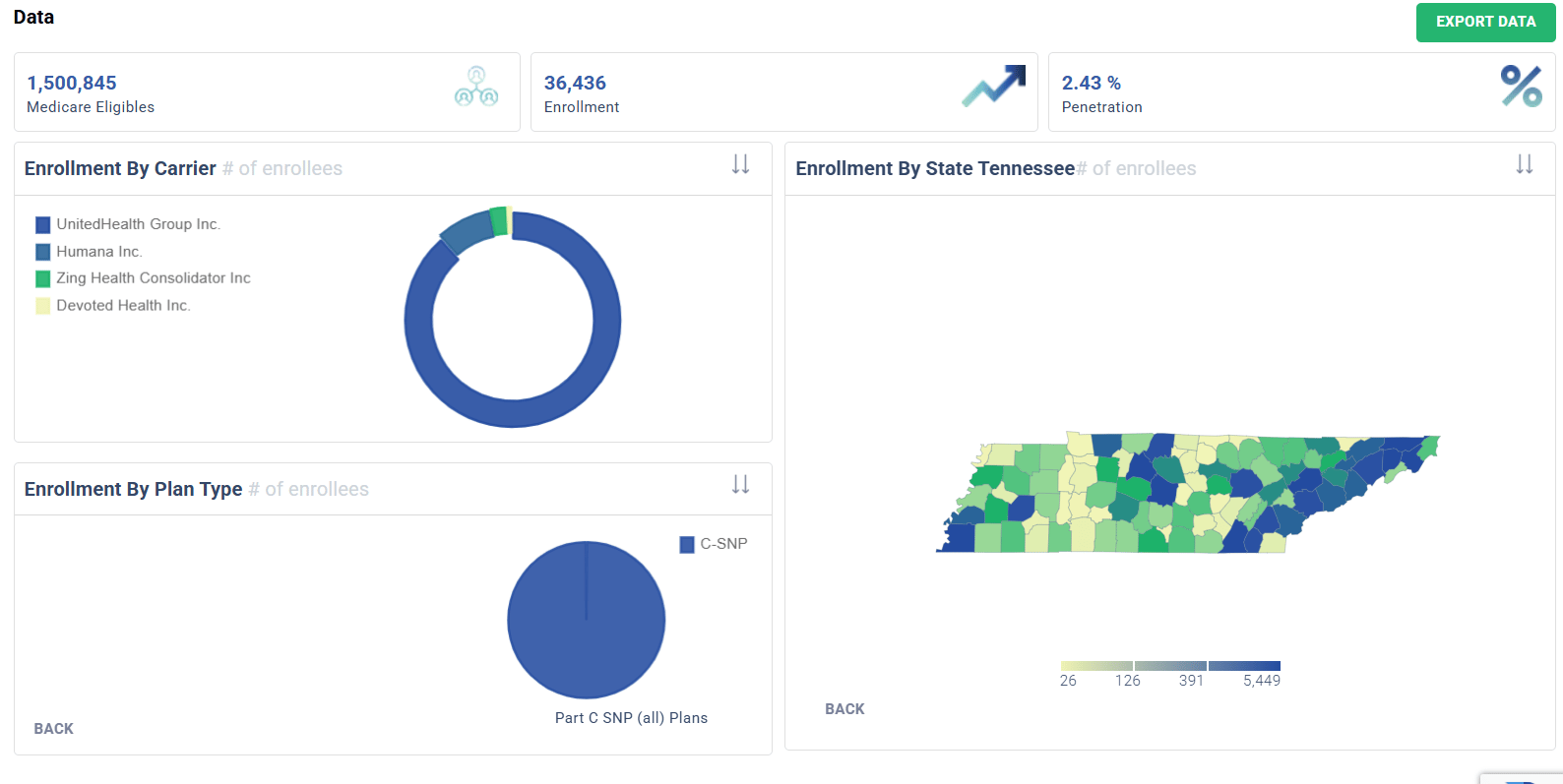

TN → 36,000 C-SNP enrollees; 88% United, 8% Humana, 3% Zing

source: MMI+ MA Web App

And a few “mature” markets where there are a number of Carriers with significant share…

For Example:

CA → 141,000 C-SNP enrollees; 29% Alignment, 21% SCAN, 14% Molina, 13% United

FL → 225,000 C-SNP enrollees; 49% Elevance; 34% Humana, 13% UnitedHealth

__

The C-SNP market continues to expand much faster than the overall Medicare Advantage market.

With only 4.4% penetration nationwide, C-SNPs remain one of the least saturated — but fastest-growing — opportunities in Medicare Advantage.

Expect this segment to be a key battleground heading into 2026.

SPONSOR SNAPSHOT 🚀: Telos Actuarial

The Medicare program currently serves 67.6 million beneficiaries with that number expected to grow to 80.5 million by 2034. Medicare supplement insurance will continue to be a popular option for a significant portion of these beneficiaries in providing health insurance benefits.

After several years of sizable decreases in Medicare Supplement enrollments, the decline slowed in 2024. It is projected that enrollments will return to grow in future years, creating robust opportunities in the Medicare Supplement market.

Download our updated free white paper “The Future of Medicare Supplement - 15th annual Market Projection” below.

What MMI + Subscribers read this week…

COMPLIANCE CHATTER 📢

Check out this month’s Insurance Regulatory Insights newsletter.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: