- Medicare Market Insights

- Posts

- D‐SNP Enrollment Trends: Mid-Year 2025 Update

D‐SNP Enrollment Trends: Mid-Year 2025 Update

A look at D-SNP enrollment trends in 2024 and 2025.

This week’s newsletter is Sponsored By: Medicare Market Insights +

Get Members only Content + Medicare Advantage Enrollment Insights web app → (Learn More)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - D‑SNP Enrollment Trends: Mid-Year 2025 Update

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights +

Compliance Chatter 📢 - Several new regulations to review!

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Dual eligibles more likely to stay in MA plans catered to them, research reveals - (link)

The Medicare Shift: Navigating Senior Care Stocks in a New Era of Healthcare Costs and Policy - (link)

How Medicare Advantage Is Hurting Workers - (link)

Trump’s Sneak Attack on Medicare - (link)

Alignment Health notches partial win in Star Ratings challenge - (link)

Senior Market Sales® (SMS) Acquires MIC Insurance Services - (link)

Dr. Boris Vabson on Medicare Advantage Reform: From Soviet Union to CMMI Major Policy Change - (link)

Proposed Law Would Mandate Automatic Enrollment Into Medicare Advantage - (link)

Agent Boost Marketing Joins Forces with AmeriLife’s Senior Market Advisors - (link)

Jared’s recent LinkedIn posts:

FIDE D-SNP have better retention than other D-SNPs. - (link)

DEEP DIVE 📚

D‑SNP Enrollment Trends: Mid-Year 2025 Update

Earlier this year we took a look at D-SNP Enrollment trends during 2024.

As we discussed then, the D-SNP market was anticipating changes to special enrollment periods.

I won’t go into the details here. You can go read our previous deep dive instead. (D-SNPs and C-SNPs: What’s changing for AEP 2025 🔍).

But, as a reminder:

Before 2025: D-SNP members had a quarterly SEP, allowing them to switch plans every three months.

Starting in 2025: D-SNPs will no longer have a quarterly SEP. Instead, a monthly SEP will apply, but only for a limited subset of D-SNP members.

As a result, many are anticipating fewer sales opportunities and improved retention in the D-SNP market.

[Note: A recent study by JAMA supports the idea the FIDE D-SNPs have better retention than other types of D-SNPs (link).]

Our previous analysis of the 2024 enrollment trends revealed that there was:

Higher mid-year switching between carriers - While total D‑SNP enrollment remained broadly stable from March through December, individual carriers saw significant month-to-month fluctuations—some gaining and others losing thousands of members—indicating that enrollment changes were mostly driven by plan-to-plan switching rather than new members

D‑SNP enrollment was markedly more volatile than non-SNP plans - Compared to Individual Non‑SNP plans, which saw much steadier enrollment, D‑SNP plans experienced notably larger month-over-month percentage changes—further evidence of higher switching rates among dual-eligible plan members

—

Now that the new SEP rules have been in place for a few months, what does the enrollment data show us so far in 2025?

Have trends in switching between carriers slowed?

—

No Evidence of less switching. So Far.

Since the data we have access to only reports total enrollment counts by month at the Contract, State, Plan, County level, and not at the individual member level there is no exact way of calculating sales and lapses. They are all mixed together in one number.

But by observing month-over-month changes per carrier, we can get a strong indication of switching activity.

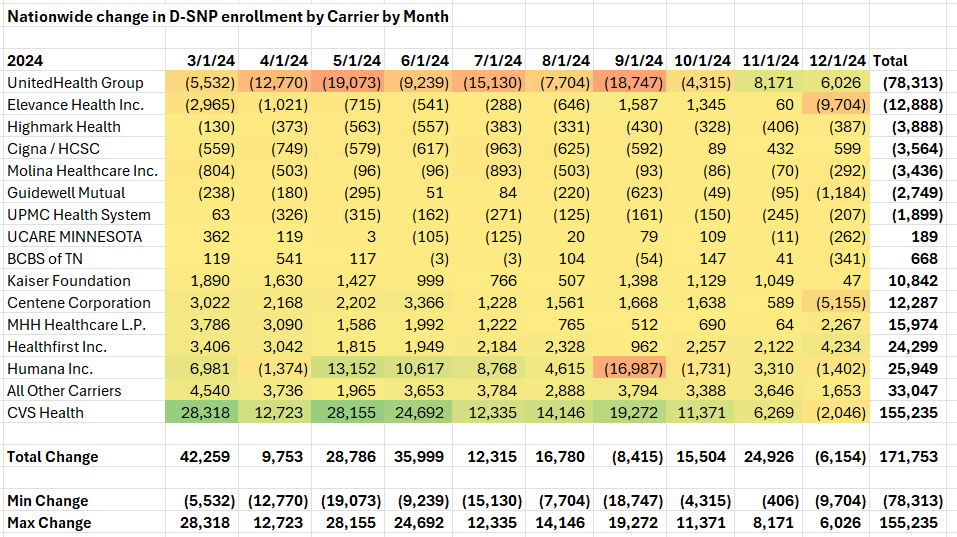

The table below displays month-over-month enrollment changes by carrier, highlighting which plans gained and lost the most members:

Here’s 2024:

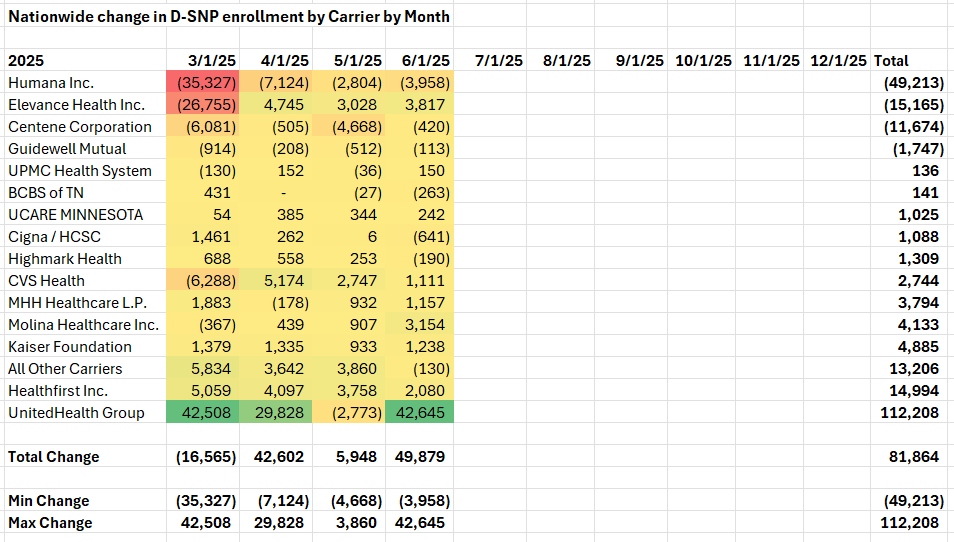

And here is 2025 (so far):

So far, similar observations can be made about the 2025 trends. While the overall change in D-SNP enrollment is minimal, some carriers increase substantially while others decrease substantially.

Some of this could simply be switching related to the HIDE/FIDE rules. Are enrollees moving into HIDE/FIDE plans where they are available resulting in a lot of initial switching?

—

D-SNP vs. Individual Non-SNP

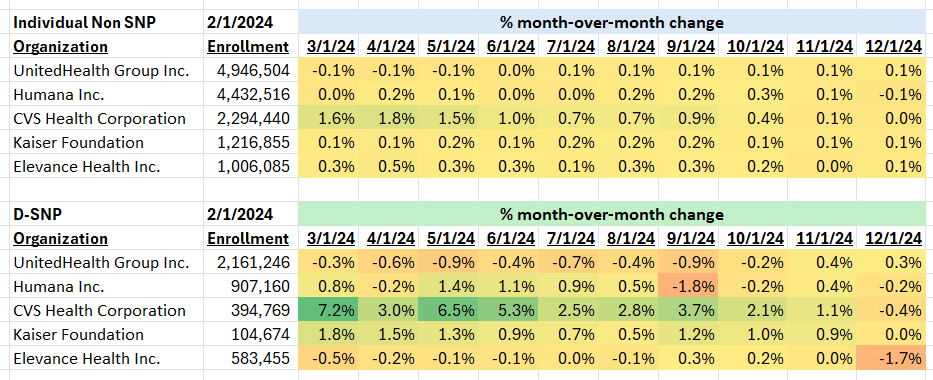

📉 Individual Non-SNP plans are far more stable. When comparing D-SNPs to Individual Non-SNP plans, the latter sees lower volatility in enrollment, implying less frequent switching compared to D-SNPs.

One way of observing this is to look at the % change in enrollment each month. In particular, comparing Individual Non SNP to D-SNP for the same Carriers.

Here is 2024:

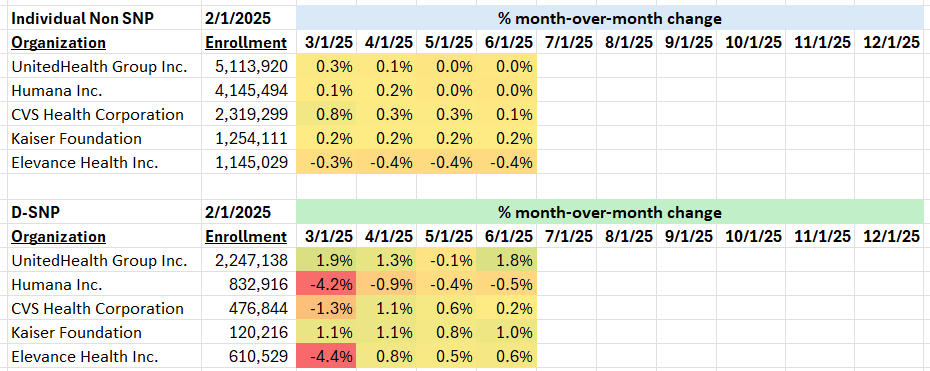

and here is 2025 (so far):

Again, there is no clear indication of less volatility in enrollment changes in 2025 for D-SNPs.

—

Big Beautiful Bill and D-SNPs

It’s worth noting that while much of this analysis has focused on short-term volatility in D‑SNP enrollment, there are also longer-term headwinds.

One of the most significant is a set of Medicaid-related funding changes proposed in federal budget legislation— the “Big Beautiful Bill”. According to the Congressional Budget Office (CBO), provisions in the bill would reduce federal Medicaid spending, resulting in approximately 1.3 million fewer D‑SNP enrollees by 2034.

See KFF’s write up here (link).

For context: As of now, there are about 6.1 million D‑SNP enrollees nationwide, so the projected decline would represent over 20% of the market.

It will be important for Carriers and Distributors to consider all of this in their D-SNP sales and retention strategies going forward.

While it’s anticipated D-SNP will experience improved retention (though no clear evidence of that yet as we’ve established above), the reduction in Medicaid may actually result in an increase in lapses over the coming years.

SPONSOR SNAPSHOT 🚀: Medicare Market Insights +

What is Medicare Market Insights - Plus?

1) Medicare Advantage Insights Web Application tool.

2) Members-Only Content

All the moving pieces in the Medicare market result in opportunities!

Opportunities for you to help numerous consumers.

Opportunities for distributors to grow books of business.

Opportunities for Carriers to add new members.

Opportunities for Investors to invest in companies solving problems in the changing Medicare space.

What are you going to do to take advantage?

Stop guessing. Start making informed decisions.

What MMI + Subscribers read this week…

How was today's newsletter? |

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)