This week’s newsletter is Sponsored By: 2024 Medicare Enrollment State Pages

Purchase Here → (link)

OR get it for free by referring One Person to MMI! Scroll down to the Sponsor Snapshot🚀 for more info.

Here is what you’ll find in this week’s newsletter!

Important links 🔗- the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive📚 - UnitedHealth Group - Q2 2024 Results 🩺

Compliance Chatter📢 - CMS’ Part Two Final Guidance on the Medicare Prescription Drug Plan

Sponsor Snapshot 🚀 - brought to you by the 2024 Medicare Enrollment State Pages

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

15 health systems dropping Medicare Advantage plans 2024 - (link)

Medicare Advantage Beneficiaries Less Likely to Receive Aggressive End-of-Life-Care - (link)

Big Insurers UnitedHealth, Elevance Ride Out Medicare Advantage Storm - (link)

HealthCheck, Summer 2024 I American Academy of Actuaries - (link)

Medicare coverage to change for millions under new proposal - (link)

Humana invests in Medicare choice tool Healthpilot - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

UnitedHealth Group - Q2 2024 Results 🩺

When it comes to companies focused on the Medicare market, UnitedHealth Group (NYSE: UNH) is the giant in the room.

But, they didn’t hit the scene overnight.

It’s been a long consistent growth over time, combined with vertical integration, that has resulted in their dominance.

A few weeks ago, UNH released Q2 ‘24 financials (see my LI post for some quick stats).

In this week’s deep dive, we are analyzing Quarter 2 results over the past 6 years to better understand recent trends. (We analyzed Q1 here, and full year results here)

Before we get to the numbers it’s important to understand UNH’s two main business units, UnitedHealthcare and Optum.

UnitedHealthcare is an insurance carrier, providing health insurance benefits. They collect premiums, pay health insurance benefits, and make a profit on what’s left over.

Optum is (for the most part) a healthcare provider. This includes doctors, hospitals, value-based care clinics, technology and pharmacies. They receive revenues via health insurance benefits, pay expenses associated with running health provider systems, and make a profit on what’s left over.

This is what is called vertical integration!

Okay, now let’s look at some numbers.

Membership

Surprisingly, overall membership growth has been very modest over the last 6 years.

Q2 ‘18 membership: 48.83 million

Q2 ‘24 membership: 50.42 million

Overall Growth: 3%

% Change (current yr.): -4.6%

% Change (prior yr.): 3.1%

CAGR (“Compound Annual Growth Rate”): 0.5%

The largest membership segment is their Commercial line. 2024 results show a significant uptick in growth after being mostly flat for several years. Likely due to growth in both Group business due to Humana exiting, and overall market growth in ACA business.

UNH is the market leader in the Medicare Supplement market, but the membership in that line of business has been in slight decline over the last several years. Q2 2024 saw a slight lift YoY (“Year over Year”).

The Medicaid line saw significant decline YoY. The decline is likely due to Medicaid “unwinding”.

The Medicare Advantage line has seen significant growth over the last 6 years. 2024 growth slowed significantly compared to 2023, and compared to the past 6 year CAGR (“compound annual growth rate”).

Revenues

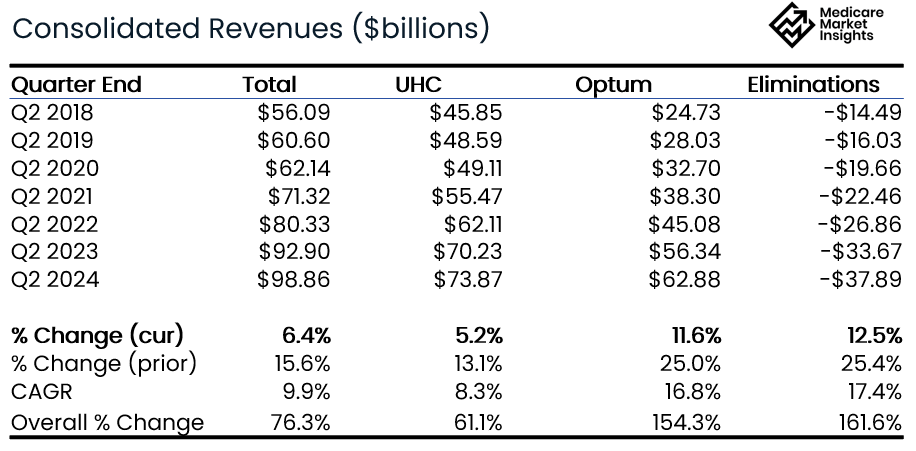

UNH reports revenues by vertical (UnitedHealthcare and Optum), and provides further details within each vertical. In addition, “eliminations” are reported in order to remove revenues that Optum receives from UnitedHealthcare (can’t count that revenue twice).

UnitedHealthcare Q2 Revenues (the insurance Carrier segment) have grown steadily over the past 6 years.

Q2 ‘18 Revenues: $45.85 billion

Q2 ‘24 Revenues: $73.87 billion

Overall Growth: 61%

% Change (current yr.): 5.2%

% Change (prior yr.): 13.1%

CAGR: 8.3%

The largest segment is the Medicare & Retirement segment. The 7.6% YoY growth in Q2 2024 was down compared to the prior year and also below the CAGR.

All segments saw lower revenue growth in Q2 2024 compared to both the prior year and the CAGR.

Optum Q2 Revenues (the healthcare provider segment) have grown 2.5x over the past 6 years.

Q2 ‘18 Revenues: $24.7 billion

Q2 ‘24 Revenues: $62.9 billion

Overall Growth: 154%

% Change (current yr.): 11.6%

% Change (prior yr.): 25.0%

CAGR: 16.8%

While Optum continued to grow significantly, all segments saw lower revenue growth in Q2 2024 compared to the prior year and all but Optum Rx were lower than the CAGR.

Combining UnitedHealthcare, Optum, and including eliminations, results in the company’s Total Consolidated Q2 Revenues.

Q2 ‘18 Revenues: $56.09 billion

Q2 ‘24 Revenues: $98.86 billion

Overall Growth: 76%

% Change (current yr.): 6.4%

% Change (prior yr.): 15.6%

CAGR: 9.9%

As you can see, revenue eliminations have grown steadily over the past 6 years, and has grown faster than overall top line revenue.

This indicates there is more vertical integration today than there was 6 years ago.

More of the insurance company benefit expense is going to Optum providers and pharmacies as revenue. (Since they already recognized the revenue in the insurance company, they can’t also recognize it as revenue in the provider company.)

Operating Income

The combined UnitedHealth Group’s Q2 Operating Income has grown steadily over the past 6 years.

Q2 ‘18 Operating Income: $4.20 billion

Q2 ‘24 Operating Income: $7.88 billion

Overall Growth: 87%

% Change (current yr.): -2.3%

% Change (prior yr.): 13.0%

CAGR: 11.0%

Q2 Operating Income was down 2.3% YoY, far off the prior year growth (13.0%) and lower than the CAGR (11.0%).

Impacted by the Change Healthcare cyber attack and continued higher loss ratios. UNH estimates the total cyberattacks impact to be $1.1 billion during Q2, and $1.9 billion YTD.

Medical Loss Ratio

The Medical Loss Ratio has been a major topic point in the Medicare industry over the past year with most companies reporting higher utilization in Medicare products resulting in higher loss ratios.

You can see in the chart below that the Q2 2024 loss ratio of 85.1% is the highest reported over the prior 6 years.

Bottom Line

Medicare Advantage membership growth slowed in 2024 while Commercial saw a significant increase.

Overall Revenue growth slowed during Q2 2024 for all segments.

Overall profitability took a hit with a decrease in Operating Income for Q2 2024 compared to Q2 2023. With that said, the 8.0% profit margin continues to be healthy.

The company made no predictions on upcoming AEP growth, but mentioned being comfortable with their MA bid pricing approach.

The loss ratio continues to be elevated compared to recent history and continues to be something to watch.

Sources: Company Quarterly Earnings Releases

Sponsor Snapshot🚀: Telos Actuarial

This ebook presents Medicare enrollment statistics for all 50 States in colorful data visuals.

It includes Medicare Advantage enrollment, Medicare Supplement enrollment, Top Carriers in each state, Market Penetration, and more.

Or get it for free by referring one person (click below).

COMPLIANCE CHATTER 📢:

CMS recently issued Final Part Two Guidance on the Medicare Prescription Drug Plan.

Changes and clarifications from the Draft Part Two Guidance include:

Part D plans that exclusively charge $0 cost sharing for covered Part D drugs to all plan enrollees are not required to offer enrollees the option to pay their OOP costs through monthly payments or otherwise comply with the final part one or two guidance;

Part D sponsors may choose to either send a program election request form with the membership ID card mailing or separately in a different mailing sent out within the same timeframe

Part D sponsors must develop their own strategies for ongoing outreach during the plan year to enrollees who are likely to benefit from the program;

Provides CMS-developed model communication materials that Part D sponsors must send to enrollees regarding election into, participation in, and termination from the program;

Part D sponsors may only include the participant’s original Part D cost sharing in the Medicare Prescription Payment Plan, as determined by their plan-specific benefit structure, in situations where a supplemental payer to Part D returns a higher final patient pay amount to the pharmacy, and

Part D plan sponsors should require long-term care pharmacies to provide notice to the enrollee at the time of its typical enrollee cost-sharing billing process.

You can receive weekly regulatory updates like these by subscribing to our Insurance Regulatory Insights newsletter.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: