This week’s newsletter is Sponsored By: Modivcare

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - Medicare Advantage (Part C) 101

Compliance Chatter 📢 - D-SNP proposed rule for 2025.

Sponsor Snapshot 🚀 - brought to you by Modivcare.

Data Visual of the week 📊 - Data Visual highlighting MA Penetration over time.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

Alignment Healthcare Delivers 44% Year-Over-Year Membership Growth - (link)

JPM24: How Aetna charted a comeback in the 2024 MA star ratings - (link)

Molina Healthcare Announces the Closing of its Acquisition of Bright Healthcare’s California Medicare Business - (link)

Elevance Health sues HHS over Medicare Advantage star ratings changes - (link)

Editor's Corner—Fierce Health Payer's top 10 stories of 2023 - (link)

AGILON’S NO GOOD, VERY BAD START TO 2024 - (link)

Medicare Supplement Broker Incentives- 2023 Q4 Review - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

A+B=C? : Medicare Advantage (Part C) 101

Last year, we looked at Parts A and B of original Medicare including its history, administration, eligibility, coverage, enrollment statistics, and how it is funded.

This week’s deep dive is going to continue through the Medicare alphabet by looking at Part C.

Part C is more commonly known as a Medicare Advantage (MA) Plan. Medicare Advantage (MA) plans are offered by private companies who have been approved by Medicare.

MA plans provide a beneficiary’s Part A and Part B coverage, instead of original Medicare, and may offer additional benefits.

Medicare will pay a fixed amount every month to the companies offering MA plans. In addition, companies can earn additional amounts from Medicare through risk adjustment and bonus payments. These companies must follow rules set by Medicare and meet minimum loss ratios and quality standards.

Each MA plan can charge different out-of-pocket costs and have different rules for how beneficiaries receive services – like requiring referrals or pre-authorizations. These rules can change each year along with benefits and coverage amounts.

Companies can make plans available in an entire state or only in certain counties. They can also offer multiple plans in an area – with different benefits & different beneficiary costs.

Let’s take a few steps back from this current MA plan overview and dive into the history of Part C.

History

The history of Part C begins shortly after the inception of the original Medicare program in 1965.

From the early 1970s to the late 1990s, Medicare contracted with some health maintenance organizations (HMOs) to provide Part A and Part B coverage for beneficiaries. HMOs were paid a monthly fee per member and could elect a risk sharing or non-risk sharing contract option.

Legislation changes during these years focused on refining risk sharing payment models, increasing Medicare cost savings, and reducing overpayment rates to HMOs. Starting in the early 1980s, plans were required to use any overpayments from Medicare to fund additional health benefits – a feature that remains present and popular in today’s plans!

“Part C” was officially created as part of the Balanced Budget Act of 1997. The Act created an annual enrollment period, further refined risk sharing payment models, and introduced new types of private plans:

preferred-provider organizations (PPOs)

provider-sponsored organizations (PSOs)

private fee-for-service (PFFS) plans

and high deductible health plans with medical savings accounts (MSAs)

In 2003, Part C was renamed Medicare Advantage under the Medicare Prescription Drug, Improvement, and Modernization Act of 2003 (MMA). This legislation also created the bid system utilized today that carriers use to submit plans to the Centers for Medicare & Medicaid Services (CMS) for review and approval each contract year. Finally, this act introduced two new types of plans:

regional preferred provider organizations (RPPOs)

and special needs plans (SNPs)

Benefits & Costs: Original Medicare vs Medicare Advantage

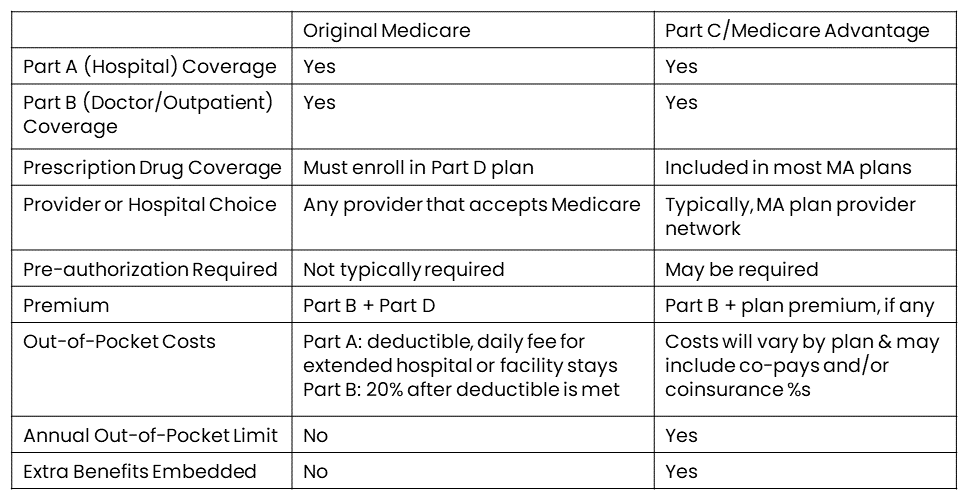

A comparison of beneficiary benefits and costs associated with original Medicare and MA plans is detailed in the table below.

Generally, a beneficiary will pay higher monthly Medicare premiums but typically pay less for health services with original Medicare; they’ll pay lower (or no!) monthly MA premiums but could pay more for health services depending on copays and coinsurance amounts for their MA plan.

Types of Plans

Next, let’s look at the different types of Part C/Medicare Advantage plans that carriers may offer.

Health Maintenance Organizations (HMOs)

HMO plans have a network of providers and hospitals available to beneficiaries. There may be coverage for services out-of-network, although at an increased copay or coinsurance amount. Beneficiaries are required to coordinate care through their primary care doctor if specialist care is required.

Preferred-Provider Organizations (PPOs)

PPO plans have a network of providers and hospitals available to beneficiaries. There may be coverage for services out-of-network, although at an increased copay or coinsurance amount. Specialized care can be sought without a referral from a primary care doctor.

Medicare Medical Savings Account Plans (MSAs)

This type of plan provides coverage after a high annual deductible is met. It also includes a special type of savings account, funded by the plan, that beneficiaries can use to pay for health care costs.

Private Fee-For-Service Plans (PFFS)

This type of plan sets how much it will pay providers and hospitals, and how much beneficiaries must pay for care. Beneficiaries can receive care from any provider or hospital that has accepted the plan’s payment terms. PFFS plans may also allow “balance billing” where the beneficiary may be responsible for an additional charge if the provider’s fee is higher than the payment from Medicare.

Special Needs Plans (SNPs)

Special Needs Plans provide tailored benefits and services to people with specific diseases, certain health care needs, or who also have Medicaid coverage.

Plan Star Ratings

CMS publishes MA Star Ratings each year to measure the quality of health and drug services received by consumers enrolled in MA plans.

For Individuals –

The Star Ratings system helps beneficiaries compare the quality of Medicare health and drug plans being offered so they are informed and empowered to make the best health care decisions for them.

For Companies –

Depending on their overall star rating, MA organizations may receive bonus payments and rebates. The higher the rating, the greater possible bonus payment or rebate.

On the other hand, regulations also give CMS the option to terminate contracts with plans that fail to achieve at least 3 stars for three consecutive years.

Find out more about Star Ratings here (link).

Enrollment Statistics

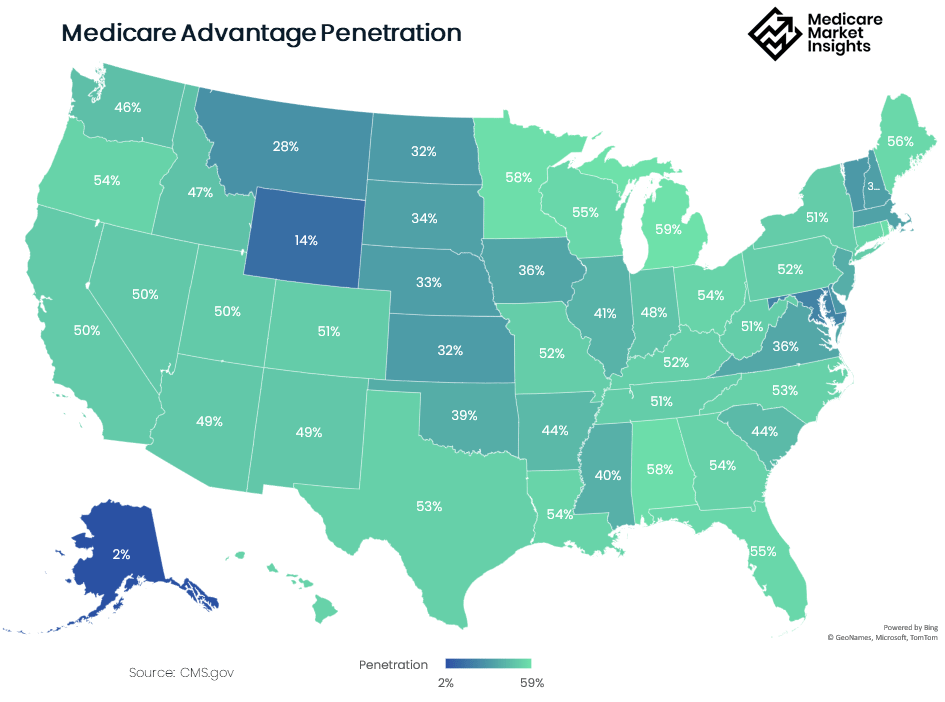

Over the past decade, enrollment in Part C has shown significant growth, from just 19% of the total Medicare beneficiary population in 2007 to 51% of beneficiaries in 2023. The Congressional Budget Office (CBO) projects that the share of all Medicare beneficiaries enrolled in MA plans will rise to 62 percent by 2033!

(see data visual of the week below for MA penetration over time)

There are several factors that contribute to the popularity of MA plans including:

Additional benefits included (like prescription drugs, vision, dental) that aren’t part of original Medicare

Low (or no!) premium

No underwriting requirements

Annual enrollment windows to easily change plans

New and creative supplemental benefits (fitness, meal delivery, caregiver support, telemedicine)

Heavy marketing by companies and distribution channels

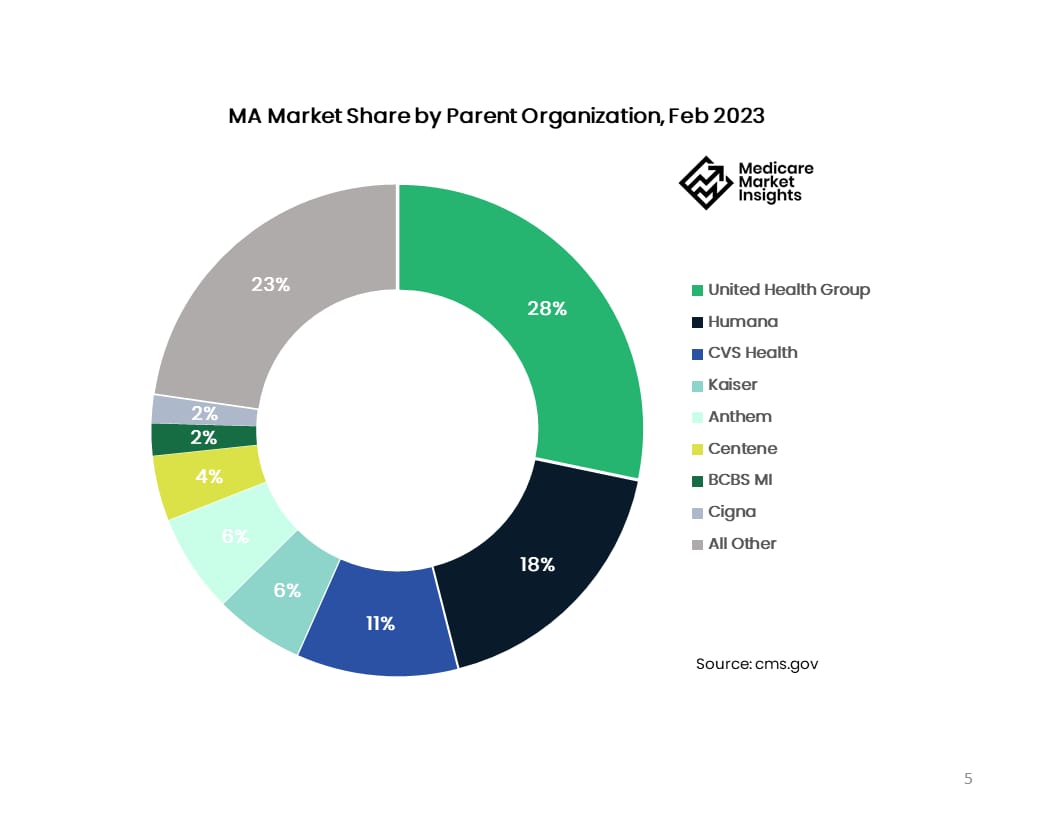

It’s no secret that the MA market is dominated by a few large companies. United Health Group, Humana, and CVS Health comprise over half the market share.

It’s important to note in our overview that MA popularity does vary significantly by state and county. Many counties with high MA penetration rates are centered around relatively large, urban areas whereas counties with low MA plan enrollment tend to be less populated or rural areas. The map below shows MA penetration rates out of total eligible beneficiaries by state.

That completes our first look into Part C! Now you’re up to speed on the basics of MA plans. Keep an eye out for future deep dives into the MA world.

If you can’t wait for the next installment, feel free to check out these prior deep dives related to MA plans!

Sources:

COMPLIANCE CHATTER 📢:

On November 11, 2023, CMS introduced a Proposed Rule for Contract Year 2025 plans, that includes regulatory changes to D-SNP plans. CMS has acknowledged that many D-SNP plans do not meaningfully integrate Medicare and Medicaid care, mainly because the D-SNP carrier does not also provide the enrollee’s Medicaid services. The proposed rule focuses on increasing enrollment in D-SNP types (FIDE and HIDE) that more meaningfully integrate Medicare and Medicaid services by:

replacing the current quarterly special enrollment period (SEP) with a monthly SEP for dual and other LIS eligible individuals to elect a standalone PDP,

creating a new monthly SEP allowing dually eligible individuals to elect an integrated D–SNP,

limiting enrollment in certain D–SNPs to individuals also enrolled in an affiliated Medicaid MCO (beginning plan year 2027),

requiring integrated D-SNPs to disenroll individuals who are not enrolled in both the D–SNP and Medicaid MCO offered under the same MA or parent organization (beginning plan year 2030), and

limiting the number of D–SNPs an MA or parent organization can offer in the same service area as an affiliated Medicaid MCO to reduce “choice overload” of D–SNP options.

Want to learn more about the D-SNP market? Check out our recent deep dive here.

If you would like to learn more about our compliance services, reach out to [email protected].

Sponsor Snapshot 🚀: Modivcare

Modivcare helps enhance supplemental benefits that matter to your Medicare Advantage & SNP members.

Transportation,

In-Home & Personal Care,

Virtual & Remote Care Management,

Health Risk and SDOH Survey Capture

Learn more here → (click)

DATA VISUAL of the Week 📊

This week’s data visual comes from kff.org! It shows MA penetration over time.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: