This week’s newsletter is Sponsored By: 2024 AEP Medicare Advantage State Deep Dives

221 page eBook (by Medicare Market Insights) full of Medicare Advantage AEP 2024 enrollment statistics for each State.

Get your copy now - > (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - AEP 2024 → Medicare Advantage Enrollment Growth (Part 2) 🚀

Compliance Chatter 📢 - Release of final Part One guidance for the Medicare Prescription Payment Plan by CMS.

Sponsor Snapshot 🚀 - brought to you by 2024 AEP Medicare Advantage State Deep Dives.

Data Visual of the week 📊 - Data Visual highlighting enrollment distribution by Star Rating.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

5 Trends Driving Medicare Advantage Enrollment in 2024 - (link)

Increased Medicare Advantage utilization likely credit neutral, finds Fitch - (link)

HHS Statement Regarding the Cyberattack on Change Healthcare - (link)

Whistleblower Accuses Aledade, Largest US Independent Primary Care Network, of Medicare Fraud - (link)

US Fire Will Be Exiting the Medicare Supplement Market April 2024 - (link)

5 Best Medicare Supplement Providers For 2024 - (link)

Jared’s recent LinkedIn posts:

Why did Aetna "win" AEP? Here is what agents say... - (link)

Alignment Health (ALHC) - an MA Carrier - reported Q4 2023 recently. - (link)

A few states overperformed during AEP, while a few underperformed. Who are they? - (link)

DOJ is investigating UnitedHealth Group. - (link)

PPO plan type enrollment increased ~843,000 during AEP (6% increase). - (link)

DEEP DIVE 📚

AEP 2024 → Medicare Advantage Enrollment Growth (Part 2) 🚀

Last week, we dove into enrollment growth by Geography and Health Plan. Today, we will shift our focus to AEP growth by Plan Type.

Remember, “AEP growth” is the change in enrollment counts from December 2023 to February 2024.

Individual vs. Group

We shared last week that UnitedHealth Group saw significant growth during AEP in Employer Group membership. Employer Group Plans are offered by employers or unions to Medicare-eligible retirees.

Let’s look at Employer Group versus Individual plan AEP growth.

Employer Group plans grew 4%, or ~ 238k enrollees. Comparatively, Individual plans grew 3%, or ~710k enrollees. While Employer Group plans saw growth in AEP ‘24, they only account for 17% of the market, with the majority being Individual plans.

This graph compares Individual and Employer Group plan AEP growth in the top 10 states with the largest overall growth:

State | AEP ’24 Growth Overall | AEP ’24 Growth Individual | AEP ’24 Growth Employer Group |

Florida | 68,144 | 48,419 | 19,725 |

Texas | 62,629 | 41,688 | 20,941 |

Michigan | 52,769 | 34,257 | 18,512 |

North Carolina | 47,805 | 40,187 | 7,618 |

Illinois | 46,745 | 28,184 | 18,561 |

Washington | 43,949 | 18,199 | 25,750 |

Pennsylvania | 40,888 | 40,886 | 2 |

Ohio | 38,299 | 30,405 | 7,894 |

New York | 38,205 | 25,267 | 12,938 |

California | 31,615 | 16,386 | 15,229 |

Washington saw the largest growth in Employer Group enrollment for all states, in addition to higher growth for Employer Group plans versus Individual. Pennsylvania’s growth is attributed to Individual plan growth.

We should note that Employer Group and Individual plans are a larger umbrella that many other MA plan types fall under. We will look at these next. (Note- for a quick refresher on all MA plan types, see our recent deep dive)

Plan Type

This next graph compares growth by Plan Type (combines Individual and Employer Group plans):

HMO plans, which account for 55% of the market, added ~138K enrollees (1% growth) during AEP.

However, Local PPO plans “won” AEP, adding ~927k enrollees (7% growth).

Regional PPO’s, which have a larger network of providers to meet the needs of beneficiaries in more rural areas, declined ~84K enrollees.

PFFS, MSA, Medicare-Medicaid, and 1876 Cost plans also declined in AEP.

SNP’s

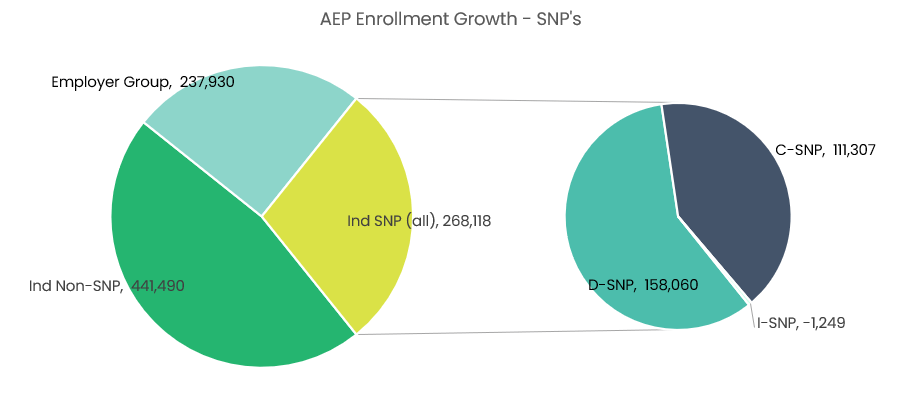

Special Needs Plans (SNP’s), which fall under the “Individual Plan” umbrella, saw an overall AEP growth of ~268k (4%).

Dual-Eligible (D-SNP) Plans, which control 88% of the SNP market, saw the most growth at ~158k enrollees (3%).

Chronic or Disabling Condition (C-SNP) Plans grew by 21%, or ~111k enrollees. Institutional (I-SNP) Plans decreased by ~1k enrollees.

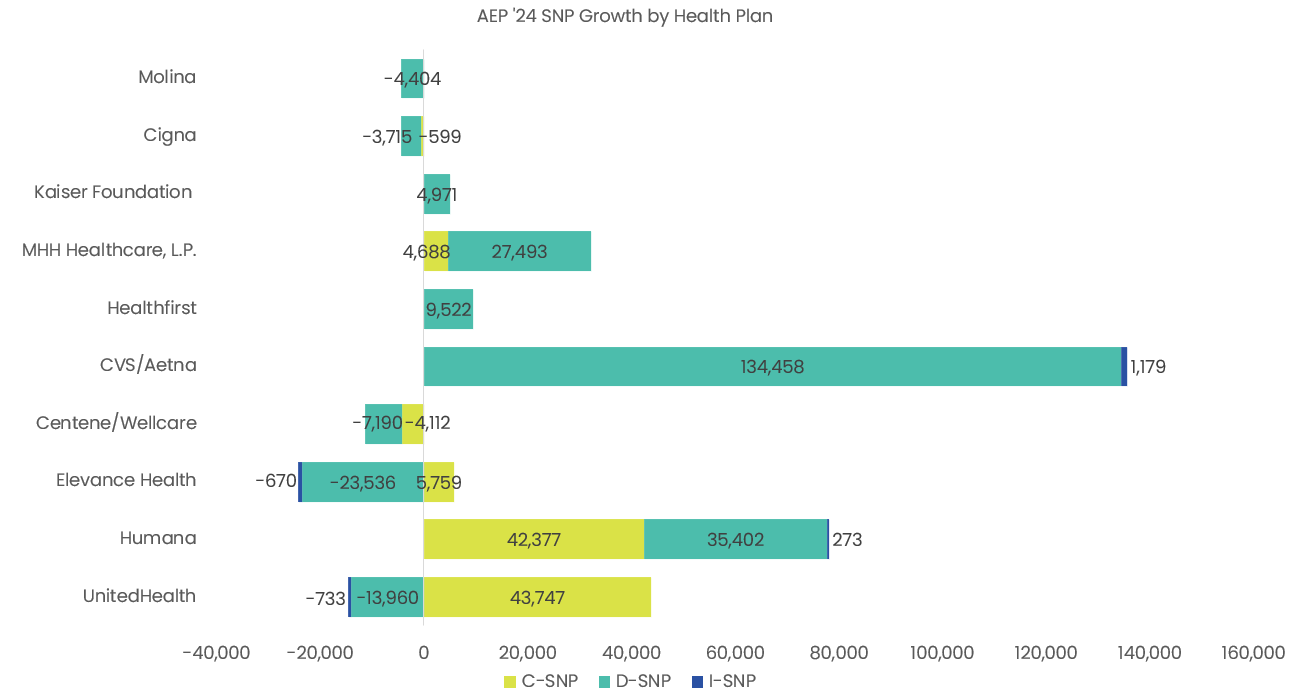

This next graph compares AEP growth by SNP Type for the top 10 Health Plans with the largest overall SNP enrollment in Feb ’24:

CVS/Aetna’s SNP’s grew ~135k, followed by Humana at ~78k. Elevance Health, Centene/Wellcare, Molina, and Cigna’s SNP enrollment all declined.

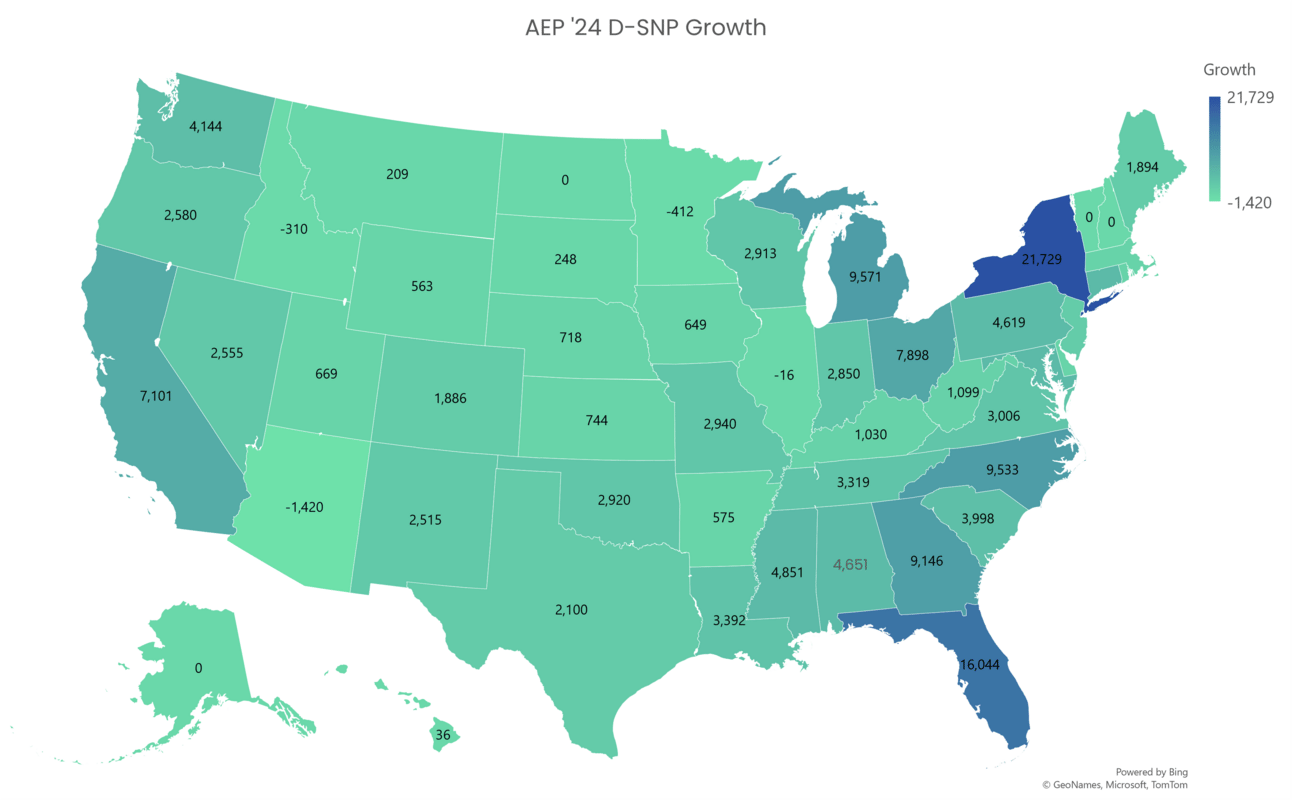

The below map shows AEP growth by State for D-SNP plans. Florida, New York, and Michigan saw the most D-SNP growth, while Arizona saw the largest decline.

That’s all for now! We hope you have gained valuable AEP insights over the past two weeks. If you want even more information, check out our e-book, which gives you Medicare Advantage AEP enrollment statistics for all 50 states.

Plus, when you purchase prior to March 11th you’ll get an exclusive offer to our webinar called “2024 MA AEP results – What the Data says” on March 12th 1 EST!

___

Sources: Source Data: Dec 2023 and Feb 2024 CMS Medicare Advantage/Part D Contract and Enrollment Data, CMS PBP Benefits Q42023, CMS CY2024 Landscape Files. * Enrollment data excludes plans with less than 10 enrollees

Sponsor Snapshot 🚀: AEP 2024 State Deep Dives

Understanding Medicare enrollment statistics is important when making strategic decisions related to plan development, marketing, and more.

Buy your AEP 2024 Medicare Advantage State Deep Dives ebook here.

Be the first to get access to data like this for every state:

COMPLIANCE CHATTER 📢

Last week, the Centers for Medicare & Medicaid Services (CMS) released final part one guidance for the new Medicare Prescription Payment Plan, which begins in 2025. This guidance focuses on:

identifying Medicare Part D enrollees likely to benefit from the program;

opt-in process for Part D enrollees;

program participant protections; and

data collection to evaluate the program.

The final part one guidance includes a requirement that Part D sponsors must notify pharmacies to provide information on the Medicare Prescription Payment Plan to Part D beneficiaries who meet a $600 out-of-pocket threshold based on a single prescription at the point-of-sale.

Draft part two guidance for the program was published on February 15 and is open for comment until March 16, 2024.

If you would like to learn more about our compliance services, reach out to [email protected].

DATA VISUAL of the Week 📊

The data visual of the week comes from CHARTIS. It shows enrollment distribution by MA plan star rating over the past 5 years. Highlights the decrease in 5 star plan enrollment in 2024, with an increase for 4+ star plans.

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: