This week’s newsletter is sponsored by: HealthSherpa

The all-in-one Medicare platform for brokers.→ Get Your Free Account

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - eBroker Q3 '25 Results: Side-By-Side

Sponsor Snapshot 🚀 - brought to you by HealthSherpa

It’s only a 6 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

2026 Medicare Deductibles and Copays - (link)

Medica acquires UCare; providers promise services 'without interruption' - (link)

Medicare Part D 2026: Preferred Networks Vanish as the PDP Market Collapses - (link)

2026 Medicare Physician Fee Schedule — ‘We care about primary care’ - (link)

Aetna pulls back on new Medicare Advantage payment policy - (link)

Humana, Epic collaborate to automate insurance verification, patient check-in - (link)

ACO West Virginia saves Medicare money for the fourth year in a row - (link)

November Insurance Regulatory Insights - State Bulletins Galore! - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

Medicare Distributor Side-by-Side

This week, we’re digging into Q3 2025 financials for publicly traded Direct-to-Consumer distributors — the “eBrokers.”

The three we’ll compare are:

GoHealth ($GOCO ( ▲ 2.85% ) )

eHealth ($EHTH ( ▲ 1.32% ) )

SelectQuote ($SLQT ( ▼ 0.4% ) )

—

Company Commentary

Before comparing these 3 companies, it’s worth mentioning some notable commentary to help provide context for this quarter’s results.

GOCO strategically pulled back.

GoHealth intentionally reduced Medicare Advantage volume this quarter due to pressures in the MA space (link).

As a result, Q3 likely included a higher mix of Final Expense and fewer MA enrollments.

GOCO doesn’t break out product mix, so comparisons this quarter aren’t fully apples-to-apples.

Their “Sales per Submission” and LTV metrics likely include a higher than normal mix of Final Expense.

GOCO also reported $206 million in impairment charges related to indefinite-lived assets.

For comparability, this impairment is excluded from the operating expense figures below.

EHTH and SLQT did not strategically pull back

Both saw expected volume declines from SEP rule changes (mostly D-SNP related), but neither intentionally reduced MA activity the way GOCO did. Both expect meaningful enrollment this AEP.

It’s also work noting that there are Two other big players don’t break out segment financials:

HealthMarkets (UnitedHealth Group)

Innovative Financial Group (Humana)

Side-By-Side Results

To compare and contrast Q3 2025 results we are looking at the Income Statement, a few key Balance Sheet items, LTV metrics, and Sales metrics.

Notes:

GOCO Income Statement excludes $206 million “Indefinite and long-lived asset impairment charges”

GOCO Sales likely include a material mix of Final Expense products, but financials don’t break out product line

Key Takeaways:

All three posted operating losses.

SLQT led in total revenue, overhead efficiency, and profit margin.

EHTH reported the highest Medicare Advantage LTV at $975.

EHTH also maintained the lowest debt load.

SLQT led in volume, adding 76,000+ approved policies.

All three carried ~$1 billion in Commission Receivables.

—

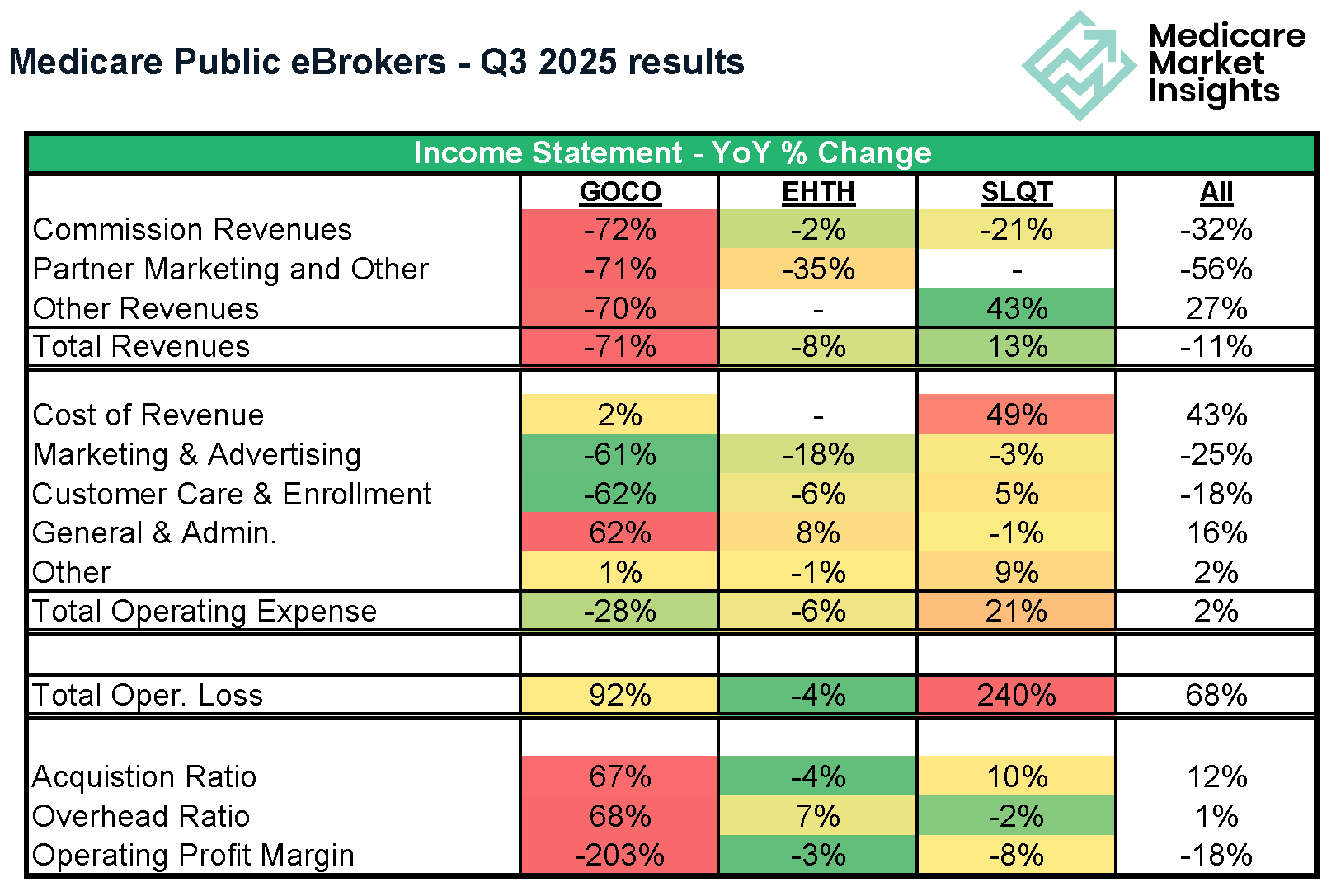

YoY % Change

Let’s observe and discuss the year-over-year (“YoY”) % changes.

Revenues

SLQT led with +13% revenue growth, driven by its healthcare vertical (SelectRx).

GOCO posted a sharp decline in Revenue, driven by strategic pull-back

Expenses

EHTH cut expenses 6% driven by lower Marketing & Advertising and Customer Care & Enrollment expense

GOCO cut expenses 28% driven by strategic pull-back resulting in lower acquisition spend.

SLQT expenses up 21% driven by increase in “Cost of Goods Sold” on Healthcare segment.

Marketing spend declined across the board.

Profitability (Loss)

SLQT’s operating loss grew the most on a % basis, but it still posts the best overall profit/loss profile.

EHTH narrowed its loss –4% YoY, showing improvement.

GOCO’s operating loss grew 92% (excluding $206 million “Indefinite and long-lived asset impairment charges”)

Balance Sheet Changes

contract asset balances rose a combined 9%.

SLQT cut long-term debt –42%, a major deleveraging move.

GOCO increased long-term debt 21% to help weather the strategic changes.

LTV Changes

Medicare Advantage LTV is down overall.

GOCO “Sales per submission” decreased from the prior year, likely due to a shift to a higher mix of Final Expense business.

Sales

Overall sales fell –41% YoY, driven by GOCO’s strategic pull-back, and shift in SEP rules (related to D-SNP policies).

SLQT’s SelectRx customers grew +24% YoY

Reporting Note: GOCO reports submitted policies; SLQT and EHTH report approved policies.

—

The Big Picture

Yes, the eBroker model is still challenged. Yes, operating losses continue. And yes, the contracts-on-balance-sheet dynamic is still massive.

But Q3 has always been the “cost ramp” quarter, not the revenue quarter. DTC distributors spend heavily to prepare for AEP, while commissions don’t show up until months later. In other words, Q3 is the bottom of the curve for these businesses.

That’s why the next phase matters.

How these three companies perform during AEP, in submissions, approvals, LTV, and early persistency indicators, will determine which strategies are viable heading into 2026.

SPONSOR SNAPSHOT 🚀: HealthSherpa

Introducing HealthSherpa for Medicare!

A modern, all-in-one Medicare platform where any broker can quote, enroll, and manage their clients with ease.

FMO-neutral • Multi-carrier • No cost

Trusted by 50,000 brokers – now transforming Medicare.

We built the largest ACA platform for brokers, processing >10 million annual enrollments. Now we're bringing that experience to Medicare.Open to everyone

Any broker can sign up for free and start quoting and enrolling immediately.FMO-neutral

We're not an FMO or upline – use our platform no matter which uplines you have.AI drug entry

Add drug lists in seconds with RxAssist, our new AI-powered data entry tool.Integrated

Easy self-serve integration with GoHighLevel, MedicarePro, RetireFlo, and more.

What MMI + Subscribers read this week…

Receive regulatory updates with the Insurance Regulatory Insights newsletter.

Monthly newsletters providing insight into recent insurance regulatory action

Access to Reg Tracker, a comprehensive list of insurance regulatory actions in all states for this calendar year that are included in the newsletters.

Insurance Regulatory Insights is now included in your MMI+ subscription! You can also subscribe using the link below.

How was today's newsletter?

If you’re ready, here are some ways we can help you:

Did this get forwarded to you? Get the Medicare Market Insights newsletter sent directly to your email weekly: