- Medicare Market Insights

- Posts

- GoHealth + e-TeleQuote = 🤝

GoHealth + e-TeleQuote = 🤝

GoHealth just announced they are acquiring e-TeleQuote. Here is an analysis of their recent results combined.

This week’s newsletter is Sponsored By: Medicare Market Insights - Plus

Click here to find out more - (link)

Here is what you’ll find in this week’s newsletter!

Important links 🔗 - the best articles we found this week about the Medicare Market along with links to Jared’s recent LinkedIn posts.

Deep Dive 📚 - GoHealth + eTeleQuote = 🤝

Compliance Chatter 📢 - summary of Medicare legislation that states have passed in 2024.

Sponsor Snapshot 🚀 - brought to you by Medicare Market Insights - Plus

DATA VISUAL of the Week 📊 - MA enrollment statistics as of August 2024.

It’s only a 5 minute read, but it will make you 10x smarter.

Here are IMPORTANT LINKS 🔗 for the week:

GoHealth Acquiring e-TeleQuote, Strengthening Position as Leading Medicare Insurance Marketplace - (link)

Will Big Health Insurers Expand 2025 Medicare Advantage Footprints? - (link)

Agents fight for Part D commissions - (link)

HealthSherpa Getting into the Medicare Space - (link)

PODCAST - Episode 56: PDPocalypse! Commissions Going Away! - (link)

Medicare Supplement Broker Sales Mix – 2024 Q2 Review - (link)

Jared’s recent LinkedIn posts:

DEEP DIVE 📚

GoHealth + e-TeleQuote = 🤝

This wasn’t the planned topic for this week, but some interesting news dropped yesterday that I had to take a look at a bit closer.

GoHealth (“GOCO”) is acquiring e-Telequote. (link)

eTelequote is part of Primerica who just two months ago announced that they were exiting the Senior segment as they did “not have a clear path toward anticipated profitability within an acceptable timeframe in the increasingly challenging senior health distribution market. Further, the industry is facing an uncertain regulatory environment that could adversely impact the business.”

Now they will be part of GoHealth.

Specifically, they “entered into a purchase and subscription agreement which will ultimately lead to the acquisition of e-TeleQuote Insurance, Inc., a distinguished name in the Medicare insurance marketplace. The transaction is expected to close on September 30, 2024.”

Based on the comments by both CEOs, it sounds like GoHealth is acquiring more than just the book of business, but also the people/operations.

Here is what GoHealth’s CEO says:

“GoHealth’s scale, proprietary technology and operational excellence combined with e-TeleQuote’s established talent and high-quality track record will create a mutually accretive relationship poised to drive better outcomes for and meet the evolving needs of our Medicare consumers,” said Vijay Kotte, CEO of GoHealth.

…and e-Telequote’s CEO:

“At the heart of this transaction is a shared commitment to a consumer-first approach. Both GoHealth and e-TeleQuote have consistently demonstrated a deep understanding of and responsiveness to consumer needs. We are excited to tap into the power of the proprietary technology at GoHealth, including the PlanFit Checkup, which will better serve our consumers while driving increased efficiency and effectiveness in choosing the Medicare plan that best meets their needs. By combining our resources and expertise, we are poised to collectively elevate our consumer experience and deliver even better tailored solutions that prioritize the well-being of our consumers,” said Craig Uchytil, CEO of e-TeleQuote.

While there is no information on the structure or terms of the deal, we can look at past results to observe what GoHealth is acquiring, and what their combined financials would have been in 2023, and this past quarter.

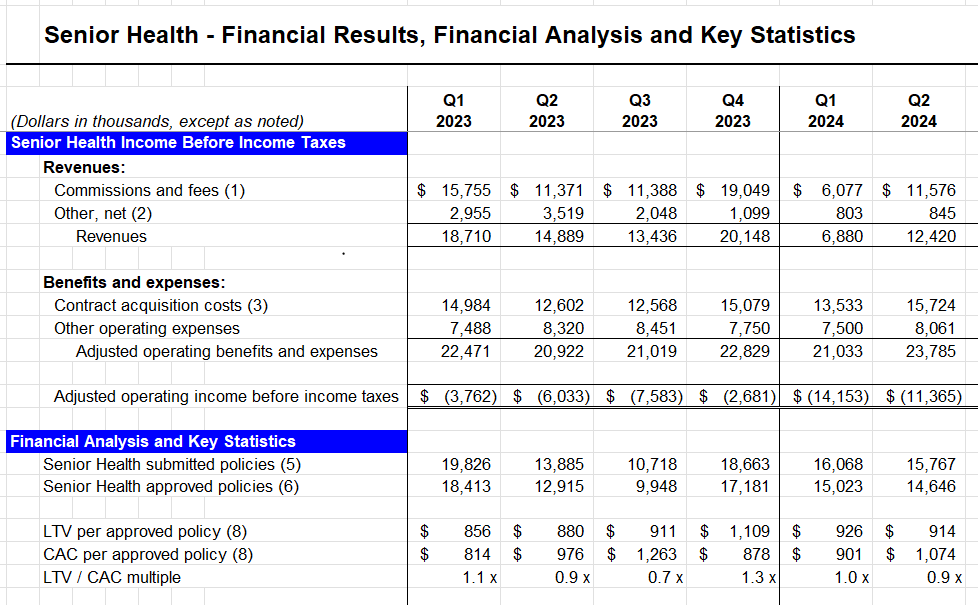

Here are the financial statistics for e-Telequote over the past 6 quarters:

Here is what their calendar year 2023 financials would have looked like if they were combined.

If e-Telequote would have been part of GoHealth in 2023, GoHealth would have had:

9% higher revenues

11% higher expenses

25% higher operating loss

21% increased commission receivable balance

1% higher Medicare Advantage (“MA”) Lifetime Value (“LTV”)

7% more approved MA policies

A few thoughts:

GoHealth already lead their publicly traded peers in terms of Medicare Advantage sales. This would have added to that lead.

While the numbers above show that operating profits get worse when combined, GoHealth likely sees potential for operating efficiency. Perhaps improving Acquisition and General & Admin. expenses.

This AEP is setting up to be wild. Overall it’s a positive that e-Telequote agents will be on the phone helping consumers make decisions about their coverage options.

There are undoubtedly other strategic components behind the scenes that may not be obvious on the surface.

That’s it for this week, I hope it was helpful!

Be sure to take a look at the sponsor snapshot below→

Sponsor Snapshot 🚀: Medicare Market Insights - Plus

We are happy to announce Medicare Market Insights - Plus.

The Medicare market is filled with data, but pulling it all together, interpreting it, and making it actionable takes time—time that busy leaders don’t have.

Plus, with the expected wave of market exits in the Medicare Advantage space this AEP, the pressure to stay informed is greater than ever.

The Solution: Medicare Market Insights - Plus offers you the advantage you need:

Exclusive Medicare Advantage Insights Web Application: Instantly access critical data and trends with our easy-to-use tool. Drill down into enrollment by state, payer, county, and plan type, and uncover opportunities that others miss.

Members-Only Deep Dives: Stay ahead with in-depth analyses of market shifts and strategic opportunities. Our content is designed to help you find the next big win.

Expertly Curated: Our data is combined with analysis from experienced actuaries and presented in a way that’s easy to digest, even for the busiest executives.

COMPLIANCE CHATTER 📢

Check out this week’s Insurance Regulatory Insights newsletter, which summarizes Medicare legislation that states have passed in 2024.

DATA VISUAL of the Week 📊

This week’s visual comes from MMI + and looks at the overall Medicare Advantage enrollment statistics as of August 2024.

The MMI + web app allows you to easily create you own visuals just like this and drill down into the data to gain a deeper understanding of the markets.

If you’re ready, here are some ways we can help you:

Newsletter Sponsorship opportunities: Promote your product or services to leaders in the Medicare space. Let’s discuss. (link)

Market Research: Reports that help you wrap your arms around the Senior focused insurance markets. (link)

Consulting: We can help you develop new insurance products for the Medicare market, appraise your books of business, and keep you compliant. Let’s discuss. (link)